All amounts in US$ unless otherwise

indicated

Capstone Copper Corp. (“Capstone” or the “Company”) (TSX:

CS) (ASX: CSC) today reported financial results for the nine months

and quarter ended September 30, 2024 (“Q3 2024”). Copper production

in Q3 2024 totaled 47,460 tonnes at C1 cash costs1 of $2.83 per

payable pound of copper produced. Link HERE for Capstone’s Q3 2024

webcast presentation.

John MacKenzie, CEO of Capstone, commented, "The third quarter

marked an important step in the transformation of our business,

with tangible delivery on our peer leading growth. Our operations

in Chile exhibited meaningful milestones at both our flagship

Mantoverde Development Project (where we achieved commercial

production) and at Mantos Blancos (which has now demonstrated that

it is capable of delivering its nameplate capacity). We expect Q4

to be our strongest quarter of the year, providing a glimpse of the

future Capstone with a larger production base and lower unit

operating costs. During the past few months, we also released

studies for our Mantoverde Optimized and Santo Domingo projects,

and announced a leadership succession plan, all of which have

positioned us extremely well for our next phase of growth."

Q3 2024 OPERATIONAL AND FINANCIAL HIGHLIGHTS

- The Mantoverde Development Project ("MVDP") achieved

commercial production in September, as the mine advances

commissioning and continues to ramp up to full production levels.

The first two shipments of copper concentrates were made during the

quarter and met all required specifications. Project capital for

the MVDP came in line with the revised budget at $870 million.

- Consolidated copper production for Q3 2024 was 47,460 tonnes

at C1 cash costs1 of $2.83/lb. Consolidated copper production

consisted of 17,481 tonnes at Mantoverde, 13,980 tonnes at Pinto

Valley, 9,974 tonnes at Mantos Blancos, and 6,025 tonnes at

Cozamin. Total Q3 2024 copper sold of 44,684 payable tonnes was

approximately 1,500 tonnes below payable production, largely driven

by the initial build up of copper concentrates inventory at

Mantoverde during the MVDP ramp-up.

- Net income attributable to shareholders of $12.5 million, or

$0.02 per share for Q3 2024 compared to net loss attributable

to shareholders of $32.9 million, or $(0.05) per share for Q3 2023,

primarily due to the higher copper production and higher realized

copper price of $4.24/lb compared to $3.77/lb.

- Adjusted net income attributable to shareholders1 of $25.4

million, or $0.03 per share for Q3 2024, compared to adjusted

net loss attributable to shareholders1 of $15.8 million in Q3

2023.

- Adjusted EBITDA1 nearly doubled to $120.8 million for Q3

2024 compared to $62.8 million for Q3 2023. The increase in

Adjusted EBITDA1 is primarily driven by a higher copper production

and realized copper price.

- Operating cash flow before changes in working capital of

$116.9 million in Q3 2024 compared to $59.2 million in Q3

2023.

- Net debt1 of $750.7 million as at September 30, 2024 was

largely unchanged compared to net debt of $741.3 million as at June

30, 2024 with the majority of the MVDP capital spend complete.

Total available liquidity1 of $515.6 million as at September 30,

2024, comprising $138.6 million of cash and short-term

investments, and $377.0 million of undrawn amounts on the corporate

revolving credit facility.

- The Company notes that 2024 consolidated production is

expected to finish at the low end of the guidance range of

190,000 to 220,000 tonnes of copper. 2024 consolidated C1 cash

costs1 guidance has been revised to $2.60/lb to $2.80/lb mainly

due to the ramp-ups at Mantoverde and Mantos Blancos occurring

later in the year than was expected when guidance was issued in

January 2024.

- Capstone released a Feasibility Study on the next stage of

growth for the Santo Domingo copper-iron-gold project that

includes a strong $1.72 billion after-tax net present value and a

24.1% internal rate of return, with an initial capital cost of $2.3

billion. Over the first seven years of the mine plan, production is

expected to average 106,000 tonnes of copper and 3.7 million tonnes

of iron concentrate at first quartile C1 cash costs1 of $0.28 per

payable pound of copper produced.

- Capstone acquired 100% of Sierra Norte, located 15 km

from Santo Domingo, for $40 million in shares. This acquisition

provides a potential future sulphide feed source to extend the

higher-grade copper sulphide life at Santo Domingo.

- Subsequent to quarter-end, the Company announced the results of

a Feasibility Study for its Mantoverde Optimized

brownfield expansion project. Mantoverde Optimized is a capital

efficient expansion of the existing sulphide concentrator from

throughput of 32,000 to 45,000 ore tpd. The study increased

sulphide reserves from 236 million at 0.60% copper to 398 million

tonnes at 0.49% copper and 0.10 g/t gold which extended the mine

life to 25 years. MV Optimized is a high return and low risk

expansion project that is expected to bring on an additional 20,000

tonnes per annum of copper for approximately $146 million of

initial expansionary capital.

- Subsequent to quarter-end, the Company announced its

leadership succession plan. At the next Annual General

Meeting on May 2, 2025, John MacKenzie will transition from CEO and

be nominated to the role of Non-Executive Chair of the Board, with

Cashel Meagher succeeding him as CEO and also to be nominated as a

member of the Board, while James Whittaker will become COO. Founder

of Capstone Mining and current Chair of Capstone, Darren Pylot,

will step down from the Board after more than 20 years of combined

service to the Company.

1 These are Non-GAAP performance measures.

Refer to the section titled “Non-GAAP and Other Performance

Measures”.

OPERATIONAL OVERVIEW

Refer to Capstone's Q3 2024 MD&A and Financial Statements

for detailed operating results.

Q3 2024

Q3 2023

2024 YTD

2023 YTD

Copper production (tonnes)

Sulphide business

Pinto Valley

13,980

13,657

45,646

39,157

Cozamin

6,025

5,876

18,183

17,776

Mantos Blancos

8,246

9,138

25,579

28,338

Mantoverde2

8,139

—

8,197

—

Total sulphides

36,390

28,671

97,605

85,271

Cathode business

Mantos Blancos

1,728

2,997

5,432

9,597

Mantoverde2

9,342

8,582

27,481

25,382

Total cathodes

11,070

11,579

32,913

34,979

Consolidated

47,460

40,250

130,518

120,250

Copper sales

Copper sold (tonnes)

44,684

38,699

125,428

116,910

Realized copper price1 ($/pound)

4.24

3.77

4.20

3.87

C1 cash costs1 ($/pound)

produced

Sulphide business

Pinto Valley

2.92

2.83

2.63

2.96

Cozamin

1.82

1.85

1.83

1.73

Mantos Blancos

3.40

2.85

3.26

2.80

Mantoverde

2.52

—

2.52

—

Total sulphides

2.76

2.63

2.64

2.65

Cathode business

Mantos Blancos

3.44

2.75

3.33

3.07

Mantoverde

3.00

3.74

3.50

3.89

Total cathodes

3.07

3.48

3.47

3.67

Consolidated

2.83

2.88

2.85

2.96

2 Mantoverde production shown on a 100%

basis.

Consolidated Production

Q3 2024 copper production of 47,460 tonnes was 18% higher than

Q3 2023 primarily as a result of sulphide production starting at

Mantoverde. MVDP continues to ramp-up towards full production

levels and at various points during Q3 2024, mine operations,

crushing, grinding, flotation and tailings, all operated at or

above design capacity.

Q3 2024 C1 cash costs1 of $2.83/lb were 2% lower than $2.88/lb

Q3 2023 mainly due to higher production (-$0.19/lb), partially

offset by lower capitalized stripping costs ($0.13/lb).

Pinto Valley Mine

Copper production of 14.0 thousand tonnes in Q3 2024 was 2%

higher than in Q3 2023 due to higher grades (Q3 2024 – 0.37% versus

Q3 2023 - 0.34%) as a result of mining in a higher-grade area of

Castle Dome and a high grade area of Jewel Hill, partially offset

by lower mill throughput during the quarter (Q3 2024 - 44,915 tpd

versus Q3 2023 - 47,426 tpd), resulting from an unplanned 10 days

of downtime during the quarter related to a conveyor belt rip and

electrical faults.

C1 cash costs1 of $2.92/lb in Q3 2024 were 3% higher than Q3

2023 of $2.83/lb primarily due to increases in operating costs

($0.15/lb) driven by contractor and mechanical parts spend in the

mill, electricity cost, labor cost, lower by-product credits

($0.12/lb) and higher treatment costs ($0.06/lb), partially offset

by higher production volume (-$0.07/lb) and capitalized stripping

(-$0.17/lb).

Mantos Blancos Mine

Q3 2024 production was 10.0 thousand tonnes, composed of 8.2

thousand tonnes from sulphide operations and 1.7 thousand tonnes of

cathode from oxide operations, which was 18% lower than the 12.2

thousand tonnes produced in Q3 2023. Sulphide production declined

in Q3 2024 due to lower grades, partially offset by higher

recoveries. Lower cathode production was impacted by lower dump

grades and throughput.

In July, a successful two-week planned shutdown was completed

which included the installation of a new holding tank and

additional pumps in the tailings area in order to address

deficiencies identified preventing the sustained achievement of the

20ktpd capacity from the sulphide operations. Following the plant

ramp-up period in August, ore throughput averaged 18,062 tpd

through to the end of Q3, with plant throughput meeting or

exceeding the nameplate capacity of 20,000 tpd on 23 operating

days. The overall variability of the milling process has been

significantly reduced and higher throughput is expected in Q4.

Combined Q3 2024 C1 cash costs1 of $3.41/lb ($3.40/lb sulphides

and $3.44/lb cathodes) were 21% higher compared to combined C1 cash

costs1 of $2.82/lb in Q3 2023, mainly due to lower production

($0.63/lb) and increase in mine expense ($0.12/lb) partially offset

by lower acid and energy consumption due to lower production

(-$0.16/lb).

Mantoverde Mine

The Company achieved commercial production at MVDP in September

2024. In making this determination, management considered a number

of factors, including completion of substantially all the

construction development activities in accordance with design and a

production ramp-up period during which mill throughput, in terms of

tonnes of ore, equalled an average of 75% of nameplate capacity

over a 30-day period. With this achievement, on September 30, 2024

substantially all of Construction-in-Progress was reclassified to

Plant & Equipment. Depletion and amortization will commence on

October 1, 2024.

Q3 2024 copper production of 17.5 thousand tonnes, composed of

8.1 thousand tonnes of copper from sulphide operations and 9.3

thousand tonnes of cathode, was 104% higher compared to 8.6

thousand tonnes in Q3 2023. Heap production increased in Q3 2024

given higher grades (0.36% in Q3 2024 versus 0.32% in Q3 2023) and

recoveries (76.1% in Q3 2024 versus 66.5% in Q3 2023). The new

concentrator (MVDP) continued its ramp-up in Q3, resulting in 8.1

thousand tonnes of copper production from sulphide operations,

driven by average mill throughput of 18.4 ktpd, copper grades of

0.71%, and recoveries of 68.2%. The quarter included an approximate

two-week shutdown in August driven by the achievement of Facility

Practical Completion and the average mill throughput in September

was 26,200 tpd. While physical recoveries in Q3 were 68.2%, this

includes gain/(draw) on inventory, sampling error, and analytical

error. The implied metallurgical recovery, determined based on

assays measured on the feed, concentrate and tailings samples

obtained with the slurry samplers, indicate overall metallurgical

recoveries for the quarter of 78.2%, with implied recoveries above

80% observed in August and September.

Q3 2024 C1 cash costs1 were $2.78/lb, 26% lower than $3.74/lb in

Q3 2023 due to higher production (-$1.21/lb), lower energy prices

(-$0.16/lb) which averaged $0.10/kWh in Q3 2024 versus $0.17/kWh in

Q3 2023, and lower acid consumption (-$0.11/lb), partially offset

by an increase in contracted services, spare parts and labour cost

mainly driven by higher mine movement ($0.52/lb).

Cozamin Mine

Q3 2024 copper production of 6.0 thousand tonnes was 2% higher

than the same period prior year, mainly on higher mill throughput

(3,609 tpd in Q3 2024 versus 3,567 tpd in Q3 2023) driven by mine

sequence. Grades and recoveries were consistent quarter over

quarter.

Q3 2024 C1 cash costs1 were $1.82/lb, 2% lower than $1.85/lb in

the same period last year, mainly due to higher production in Q3

2024 than the same period last year on higher grades, higher silver

by-product volume and price (40%), offset by higher operating costs

(9%) mainly on contractors due to change in mine method and

manpower for bonus profit sharing effect.

Mantoverde Development Project

MVDP achieved commercial production in September, and the mill

continues to advance commissioning and ramp up to full production

levels. MVDP involved the addition of a sulphide concentrator

(nominal 32,000 ore tonnes per day ("tpd")) and tailings storage

facility, and the expansion of the existing desalination plant and

other minor infrastructure.

In 2024, Capstone has been focused on a safe, efficient and

phased project commissioning and ramp-up. All key milestones have

been achieved during the commissioning and ramp-up including:

- First ore to the primary crusher – completed in Q4 2023

- First ore to the grinding circuit – completed in Q1 2024

- First saleable concentrate – completed in Q2 2024

- Achievement of nameplate operating rates and Facility Practical

Completion – completed in Q3 2024

- First two shipments of copper concentrates - delivered in Q3

2024

During Q3, MVDP achieved Facility Practical Completion with

Ausenco which was followed by a planned two-week shutdown for

vendor maintenance and project handover in August. On September 21,

2024, the MVDP achieved commercial production defined as the

achievement of reaching a minimum of 30 consecutive days of

operations during which the mill operated at an average of 75% of

nameplate throughput of 32,000 ore tonnes per day. The average mill

throughput for September was 26,200 tpd, which included an exit

rate with the last 7 days averaging 32,400 tpd.

During Q4, the goal is to continue to improve runtime, overall

average throughput, and recoveries.

The MVDP project capital spent was $870 million since inception

and came in line with the revised budget, which was reclassified to

available for use property, plant and equipment at September 30,

2024 upon achieving the commercial production milestone.

As MVDP has achieved commercial production, we expect our

quarterly finance expense to increase by approximately $25 million

beginning in the fourth quarter of 2024 as the capitalization of

finance charges relating to MVDP will cease. Similarly, we expect

our annualized depletion and amortization to increase by

approximately $80 million.

MV Optimized Feasibility Study

The Company announced its Mantoverde Optimized ("MV-O")

Feasibility Study ("FS") on October 1, 2024. The project is a

capital-efficient expansion of Mantoverde's sulphide concentrator,

increasing throughput from 32,000 to 45,000 ore tpd and extending

the mine life to 25 years. With an updated sulphide Mineral Reserve

of 398 million tonnes at a copper grade of 0.49% (compared to 236

million tonnes at 0.60% copper previously), the project will yield

an additional 368,000 tonnes of copper and 215,000 ounces of gold,

with an initial expansionary capital investment of $146 million and

an implied capital intensity of approximately $7,500 per tonne of

incremental annual copper equivalent production. The Feasibility

Study includes average annual production over the next five years

of 135,000 tonnes of copper and 37,000 ounces of gold at C1 cash

costs1 of $1.81 per pound of copper. Capstone anticipates starting

construction after receiving environmental permit approval,

expected in H1 2025. The MV-O FS also features a robust after-tax

NPV(8%) of $2.9 billion for Mantoverde operation on a 100%-basis

based on a long-term copper price of $4.10/lb and gold price of

$1,800/oz.

Given the above, the Mantoverde Phase II opportunity will

evaluate the addition of an entire second processing line, possibly

a duplication of the first line, to process some of the

approximately 0.2 billion tonnes of Measured & Indicated and

0.6 billion tonnes of Inferred sulphide resources not in

reserves.

Santo Domingo Feasibility Study & Sierra Norte

Acquisition

Capstone announced the results of an updated Feasibility Study

for its 100%-owned Santo Domingo copper-iron-gold project in Region

III Chile, 35km northeast of Mantoverde on July 31, 2024. The

updated FS outlines the next phase of transformational growth for

the Company in the world-class Mantoverde-Santo Domingo District.

Santo Domingo completed the updated FS with Ausenco.

The 2024 FS for Santo Domingo outlines a robust copper-iron-gold

project with an after-tax NPV (8%) of $1.7 billion and an after-tax

internal rate of return of 24.1%. Total initial capital cost of

$2.3 billion drives a capital intensity of approximately $21,900

per tonne of annual copper equivalent production over the life of

mine. Over the first seven years of the mine plan, production is

expected to average 106,000 tonnes of copper and 3.7 million tonnes

of iron ore magnetite at first quartile cash costs of $0.28 per

payable pound of copper produced. Over Santo Domingo's 19-year mine

life, production is expected to average 68,000 tonnes of copper and

3.6 million tonnes of iron ore magnetite at first quartile cash

costs of $0.33 per payable pound of copper produced.

The 19-year Santo Domingo mine life is supported by an increased

Mineral Reserve estimate of 436 million tonnes (compared to 392

million tonnes previously) at a copper grade of 0.33%, iron ore

grade of 26.5%, and a gold grade of 0.05 grams per tonne. Increased

Measured and Indicated (“M&I”) Mineral Resources total 547

million tonnes (compared to 537 million tonnes previously) at a

copper grade of 0.31% and a gold grade of 0.04 grams per tonne,

including 506 million tonnes with an iron grade of 25.8%.

The feasibility study updated the level of engineering to

Association for the Advancement of Cost Engineering ("AACE") Class

3. Further detailed engineering will increase the precision of

capital estimates to AACE Class 2 over the next couple of

quarters.

During the quarter, Capstone acquired 100% of the shares of

Compania Minera Sierra Norte, S.A. ("Sierra Norte") for $40 million

in share consideration. Sierra Norte is located approximately 15

kilometers northwest of the Santo Domingo Project and represents an

opportunity to potentially be a future sulphide feed source for

Santo Domingo, extending the higher grade copper sulphide life.

The Company plans to progress several value enhancement

initiatives within the Mantoverde-Santo Domingo (“MV-SD”) district

that are not incorporated in the Santo Domingo 2024 Feasibility

Study, or the recently announced base case MV Optimized plan.

Copper Oxides Opportunity

Capstone plans to progress drilling and studies regarding the

processing of oxide material from Capstone’s neighbouring Santo

Domingo and Sierra Norte projects by capitalizing on Mantoverde’s

excess SX/EW capacity to extract copper from Santo Domingo’s oxide

material. To date, oxide materials have been recognized in the

shallower portions of the Santo Domingo, Iris Norte, and Estrellita

sulphide ore bodies. Currently, these oxides are considered as

waste material in the recently announced Santo Domingo 2024

Feasibility Study. Meanwhile, only approximately two thirds of

processing capacity is being used at Mantoverde’s SX-EW cathode

copper plant. Exploration efforts at Santo Domingo will target a

potential 80-100 million tonnes of oxide material, which could add

up to 10 thousand tonnes per annum of copper production.

Exploration Opportunities in the MV-SD

District

Capstone has significant untapped exploration potential within

MV-SD district. The Mantoverde Optimized plan was prepared without

any expansionary drilling campaign since 2019. At Mantoverde, there

are 0.2 billion tonnes of Measured & Indicated and 0.6 billion

tonnes of Inferred sulphide resources not in reserves. At Santo

Domingo, there are 0.1 billion tonnes of Measured & Indicated

and 0.2 billion tonnes of Inferred sulphide resources not in

reserves. The recently acquired Sierra Norte property also

represents an opportunity to potentially be a future feed source in

the district. Capstone intends to progress its exploration strategy

to service its two eventual processing centers between Mantoverde

and Santo Domingo, in addition to continuing to evaluate the

potential for Mantoverde Phase II which could include the addition

of an entire second processing line at Mantoverde.

Mantoverde - Santo Domingo Cobalt Study

A district cobalt plant for the MV-SD district is designed to

unlock cobalt production while reducing sulphuric acid consumption

and increasing heap leach copper production. The cobalt recovery

process comprises a pyrite flotation step to recover cobaltiferous

pyrite from the tailings streams at Mantoverde and Santo Domingo

and redirect it to the dynamic heap leach pads, which will be

upgraded to a bioleach configuration through the addition of an

aeration system as part of MV Optimized. The pyrite oxidizes in the

leach pads and the solubilized cobalt is recovered via an ion

exchange plant treating a bleed stream from the copper solvent

extraction plant. The approach has been successfully demonstrated

at the bench scale, and onsite piloting commenced in January 2024

at Mantoverde.

As currently envisioned, a smaller capacity countercurrent

ion-exchange plant will initially treat cobalt by-product streams

from Mantoverde producing up to 1,500 tonnes per annum of cobalt,

and following sanctioning of the Santo Domingo project, the

facility will be expanded to accommodate by-product streams from

Santo Domingo. In line with this, Santo Domingo has initiated a

Feasibility Study to assess the optimum process configuration for

the pyrite flotation and pumping transportation facilities needed

to transport pyrite concentrate to Mantoverde’s leach facilities.

This information will be part of the MV-SD cobalt study expected in

2025.

At a combined MV-SD target of 4,500 to 6,000 tpa of mined cobalt

production, this would be one of the largest and lowest cost cobalt

producers in the world, outside of Indonesia and the Democratic

Republic of the Congo ("DRC").

PV District Growth Study

The company continues to review and evaluate the consolidation

potential of the Pinto Valley district. Opportunities under

evaluation include a potential mill expansion and increased

leaching capacity supported by optimized water, heap and dump

leach, and tailings infrastructure. District consolidation could

unlock significant ESG opportunities and may transform our approach

to create value for all stakeholders in the Globe-Miami

District.

Leadership Succession Plan

As previously announced the following leadership changes will

take effect at the next Annual General Meeting of the Company on

May 2, 2025:

- John MacKenzie will transition from Chief Executive Officer and

will be nominated to the role of Non-Executive Chair of the

Capstone Board of Directors;

- Cashel Meagher, current President and Chief Operating Officer,

will succeed Mr. MacKenzie as CEO of Capstone, and will also be

nominated as a member of the Board;

- James Whittaker, current Senior Vice President, Head of Chile,

will succeed Mr. Meagher as COO. This facilitates a flattening of

the organizational structure with all mine general managers

reporting directly to the COO;

- Darren M. Pylot, founder of Capstone Mining Corp. and current

Chair of the Board, will end his term on the Board after over 20

years with Capstone Mining Corp. as a founder and CEO, and

subsequently as Chair of the Board of Capstone.

In addition, commencing in Q4 2024, Daniel Sampieri, Director,

Investor Relations & Strategic Analysis, will lead the investor

relations function as Jerrold Annett, former SVP Strategy &

Capital Markets, has retired from the Company. Capstone's Board and

management would like to thank Jerrold for his five years of

service and significant contributions to the Company.

Corporate Exploration Update

Cozamin: Exploration drilling continued in Q3 2024 at

Cozamin targeting step-outs up-dip and down-dip from the Mala Noche

West Target and also down-dip of other historical Mala Noche Vein

workings. Drilling is currently being conducted with one

underground rig positioned at the level 19.1 cross-cut, a second

underground rig positioned at the level 12.7 cross-cut, and one

surface rig being added to the program in Q4 2024.

Copper Cities, Arizona: On January 20, 2022, Capstone

Mining announced that it had entered into an access agreement with

BHP Copper Inc. ("BHP") to conduct drill and metallurgical

test-work at BHP's Copper Cities project ("Copper Cities"), located

approximately 10 km east of the Pinto Valley mine. This access

agreement was recently extended to July 2025. Drilling with two

surface rigs twinning historical drill holes was completed in 2022

with metallurgical testing continuing in 2024. As explained in the

PV District Growth Study section, district consolidation

opportunities are being evaluated.

Mantoverde, Santo Domingo, and Mantos Blancos, Chile:

Preparations for the exploration drilling program at Mantoverde is

ongoing and drilling is now expected to begin in Q4 2024. The

program will target first the areas closer to MV Optimized pit

focusing on improving copper grades and mineralization continuity

within and nearby the pit boundaries. Infill drilling was conducted

during Q3 2024 in Mantos Blancos in Phases 15 and 16 and

exploration drilling began in Veronica Oxides target.

2024 Guidance

The Company notes that 2024 consolidated copper production is

expected to finish at the low end of the guidance range of

190-220kt. 2024 consolidated C1 cash costs1 guidance has been

revised to $2.60 to $2.80 per payable pound of copper produced

mainly due to the ramp-ups at Mantoverde and Mantos Blancos

occurring later in the year than was expected when guidance was

issued in January 2024.

Pinto Valley and Cozamin are trending in line with respect to

their full year production and C1 cash costs1 guidance ranges as

announced in January 2024. Mantoverde is trending to the low end of

its production guidance range, and above the high end of its C1

cash costs1 guidance range due to the start of the MVDP ramp-up

occurring later in the year than was expected when guidance was

issued in January. Mantos Blancos is trending below its production

guidance range and above its C1 cash costs1 guidance range due to

longer equipment procurement and installation timelines for the

20ktpd debottlenecking in addition to additional maintenance spend

for unplanned downtime.

FINANCIAL OVERVIEW

Please refer to Capstone's Q3 2024 MD&A and Financial

Statements for detailed financial results.

($ millions, except per share data)

Q3 2024

Q3 2023

2024 YTD

2023 YTD

Revenue

419.4

322.2

1,152.3

991.8

Net income (loss)

17.0

(42.3

)

38.7

(105.2

)

Net income (loss) attributable to

shareholders

12.5

(32.9

)

37.0

(89.4

)

Net income (loss) attributable to

shareholders per common share - basic and diluted ($)

0.02

(0.05

)

0.05

(0.13

)

Adjusted net income (loss)1

25.4

(15.8

)

41.9

(10.5

)

Adjusted net income (loss) attributable to

shareholders per common share - basic and diluted

0.03

(0.02

)

0.06

(0.02

)

Operating cash flow before changes in

working capital

116.9

59.2

282.0

124.3

Adjusted EBITDA1

120.8

62.8

324.1

172.2

Realized copper price1

($/pound)

4.24

3.77

4.20

3.87

($ millions)

September 30, 2024

December 31, 2023

Net debt1

(750.7)

(927.2)

Attributable net (debt)/cash1

(598.9)

(776.6)

CONFERENCE CALL AND WEBCAST DETAILS

Capstone will host a conference call and webcast on Thursday,

October 31, 2024 at 5:00 pm Eastern Time / 2:00 pm Pacific Time

(Friday, November 1, 2024, 8:00 am Australian Eastern Daylight

Time). Link to the audio webcast:

https://app.webinar.net/P6EqjwqrkgL

Dial-in numbers for the audio-only portion of the conference

call are below. Due to an increase in call volume, please dial-in

at least five minutes prior to the call to ensure placement into

the conference line on time.

Toronto: 1-437-900-0527 Australia: 61-280-171-385 North America

toll free: 1-888-510-2154

A replay of the conference call will be available until November

7, 2024. Dial-in numbers for Toronto: 1-289-819-1450 and North

American toll free: 1-888-660-6345. The replay code is 11379#.

Following the replay, an audio file will be available on Capstone’s

website at

https://capstonecopper.com/investors/events-and-presentations/.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document may contain “forward-looking information” within

the meaning of Canadian securities legislation and “forward-looking

statements” within the meaning of the United States Private

Securities Litigation Reform Act of 1995 (collectively,

“forward-looking statements”). These forward-looking statements are

made as of the date of this document and the Company does not

intend, and does not assume any obligation, to update these

forward-looking statements, except as required under applicable

securities legislation.

Forward-looking statements relate to future events or future

performance and reflect our expectations or beliefs regarding

future events. Our Sustainable Development Strategy goals and

strategies are based on a number of assumptions, including, but not

limited to, the biodiversity and climate-change consequences;

availability and effectiveness of technologies needed to achieve

our sustainability goals and priorities; availability of land or

other opportunities for conservation, rehabilitation or capacity

building on commercially reasonable terms and our ability to obtain

any required external approvals or consensus for such

opportunities; the availability of clean energy sources and

zero-emissions alternatives for transportation on reasonable terms;

availability of resources to achieve the goals in a timely manner,

our ability to successfully implement new technology; and the

performance of new technologies in accordance with our

expectations.

Forward-looking statements include, but are not limited to,

statements with respect to the estimation of Mineral Resources and

Mineral Reserves, the success of the underground paste backfill and

tailings filtration projects at Cozamin, the timing and cost of the

Mantoverde Development Project ("MVDP"), the timing and results of

the Optimized Mantoverde Development Project ("MV Optimized FS")

and Mantoverde Phase II study, the timing and results of PV

District Growth Study (as defined below), the timing and results of

Mantos Blancos Phase II Feasibility Study, the timing and success

of the Mantoverde - Santo Domingo Cobalt Feasibility Study, the

timing and results of the Santo Domingo FS Update and success of

incorporating synergies previously identified in the Mantoverde -

Santo Domingo District Integration Plan, the timing and results of

exploration and potential opportunities at Sierra Norte, the

realization of Mineral Reserve estimates, the timing and amount of

estimated future production, the costs of production and capital

expenditures and reclamation, the timing and costs of the Minto

obligations and other obligations related to the closure of the

Minto Mine, the budgets for exploration at Cozamin, Santo Domingo,

Pinto Valley, Mantos Blancos, Mantoverde, and other exploration

projects, the timing and success of the Copper Cities project, the

success of our mining operations, the continuing success of mineral

exploration, the estimations for potential quantities and grade of

inferred resources and exploration targets, our ability to fund

future exploration activities, our ability to finance the Santo

Domingo development project, environmental and geotechnical risks,

unanticipated reclamation expenses and title disputes, the success

of the synergies and catalysts related to prior transactions, in

particular but not limited to, the potential synergies with

Mantoverde and Santo Domingo, the anticipated future production,

costs of production, including the cost of sulphuric acid and oil

and other fuel, capital expenditures and reclamation of Company’s

operations and development projects, our estimates of available

liquidity, and the risks included in our continuous disclosure

filings on SEDAR+ at www.sedarplus.ca. The impact of global events

such as pandemics, geopolitical conflict, or other events, to

Capstone is dependent on a number of factors outside of our control

and knowledge, including the effectiveness of the measures taken by

public health and governmental authorities to combat the spread of

diseases, global economic uncertainties and outlook due to

widespread diseases or geopolitical events or conflicts, supply

chain delays resulting in lack of availability of supplies, goods

and equipment, and evolving restrictions relating to mining

activities and to travel in certain jurisdictions in which we

operate. In certain cases, forward-looking statements can be

identified by the use of words such as “anticipates”,

“approximately”, “believes”, “budget”, “estimates”, “expects”,

“forecasts”, “guidance”, “intends”, “plans”, “scheduled”, “target”,

or variations of such words and phrases, or statements that certain

actions, events or results “be achieved”, “could”, “may”, “might”,

“occur”, “should”, “will be taken” or “would” or the negative of

these terms or comparable terminology.

In certain cases, forward-looking statements can be identified

by the use of words such as “anticipates”, “approximately”,

“believes”, “budget”, “estimates”, expects”, “forecasts”,

“guidance”, intends”, “plans”, “scheduled”, “target”, or variations

of such words and phrases, or statements that certain actions,

events or results “be achieved”, “could”, “may”, “might”, “occur”,

“should”, “will be taken” or “would” or the negative of these terms

or comparable terminology. In this document certain forward-looking

statements are identified by words including “anticipated”,

“expected”, “guidance” and “plan”. By their very nature,

forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause our actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements. Such factors include, amongst

others, risks related to inherent hazards associated with mining

operations and closure of mining projects, future prices of copper

and other metals, compliance with financial covenants, inflation,

surety bonding, our ability to raise capital, Capstone Copper’s

ability to acquire properties for growth, counterparty risks

associated with sales of our metals, use of financial derivative

instruments and associated counterparty risks, foreign currency

exchange rate fluctuations, market access restrictions or tariffs,

changes in general economic conditions, availability and quality of

water, accuracy of Mineral Resource and Mineral Reserve estimates,

operating in foreign jurisdictions with risk of changes to

governmental regulation, compliance with governmental regulations

and stock exchange rules, compliance with environmental laws and

regulations, reliance on approvals, licences and permits from

governmental authorities and potential legal challenges to permit

applications, contractual risks including but not limited to, our

ability to meet the requirements under the Cozamin Silver Stream

Agreement with Wheaton Precious Metals Corp. ("Wheaton"), our

ability to meet certain closing conditions under the Santo Domingo

Gold Stream Agreement with Wheaton, acting as Indemnitor for Minto

Metals Corp.’s surety bond obligations, impact of climate change

and changes to climatic conditions at our operations and projects,

changes in regulatory requirements and policy related to climate

change and greenhouse gas ("GHG") emissions, land reclamation and

mine closure obligations, introduction or increase in carbon or

other "green" taxes, aboriginal title claims and rights to

consultation and accommodation, risks relating to widespread

epidemics or pandemic outbreaks; the impact of communicable disease

outbreaks on our workforce, risks related to construction

activities at our operations and development projects, suppliers

and other essential resources and what effect those impacts, if

they occur, would have on our business, including our ability to

access goods and supplies, the ability to transport our products

and impacts on employee productivity, the risks in connection with

the operations, cash flow and results of Capstone Copper relating

to the unknown duration and impact of the epidemics or pandemics,

impacts of inflation, geopolitical events and the effects of global

supply chain disruptions, uncertainties and risks related to the

potential development of the Santo Domingo development project,

risks related to the Mantoverde Development Project, increased

operating and capital costs, increased cost of reclamation,

challenges to title to our mineral properties, increased taxes in

jurisdictions the Company operates or is subject to tax, changes in

tax regimes we are subject to and any changes in law or

interpretation of law may be difficult to react to in an efficient

manner, maintaining ongoing social licence to operate, seismicity

and its effects on our operations and communities in which we

operate, dependence on key management personnel, Toronto Stock

Exchange ("TSX") and Australian Securities Exchange ("ASX") listing

compliance requirements, potential conflicts of interest involving

our directors and officers, corruption and bribery, limitations

inherent in our insurance coverage, labour relations, increasing

input costs such as those related to sulphuric acid, electricity,

fuel and supplies, increasing inflation rates, competition in the

mining industry including but not limited to competition for

skilled labour, risks associated with joint venture partners and

non-controlling shareholders or associates, our ability to

integrate new acquisitions and new technology into our operations,

cybersecurity threats, legal proceedings, the volatility of the

price of the common shares, the uncertainty of maintaining a liquid

trading market for the common shares, risks related to dilution to

existing shareholders if stock options or other convertible

securities are exercised, the history of Capstone Copper with

respect to not paying dividends and anticipation of not paying

dividends in the foreseeable future and sales of common shares by

existing shareholders can reduce trading prices, and other risks of

the mining industry as well as those factors detailed from time to

time in the Company’s interim and annual financial statements and

MD&A of those statements and Annual Information Form, all of

which are filed and available for review under the Company’s

profile on SEDAR+ at www.sedarplus.ca. Although the Company has

attempted to identify important factors that could cause our actual

results, performance or achievements to differ materially from

those described in our forward-looking statements, there may be

other factors that cause our results, performance or achievements

not to be as anticipated, estimated or intended. There can be no

assurance that our forward-looking statements will prove to be

accurate, as our actual results, performance or achievements could

differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on our

forward-looking statements.

COMPLIANCE WITH NI 43-101

Unless otherwise indicated, Capstone Copper has prepared the

technical information in this document (“Technical Information”)

based on information contained in the technical reports, Annual

Information Form and news releases (collectively the “Disclosure

Documents”) available under Capstone Copper’s company profile on

SEDAR+ at www.sedarplus.ca. Each Disclosure Document was prepared

by or under the supervision of a qualified person (a “Qualified

Person”) as defined in National Instrument 43-101 – Standards of

Disclosure for Mineral Projects of the Canadian Securities

Administrators (“NI 43-101”). Readers are encouraged to review the

full text of the Disclosure Documents which qualifies the Technical

Information. Readers are advised that Mineral Resources that are

not Mineral Reserves do not have demonstrated economic viability.

The Disclosure Documents are each intended to be read as a whole,

and sections should not be read or relied upon out of context. The

Technical Information is subject to the assumptions and

qualifications contained in the Disclosure Documents.

Disclosure Documents include the National Instrument 43-101

compliant technical reports titled "NI 43-101 Technical Report on

the Cozamin Mine, Zacatecas, Mexico" effective January 1, 2023, “NI

43-101 Technical Report on the Pinto Valley Mine, Arizona, USA”

effective March 31, 2021, “Santo Domingo Project, NI 43-101

Technical Report and Feasibility Study Update, Atacama Region,

Chile” effective July 31, 2024, and "Mantos Blancos Mine NI 43-101

Technical Report Antofagasta / Región de Antofagasta, Chile" and

"Mantoverde Mine and Mantoverde Development Project NI 43-101

Technical Report Chañaral / Región de Atacama, Chile", both

effective November 29, 2021.

The disclosure of Scientific and Technical Information in this

document was reviewed and approved by Peter Amelunxen, P.Eng.,

Senior Vice President, Technical Services (technical information

related to project updates at Santo Domingo and Mineral Resources

and Mineral Reserves at Mantoverde), Clay Craig, P.Eng., Director,

Mining & Strategic Planning (technical information related to

Mineral Reserves at Pinto Valley and Cozamin), and Cashel Meagher,

P.Geo., President and Chief Operating Officer (technical

information related to Mineral Reserves and Resources at Mantos

Blancos) all Qualified Persons under NI 43-101.

Non-GAAP and Other Performance Measures

The Company uses certain performance measures in its analysis.

These Non-GAAP performance measures are included in this document

because these statistics are key performance measures that

management uses to monitor performance, to assess how the Company

is performing, and to plan and assess the overall effectiveness and

efficiency of mining operations. These performance measures do not

have a standard meaning within IFRS and, therefore, amounts

presented may not be comparable to similar data presented by other

mining companies. These performance measures should not be

considered in isolation as a substitute for measures of performance

in accordance with IFRS.

Some of these performance measures are presented in Highlights

and discussed further in other sections of the document. These

measures provide meaningful supplemental information regarding

operating results because they exclude certain significant items

that are not considered indicative of future financial trends

either by nature or amount. As a result, these items are excluded

for management assessment of operational performance and

preparation of annual budgets. These significant items may include,

but are not limited to, restructuring and asset impairment charges,

individually significant gains and losses from sales of assets,

share based compensation, unrealized gains or losses, and certain

items outside the control of management. These items may not be

non-recurring. However, excluding these items from GAAP or Non-GAAP

results allows for a consistent understanding of the Company's

consolidated financial performance when performing a multi-period

assessment including assessing the likelihood of future results.

Accordingly, these Non-GAAP financial measures may provide insight

to investors and other external users of the Company's consolidated

financial information.

C1 Cash Costs Per Payable Pound of Copper Produced

C1 cash costs per payable pound of copper produced is a measure

reflective of operating costs per unit. C1 cash costs is calculated

as cash production costs of metal produced net of by-product

credits and is a key performance measure that management uses to

monitor performance. Management uses this measure to assess how

well the Company’s producing mines are performing and to assess the

overall efficiency and effectiveness of the mining operations and

assumes that realized by-product prices are consistent with those

prevailing during the reporting period.

All-in Sustaining Costs Per Payable Pound of Copper

Produced

All-in sustaining costs per payable pound of copper produced is

an extension of the C1 cash costs measure discussed above and is

also a non-GAAP key performance measure that management uses to

monitor performance. Management uses this measure to analyze

margins achieved on existing assets while sustaining and

maintaining production at current levels. Consolidated All-in

sustaining costs includes sustaining capital and corporate general

and administrative costs.

Net debt / Net cash

Net debt / Net cash is a non-GAAP performance measure used by

the Company to assess its financial position and is composed of

Long-term debt (excluding deferred financing costs and purchase

price accounting ("PPA") fair value adjustments), Cost overrun

facility from MMC, Cash and cash equivalents, Short-term

investments, and excluding shareholder loans.

Attributable Net debt / Net cash

Attributable net debt / net cash is a non-GAAP performance

measure used by the Company to assess its financial position and is

calculated as net debt / net cash excluding amounts attributable to

non-controlling interests.

Available Liquidity

Available liquidity is a non-GAAP performance measure used by

the Company to assess its financial position and is composed of RCF

credit capacity, the $520 million Mantoverde DP facility capacity,

Cash and cash equivalents and Short-term investments. For clarity,

Available liquidity does not include the Mantoverde $60 million

cost overrun facility from MMC nor the $260 million undrawn portion

of the gold stream from Wheaton related to the Santo Domingo

development project as they are not available for general

purposes.

Adjusted net income (loss) attributable to

shareholders

Adjusted net income (loss) attributable to shareholders is a

non-GAAP measure of Net income (loss) attributable to shareholders

as reported, adjusted for certain types of transactions that in our

judgment are not indicative of our normal operating activities or

do not necessarily occur on a regular basis.

EBITDA

EBITDA is a non-GAAP measure of net income (loss) before net

finance expense, tax expense, and depletion and amortization.

Adjusted EBITDA

Adjusted EBITDA is non-GAAP measure of EBITDA before the pre-tax

effect of the adjustments made to net income (loss) (above) as well

as certain other adjustments required under the RCF agreement in

the determination of EBITDA for covenant calculation purposes.

The adjustments made to Adjusted net income (loss) attributable

to shareholders and Adjusted EBITDA allow management and readers to

analyze our results more clearly and understand the cash-generating

potential of the Company.

Sustaining Capital

Sustaining capital is expenditures to maintain existing

operations and sustain production levels. A reconciliation of this

non-GAAP measure to GAAP segment MPPE additions is included within

the mine site sections of this document.

Expansionary Capital

Expansionary capital is expenditures to increase current or

future production capacity, cash flow or earnings potential. A

reconciliation of this non-GAAP measure to GAAP segment MPPE

additions is included within the mine site sections of this

document.

Realized copper price (per pound)

Realized price per pound is a non-GAAP ratio that is calculated

using the non-GAAP measures of revenue on new shipments, revenue on

prior shipments, and pricing and volume adjustments. Realized

prices exclude the effects of the stream cash effects as well as

TC/RCs. Management believes that measuring these prices enables

investors to better understand performance based on the realized

copper sales in the current and prior period.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031874423/en/

Daniel Sampieri, Director, Investor Relations & Strategic

Analysis 437-788-1767 dsampieri@capstonecopper.com

Michael Slifirski, Director, Investor Relations, APAC Region

(+61) 412-251-818 mslifirski@capstonecopper.com

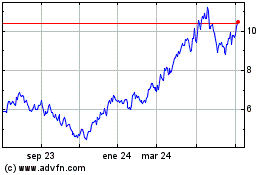

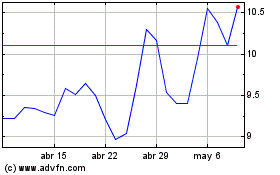

Capstone Copper (TSX:CS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Capstone Copper (TSX:CS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024