Athabasca Oil Announces Closing of C$200 Million Unsecured Notes Offering

09 Agosto 2024 - 10:44AM

Athabasca Oil Corporation (“Athabasca” or the “Company”) (TSX: ATH)

announced today that it has closed its previously announced private

placement (the “Offering”) of $200 million aggregate principal

amount of 6.75% senior unsecured notes due August 9, 2029 (the

“Notes”).

The net proceeds from the Offering together with

cash on hand were used to redeem its US$157 million aggregate

principal amount of 9.75% senior secured second lien notes due

November 1, 2026.

Prudent long-term balance sheet management is a

core tenet of Athabasca’s strategy. The Company proactively

refinanced its term debt on attractive terms, supported by strong

business fundamentals and constructive credit markets. The Offering

supports a lower level of outstanding debt and provides strategic

flexibility and business resiliency throughout commodity price

cycles, and aligns the Company’s long term debt maturity to its

asset development horizon. Pro forma the Offering, the Company is

in a Net Cash position of ~$110 million with Liquidity of ~$400

million (including ~$270 million of cash). The Company estimates a

~$6 million reduction in annual debt servicing costs as a result of

the optimized capital structure.

The Notes were offered for sale in Canada on a

private placement basis pursuant to certain prospectus exemptions.

The Notes have not been registered under the U.S. Securities Act,

or any state securities laws, and were offered and sold in the

United States only to qualified institutional buyers in reliance on

Rule 144A under the U.S. Securities Act and applicable state

securities laws and outside the United States in offshore

transactions in reliance on Regulation S under the U.S. Securities

Act.

About Athabasca Oil

Corporation

Athabasca Oil Corporation is a Canadian energy

company with a focused strategy on the development of thermal and

light oil assets. Situated in Alberta’s Western Canadian

Sedimentary Basin, the Company has amassed a significant land base

of extensive, high quality resources. Athabasca’s light oil assets

are held in a private subsidiary (Duvernay Energy Corporation) in

which Athabasca owns a 70% equity interest. Athabasca’s common

shares trade on the TSX under the symbol “ATH”. For more

information, visit www.atha.com.

| For more information, please contact: |

| Matthew

Taylor |

Robert

Broen |

| Chief Financial Officer |

President and CEO |

| 1-403-817-9104 |

1-403-817-9190 |

| mtaylor@atha.com |

rbroen@atha.com |

| |

|

Reader Advisory:

Certain information included herein is

forward-looking. Many of these forward looking statements can be

identified by words such as “believe”, “expects”, “expected”,

“will”, “intends”, “projects”, “projected”, “anticipates”,

“estimates”, “continues”, “objective” or similar words and include,

but are not limited to, statements regarding Athabasca’s strategy,

its pro forma position after the Offering, its estimates of reduced

annual debt servicing costs, prudent long-term balance sheet

management being a core tenet of Athabasca’s strategy, maintaining

a similar level of outstanding debt providing strategic flexibility

and business resiliency throughout commodity price cycles and the

Company’s debt maturity to asset development horizon. Athabasca

believes the expectations reflected in such forward-looking

statements are reasonable but no assurance can be given that these

expectations will prove to be correct and such forward-looking

statements should not be unduly relied upon.

The forward-looking statements contained herein

are based upon certain assumptions and factors including, without

limitation: historical trends, current and future economic and

financial conditions, and expected future developments. Athabasca

believes such assumptions and factors are reasonably accurate at

the time of preparing this press release. However, forward-looking

statements are not guarantees of future performance and involve a

number of risks and uncertainties some of which are described in

Athabasca’s annual information form dated February 29, 2024 (the

“AIF”) available on SEDAR+ at www.sedarplus.ca. Such

forward-looking statements necessarily involve known and unknown

risks and uncertainties and other factors, which may cause

Athabasca’s actual performance and financial results in future

periods to differ materially from any projections of future

performance or results expressed or implied by such forward looking

statements. Such factors include, but are not limited to, risks

associated with general economic, market and business conditions;

and other factors, many of which are beyond the control of

Athabasca. Readers are directed to, and are encouraged to read,

Athabasca’s management discussion and analysis for the year ended

December 31, 2023, management discussion and analysis for the six

months ended June 30, 2024 and the AIF, including the disclosure

contained under the heading "Risk Factors" therein.

Non-GAAP and Other Financial

Measures

The “Net Cash” and “Liquidity” supplementary financial measures in this press release do not have standardized meanings which are prescribed by IFRS.

Net Cash

Net Cash is defined as the face value of term

debt, plus accounts payable and accrued liabilities, plus current

portion of provisions and other liabilities less current assets,

excluding risk management contracts and warrant liability. Net Cash

as at June 30, 2024 pro forma the refinancing transaction.

Liquidity

Liquidity is defined as cash and cash equivalents plus available credit capacity.

Liquidity as at June 30, 2024 pro forma the refinancing

transaction.

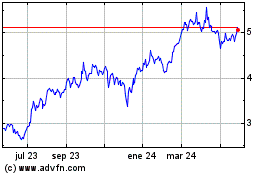

Athabasca Oil (TSX:ATH)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

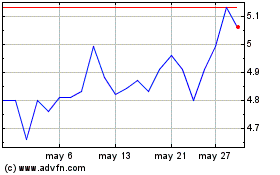

Athabasca Oil (TSX:ATH)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024