As filed with the Securities and Exchange Commission on October 1, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

TE CONNECTIVITY PLC

(Exact name of registrant as specified in its charter)

| |

Ireland

(State or other jurisdiction of incorporation or

organization)

|

|

|

98-1779916

(I.R.S. Employer Identification Number)

|

|

Parkmore Business

Park West,

Parkmore,

H91VN2T Ballybrit,

Galway,

Ireland

+353 91 378 040

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

John S. Jenkins, Jr.

Executive Vice President and General Counsel

TE Connectivity plc

1050 Westlakes Drive

Berwyn, Pennsylvania 19312

(610) 893-9800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Corey R. Chivers

Weil, Gotshal & Manges LLP

767 Fifth Avenue

New York, New York 10153

(212) 310-8000

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement as determined by the Registrants.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer

☒

|

|

|

Smaller reporting company

☐

|

|

|

Emerging growth company

☐

|

|

| |

Non-accelerated filer

☐

|

|

|

Accelerated filer

☐

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

TABLE OF ADDITIONAL REGISTRANTS

Exact Name of Additional

Registrant as Specified in its

Charter*

|

|

|

State or other Jurisdiction of

Incorporation or Organization

|

|

|

I.R.S. Employment

Identification No.

|

|

|

Address, including Zip Code, of

Principal Executive Offices

|

|

|

Telephone Number

including Area Code

|

|

|

TYCO ELECTRONICS GROUP S.A.

|

|

|

Luxembourg

|

|

|

98-0518566

|

|

|

46 Place Guillaume II

L-1648 Luxembourg

|

|

|

+352 46 43 40 401

|

|

|

TE CONNECTIVITY SWITZERLAND LTD.

|

|

|

Switzerland

|

|

|

98-1808270

|

|

|

Mühlenstrasse 26

CH-8200 Schaffhausen, Switzerland

|

|

|

+41(0)52 633 66 61

|

|

PROSPECTUS

TE CONNECTIVITY PLC

REGISTERED SHARES

WARRANTS

UNITS

GUARANTEES

TE CONNECTIVITY SWITZERLAND LTD.

GUARANTEES

TYCO ELECTRONICS GROUP S.A.

DEBT SECURITIES

UNITS

TE Connectivity plc (“TE Connectivity”) may from time to time offer to sell its registered shares, warrants or units. Warrants may be exercisable for registered shares of TE Connectivity or the debt securities described below. Units may include, be convertible into or exercisable or exchangeable for registered shares or warrants of TE Connectivity or the debt securities described below. TE Connectivity may from time to time issue guarantees of the debt securities as described below.

TE Connectivity Switzerland Ltd. (“Swiss TEL”) may from time to time issue guarantees of the debt securities as described below.

Tyco Electronics Group S.A. (“TEGSA”) may from time to time offer to sell its debt securities as well as units. The debt securities may consist of debentures, notes or other types of debt. The debt securities issued by TEGSA may be convertible or exchangeable for registered shares or other securities of TE Connectivity. The debt securities issued by TEGSA may also be investment grade. If the debt securities issued by TEGSA are either convertible or exchangeable or are not investment grade, such securities shall be fully and unconditionally guaranteed by TE Connectivity and Swiss TEL. Units may include, be convertible into or exercisable or exchangeable for debt securities of TEGSA and registered shares or warrants of TE Connectivity.

TE Connectivity, Swiss TEL and TEGSA may offer and sell these securities to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis. TE Connectivity, Swiss TEL and TEGSA will provide a specific plan of distribution for any securities to be offered in a supplement to this prospectus. TE Connectivity, Swiss TEL and TEGSA will provide specific terms of any securities to be offered in a supplement to this prospectus. You should read this prospectus and the applicable prospectus supplement carefully before you invest.

The principal executive offices of TE Connectivity are located at Parkmore Business Park West, Parkmore, H91VN2T Ballybrit, Galway, Ireland and its telephone number at that address is +353 91 378 040. The principal executive offices of Swiss TEL are located at Mühlenstrasse 26, CH-8200 Schaffhausen, Switzerland, and its telephone number at that address is +41 (0)52 633 66 61. The principal executive offices of TEGSA are located at 46 Place Guillaume II, L-1648 Luxembourg, Grand Duchy of Luxembourg (Luxembourg) and its telephone number at that address is +352 46 43 40 401.

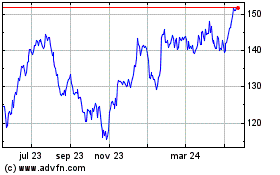

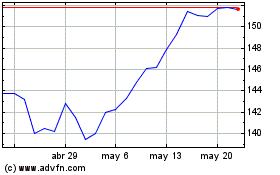

TE Connectivity’s ordinary shares are listed on the NYSE and trade under the symbol “TEL”.

Investing in the securities involves risks. See “Risk Factors” on page 3 of this prospectus to read about factors you should consider before investing in the securities.

None of the Securities and Exchange Commission, any state securities commission, nor any similar authority in Switzerland, Ireland or Luxembourg, has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus may not be used to sell securities unless accompanied by a prospectus supplement that contains a description of those securities.

The date of this prospectus is October 1, 2024

TABLE OF CONTENTS

| |

|

|

Page

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

8

|

|

|

ABOUT THIS PROSPECTUS

This prospectus is part of an automatic shelf registration statement on Form S-3 that TE Connectivity, Swiss TEL and TEGSA have filed with the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”). By using a shelf registration statement, we may sell, at any time and from time to time, in one or more offerings, any combination of the securities described in this prospectus. As allowed by the SEC’s rules, this prospectus does not contain all of the information included in the registration statement. For further information, we refer you to the registration statement, including its exhibits, filed with the SEC. Statements contained in this prospectus about the provisions or contents of any agreement or other document are not necessarily complete. If the SEC’s rules and regulations require that an agreement or document be filed as an exhibit to the registration statement, please see that agreement or document for a complete description of these matters.

You should read this prospectus, any prospectus supplement and any free writing prospectus we file with the SEC together with any additional information you may need to make your investment decision. You should also read and carefully consider the information in the documents we have referred you to in “Where You Can Find More Information” below. Information incorporated by reference after the date of this prospectus is considered a part of this prospectus and may add, update or change information contained in or incorporated by reference into this prospectus. Any information in such subsequent filings that is inconsistent with the information in or incorporated by reference into this prospectus will supersede the information in this prospectus or any earlier prospectus supplement.

You should rely only on the information incorporated by reference or provided in this prospectus, any supplement or any free writing prospectus we file with the SEC. We have not authorized anyone else to provide you with other information. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information in this prospectus, any prospectus supplement, any free writing prospectus or any document incorporated herein or therein by reference is accurate as of any date other than the date of the applicable document. Our business, financial condition, results of operations and prospects may have changed since that date.

Unless otherwise stated, or the context otherwise requires, references in this prospectus to “we,” “us” and “our” are to TE Connectivity plc and its consolidated subsidiaries, including Swiss TEL and TEGSA, and/or, as the context requires, to our predecessor registrant, TE Connectivity Ltd. On September 30, 2024, TE Connectivity Ltd. completed the change of its place of incorporation from Switzerland to Ireland by merging with and into its subsidiary, TE Connectivity plc, a public limited company incorporated under the laws of Ireland (the “Merger”). In connection with the Merger and by operation of Rule 12g-3(a) promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), TE Connectivity plc became the successor registrant to TE Connectivity Ltd. and succeeded to the attributes of TE Connectivity Ltd. as the registrant. TE Connectivity plc’s ordinary shares are listed on the New York Stock Exchange (the “NYSE”) and trade under the symbol “TEL,” the same symbol under which TE Connectivity Ltd.’s common shares traded prior to the effective time of the Merger. References to TE Connectivity are to TE Connectivity plc or, prior to the Merger, TE Connectivity Ltd.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, in accordance with these requirements, we file reports and other information relating to our business, financial condition and other matters with the SEC. We are required to disclose in such reports certain information, as of particular dates, concerning our operating results and financial condition, officers and directors, principal holders of shares, any material interests of such persons in transactions with us and other matters. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers like us that file electronically with the SEC. The address of such site is: http://www.sec.gov.

Our Internet website is www.te.com. We make available free of charge on our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, reports filed pursuant to Section 16 and amendments to those reports as soon as reasonably practicable after we electronically file or furnish such materials to the SEC. In addition, we have posted the charters for our

Audit Committee, Management Development and Compensation Committee and Nominating, Governance and Compliance Committee, as well as our Board Governance Principles, under the heading “Executive Team — Board Documents” in the About TE section of our website. Other than any documents expressly incorporated by reference, the information on our website and any other website that is referred to in this prospectus is not part of this prospectus.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring to those documents. This prospectus incorporates by reference the documents set forth below, which TE Connectivity has filed with the SEC, and any future filings made by TE Connectivity, Swiss TEL and TEGSA with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act. On September 30, 2024, TE Connectivity Ltd. completed the Merger, and upon the consummation of such transaction, we became the successor registrant to TE Connectivity Ltd. pursuant to Rule 12g-3(a) of the Exchange Act. Notwithstanding the foregoing, unless expressly stated to the contrary, none of the information that TE Connectivity discloses under Item 2.02 or 7.01 of any Current Report on Form 8-K or exhibits relating to such disclosure that it has furnished or may from time to time furnish to the SEC will be incorporated by reference into, or otherwise included in, this prospectus. The information we file later with the SEC will automatically update and in some cases supersede the information in this prospectus and the documents listed below.

•

•

•

•

•

TE Connectivity’s Current Reports on Form 8-K filed on December 12, 2023, March 14, 2024, March 18, 2024, March 18, 2024, April 25, 2024, June 12, 2024, August 2, 2024 and September 17, 2024; and

•

Upon your oral or written request, we will provide you with a copy of any of these filings at no cost. Requests should be directed to Corporate Secretary, TE Connectivity plc, 1050 Westlakes Drive, Berwyn, PA 19312, Telephone No. (610) 893-9800.

BUSINESS

TE Connectivity plc

TE Connectivity is a global industrial technology leader creating a safer, sustainable, productive and connected future. Our broad range of connectivity and sensor solutions enable the distribution of power, signal and data to advance next-generation transportation, renewable energy, automated factories, data centers, medical technology and more.

We operate through the following reportable segments: Transportation Solutions, Industrial Solutions and Communications Solutions.

TE Connectivity is an Irish public limited company. Its registered office is located at Ten Earlsfort Terrace, Dublin 2, D02 T380, Ireland, its principal place of business is Parkmore Business Park West, Parkmore, H91VN2T Ballybrit, Galway, Ireland and its telephone number at that address is +353 91 378 040.

TE Connectivity Switzerland Ltd.

Swiss TEL is a Swiss corporation and a direct, wholly-owned subsidiary of TE Connectivity and the direct parent of TEGSA. Swiss TEL’s registered and principal office is located at Mühlenstrasse 26, CH-8200 Schaffhausen, Switzerland, and its telephone number at that address is +41(0)52 633 66 61.

Tyco Electronics Group S.A.

TEGSA is a Luxembourg public limited liability company (société anonyme) and a wholly-owned subsidiary of Swiss TEL. TEGSA’s registered and principal office is located at 46 Place Guillaume II, L-1648 Luxembourg, and its telephone number at that address is +352 46 43 40 401. TEGSA is a holding company established to directly and indirectly own all of the operating subsidiaries of TE Connectivity, to issue debt securities and to perform treasury operations for TE Connectivity. Otherwise, it conducts no independent business.

RISK FACTORS

Investing in our securities involves risks. Before deciding to purchase any of our securities, you should carefully consider the discussion of risks and uncertainties under “Part I, Item 1A — Risk Factors” in TE Connectivity’s Annual Report on Form 10-K for the fiscal year ended September 29, 2023, which is incorporated by reference in this prospectus, and under similar headings in TE Connectivity’s subsequently filed quarterly reports on Form 10-Q and annual reports on Form 10-K, as well as the other risks and uncertainties described in any applicable prospectus supplement and in the other documents incorporated by reference in this prospectus. See the section entitled “Where You Can Find More Information” in this prospectus. The risks and uncertainties discussed in the documents incorporated by reference in this prospectus are those we currently believe may materially affect us. Additional risks and uncertainties not presently known to us or that we currently believe are immaterial also may materially and adversely affect our business, financial condition and results of operations.

FORWARD-LOOKING STATEMENTS

Certain statements in this prospectus are “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. We have made forward-looking statements in this prospectus and the documents incorporated in this prospectus that are based on our management’s beliefs and assumptions and on information available to our management at the time such statements were made. Forward-looking statements include, among others, the information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance improvements, acquisitions, divestitures, the effects of competition, and the effects of future legislation or regulations. Forward-looking statements also include statements addressing our environmental, social, governance, and sustainability plans and goals. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “aspire,” “estimate,” “predict,” “potential,” “goal,” “target,” “continue,” “may,” and “should,” or the negative of these terms or similar expressions.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in our forward-looking statements. You should not put undue reliance on any forward-looking statements.

The risk factors discussed under “Part I, Item 1A — Risk Factors” in TE Connectivity’s Annual Report on Form 10-K for the fiscal year ended September 29, 2023, and under similar headings in TE Connectivity’s subsequently filed quarterly reports on Form 10-Q and annual reports on Form 10-K, as well as the other risks and uncertainties described in any applicable prospectus supplement and in the other documents incorporated by reference into this prospectus, could cause our results to differ materially from those expressed in forward-looking statements. There may be other risks and uncertainties that we are unable to predict at this time or that we currently do not expect to have a material adverse effect on our business. We expressly disclaim any obligation to update these forward-looking statements other than as required by law.

USE OF PROCEEDS

Unless otherwise stated in the prospectus supplement accompanying this prospectus, we will use the net proceeds from the sale of any registered shares, warrants, debt securities or units that may be offered hereby for general corporate purposes. Such general corporate purposes may include, but are not limited to, reducing or refinancing our indebtedness or the indebtedness of our subsidiaries, financing possible acquisitions and redeeming outstanding securities. The prospectus supplement relating to an offering will contain a more detailed description of the use of proceeds of any specific offering of securities.

DESCRIPTION OF SECURITIES

We will set forth in the applicable prospectus supplement a description of the registered shares, warrants, debt securities, guarantees or units that may be offered under this prospectus.

PLAN OF DISTRIBUTION

TE Connectivity, Swiss TEL and TEGSA may offer and sell the securities offered by this prospectus to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis. TE Connectivity, Swiss TEL and TEGSA will provide a specific plan of distribution for any securities to be offered in a supplement to this prospectus.

ENFORCEMENT OF CIVIL LIABILITIES

TE Connectivity is an Irish public limited company, Swiss TEL is a Swiss company, and TEGSA is a Luxembourg company. TE Connectivity, Swiss TEL and TEGSA have consented in the indenture to be used in connection with the issuance of debt securities to submit to the jurisdiction of the U.S. federal and state courts in The City of New York and to receive service of process in The City of New York in any legal suit, action or proceeding brought to enforce any rights under or with respect to such indenture and any debt securities or guarantees issued under it. A substantial majority of Swiss TEL’s directly held assets consists of the equity interests of TEGSA. Accordingly, any judgment against TEGSA, Swiss TEL or TE Connectivity in respect of the indenture, the notes or the guarantees, including for civil liabilities under the U.S. federal securities laws, obtained in any U.S. federal or state court may have to be enforced in the courts of Luxembourg, Ireland or Switzerland. Investors should not assume that the courts of Luxembourg, Ireland or Switzerland would enforce judgments of U.S. courts obtained against TEGSA, Swiss TEL or TE Connectivity predicated upon the civil liability provisions of the U.S. federal securities laws or that such courts would enforce, in original actions, liabilities against TEGSA, Swiss TEL or TE Connectivity predicated solely upon such laws.

Ireland

It may not be possible to enforce court judgments obtained in the United States in Ireland, based on the civil liability provisions of the U.S. federal or state securities laws. In addition, there is some uncertainty as to whether the courts of Ireland would recognize or enforce judgments of U.S. courts based on the civil liabilities provisions of the U.S. federal or state securities laws or hear actions based on those laws. We have been advised that the United States currently does not have a treaty with Ireland providing for the reciprocal recognition and enforcement of judgments in civil and commercial matters. Therefore, a final judgment for the payment of money rendered by any U.S. federal or state court based on civil liability, whether or not based solely on U.S. federal or state securities laws, would not automatically be enforceable in Ireland.

A judgment obtained in the United States will be enforced by the courts of Ireland, with the leave of the court, if the following general requirements are met:

•

the judgment is for a definite sum of money;

•

the U.S. court handing down judgment must amount to a court of competent jurisdiction for the purpose of Irish conflicts of law rules; for this purpose the defendant must have been (a) resident or present in the United States at the time of the proceedings; or (b) participated in the proceedings; or (c) contracted to submit to the jurisdiction of the relevant court (a submission to jurisdiction by the defendant would satisfy this); and

•

the judgment must be final and conclusive and the decree must be final and unalterable in the court which pronounces it. A judgment can be final and conclusive even if it is subject to appeal or even if an appeal is pending. Where however the effect of lodging an appeal under the applicable law is to stay execution of the judgment, it is possible that in the meantime the judgment may not be actionable in Ireland.

It remains to be determined whether final judgment given in default of appearance is final and conclusive and/or is sufficient evidence of submission to jurisdiction of the foreign court.

Even if the above requirements are satisfied, the Irish courts may still refuse to enforce a judgment of the U.S. courts if one of the following circumstances applies:

•

the judgment was obtained by fraud;

•

the enforcement of the judgment in Ireland would be contrary to natural or constitutional justice;

•

the judgment is contrary to Irish public policy or involves certain U.S. laws which will not be enforced in Ireland;

•

the judgment is inconsistent with an earlier judgment of the Irish courts;

•

the procedural rules of the U.S. court giving the judgment have not been observed;

•

new evidence is adduced by a party which could not have been discovered prior to the judgment of the U.S. courts by reasonable diligence by such party and which shows such judgment to be erroneous;

•

enforcement proceedings are not instituted in Ireland within six years of the date of the judgment of the U.S. courts; and

•

jurisdiction cannot be obtained by the Irish courts over the judgment debtor(s) in the enforcement proceedings by personal service in Ireland or outside Ireland under Order 11 of the Ireland Superior Court Rules.

In order to enforce a judgment of the U.S. courts in Ireland, separate proceedings have to be issued in Ireland seeking an Irish judgment in the terms of the judgment of the U.S. courts.

Luxembourg

TEGSA is incorporated under the laws of Luxembourg. Certain members of the board of directors are non-residents of the United States and a substantial portion of TEGSA’s assets and those of such directors are located outside the United States. As a result, you may not be able to effect a service of process within the United States on TEGSA or on such persons or to enforce in Luxembourg courts judgments obtained against TEGSA or such persons in U.S. courts, including actions predicated upon the civil liability provisions of the U.S. federal and state securities laws or other laws. Likewise, it may also be difficult for an investor to enforce in U.S. courts judgments obtained against TEGSA or such persons in courts in jurisdictions outside the United States, including actions predicated upon the civil liability provisions of the U.S. securities laws.

TEGSA has been advised by Allen Overy Shearman Sterling SCS, société en commandite simple, its Luxembourg counsel, that the United States and the Grand-Duchy of Luxembourg are not currently bound by a treaty providing for reciprocal recognition and enforcement of judgments (other than arbitral awards) rendered in civil and commercial matters. According to such counsel, an enforceable judgment for the payment of monies rendered by any U.S. federal or state court based on civil liability, whether or not predicated solely upon the U.S. securities laws, would not directly be enforceable in Luxembourg. However, a party who received such favorable judgment in a U.S. court may initiate enforcement proceedings in Luxembourg (exequatur) by requesting enforcement of the U.S. judgment before the District Court (Tribunal d’Arrondissement) of Luxembourg sitting in civil matters pursuant to Article 678 of the New Luxembourg Code of Civil Procedure. The president of the District Court will authorize the enforcement in Luxembourg of the U.S. judgment if it is satisfied that all of the following conditions are met:

•

the U.S. judgment is enforceable (exécutoire) in the United States;

•

the jurisdictional ground of the U.S. court is founded according to Luxembourg private international law rules and to the applicable domestic U.S. federal or state jurisdiction rules;

•

the U.S. court has applied to the dispute the substantive law which would have been applied by Luxembourg courts or, at least, the judgment must not contravene the principles underlying these rules;

•

the U.S. judgment must not have violated the right of the defendant to present a defense;

•

the considerations of the U.S. judgment as well as the U.S. judgment as such do not contravene Luxembourg international public policy;

•

the U.S. court has acted in accordance with its own procedural laws; and

•

the U.S. judgment was not rendered as a result of or in connection with an evasion of Luxembourg law (“fraude à la loi”).

LEGAL MATTERS

Unless otherwise indicated in the applicable prospectus supplement, Weil, Gotshal & Manges LLP, New York, New York will pass upon the validity of the debt securities, guarantees, warrants and units offered by TE Connectivity, Swiss TEL or TEGSA. Unless otherwise indicated in the applicable prospectus supplement, Arthur Cox LLP, Dublin, Ireland, will opine upon certain Irish law matters, including the validity of the ordinary shares offered by TE Connectivity.

EXPERTS

The financial statements of TE Connectivity Ltd. as of September 29, 2023 and September 30, 2022, and for each of the three years in the period ended September 29, 2023, incorporated by reference in this Prospectus by reference to TE Connectivity Ltd.’s Annual Report on Form 10-K for the fiscal year ended September 29, 2023, and the effectiveness of TE Connectivity Ltd.’s internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their reports. Such financial statements are incorporated by reference in reliance upon the reports of such firm given upon their authority as experts in accounting and auditing.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following statement sets forth the expenses of TE Connectivity plc (“TE Connectivity”), TE Connectivity Switzerland Ltd. (“Swiss TEL”) and Tyco Electronics Group S.A. (“TEGSA” and together with TE Connectivity, the “Registrants”) in connection with the offering described in this Registration Statement (all of which will be borne by the Registrants). All amounts shown are estimated.

| |

SEC registration fee

|

|

|

|

$ |

* |

|

|

| |

Printing expenses

|

|

|

|

|

+ |

|

|

| |

Legal fees and expenses

|

|

|

|

|

+ |

|

|

| |

Audit fees and expenses

|

|

|

|

|

+ |

|

|

| |

Miscellaneous expenses

|

|

|

|

|

+ |

|

|

| |

Trustee fees and expenses

|

|

|

|

|

+ |

|

|

| |

Total

|

|

|

|

$ |

|

|

|

*

In accordance with Rules 456(b) and 457(r), the Registrants are deferring payment of the registration fee for the securities offered by this prospectus.

+

Estimated expenses are not presently known.

The foregoing sets forth the general categories of expenses (other than underwriting discounts and commissions) that the Registrants anticipate they will incur in connection with the offering of securities under this registration statement. Information regarding estimated expenses of issuance and distribution of each identified class of securities being registered will be provided at the time information as to such class is included in a prospectus supplement in accordance with Rule 430B.

Item 15. Indemnification of Directors and Officers TE Connectivity plc

Under Irish law, TE Connectivity may not exempt its directors from liability for negligence or a breach of duty. However, where a breach of duty has been established, directors may be statutorily exempted by an Irish court from personal liability for negligence or breach of duty if, among other things, the court determines that they have acted honestly and reasonably, and that they may fairly be excused as a result.

The Companies Act 2014 Act (the “Irish Companies Act”) permits a company to pay the costs or discharge the liability of a director or the secretary only where judgment is given in his/her favor in any civil or criminal action in respect of such costs or liability, or where an Irish court grants relief because the director or secretary acted honestly and reasonably and ought fairly to be excused. This restriction does not apply to executives who are not directors or the secretary. Any obligation of an Irish company that purports to indemnify a director or secretary of an Irish company over and above this will be void under Irish law, whether contained in its articles of association or any contract between the director or secretary and the company. In addition, the memorandum and articles of association of TE Connectivity provide that every director and the company secretary of TE Connectivity shall be entitled to be indemnified, to the fullest extent permitted by Irish company law, against all costs, charges, losses, expenses and liabilities incurred by them in the execution and discharge of their duties or in relation thereto including any liability incurred by them in defending any proceedings, civil or criminal, which relate to anything done or omitted or alleged to have been done or omitted by them as an officer or employee of TE Connectivity and in which judgment is given in their favor (or the proceedings are otherwise disposed of without any finding or admission of any material breach of duty on their part) or in which they are acquitted or in connection with any application under any statute for relief from liability in respect of any such act or omission in which relief is granted to them by a court.

The directors shall have power to purchase and maintain for any director, the secretary or any employees of the Company or its subsidiaries insurance against any such liability as referred to in the Irish Companies Act.

As far as is permissible under the Irish Companies Act, TE Connectivity shall indemnify any of its current or former executive officers(excluding any of its present or former directors or any company secretary), or any person who is serving or has served at the request of TE Connectivity as a director or executive officer of another company, joint venture, trust or other enterprise, including any subsidiary of TE Connectivity (each individually, a “Covered Person”), against any expenses, including attorney’s fees, judgments, fines, and amounts paid in settlement actually and reasonably incurred by him or her in connection with any threatened, pending, or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, to which he or she was or is threatened to be made a party, or is otherwise involved, by reason of the fact that he or she is or was a Covered Person.

In addition, TE Connectivity and TE Connectivity Corporation, a subsidiary of TE Connectivity, have entered into indemnification agreements with each of TE Connectivity’s directors, secretary and executive officers that provide for indemnification in respect of liabilities incurred when acting in their capacities as officers of TE Connectivity in accordance with customary standards (and in the case of TE Connectivity, in accordance with the limitations on indemnification outlined above).

Tyco Electronics Group S.A.

Under the articles of association of TEGSA, TEGSA may indemnify any director or officer and his or her heirs, executors and administrators against expenses reasonably incurred by such director or officer in connection with any action, suit or proceeding to which the director or officer may be made a party by reason of being or having been a director or officer of TEGSA or, at such director’s or officer’s request, of any other corporation of which TEGSA is a shareholder or creditor and from which the director or officer is not entitled to be indemnified, except in relation to matters as to which the director or officer is finally adjudged in such action, suit or proceeding to be liable for gross negligence or misconduct.

In the event of a settlement, indemnification will be provided only in connection with such matters covered by the settlement as to which TEGSA is advised by counsel that the person to be indemnified did not commit a breach of duty. Luxembourg law permits TEGSA to maintain insurance to compensate for any civil liability incurred by a director or officer in his or her official capacity or to indemnify for such loss or liability, and TE Connectivity has policies covering TEGSA’s directors and officers.

Item 16. Exhibits

| |

Exhibit

Number

|

|

|

Description

|

|

| |

1.1

|

|

|

Form of Underwriting Agreement.*

|

|

| |

2.1

|

|

|

Merger Agreement, dated March 18, 2024, between TE Connectivity Ltd. and TE Connectivity plc (incorporated by reference to Exhibit 2.1 to TE Connectivity Ltd.’s Current Report on Form 8-K filed with the SEC on March 18, 2024).

|

|

| |

4.1

|

|

|

Memorandum and Articles of Association of TE Connectivity plc, adopted with effect from September 30, 2024 (incorporated by reference to Exhibit 3.1 to TE Connectivity plc’s Current Report on Form 8-K, filed September 30, 2024).

|

|

| |

4.2

|

|

|

Indenture, dated as of September 25, 2007, among Tyco Electronics Group S.A., as issuer, TE Connectivity Ltd., as guarantor, and Deutsche Bank Trust Company Americas, as trustee (incorporated by reference to Exhibit 4.1(a) to TE Connectivity Ltd.’s Annual Report on Form 10-K for the fiscal year ended September 28, 2007, filed December 14, 2007).

|

|

| |

4.3

|

|

|

Twenty First Supplemental Indenture, dated as of September 24, 2024, among Tyco Electronics Group S.A., TE Connectivity Ltd., TE Connectivity plc, TE Connectivity Switzerland Ltd. and Deutsche Bank Trust Company Americas (incorporated by reference to Exhibit 4.1 to TE Connectivity Ltd.’s Current Report on Form 8-K12B filed with the SEC on September 30, 2024).

|

|

| |

4.4

|

|

|

Form of Note.*

|

|

| |

4.5

|

|

|

Form of certificated shares of TE Connectivity plc.*

|

|

| |

4.6

|

|

|

Form of Warrant Agreement for TE Connectivity plc.*

|

|

| |

4.7

|

|

|

Form of Unit Agreement for TE Connectivity plc.*

|

|

| |

4.8

|

|

|

Form of Unit Agreement for Tyco Electronics Group S.A.*

|

|

| |

5.1

|

|

|

|

|

| |

5.2

|

|

|

|

|

| |

23.1

|

|

|

|

|

| |

23.2

|

|

|

|

|

| |

23.3

|

|

|

|

|

| |

24.1

|

|

|

|

|

| |

25.1

|

|

|

|

|

| |

107

|

|

|

|

|

*

To be filed by amendment or as an exhibit to a document filed under the Securities Exchange Act of 1934 and incorporated herein by reference.

+

Filed herewith.

Item 17. Undertakings

The undersigned Registrants hereby undertake:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be

reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Filing Fee Tables” or “Calculation of Registration Fee” table, as applicable, in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (i), (ii) and (iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Securities and Exchange Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned Registrants undertake that in a primary offering of securities of the undersigned Registrants pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrants will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned Registrants relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrants or used or referred to by the undersigned Registrants;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned Registrants or its securities provided by or on behalf of the undersigned Registrants; and

(iv) Any other communication that is an offer in the offering made by the undersigned Registrants to the purchaser.

(6) That, for purposes of determining any liability under the Securities Act of 1933, each filing of TE Connectivity’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(7) To file an application for the purpose of determining the eligibility of the trustee to act under subsection (a) of Section 310 of the Trust Indenture Act in accordance with the rules and regulations prescribed by the Commission under Section 305(b)(2) of the Trust Indenture Act.

(8) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrants pursuant to the foregoing provisions, or otherwise, the Registrants have been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by a registrant of expenses incurred or paid by a director, officer or controlling person of such registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrants will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities and Exchange Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Berwyn, Pennsylvania, on this 1st day of October 2024.

| |

|

|

|

TE CONNECTIVITY PLC

|

|

| |

|

|

|

By:

|

|

|

/s/ Heath A. Mitts

Name: Heath A. Mitts

Title:

Executive Vice President and Chief Financial Officer

|

|

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons on October 1, 2024 in the capacities indicated below.

| |

Signature

|

|

|

Title

|

|

| |

/s/ Terrence R. Curtin

Terrence R. Curtin

|

|

|

Chief Executive Officer and Director

(Principal Executive Officer)

|

|

| |

/s/ Heath A. Mitts

Heath A. Mitts

|

|

|

Executive Vice President, Chief Financial Officer and Director (Principal Financial Officer)

|

|

| |

/s/ Robert J. Ott

Robert J. Ott

|

|

|

Senior Vice President and Corporate Controller (Principal Accounting Officer)

|

|

| |

/s/ Jean-Pierre Clamadieu

Jean-Pierre Clamadieu

|

|

|

Director

|

|

| |

/s/ Carol A. Davidson

Carol A. Davidson

|

|

|

Director

|

|

| |

/s/ Lynn A. Dugle

Lynn A. Dugle

|

|

|

Director

|

|

| |

/s/ William A. Jeffrey

William A. Jeffrey

|

|

|

Director

|

|

| |

/s/ Syaru Shirley Lin

Syaru Shirley Lin

|

|

|

Director

|

|

| |

/s/ Abhijit Y. Talwalkar

Abhijit Y. Talwalkar

|

|

|

Director

|

|

| |

/s/ Mark C. Trudeau

Mark C. Trudeau

|

|

|

Director

|

|

| |

Signature

|

|

|

Title

|

|

| |

/s/ Dawn C. Willoughby

Dawn C. Willoughby

|

|

|

Director

|

|

| |

/s/ Laura H. Wright

Laura H. Wright

|

|

|

Director

|

|

AUTHORIZED REPRESENTATIVE

Pursuant to the requirements of the Securities Act of 1933, as amended, the undersigned has signed this Registration Statement, solely in the capacity of the duly authorized representative of TE Connectivity plc in the United States, on this 1st day of October 2024.

| |

|

|

|

By:

|

|

|

/s/ John S. Jenkins, Jr.

John S. Jenkins, Jr.

TE Connectivity plc

Executive Vice President and General Counsel

|

|

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Berwyn, Pennsylvania, on this 1st day of October 2024.

| |

|

|

|

TE CONNECTIVITY SWITZERLAND LTD.

|

|

| |

|

|

|

By:

|

|

|

/s/ Harold G. Barksdale

Name: Harold G. Barksdale

Title:

Director

|

|

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons on October 1, 2024 in the capacities indicated below.

| |

Signature

|

|

|

Title

|

|

| |

/s/ Harold G. Barksdale

Harold G. Barksdale

|

|

|

Director and Authorized Representative in the United States

|

|

| |

/s/ Matthew M. Pilcher

Matthew M. Pilcher

|

|

|

Director

|

|

| |

/s/ Daniel T. Morgan

Daniel T. Morgan

|

|

|

Director

|

|

| |

/s/ Sarah Huot de Saint Albin

Sarah Huot de Saint Albin

|

|

|

Director

|

|

| |

/s/ Christian Schmidt

Christian Schmidt

|

|

|

Director

|

|

| |

/s/ Jörg Casparis

Jörg Casparis

|

|

|

Director

|

|

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Berwyn, Pennsylvania, on this 1st day of October 2024.

| |

|

|

|

TYCO ELECTRONICS GROUP S.A.

|

|

| |

|

|

|

By:

|

|

|

/s/ Harold G. Barksdale

Name: Harold G. Barksdale

Title:

Director

|

|

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons on October 1, 2024 in the capacities indicated below.

| |

Signature

|

|

|

Title

|

|

| |

/s/ Harold G. Barksdale

Harold G. Barksdale

|

|

|

Director and Authorized Representative in the United States

|

|

| |

/s/ Helena Brogan

Helena Brogan

|

|

|

Director

|

|

| |

/s/ Sabine M. Carbon

Sabine M. Carbon

|

|

|

Director and Controller

(Principal Financial and Accounting Officer)

|

|

| |

/s/ Jean-Jacques Fotzeu

Jean-Jacques Fotzeu

|

|

|

Director

|

|

| |

/s/ Sarah Huot de Saint Albin

Sarah Huot de Saint Albin

|

|

|

Director

|

|

| |

/s/ Patrick Segmueller

Patrick Segmueller

|

|

|

Director

|

|

Exhibit 5.1

767 Fifth Avenue

New York, NY 10153-0119

+1 212 310 8000 tel

+1 212 310 8007 fax

October 1, 2024

TE Connectivity plc

Ten Earlsfort Terrace

Dublin 2, D02 T380, Ireland

TE Connectivity Switzerland Ltd.

Mühlenstrasse 26

CH-8200 Schaffhausen

Switzerland

Tyco Electronics Group S.A.

46 Place Guillaume II

L-1648 Luxembourg

Ladies and Gentlemen:

We have acted as counsel to TE Connectivity plc,

an Irish public limited company (“TE Connectivity”), TE Connectivity Switzerland Ltd., a Swiss corporation (“Swiss

TE”), and Tyco Electronics Group S.A., a Luxembourg company (“TEGSA” and, together with TE Connectivity and Swiss TE,

the “Registrants”), in connection with the preparation and filing with the Securities and Exchange Commission (the “Commission”)

of the Registrants’ Registration Statement on Form S-3 (the “Registration Statement”), under the Securities Act

of 1933, as amended (the “Securities Act”), relating to the registration of the offer, issuance and sale from time to time

(i) by TE Connectivity of an indeterminate amount of (a) registered shares (the “Registered Shares”); (b) warrants

(the “Warrants”); (c) units (the “TE Connectivity Units”) comprised of Registered Shares, Warrants or Debt

Securities (as defined below); and (d) guarantees (the “Parent Guarantees”) of Debt Securities; (ii) by Swiss TE

of an indeterminate amount of guarantees of Debt Securities (the “Additional Guarantees” and, together with the Parent Guarantees,

the “Guarantees”); and (iii) by TEGSA of an indeterminate amount of (a) debt securities (the “Debt Securities”)

and (b) units comprised of Debt Securities and Registered Shares or Warrants (the “TEGSA Units” and, together with the

TE Connectivity Units, the “Units”). We refer to the Registered Shares, the Warrants, the Units, the Guarantees and the Debt

Securities collectively as the “Securities.”

In so acting, we have examined originals or copies

(certified or otherwise identified to our satisfaction) of the Registration Statement, the Prospectus contained in the Registration Statement

(the “Prospectus”), the Indenture, dated as of September 25, 2007 (the “Indenture”), among TEGSA, as issuer,

TE Connectivity, as guarantor, and Deutsche Bank Trust Company Americas, as trustee (the “Trustee”), the form of Guarantee

of TE Connectivity included in the Indenture and such corporate records, agreements, documents and other instruments, and such certificates

or comparable documents of public officials and of officers and representatives of each of the Registrants, and have made such inquiries

of such officers and representatives, as we have deemed relevant and necessary as a basis for the opinions hereinafter set forth.

| TE Connectivity plc |

|

| TE Connectivity Switzerland Ltd. |

|

| Tyco Electronics Group S.A. |

|

October 1, 2024

Page 2

In such examination, we have assumed the genuineness

of all signatures, the legal capacity of all natural persons, the authenticity of all documents submitted to us as originals, the conformity

to original documents of all documents submitted to us as certified, conformed or photostatic copies and the authenticity of the originals

of such latter documents. As to all questions of fact material to this opinion that have not been independently established, we have

relied upon certificates or comparable documents of officers and representatives of each of the Registrants.

Based on and subject to the foregoing and assuming

that (i) each of the Registrants validly exists and has the requisite corporate power and authority to issue the Securities and

to execute, deliver and perform its obligations under the Securities, (ii) each trustee for the Debt Securities and warrant agent

for the Warrants, when appointed, will validly exist and have the requisite corporate power and authority to enter into and perform its

obligations under the Indenture, the supplemental indenture relating to the Debt Securities and any warrant agreement, as applicable,

(iii) any Securities issuable upon conversion, exercise or exchange of any Securities being offered or issued will be duly authorized,

created and, if appropriate, reserved for issuance upon such conversion, exercise or exchange, (iv) the Registration Statement and

any amendments thereto (including any post-effective amendments) will have become effective and comply with all applicable laws and no

stop order suspending the Registration Statement’s effectiveness will have been issued and remain in effect, in each case, at the

time the Securities are offered or issued as contemplated by the Registration Statement, (v) a prospectus supplement will have been

prepared and filed with the Commission describing the Securities offered thereby and will at all relevant times comply with all applicable

laws, (vi) TE Connectivity has timely filed all necessary reports pursuant to the Securities Exchange Act of 1934, as amended, which

are incorporated by reference into the Registration Statement, (vii) all Securities will be issued and sold in compliance with applicable

federal and state securities laws and in the manner stated in the Registration Statement and any applicable prospectus supplement and

(viii) any definitive purchase, underwriting or similar agreement with respect to any Securities will have been duly authorized

and validly executed and delivered by the Registrants and the other party or parties thereto, we are of the opinion that:

1. Debt Securities. Assuming

that (i) the execution, delivery and performance of any Debt Securities (including any Debt Securities that may be issued as part

of Units or otherwise pursuant to the terms of any other Securities) and the terms thereof have been duly authorized by all necessary

corporate action on the part of TEGSA, (ii) the form of the Debt Securities and any supplemental indenture relating to such Debt

Securities has been duly authorized, executed and delivered by all parties thereto substantially in the form so filed, (iii) the

terms of such Debt Securities to be issued under the Indenture and the applicable supplemental indenture have been duly established in

conformity with the Indenture and the applicable supplemental indenture so as not to violate any applicable law, affect the enforceability

of such Debt Securities or result in a default under or breach of any agreement or instrument binding upon the Registrants, and so as

to comply with any requirement or restriction imposed by any court or governmental or regulatory body having jurisdiction over the Registrants,

(iv) such Debt Securities have been duly executed and authenticated in accordance with the Indenture and delivered against any contemplated

payment therefor and issued and sold as contemplated in the Registration Statement, the Prospectus and any prospectus supplement relating

thereto, and in accordance with any underwriting agreement and (v) such Debt Securities and the supplemental indenture relating

to such Debt Securities are governed by New York law, such Debt Securities (including any Debt Securities that may be issued as part

of Units or otherwise pursuant to the terms of any other Securities) will constitute legal, valid and binding obligations of TEGSA, enforceable

against TEGSA in accordance with their terms.

| TE Connectivity plc |

|

| TE Connectivity Switzerland Ltd. |

|

| Tyco Electronics Group S.A. |

|

October 1, 2024

Page 3

2. Warrants. Assuming that (i) the

execution, delivery and performance of any Warrants (including any Warrants that may be issued as part of Units or otherwise pursuant

to the terms of any other Securities) and the terms thereof have been duly authorized by all necessary corporate action on the part of

TE Connectivity, (ii) the warrant agreement or warrant agreements relating to such Warrants have been duly authorized, executed

and delivered by all parties thereto substantially in the form so filed, (iii) the terms of such Warrants have been duly established

so as not to violate any applicable law, affect the enforceability of such Warrants or result in a default under or breach of any agreement

or instrument binding upon TE Connectivity, and so as to comply with any requirement or restriction imposed by any court or governmental

or regulatory body having jurisdiction over TE Connectivity, (iv) such Warrants or certificates representing such Warrants have

been duly executed, authenticated and delivered against any contemplated payment therefor and issued and sold as contemplated in the

Registration Statement, the Prospectus and any prospectus supplement relating thereto, and in accordance with any underwriting agreement

and (v) such Warrants and the warrant agreement or warrant agreements relating to such Warrants are governed by New York law, such

Warrants (including any Warrants that may be issued as part of Units or otherwise pursuant to the terms of any other Securities) will

constitute legal, valid and binding obligations of TE Connectivity, enforceable against TE Connectivity in accordance with their terms.

3. Units. Assuming that (i) the

execution, delivery and performance of any Units and the terms thereof have been duly authorized by all necessary corporate action on

the part of the applicable Registrant and the securities of any other entities to be included in the Units, if any, have been duly authorized

and issued by such entity, (ii) the unit agreement or unit agreements relating to such Units have been duly authorized, executed

and delivered by all parties thereto substantially in the form so filed, (iii) the terms of such Units have been duly established

so as not to violate any applicable law, affect the enforceability of such Units or result in a default under or breach of any agreement

or instrument binding upon the applicable Registrant, and so as to comply with any requirement or restriction imposed by any court or

governmental or regulatory body having jurisdiction over the applicable Registrant, (iv) such Units have been issued, paid for and

delivered against any contemplated payment therefor and issued and sold as contemplated in the Registration Statement, the Prospectus

and any prospectus supplement relating thereto, and in accordance with any underwriting agreement and (v) such Units and the unit

agreement or unit agreements relating to such Units are governed by New York law, such Units will constitute legal, valid and binding

obligations of the applicable Registrant, enforceable against the applicable Registrant in accordance with their terms.

| TE Connectivity plc |

|

| TE Connectivity Switzerland Ltd. |

|

| Tyco Electronics Group S.A. |

|

October 1, 2024

Page 4

4. Guarantees. Assuming that

(i) the execution, delivery and performance of any Guarantees and the terms of the offering thereof have been duly authorized by

all necessary corporate action on the part of each of TE Connectivity and Swiss TE (each, a “Guarantor”), (ii) any

supplemental indenture relating to such Debt Securities and such Guarantees has been duly authorized, executed and delivered by all parties

thereto substantially in the form so filed, (iii) the Debt Securities have been duly executed and authenticated in accordance with

the Indenture and any applicable supplemental indenture, (iv) the terms of the Guarantees to be issued under the Indenture and any

applicable supplemental indenture have been duly established in conformity with the Indenture and any applicable supplemental indenture

so as not to violate any applicable law, affect the enforceability of such Guarantees or result in a default under or breach of any agreement

or instrument binding upon each Guarantor, and so as to comply with any requirement or restriction imposed by any court or governmental

or regulatory body having jurisdiction over each Guarantor, (v) the Guarantees have been duly executed in accordance with the Indenture

and any applicable supplemental indenture and delivered against any contemplated payment therefor and issued and sold as contemplated

in the Registration Statement, the Prospectus and any prospectus supplement relating thereto, and in accordance with any underwriting

agreement and (vi) such Guarantees and the supplemental indenture relating to such Guarantees are governed by New York law, such

Guarantees will constitute legal, valid and binding obligations of each Guarantor, enforceable against each Guarantor in accordance with

their terms.

The opinions expressed above with respect to the

validity, binding effect and enforceability of the Securities are subject to applicable bankruptcy, insolvency, fraudulent conveyance,

reorganization, moratorium and similar laws affecting creditors’ rights and remedies generally, and subject, as to enforceability,

to general principles of equity, including principles of commercial reasonableness, good faith and fair dealing (regardless of whether

enforcement is sought in a proceeding at law or in equity) and except that rights to indemnification and contribution thereunder may

be limited by federal or state securities laws or public policy relating thereto. The opinions are also subject to the issuance of any

legally required consents, approvals, authorizations or orders of the Commission and any other regulatory authority.

| TE Connectivity plc |

|

| TE Connectivity Switzerland Ltd. |

|

| Tyco Electronics Group S.A. |

|

October 1, 2024

Page 5

The opinions expressed herein are limited to the laws of the State

of New York, and we express no opinion as to the effect on the matters covered by this letter of the laws of any other jurisdiction.

We hereby consent to the use of this letter as

an exhibit to the Registration Statement and to the reference to our firm under the caption “Legal Matters” in the Prospectus,

which is a part of the Registration Statement. In giving such consent, we do not hereby admit that we are in the category of persons

whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission.

Very truly yours,

/s/ Weil, Gotshal & Manges LLP

Exhibit 5.2

1 October 2024

| To: | Board of Directors |

| | TE Connectivity plc

10 Earlsfort Terrace

Dublin 2

D02 T380

Ireland

|

| Re: | TE Connectivity plc Form S-3 Registration Statement |

Dear Directors

| 1.1 | We are acting as Irish counsel to TE Connectivity plc, a public company limited by shares, incorporated

under the laws of Ireland, with its registered office at 10 Earlsfort Terrace, Dublin 2, D02 T380, Ireland (the “Company”),

in connection with the preparation and filing of a Registration Statement on Form S-3 (the “Registration Statement”)

with the United States Securities and Exchange Commission (the “Commission”), under the Securities Act of 1933, as

amended (the “Securities Act”). We refer in particular to Ordinary Shares with a nominal value of US$0.01 each of the

Company (the “Shares”) that may be issued pursuant to the Registration Statement. |

| 1.2 | This Opinion is confined to and given in all respects on the basis of the laws of Ireland (meaning Ireland

exclusive of Northern Ireland) in force as at the date of this Opinion as currently applied by the courts of Ireland. We have made no

investigation of and we express no opinion as to the laws of any other jurisdiction or the effect thereof. |

| 1.3 | This Opinion is also strictly confined to: |

| (a) | the matters expressly stated herein at paragraph 2 below and is not to be read as extending by implication

or otherwise to any other matter; |

| (b) | the documents listed in the schedule to this Opinion (the “Documents”); and |

| (c) | the searches listed at Paragraph 1.6 below. |

| 1.4 | We express no opinion, and make no representation or warranty, as to any matter of fact or in respect

of any documents which may exist in relation to the Shares, other than the Documents. |

| 1.5 | For the purpose of giving this Opinion, we have examined copies of the Documents sent to us by email in

pdf or other electronic format. |

| 1.6 | For the purpose of giving this Opinion, we have caused to be made the following legal searches against

the Company on or about the date hereof (the “Searches”): |

| (a) | on the file of the Company maintained by the Irish Registrar of Companies in Dublin for returns of allotments,

special resolutions amending the Memorandum and Articles of Association of the Company and notice of the appointment of directors and

secretary of the Company and for the appointment of any receiver, examiner or liquidator; |

| (b) | in the Judgments Office of the High Court for unsatisfied judgments, orders, decrees and the like for

the five years immediately preceding the date of the search in respect of the Company; and |

| (c) | in the Central Office of the High Court in Dublin for any proceedings or petitions filed. |

| 1.7 | This Opinion is governed by and is to be construed in accordance with the laws of Ireland as interpreted

by the courts of Ireland at the date hereof. |

Subject to the assumptions and qualifications

set out in this Opinion and to any matters not disclosed to us, we are of the opinion that:

| 2.1 | the Company is a public company limited by shares, is duly incorporated and validly existing under the

laws of Ireland and has the requisite corporate authority to issue the Shares; |

| 2.2 | when the Shares have been issued and allotted pursuant to and in accordance with the terms and conditions

referred to or summarized in the applicable resolutions of the board of directors of the Company, the Shares will be validly issued, fully

paid up and non-assessable (which term means when used herein that no further sums are required to be paid by the holders thereof in connection

with the issue of such Shares). |

For the purpose of giving this Opinion,

we assume the following without any responsibility on our part if any assumption proves to have been untrue as we have not verified independently

any assumption:

Registration Statement and the Shares

| 3.1 | that when filed with the SEC, the Registration Statement will not differ in any material respect from

the drafts that we have examined; |

| 3.2 | that any Shares issued under the Registration Statement will be in consideration of the receipt by the

Company prior to the issue of the Shares pursuant thereto of either cash or the release of a liability of the Company for a liquidated

sum, at least equal to the nominal value of such Shares and any premium required to be paid up on the Shares pursuant to their terms of

issue; |

| 3.3 | that the filing of the Registration Statement with the SEC has been authorized by all necessary actions

under all applicable laws other than Irish law; |

| 3.4 | with respect to Shares issued on or after 30 September 2029 (the date of expiry of the Company’s

existing authority to issue Shares), that, at the time of issue of the Shares, the authority of the Company and the directors of the Company

to issue the Shares, as granted by the articles of association of the Company (the “Articles of Association”) and the

Companies Act 2014 of Ireland (the “Companies Act”), is in full force and effect; |

| 3.5 | with respect to Shares which are relevant securities (as defined in section 1021 of the Companies Act)

that will have not been authorised for issue prior to 30 September 2029 but are issued and/or authorised for issue on or after 30

September 2029 (the date of expiry of the Company’s existing authority to issue Shares), that the Company will, at each subsequent

annual general meeting, have renewed its authority to issue the Shares in accordance with the terms and conditions set out in the Articles

of Association and the Companies Act for the remainder of the period that the Registration Statement will continue in effect; |

| 3.6 | that the issue of the Shares upon the conversion, exchange and exercise of any securities issued under

the Registration Statement will be conducted in accordance with the terms and the procedures described in the Articles of Association,

the Companies Act and the terms of issue of such securities; |

| 3.7 | that, at the time of issue of the Shares, the Company will have sufficient authorised but unissued share

capital to issue the required number of Shares and the Company will not have prior to, or by virtue of, the issuance, exceeded or exceed

the maximum number of Shares permitted by the Company’s shareholders to be issued pursuant to the authorities referred to in paragraphs

3.4 and 3.5 above; |

| 3.8 | that any issue of Shares will be in compliance with the Companies Act, the Irish Takeover Panel Act, 1997,

Takeover Rules 2022 and all other applicable Irish company, takeover, securities, market abuse, insider dealing laws and other rules and

regulations; |

| 3.9 | that as at the time of the issuance of the Shares, such issuance shall not be in contravention or breach

of any agreement, undertaking, arrangement, deed or covenant affecting the Company or to which the Company is a party or otherwise bound

or subject; |

| 3.10 | that any power of attorney granted by the Company in respect of the issue and allotment of the Shares

shall have been duly granted, approved and executed in accordance with the Company’s Articles of Association, the Companies Act,