Coach Establishes New $500 Million Share Repurchase Program; Announces Completion of Current Program

09 Mayo 2006 - 6:00AM

Business Wire

Coach, Inc. (NYSE: COH), a leading marketer of modern classic

American accessories, today announced that its Board of Directors

has authorized the repurchase of up to $500 million of its

outstanding common stock by the end of June 2007. Pursuant to this

new program, purchases of shares of the company's common stock will

be made from time to time, subject to market conditions and at

prevailing market prices, through open market purchases.

Repurchased shares of common stock will become authorized but

unissued shares, and may be issued in the future for general

corporate and other purposes. The company may terminate or limit

the stock repurchase program at any time. Lew Frankfort, Chairman

and Chief Executive Officer of Coach, Inc., said, "The stock

repurchase program is designed both to offset share issuances under

our employee compensation plans, as well as to increase economic

value for shareholders. Coach's excellent financial condition

allows us to take advantage of opportunities to purchase our

securities at attractive prices, particularly considering our

outstanding prospects." Concurrently, the company announced that it

has just completed the current $250 million repurchase program that

was put into place in May 2005. The company has acquired a total of

7,609,440 shares of its outstanding common stock under this

program, at a cost of approximately $250 million, or an average

cost of $32.89 per share. Coach, with headquarters in New York, is

a leading American marketer of fine accessories and gifts for women

and men, including handbags, women's and men's small leathergoods,

business cases, weekend and travel accessories, footwear, watches,

outerwear, sunwear, and related accessories. Coach is sold

worldwide through Coach stores, select department stores and

specialty stores, through the Coach catalog in the U.S. by calling

1-800-223-8647 and through Coach's website at www.coach.com.

Coach's shares are traded on The New York Stock Exchange under the

symbol COH. This press release contains forward-looking statements

based on management's current expectations. These statements can be

identified by the use of forward-looking terminology such as "may,"

"will," "should," "expect," "intend," "estimate," "are positioned

to," "continue," "project," "guidance," "forecast," "anticipated,"

or comparable terms. Future results may differ materially from

management's current expectations, based upon risks and

uncertainties such as expected economic trends, the ability to

anticipate consumer preferences, the ability to control costs, etc.

Please refer to Coach's latest Annual Report on Form 10-K for a

complete list of risk factors.

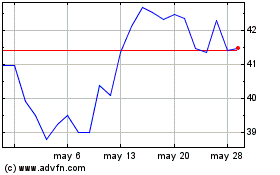

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

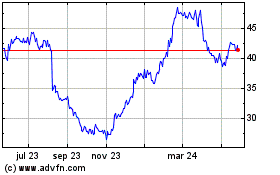

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024