AirBoss Announces 2nd Quarter 2012 Results

08 Agosto 2012 - 4:22PM

Marketwired

AirBoss Of America Corp. (TSX:BOS) -

Q2 2012 Highlights:

-- Declared dividend $0.05 payable October 18, 2012

-- Opened R&D centre in Bromont, Quebec July 30, 2012

Three months ended Six months ended

June 30 June 30

(US $ thousands, except shares and

per share amounts) 2012 2011 2012 2011

----------------------------------------------------------------------------

Net Sales 66,784 77,440 136,683 147,756

Gross margin 6,423 9,983 14,025 20,946

Earnings before interest, tax and

amortization from

operations (EBITDA) (Note 1) 3,820 7,995 8,440 15,990

Interest expense 302 377 545 730

----------------------------------------------------------------------------

Net income 1,621 4,527 3,908 8,824

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income per share

-Basic 0.07 0.19 0.17 0.37

-Diluted 0.07 0.19 0.17 0.37

----------------------------------------------------------------------------

Common shares outstanding (millions)

-Basic 23.0 23.6 23.1 23.6

-Diluted 23.2 24.1 23.2 24.1

----------------------------------------------------------------------------

Sales decreased by $10.6 million or 14% for the quarter and by

$11.1 million or 8% year-to-date. Of the decrease in the quarter,

$6.4 is due to declines in sales of rubber compounds to both the

major tire and heavy belting sectors. The decline to the belting

industry began in mid-quarter and is attributed to reduced demand

in the coal industry. The majority of the remainder of the sales

decline is due to the reduced sales in the current year of military

protective wear due to reduced demand from the US military.

The rubber compounding business is expected to be impacted by

the reduced demand by the belting industry for the remainder of the

year but the company anticipates improvement in volumes from the

tire industry by mid-third quarter with potential further

significant increases in the fourth quarter. Raw material prices

are expected to trend downwards and this should have a positive

impact on margins for certain products as well as for reduced

working capital requirements.

The Defense and Industrial Products businesses are performing

slightly ahead of expectations beginning the year and this is

expected to continue.

The company moved its Defense products business into its new

research & development and administrative offices in July. Work

is progressing well on new products and we hope to have multiple

working prototypes before the end of the calendar year.

AirBoss of America Corp. develops, manufactures, and sells high

quality, proprietary rubber-based products offering enhanced

performance to military and industrial markets. The Company is a

world leader in the development and production of CBRN protective

wear. With a capacity to supply 250 million pounds of rubber

annually to a diverse group of rubber manufacturers, AirBoss is

also one of North America's largest custom rubber compounding

companies. The Company's shares trade on the TSX under the symbol

BOS. Visit www.airbossofamerica.com.

A conference call to discuss the quarterly results is scheduled

for 9:00 a.m. EDT Thursday August 9, 2012. Please follow the link

on our website or at www.marketwire.com under webcasts or dial in

to the following numbers: 416-340-8010 or Toll Free:

1-866-226-1799. Direct Replay Access number: 1-800-408-3053.

Note 1:

Three months ended Six months ended

June 30 June 30

($ thousands) 2012 2011 2012 2011

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income 1,621 4,527 3,908 8,824

Interest expense 302 377 545 730

Amortization 1,336 1,210 2,645 2,371

Provision for income taxes 561 1,882 1,342 4,065

----------------------------------------------------------------------------

EBITDA 3,820 7,996 8,440 15,990

----------------------------------------------------------------------------

----------------------------------------------------------------------------

AIRBOSS FORWARD LOOKING STATEMENT DISCLAIMER

Certain statements included herein, including those that express

management's expectations or estimates of future developments or

AirBoss' future performance, constitute "forward-looking

statements" within the meaning of applicable securities laws. Words

such as "may", "could" "expects", "anticipates", "forecasts",

"plans", "intends" or similar expressions are intended to identify

forward-looking statements.

Forward-looking statements are necessarily based upon a number

of estimates and assumptions that, while considered reasonable by

management at the time the statements are made, are inherently

subject to significant business, economic and competitive

uncertainties and contingencies. AirBoss cautions that such

forward-looking statements involve known and unknown risks,

uncertainties and other risks that may cause AirBoss' actual

financial results, performance, or achievements to be materially

different from its estimated future results, performance or

achievements expressed or implied by those forward-looking

statements. Numerous factors could cause actual results to differ

materially from those in the forward-looking statements, including

without limitation: changes in accounting policies and methods

including uncertainties associated with critical accounting

assumptions and estimates; AirBoss' ability to maintain existing

customers or develop new customers in light of increased

competition; cyclical trends in the tire and automotive,

construction, mining, retail and rail transportation industries;

sufficient availability of raw materials at economical costs;

weather conditions affecting raw materials, production and sales;

potential product liability and warranty claims; its dependence on

key customers; equipment malfunction; changes in the value of the

Canadian dollar relative to the US dollar; ability to obtain

financing on acceptable terms; environmental damage caused by it

and non-compliance with environmental laws and regulations; changes

in tax laws, and potential litigation.

This list is not exhaustive of the factors that may affect any

of AirBoss' forward-looking statements. Investors are cautioned not

to put undue reliance on forward-looking statements. All subsequent

written and oral forward-looking statements attributable to AirBoss

or persons acting on its behalf are expressly qualified in their

entirety by this notice. Whether as a result of new information,

future events or otherwise, AirBoss disclaims any intent or

obligation to update publicly these forward-looking statements.

Risks and uncertainties about AirBoss's business are more fully

discussed in the Management's Discussion and Analysis of Financial

Condition and Results of Operations in the 2011 Annual Report to

Shareholders under the heading "Risk Factors".

Contacts: AirBoss Of America Corp. R.L. Hagerman CEO (905)

751-1188 AirBoss Of America Corp. Stephen Richards CFO (905)

751-1188 www.airbossofamerica.com

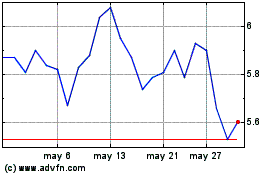

AirBoss of America (TSX:BOS)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

AirBoss of America (TSX:BOS)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024