0001025378

false

0001025378

2023-10-06

2023-10-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (Date of earliest event reported):

October 6, 2023

W. P. Carey Inc.

(Exact Name of Registrant as Specified in its Charter)

| Maryland |

|

001-13779 |

|

45-4549771 |

| (State of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

One Manhattan West, 395 9th Avenue,

58th Floor

New York, New York |

|

10001 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (212) 492-1100

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 Par Value |

|

WPC |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

On October 6, 2023, W. P. Carey Inc. (the “Company”)

issued a press release announcing the establishment of the record date and distribution date for the distribution of common shares of

Net Lease Office Properties (“NLOP”) to the holders of the Company’s common stock in connection previously announced

spin-off of certain office properties of the Company to NLOP. A copy of the press release is furnished as Exhibit 99.1 hereto and

incorporated by reference into this Item 7.01.

The information furnished pursuant to this Item 7.01, including Exhibit 99.1,

shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise subject to the liability of that Section, and shall not be incorporated by reference into any

filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act.

Forward Looking Statements

Certain of the matters discussed in this Current Report on Form 8-K

constitute forward-looking statements within the meaning of the Securities Act and the Exchange Act, both as amended by the Private Securities

Litigation Reform Act of 1995. The forward-looking statements include, among other things, statements regarding the intent, belief or

expectations of the Company and can be identified by the use of words such as “may,” “will,” “should,”

“would,” “will be,” “goals,” “believe,” “project,” “expect,” “anticipate,”

“intend,” “estimate,” “opportunities,” “possibility,” “strategy,” “maintain”

or the negative version of these words and other comparable terms. These forward-looking statements include, but are not limited to, statements

regarding the expected timing and outcome of the proposed spin-off of certain of the Company’s office properties, if it occurs at

all, including the anticipated distribution date. These statements are based on the current expectations of the Company’s management,

and it is important to note that the Company’s actual results could be materially different from those projected in such forward-looking

statements. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking

statements. Other unknown or unpredictable risks or uncertainties, like the risks related to inflation and increased interest rates, the

effects of pandemics and global outbreaks of contagious diseases (such as the COVID-19 pandemic) and domestic or geopolitical crises,

such as terrorism, military conflict (including the ongoing conflict between Russia and Ukraine and the global response to it), war or

the perception that hostilities may be imminent, political instability or civil unrest, or other conflict, and those additional risk factors

discussed in reports that the Company has filed with the Securities and Exchange Commission (the “SEC”), could also have material

adverse effects on the Company’s future results, performance or achievements. Discussions of some of these other important factors

and assumptions are contained in the Company’s filings with the SEC and are available at the SEC's website at http://www.sec.gov,

including Part I, Item 1A. Risk Factors in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31,

2022, as well as the risks described under the heading “Risk Factors” in the Registration Statement on Form 10 filed

by NLOP in connection with the proposed spin-off. Investors are cautioned not to place undue reliance on these forward-looking statements,

which speak only as of the date of this communication, unless noted otherwise. Except as required under the federal securities laws and

the rules and regulations of the SEC, the Company does not undertake any obligation to release publicly any revisions to the forward-looking

statements to reflect events or circumstances after the date of this communication or to reflect the occurrence of unanticipated events.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | W.

P. Carey Inc. |

| | |

| Date: |

October 6, 2023 | By: |

/s/

ToniAnn Sanzone |

| | |

ToniAnn

Sanzone |

| | |

Chief Financial Officer |

Exhibit 99.1

W. P. Carey Announces Record and Distribution

Dates for Spin-Off of Net Lease Office Properties

Distribution Ratio Set at 1 NLOP Share for Every

15 W. P. Carey Shares

NEW YORK, Oct. 6, 2023 -- W. P. Carey Inc. (W. P. Carey, NYSE:

WPC) today announced that the Registration Statement on Form 10 associated with the previously announced plan to spin off 59 office

properties (the “Spin-Off”), filed under the newly created company Net Lease Office Properties (“NLOP”), that will be a separate, publicly-traded real estate investment trust, was declared

effective on October 6, 2023. W. P. Carey has declared October 19, 2023 as the record date for the Spin-Off and November 1,

2023 as the distribution date for the Spin-Off.

The dates set forth above may be delayed subject to satisfaction or

waiver of the conditions to the Spin-Off. The Spin-Off will be accomplished via a pro rata dividend of one NLOP common share for every

15 shares of W. P. Carey common stock outstanding as of the record date for the Spin-Off. W. P. Carey stockholders will receive cash in

lieu of fractional shares in the Spin-Off. No action is required by W. P. Carey stockholders in order to receive common shares of NLOP in the Spin-Off.

W. P. Carey stockholders are urged to consult their financial and tax

advisors regarding the particular consequences of the Spin-Off in their situation, including, without limitation, the specific implications

of selling common shares of NLOP and the applicability and effect of any U.S. federal, state, local and foreign tax laws.

Information regarding NLOP and the Spin-Off can be found in the full Registration Statement

on Form 10 initially filed by NLOP with the Securities and Exchange Commission (“SEC”) on September 21, 2023, and

in other documents that NLOP files with the SEC, as well as in an investor presentation regarding the proposed transactions in the Investor

Relations section of W. P. Carey’s website at www.wpcarey.com/presentation. Additional information regarding NLOP may also be found on its website at www.nloproperties.com.

Additional Details About the Distribution

W. P. Carey has been advised by the New York Stock Exchange (“NYSE”)

that a "when issued" public trading market for NLOP common shares will commence on October 27, 2023 under the symbol "NLOP

WI" and continue through November 1, 2023, and that "regular way" trading of NLOP common shares will begin on November 2,

2023 under the symbol “NLOP”.

W. P. Carey common stock is expected to trade "regular way" on the NYSE under the symbol "WPC" from October 18, 2023 through November 1, 2023. Any holders who

sell W. P. Carey common stock “regular way” on or before November 1, 2023 will also be selling their right to receive

NLOP common shares.

On October 27, 2023, an “ex-distribution” market for

W. P. Carey common stock is expected to begin on the NYSE under the symbol "WPC WI" and continue through November 1, 2023.

Holders of W. P. Carey common stock who sell in the "ex-distribution" market under the symbol “WPC WI” on or before

November 1, 2023 will only be selling shares of W. P. Carey common stock and will be retaining the right to receive NLOP common shares

in the distribution.

W. P. Carey stockholders who hold common stock on the record date and

decide to sell any of their W. P. Carey common stock before the distribution date should consult with their stockbroker, bank or other

nominee to understand whether the shares of W. P. Carey common stock will be sold with or without the entitlement to NLOP common shares

pursuant to the Spin-Off.

W. P. Carey Inc.

Celebrating its 50th anniversary,

W. P. Carey ranks among the largest net lease REITs with a well-diversified portfolio of high-quality, operationally critical commercial

real estate, which includes 1,416 net lease properties covering approximately 171 million square feet and a portfolio of 85 self-storage

operating properties, pro forma for the Spin-Off of NLOP, as of June 30, 2023. With offices in New York, London, Amsterdam and Dallas,

the company remains focused on investing primarily in single-tenant, industrial, warehouse and retail properties located in the U.S. and

Northern and Western Europe, under long-term net leases with built-in rent escalations.

www.wpcarey.com

Cautionary Statement Concerning

Forward-Looking Statements

Certain of the matters discussed in this communication constitute

forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended

by the Private Securities Litigation Reform Act of 1995. The forward-looking statements include, among other things, statements regarding

the intent, belief or expectations of W. P. Carey and can be identified by the use of words such as "may," "will,"

"should," "would," "will be," "goals," "believe," "project," "expect,"

"anticipate," "intend," "estimate" "opportunities," "possibility," "strategy,"

"maintain" or the negative version of these words and other comparable terms. These forward-looking statements include, but

are not limited to, statements regarding the contemplated spin-off with NLOP, including the expected timing and outcome of the spin-off.

These statements are based on the current expectations of our management, and it is important to note that our actual results could be

materially different from those projected in such forward-looking statements. There are a number of risks and uncertainties that could

cause actual results to differ materially from the forward-looking statements. Other unknown or unpredictable risks or uncertainties,

like the risks related to inflation and increased interest rates, the effects of pandemics and global outbreaks of contagious diseases

(such as the COVID-19 pandemic) and domestic or geopolitical crises, such as terrorism, military conflict (including the ongoing conflict

between Russia and Ukraine and the global response to it), war or the perception that hostilities may be imminent, political instability

or civil unrest, or other conflict, and those additional risk factors discussed in reports that we have filed with the SEC, could also

have material adverse effects on our future results, performance or achievements. Discussions of some of these other important factors

and assumptions are contained in W. P. Carey's filings with the SEC and are available at the SEC's website at http://www.sec.gov,

including Part I, Item 1A. Risk Factors in W. P. Carey's Annual Report on Form 10-K for the fiscal year ended December 31,

2022. Investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this

communication, unless noted otherwise. Except as required under the federal securities laws and the rules and regulations of the

SEC, W. P. Carey does not undertake any obligation to release publicly any revisions to the forward-looking statements to reflect events

or circumstances after the date of this communication or to reflect the occurrence of unanticipated events.

Institutional Investors:

Peter Sands

1 (212) 492-1110

institutionalir@wpcarey.com

Individual Investors:

W. P. Carey Inc.

1 (212) 492-8920

ir@wpcarey.com

Press Contact:

Anna McGrath

1 (212) 492-1166

amcgrath@wpcarey.com

v3.23.3

Cover

|

Oct. 06, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 06, 2023

|

| Entity File Number |

001-13779

|

| Entity Registrant Name |

W. P. Carey Inc.

|

| Entity Central Index Key |

0001025378

|

| Entity Tax Identification Number |

45-4549771

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

One Manhattan West

|

| Entity Address, Address Line Two |

395 9th Avenue

|

| Entity Address, Address Line Three |

58th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10001

|

| City Area Code |

212

|

| Local Phone Number |

492-1100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 Par Value

|

| Trading Symbol |

WPC

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

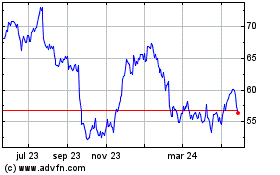

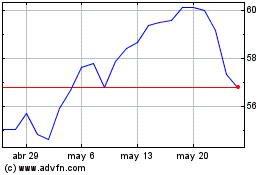

WP Carey (NYSE:WPC)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

WP Carey (NYSE:WPC)

Gráfica de Acción Histórica

De May 2023 a May 2024