Orezone Gold Corporation (TSX: ORE, OTCQX: ORZCF)

(the “Company” or “Orezone”) is pleased to announce that the

Company has secured binding commitments totaling over $105 million

to fully finance the construction of the Phase II hard rock

expansion at its flagship Bomboré Gold Mine. With this financing,

the Company’s Board of Directors has approved a positive

construction decision for this brownfield expansion.

With early works complete, engineering and

procurement well-advanced, and major works expected to commence

shortly, the Phase II expansion remains on schedule for first gold

in late 2025.

Financing Package

Highlights:

-

$58 million senior secured term loan with Coris Bank International

(“Coris Bank”), a leading West African bank and the Company’s

current senior lender.

-

$47 million non-brokered private placement of 92,743,855 common

shares of Orezone at C$0.70 per share with Nioko Resources

Corporation (“Nioko Resources”).

-

No gold hedging, offtakes, or cost overrun reserve required by

Coris Bank.

- The

Bomboré mine remains free of any hedging, gold stream or private

gold royalty, thereby preserving upside for shareholders.

Patrick Downey, President and CEO stated, “We

are extremely pleased to announce that the Phase II hard rock

expansion for Bomboré is now fully financed. We welcome Nioko

Resources, a local Burkinabe and West African investment group, as

an aligned and committed stakeholder, further strengthening our

local base and providing another platform for regional growth.

Orezone remains well-positioned to deliver this next stage of

project growth, which will see annual gold production increase to

over 170,000 ounces in 2026, an approximate 50% increase from

current levels. The capital cost for the expansion is estimated at

$85 million, and Orezone expects to deliver first gold from the

expansion in late 2025.

This financing package sets a clear path forward

for Bomboré to realize a substantial hard rock life of mine. The

path forward includes our renewed focus on exploration and

discovery, and with a greater than 14km long mineralized trend,

drilled to an average depth of approximately 200m, we see

substantial upside to further expand the project’s current stated

mineral resources of 4.5M oz in Measured and Indicated, and 0.6M oz

in Inferred.

Lastly, I would like to acknowledge our

in-country lender, Coris Bank, whose ongoing support has been

instrumental in advancing Bomboré through a phased production

ramp-up. With this Phase II financing package, we look forward to

further strengthening our partnership with Coris Bank”.

PHASE II TERM LOAN

The Company has received a credit committee

approved binding term sheet from Coris Bank for a senior secured

project-level term loan (the “Phase II Term Loan”) for the hard

rock expansion. The Phase II Term Loan is denominated in West

African Communauté Financière Africain francs (“XOF”), the official

currency of Burkina Faso, which will provide a natural currency

hedge for local construction costs.

-

~$58 million (XOF 35.0 billion at an assumed FX rate of 600).

-

Term of three years.

-

Interest rate of 11.0% per annum.

-

Available in multiple draws with the first drawdown to repay the

Company’s existing bridge loan of ~$20 million (XOF 12.0 billion)

entered into with Coris Bank on May 10, 2024.

-

Deferral of principal repayments to January 2026.

-

Early repayment permitted, with a prepayment fee of 2%.

Conditions precedent to loan drawdowns include

execution and delivery of final loan documentation, intercreditor

consents and approvals with the existing convertible debenture

holders, and other customary conditions.

EQUITY FINANCING

The Company has entered into a binding agreement

with a strategic investor, Nioko Resources, for a non-brokered

private placement of 92,743,855 common shares at a price per share

of C$0.70 for gross proceeds of $47 million (the “Equity

Financing”).

The subscription price of C$0.70 per share

represents:

-

6.9% premium to the closing price of C$0.66 per share on July 9,

2024; and

-

6.4% premium to the 10-day VWAP of C$0.66 per share on July 9,

2024.

Given the timing uncertainty of VAT refunds

during construction and the large VAT receivable accumulated

to-date, the Equity Financing was required to advance the hard rock

expansion on a fully financed basis. The proceeds from the Equity

Financing will help cover any potential shortfalls of VAT refunds

forecasted during the construction period, as well for exploration,

working capital and general corporate purposes.

The Company expects to complete the Equity

Financing in July, which is subject to final approval of the TSX.

All common shares issued pursuant to the Equity Financing will be

subject to a four-month hold period from the date of closing. No

finder’s or broker fees are payable in connection with the Equity

Financing.

This press release does not constitute an offer

of securities for sale in the United States. The securities being

offered have not been, nor will be, registered under the United

States Securities Act of 1933, as amended, and may not be offered

or sold within the United States absent U.S. registration or an

applicable exemption from U.S. registration requirements.

About Orezone Gold

Corporation

Orezone Gold Corporation (TSX: ORE OTCQX: ORZCF)

is a West African gold producer engaged in mining, developing, and

exploring its flagship Bomboré Gold Mine in Burkina Faso. The

Bomboré mine achieved commercial production on its oxide operations

on December 1, 2022, and is now focused on its staged hard rock

expansion that is expected to materially increase annual and

life-of-mine gold production from the processing of hard rock

mineral reserves. Orezone is led by an experienced team focused on

social responsibility and sustainability with a proven track record

in project construction and operations, financings, capital markets

and M&A.

The technical report entitled Bomboré Phase II

Expansion, Definitive Feasibility Study is available on SEDAR+ and

the Company’s website.

Patrick DowneyPresident and Chief Executive

Officer

Vanessa PickeringManager, Investor Relations

Tel: 1 778 945 8977 / Toll Free: 1 888 673

0663info@orezone.com / www.orezone.com

Qualified Person

Rob Henderson, P.Eng., VP Technical Services, is

the Qualified Person who has approved the scientific and technical

information in this news release.

For further information please contact

Orezone at +1 (778) 945-8977 or visit the Company’s

website at

www.orezone.com.

The Toronto Stock Exchange neither approves nor

disapproves the information contained in this news release.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains certain information

that may constitute “forward-looking information” within the

meaning of applicable Canadian Securities laws and “forward-looking

statements” within the meaning of applicable U.S. securities laws

(together, “forward-looking statements”). Forward-looking

statements are frequently characterized by words such as “plan”,

“expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”,

“potential”, “possible” and other similar words, or statements that

certain events or conditions “may”, “will”, “could”, or “should”

occur.

Forward-looking statements in this press release

include, but are not limited to, statements with respect to the

construction of the Phase II Hard Rock expansion being fully

funded, projected first gold from the Phase II expansion in late

2025, annual gold production, capital cost for the expansion, Nioko

Resources and regional growth, substantial hard rock life of mine,

substantial upside to further expand the project’s mineral

resources, and the Phase II Term Loan and the Equity Financing,

including the anticipated closing date and use of proceeds of the

Phase II Term Loan and the Equity Financing.

All such forward-looking statements are based on

certain assumptions and analyses made by management in light of

their experience and perception of historical trends, current

conditions and expected future developments, as well as other

factors management and the qualified persons believe are

appropriate in the circumstances.

All forward-looking statements are subject to a

variety of risks and uncertainties and other factors that could

cause actual events or results to differ materially from those

projected in the forward-looking statements including, but not

limited to, delays caused by pandemics, terrorist or other violent

attacks (including cyber security attacks), the failure of parties

to contracts to honour contractual commitments, unexpected changes

in laws, rules or regulations, or their enforcement by applicable

authorities; social or labour unrest; changes in commodity prices;

unexpected failure or inadequacy of infrastructure, the possibility

of unanticipated costs and expenses, accidents and equipment

breakdowns, political risk, unanticipated changes in key management

personnel and general economic, market or business conditions, the

failure of exploration programs, including drilling programs, to

deliver anticipated results and the failure of ongoing and

uncertainties relating to the availability and costs of financing

needed in the future, and other factors described in the Company's

most recent annual information form and management discussion and

analysis filed on SEDAR+. Readers are cautioned not to place undue

reliance on forward-looking statements.

Although the forward-looking statements

contained in this press release are based upon what management of

the Company believes are reasonable assumptions, the Company cannot

assure investors that actual results will be consistent with these

forward-looking statements. These forward-looking statements are

made as of the date of this press release and are expressly

qualified in their entirety by this cautionary statement. Subject

to applicable securities laws, the Company does not assume any

obligation to update or revise the forward-looking statements

contained herein to reflect events or circumstances occurring after

the date of this press release.

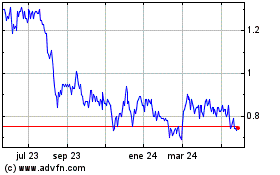

Orezone Gold (TSX:ORE)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

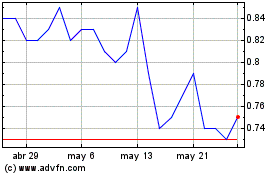

Orezone Gold (TSX:ORE)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025