Foremost Clean Energy Ltd. (

NASDAQ:

FMST) (

CSE: FAT)

(“

Foremost” or the “

Company”), an

emerging North American uranium and lithium exploration company, is

pleased to announce that it has completed its previously announced

best efforts private placement (the “

Offering”)

for aggregate gross proceeds of C$10,500,250, which includes the

full exercise of the agent’s option. Under the Offering, the

Company issued 1,473,000 units of the Company (the

“

Units”) at a price of C$3.00 per Unit (the

“

Unit Price”), 1,022,500 flow-through units of the

Company (the “

FT Units”) at a price of C$3.50 per

FT Unit, and 550,000 FT Units sold to charitable purchasers (the

“

Charity FT Units”, and together with the Units

and FT Units, the “

Offered Securities”) at a price

of C$4.55 per Charity FT Unit.

Each Unit consists of one common share of the

Company (each, a “Unit Share”) and one common

share purchase warrant (each, a “Warrant”). Each

FT Unit and Charity FT Unit consists of one common share of the

Company to be issued as a “flow-through share” within the meaning

of subsection 66(15) of the Income Tax Act (Canada) (each, a

“FT Share”) and one Warrant. Each Warrant shall

entitle the holder to purchase one common share of the Company

(each, a “Warrant Share”) at a price of C$4.00 at

any time on or before that date which is 24 months after the

closing date of the Offering.

Foremost’s largest shareholder, Denison Mines

Corp. (TSX:DML, NYSE American: DNN) (“Denison”),

acquired 607,600 Units at the Unit Price for proceeds of

C$1,822,800 under the Offering. Denison exercised its pro rata

rights under the Option Agreement with Foremost announced on

September 24, 2024 and maintained its common share ownership in

Foremost of approximately 19.95% following the completion of the

Offering. Denison is a leading Athabasca Basin-focused uranium

mining, development, and exploration company with a market

capitalization of approximately C$2.6 billion. Denison’s current

focus is advancing the development-stage Wheeler River project,

which represents the largest undeveloped uranium mining project in

the infrastructure rich eastern portion of the Athabasca Basin.

Under the Offering, Red Cloud Securities Inc.

acted as lead agent and sole bookrunner on behalf of a syndicate of

agents that included Cormark Securities Inc., SCP Resource Finance

LP and Ventum Financial Corp. (collectively, the

“Agents”). In consideration for their services,

the Agents received an aggregate cash commission of C$570,015.

Additionally, the Agents received, in aggregate, 162,730

non-transferable broker warrants (the “Broker

Warrants”), with each such Broker Warrant exercisable for

one common share of the Company at a price of C$3.00 per Common

Share at any time on or before November 14, 2026.

Subject to compliance with applicable regulatory

requirements and in accordance with National Instrument 45-106 –

Prospectus Exemptions (“NI 45-106”), a total of

832,500 Units and 550,000 Charity FT Units (collectively, the

“LIFE Securities”), representing gross proceeds of

C$5,000,000, were sold to purchasers in the provinces of Alberta,

British Columbia, and Ontario, pursuant to the listed issuer

financing exemption under Part 5A of NI 45-106 (the “Listed

Issuer Financing Exemption”). The Unit Shares, FT Shares

and Warrant Shares issued pursuant to the sale of the LIFE

Securities are immediately freely tradeable under applicable

Canadian securities legislation.

640,500 Units and 1,022,500 FT Units

(collectively, the “Non-LIFE Securities”) were

issued by way of the “accredited investor” and “minimum amount

investment” exemptions under NI 45-106 in Alberta, British

Columbia, Ontario and Saskatchewan. The Unit Shares, FT Shares and

Warrant Shares issuable pursuant to the sale of the Non-LIFE

Securities are subject to a hold period ending on March 15, 2025

under applicable Canadian securities laws.

The Company intends to use the net proceeds from

the Offering primarily for exploration expenditures on the

Company’s uranium properties in the Athabasca Basin in Saskatchewan

as well as for working capital and general corporate purposes. The

gross proceeds from the issuance of the FT Shares will be used for

Canadian exploration expenses and will qualify, once renounced to a

subscriber that is an individual (other than a trust), as

“flow-through critical mineral mining expenditures”, as defined in

subsection 127(9) of the Income Tax Act (Canada) (the

“Qualifying Expenditures”), which will be incurred

on or before December 31, 2025 and renounced to the subscribers of

the FT Units and Charity FT Units with an effective date no later

than December 31, 2024 in an aggregate amount not less than the

gross proceeds raised from the issue of the FT Shares. If the

Qualifying Expenditures are reduced by the Canada Revenue Agency,

the Company will indemnify each subscriber of FT Units and Charity

FT Units for any additional taxes payable by such subscriber as a

result of the Company’s failure to renounce the Qualifying

Expenditures as agreed.

The securities offered have not been, nor will

they be, registered under the U.S. Securities Act, as amended, or

any state securities law, and may not be offered, sold or

delivered, directly or indirectly, within the United States, or to

or for the account or benefit of U.S. persons, absent registration

or an exemption from such registration requirements. This news

release does not constitute an offer to sell or the solicitation of

an offer to buy nor shall there be any sale of securities in any

state in the United States in which such offer, solicitation or

sale would be unlawful.

About Foremost

Foremost Clean Energy (NASDAQ: FMST) (CSE: FAT)

(WKN: A3DCC8) is an emerging North American uranium and lithium

exploration company with an option to earn up to a 70% interest in

10 prospective uranium properties (with the exception of the

Hatchet Lake, where Foremost is able to earn up to 51%) spanning

over 330,000 acres in the prolific, uranium-rich Athabasca Basin

region of northern Saskatchewan. As the demand for carbon-free

energy continues to accelerate, domestically mined uranium and

lithium are poised for dynamic growth, playing an important role in

the clean energy mix of the future. Foremost’s uranium projects are

at different stages of exploration, from grassroots to those with

significant historical exploration and drill-ready targets. The

Company’s mission is to make significant discoveries, alongside and

in collaboration with Denison (TSX:DML, NYSE American: DNN),

through systematic and disciplined exploration programs.

Foremost also has a portfolio of lithium

projects at varying stages of development, which are located across

55,000+ acres in Manitoba and Quebec. For further information

please visit the company’s website at

www.foremostcleanenergy.com.

Contact and Information

CompanyJason Barnard, President

and CEO+1 (604) 330-8067info@foremostcleanenergy.com

Investor RelationsLucas A.

ZimmermanManaging DirectorMZ Group - MZ North America(949)

259-4987FMST@mzgroup.uswww.mzgroup.us

Follow Us Or Contact Us On Social

Media:X: @fmstcleanenergyLinkedin:

https://www.linkedin.com/company/foremostcleanenergy/Facebook:

https://www.facebook.com/ForemostCleanEnergy/

Forward-Looking Statements

Except for the statements of historical fact

contained herein, the information presented in this news release

and oral statements made from time to time by representatives of

the Company are or may constitute “forward-looking statements” as

such term is used in applicable United States and Canadian laws and

including, without limitation, within the meaning of the Private

Securities Litigation Reform Act of 1995, for which the Company

claims the protection of the safe harbor for forward looking

statements. Such forward-looking statements and forward-looking

information include, but are not limited to, statements concerning;

the Company’s business strategies, expectations, planned operations

and future actions and the Company's expectations with respect to

the Offering, including the use of proceeds of the Offering at

projected timelines. These statements relate to analyses and other

information that are based on forecasts of future results,

estimates of amounts not yet determinable and assumptions of

management. Any other statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives, assumptions or future events or

performance (often, but not always, using words or phrases such as

“expects” or “does not expect,” “is expected,” “anticipates” or

“does not anticipate,” “plans,” “estimates” or “intends,” or

stating that certain actions, events or results “may,” “could,”

“would,” “might” or “will” be taken, occur or be achieved) are not

statements of historical fact and should be viewed as

forward-looking statements. Such forward-looking statements involve

known and unknown risks, uncertainties and other factors which may

cause the actual results, performance or achievements of the

Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements. Such risks and other factors include,

among others that the use of proceeds under the Offering is

different than as anticipated; the availability of capital to fund

programs and the resulting dilution caused by the raising of

capital through the sale of Offered Securities; actual results of

the Company’s current proposed exploration activities; commodity

price fluctuations and cycles; potential defects in the title of

the Company’s properties; geopolitical risks; price volatility of

publicly traded securities; risks and uncertainties associated with

the environment; and delays in obtaining governmental approvals,

permits or financing. Although the Company has attempted to

identify important factors that could cause actual actions, events

or results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that such statements will prove

to be accurate as actual results and future events could differ

materially from those anticipated in such statements. Although the

Company believes that the expectations reflected in such

forward-looking statements are based upon reasonable assumptions,

it can give no assurance that its expectations will be achieved.

Forward-looking information is subject to certain risks, trends and

uncertainties that could cause actual results to differ materially

from those projected. Many of these factors are beyond the

Company’s ability to control or predict. Important factors that may

cause actual results to differ materially and that could impact the

Company and the statements contained in this news release can be

found in the Company’s filings with the Securities and Exchange

Commission. The Company assumes no obligation to update or

supplement any forward-looking statements whether as a result of

new information, future events or otherwise. Accordingly, readers

should not place undue reliance on forward-looking statements

contained in this news release and in any document referred to in

this news release. This news release shall not constitute an offer

to sell or the solicitation of an offer to buy securities. and

information. Please refer to the Company’s most recent filings

under its profile at on Sedar+ at www.sedarplus.ca and on Edgar at

www.sec.gov for further information respecting the risks affecting

the Company and its business.

The Canadian Securities Exchange has neither

approved nor disapproved the contents of this news release and

accepts no responsibility for the adequacy or accuracy hereof.

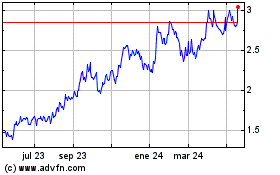

Denison Mines (TSX:DML)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

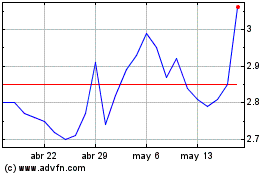

Denison Mines (TSX:DML)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024