Mosaic Minerals Announces Transaction With IAMGOLD and Gaboury Project Update

21 Septiembre 2021 - 6:00AM

Mosaic Minerals Corporation (CSE: MOC)

(“

Mosaic” or the “

Corporation”)

is pleased to announce that it has completed a transaction to sell

mining claims to IAMGOLD Corporation (TSX : IMG, NYSE: IAG).

The transaction consists of IAMGOLD acquiring

100% interest in 4 mining claims formerly part of the Opawica

Property (Chibougamau mining camp) for a total aggregate purchase

price of $150,000 payable to Mosaic according to the following

schedule: $50,000 within 10 business days of the closing, $50,000

on or before the date that is one year following the closing date

and $50,000 on or before the date that is 18 months following the

closing date. Mosaic will also retain a 0.5% net smelter royalty

(“NSR”) on the 4 mining claims.

“We are happy to conclude this transaction with

IAMGOLD, a great partner for the development of mining properties

in Quebec. We are now devoting 100% of our attention to the Gaboury

and 113 N properties which could represent an interesting potential

for battery metals particularly nickel.” Stated Jonathan Hamel,

Mosaic Minerals President and CEO.

Gaboury Project

The management of the company would also like to

mention that it has obtained all the necessary permits to undertake

a first drilling program on its Gaboury project located 150 KM SW

of Rouyn-Noranda, in Abitibi (Québec). A first prospecting survey

made it possible to trace in the western extension of the Pike

Nickel showing, a few significant nickel anomalies as well as

copper, zinc, and silver anomalies in the eastern extension of the

same showing. The drilling campaign should starts as soon as

possible.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/bc2c6c55-e745-4cd9-99f3-cf394db909ff

The technical content of this press release has

been reviewed and approved by Mr. Gilles Laverdière, P.Geo., an

independent consulting geologist and a Qualified Person as defined

in NI 43-101.

About Mosaic Minerals

Corporation

Mosaic Minerals Corp. is a Canadian mineral

exploration company listed on the Canadian Securities Exchange

(CSE: MOC) now focusing on the exploration for future strategic

Copper, Nickel and Zinc deposits in priority on the Quebec Province

territory which have a long and successful history of base metal

production principally in the Rouyn-Noranda, Matagami, Val-d’Or and

Chibougamau mining camps.

On Behalf of the Board

M. Jonathan HamelPresident & CEOjhamel@mosaicminerals.ca

This release contains certain “forward-looking

information” under applicable Canadian securities laws concerning

the Arrangement. Forward-looking information reflects the Company’s

current internal expectations or beliefs and is based on

information currently available to the Company. In some cases,

forward-looking information can be identified by terminology such

as “may”, “will”, “should”, “expect”, “intend”, “plan”,

“anticipate”, “believe”, “estimate”, “projects”, “potential”,

“scheduled”, “forecast”, “budget” or the negative of those terms or

other comparable terminology. Assumptions upon which such

forward-looking information is based includes, among others, that

the conditions to closing of the Arrangement will be satisfied and

that the Arrangement will be completed on the terms set out in the

definitive agreement. Many of these assumptions are based on

factors and events that are not within the control of the Company,

and there is no assurance they will prove to be correct or

accurate. Risk factors that could cause actual results to differ

materially from those predicted herein include, without limitation:

that the remaining conditions to the Arrangement will not be

satisfied; that the business prospects and opportunities of the

Company will not proceed as anticipated; changes in the global

prices for gold or certain other commodities (such as diesel,

aluminum and electricity); changes in U.S. dollar and other

currency exchange rates, interest rates or gold lease rates; risks

arising from holding derivative instruments; the level of liquidity

and capital resources; access to capital markets, financing and

interest rates; mining tax regimes; ability to successfully

integrate acquired assets; legislative, political or economic

developments in the jurisdictions in which the Company carries on

business; operating or technical difficulties in connection with

mining or development activities; laws and regulations governing

the protection of the environment; employee relations; availability

and increasing costs associated with mining inputs and labour; the

speculative nature of exploration and development; contests over

title to properties, particularly title to undeveloped properties;

and the risks involved in the exploration, development and mining

business. Risks and unknowns inherent in all projects include the

inaccuracy of estimated reserves and resources, metallurgical

recoveries, capital and operating costs of such projects, and the

future prices for the relevant minerals. The Canadian Securities

Exchange does not accept responsibility for the adequacy or

accuracy of this release.

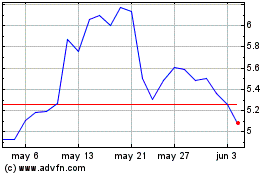

IAMGOLD (TSX:IMG)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

IAMGOLD (TSX:IMG)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024