1934 Act Registration No. 1-14700

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 6-K

_____________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

(Commission File Number: 001-14700)

_____________________________

Taiwan Semiconductor Manufacturing Company Ltd.

(Translation of Registrant’s Name Into English)

_____________________________

No. 8, Li-Hsin Rd. 6,

Hsinchu Science Park,

Taiwan, R.O.C.

(Address of Principal Executive Offices)

_____________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in papers as permitted by Regulation S-T Rule 101(b)(1):o

Indicate by check mark if the registrant is submitting the Form 6-K in papers as permitted by Regulation S-T Rule 101(b)(7):o

| | | | | | | | | | | | | | | | | | | | | | | |

| SIGNATURES | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. | |

| | | | | | | |

|

| | | | | | |

| | | | | | | | | | | | | | | | | |

| | Taiwan Semiconductor Manufacturing Company Ltd. |

| | | | | |

| Date: July 18, 2024 | By | | /s/ Wendell Huang | |

| | | | | |

| | | | Wendell Huang | |

| | | | | |

| | | | Senior Vice President & Chief Financial Officer | |

Exhibits

| | | | | |

| Exhibit Number | Exhibit Description |

| 99.1 | |

| 99.2 | |

TSMC Reports Second Quarter EPS of NT$9.56

HSINCHU, Taiwan, R.O.C., Jul. 18, 2024 -- TSMC (TWSE: 2330, NYSE: TSM) today announced consolidated revenue of NT$673.51 billion, net income of NT$247.85 billion, and diluted earnings per share of NT$9.56 (US$1.48 per ADR unit) for the second quarter ended June 30, 2024.

Year-over-year, second quarter revenue increased 40.1% while net income and diluted EPS both increased 36.3%. Compared to first quarter 2024, second quarter results represented a 13.6% increase in revenue and a 9.9% increase in net income. All figures were prepared in accordance with TIFRS on a consolidated basis.

In US dollars, second quarter revenue was $20.82 billion, which increased 32.8% year-over-year and increased 10.3% from the previous quarter.

Gross margin for the quarter was 53.2%, operating margin was 42.5%, and net profit margin was 36.8%.

In the second quarter, shipments of 3-nanometer accounted for 15% of total wafer revenue; 5-nanometer accounted for 35%; 7-nanometer accounted for 17%. Advanced technologies, defined as 7-nanometer and more advanced technologies, accounted for 67% of total wafer revenue.

“Our business in the second quarter was supported by strong demand for our industry-leading 3nm and 5nm technologies, partially offset by continued smartphone seasonality,” said Wendell Huang, Senior VP and Chief Financial Officer of TSMC. “Moving into third quarter 2024, we expect our business to be supported by strong smartphone and AI-related demand for our leading-edge process technologies.”

Based on the Company’s current business outlook, management expects the overall performance for third quarter 2024 to be as follows:

•Revenue is expected to be between US$22.4 billion and US$23.2 billion;

And, based on the exchange rate assumption of 1 US dollar to 32.5 NT dollars,

•Gross profit margin is expected to be between 53.5% and 55.5%;

•Operating profit margin is expected to be between 42.5% and 44.5%.

TSMC’s 2024 second quarter consolidated results:

(Unit: NT$ million, except for EPS)

| | | | | | | | | | | | | | | | | |

| 2Q24 Amounta | 2Q23 Amount | YoY Inc. (Dec.) % | 1Q24 Amount | QoQ Inc. (Dec.) % |

Net sales | 673,510 | 480,841 | 40.1 | 592,644 | 13.6 |

Gross profit | 358,125 | 260,200 | 37.6 | 314,505 | 13.9 |

Income from operations | 286,556 | 201,958 | 41.9 | 249,018 | 15.1 |

| | | | | | | | | | | | | | | | | |

Income before tax | 306,311 | 214,675 | 42.7 | 266,543 | 14.9 |

Net income | 247,845 | 181,799 | 36.3 | 225,485 | 9.9 |

EPS (NT$) | 9.56b | 7.01c | 36.3 | 8.70d | 9.9 |

a: 2Q2024 figures have not been approved by Board of Directors

b: Based on 25,931 million weighted average outstanding shares

c: Based on 25,929 million weighted average outstanding shares

d: Based on 25,930 million weighted average outstanding shares

About TSMC

TSMC pioneered the pure-play foundry business model when it was founded in 1987, and has been the world’s leading dedicated semiconductor foundry ever since. The Company supports a thriving ecosystem of global customers and partners with the industry’s leading process technologies and portfolio of design enablement solutions to unleash innovation for the global semiconductor industry. With global operations spanning Asia, Europe, and North America, TSMC serves as a committed corporate citizen around the world.

TSMC deployed 288 distinct process technologies, and manufactured 11,895 products for 528 customers in 2023 by providing the broadest range of advanced, specialty and advanced packaging technology services. The Company is headquartered in Hsinchu, Taiwan. For more information please visit https://www.tsmc.com.

# # #

| | | | | | | | | | | |

TSMC Spokesperson: Wendell Huang Senior Vice President and CFO Tel: 886-3-505-5901 | Media Contacts: Nina Kao Head of Public Relations Tel: 886-3-563-6688 ext.7125036 Mobile: 886-988-239-163 E-Mail: nina_kao@tsmc.com |

|

Ulric Kelly Public Relations Tel: 886-3-563-6688 ext.7126541 Mobile: 886-978-111-503 E-Mail: ukelly@tsmc.com |

Unleash Innovation TSMC, Ltd© 02024 TSMC Property Unleash Innovation 2024 Second Quarter Earnings Conference July 18, 2024

Unleash Innovation TSMC, Ltd© 12024 TSMC Property Agenda • Welcome Jeff Su, IR Director • 2Q24 Financial Results and 3Q24 Outlook Wendell Huang, CFO • Key Messages Wendell Huang, CFO C.C. Wei, Chairman & CEO • Q&A

Unleash Innovation TSMC, Ltd© 22024 TSMC Property Safe Harbor Notice • TSMC’s statements of its current expectations are forward-looking statements subject to significant risks and uncertainties and actual results may differ materially from those contained in the forward-looking statements. • Information as to those factors that could cause actual results to vary can be found in TSMC’s 2023 Annual Report on Form 20-F filed with the United States Securities and Exchange Commission (the “SEC”) on April 18, 2024 and such other documents as TSMC may file with, or submit to, the SEC from time to time. • Except as required by law, we undertake no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise.

Unleash Innovation TSMC, Ltd© 32024 TSMC Property Statements of Comprehensive Income Selected Items from Statements of Comprehensive Income 2Q24 (In NT$ billions unless otherwise noted) Guidance Net Revenue (US$ billions) 20.82 19.6-20.4 18.87 15.68 +10.3% +32.8% Net Revenue 673.51 592.64 480.84 +13.6% +40.1% Gross Margin 53.2% 51%-53% 53.1% 54.1% +0.1 ppt -0.9 ppt Operating Expenses (70.30) (65.36) (58.19) +7.6% +20.8% Operating Margin 42.5% 40%-42% 42.0% 42.0% +0.5 ppt +0.5 ppt Non-Operating Items 19.75 17.52 12.72 +12.7% +55.3% Net Income Attributable to Shareholders of the Parent Company 247.85 225.49 181.80 +9.9% +36.3% Net Profit Margin 36.8% 38.0% 37.8% -1.2 ppts -1.0 ppt EPS (NT Dollar) 9.56 8.70 7.01 +9.9% +36.3% ROE 26.7% 25.4% 23.2% +1.3 ppts +3.5 ppts Shipment (Kpcs, 12"-equiv. Wafer) 3,125 3,030 2,916 +3.1% +7.2% Average Exchange Rate--USD/NTD 32.35 32.30 31.40 30.67 +3.0% +5.5% * Diluted weighted average outstanding shares were 25,931mn units in 2Q24 ** ROE figures are annualized based on average equity attributable to shareholders of the parent company 2Q24 1Q24 2Q23 2Q24 Over 1Q24 2Q24 Over 2Q23

Unleash Innovation TSMC, Ltd© 42024 TSMC Property - 50 100 150 200 250 300 350 400 450 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 R e v e n u e ( N T $ B ) 7nm 5nm 3nm 2Q24 Revenue by Technology 7nm and Below Revenue 0.11/0.13um 2%90nm 1% 0.25um and above 1% 40/45nm 5% 28nm 8% 16nm 9% 0.15/0.18um 4% 65nm 3% 7nm 17% 5nm 35% 3nm 15%

Unleash Innovation TSMC, Ltd© 52024 TSMC Property 2Q24 Revenue by Platform +28% -1% +6% +5% +20% +5% Growth Rate by Platform (QoQ) Automotive 5% DCE 2% Others 2% IoT 6% Smartphone Automotive OthersHPC IoT DCE HPC 52% Smartphone 33%

Unleash Innovation TSMC, Ltd© 62024 TSMC Property Balance Sheets & Key Indices Selected Items from Balance Sheets (In NT$ b illions) Amount % Amount % Amount % Cash & Marketable Securities 2,048.64 34.3% 1,922.66 33.2% 1,489.96 28.9% Accounts Receivable 210.21 3.5% 201.98 3.5% 191.03 3.7% Inventories 272.49 4.5% 267.12 4.6% 234.33 4.6% Long-term Investments 140.22 2.4% 138.47 2.4% 94.61 1.8% Net PP&E 3,105.86 51.9% 3,051.85 52.7% 2,947.23 57.2% Total Assets 5,982.36 100.0% 5,787.89 100.0% 5,149.47 100.0% Current Liabilities 1,048.92 17.5% 1,026.18 17.7% 810.83 15.8% Long-term Interest-bearing Debts 974.34 16.3% 965.56 16.7% 907.32 17.6% Total Liabilities 2,162.22 36.1% 2,122.18 36.7% 1,944.00 37.8% Total Shareholders' Equity 3,820.14 63.9% 3,665.71 63.3% 3,205.47 62.2% Key Indices A/R Turnover Days Inventory Turnover Days Current Ratio (x) Asset Productivity (x) * Total outstanding shares were 25,930mn units at 6/30/24 ** Asset productivity = Annualized net revenue / Average net PP&E 83 2Q24 1Q24 2Q23 28 31 32 90 99 2.5 2.4 2.4 0.9 0.8 0.7

Unleash Innovation TSMC, Ltd© 72024 TSMC Property Cash Flows * Free cash flow = Cash from operating activities – Capital expenditures (In NT$ billions) 2Q24 1Q24 2Q23 Beginning Balance 1,698.20 1,465.43 1,385.23 Cash from operating activities 377.67 436.31 167.25 Capital expenditures (205.68) (181.30) (250.53) Cash dividends (90.76) (77.80) (71.30) Bonds payable 11.50 22.80 40.70 Investments and others 8.20 32.76 5.37 Ending Balance 1,799.13 1,698.20 1,276.72 Free Cash Flow 171.99 255.01 (83.28)*

Unleash Innovation TSMC, Ltd© 82024 TSMC Property 3Q24 Guidance ◼ Revenue to be between US$22.4 billion and US$23.2 billion Based on our current business outlook, management expects: And, based on the exchange rate assumption of 1 US dollar to 32.5 NT dollars, management expects: ◼ Gross profit margin to be between 53.5% and 55.5% ◼ Operating profit margin to be between 42.5% and 44.5%

Unleash Innovation TSMC, Ltd© 92024 TSMC Property • Please visit TSMC's website (https://www.tsmc.com) and Market Observation Post System (https://mops.twse.com.tw) for details and other announcements • TSMC Shareholders Elect Board of Directors; Board of Directors Unanimously Elects Dr. C.C. Wei as Chairman and CEO (2024/06/04) • TSMC Board of Directors Approved NT$4.00 Cash Dividend for the First Quarter of 2024 and Set September 12 as the Ex-Dividend Date, September 18 as the Record Date and October 9, 2024 as the Distribution Date (2024/05/10) • TSMC Celebrates 30th North America Technology Symposium with Innovations Powering AI with Silicon Leadership (2024/04/24) Recap of Recent Major Events

Unleash Innovation TSMC, Ltd© 102024 TSMC Property https://www.tsmc.com invest@tsmc.com

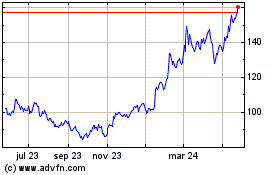

Taiwan Semiconductor Man... (NYSE:TSM)

Gráfica de Acción Histórica

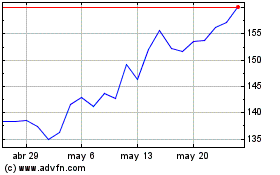

De Feb 2025 a Mar 2025

Taiwan Semiconductor Man... (NYSE:TSM)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025