EQT Earnings Shine, Outlook Bright - Analyst Blog

25 Julio 2013 - 3:00PM

Zacks

EQT Corporation’s

(EQT) second quarter 2013 adjusted earnings increased to 57 cents

per share from 21 cents in prior-year quarter and surpassed the

Zacks Consensus Estimate of 55 cents. The year-over-year increase

was primarily attributable to increases in production sales,

prices, gathered volumes, and transmission capacity sales and

throughput.

Net operating revenue in the quarter was $520.1 million, ahead of

the Zacks Consensus Estimate of $485.0 million and above the

year-ago number of $337.8 million.

Segment Details

EQT Production's second quarter operating revenues increased 93%

year over year to $306.1 million. The growth came from a 54%

increase in sales volume and higher average effective price,

partially offset by an increase in operating expenses. Operating

income increased from $17.7 million a year ago to $105.1

million.

Under the EQT Midstream segment, revenues rose 21.3% year over year

to $131.3 million in the reported quarter. Of this, net gathering

revenues surged 21% year over year to $87.0 million, owing to 50%

growth in gathered volumes. Net transmission revenue increased 81%

year over year to $38.8 million. Net storage, marketing and other

operating revenue fell $9.2 million year over year to $5.5 million,

owing to lower margins and reduced activity. Operating income rose

$12.5 million year over year to $72.2 million.

EQT Distribution’s net operating revenue increased $1.1 million

year over year to $32.3 million. The segment generated operating

income of $6.2 million versus $6.4 million a year ago.

Financials

The company’s operating cash flow was $316.7 million during the

quarter, reflecting an increase of 90.8% year over year.

EQT’s capital expenditure totaled $499 million, with $398.1 million

spent on EQT Production, $91.3 million on EQT Midstream and $9.6

million on EQT Distribution.

Guidance

The company has increased its full-year production sales volume

guidance to 360–365 Bcfe, which is 40% higher than 2012. It also

raised its 2013 NGL volume guidance to 4,800–5,000 Mbbls.

Ranks

The company holds a Zacks Rank #2, which translates to a short-term

Buy rating. However, there are other Zacks Ranked #1 (Strong Buy)

stocks – VOC Energy Trust (VOC),

Blueknight Energy Partners, L.P. (BKEP) and

Memorial Production Partners LP (MEMP), – in the

oil and gas sector that are expected to outperform the market in

the coming one to three months.

BLUEKNIGHT EGY (BKEP): Free Stock Analysis Report

EQT CORP (EQT): Free Stock Analysis Report

MEMORIAL PRODUC (MEMP): Free Stock Analysis Report

VOC ENERGY TRST (VOC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

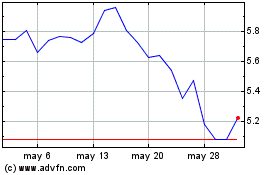

Voc Energy (NYSE:VOC)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Voc Energy (NYSE:VOC)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024