Unaudited interim results for the three-and nine-month

periods ended 30 September 2024

Serabi (AIM:SRB, TSX:SBI, OTCQX:SRBIF),

the Brazilian focused gold mining and development company, is

pleased to release its unaudited interim results for the three and

nine-month periods ended 30 September 2024.

A copy of the full interim statements together

with commentary can be accessed on the Company’s website using the

following link:-

https://bit.ly/3Z8CJiX

“This has been another excellent quarter for

Serabi, in particular for cash generation, said Clive Line,

Serabi’s CFO. “The cash balance at the end of September was $20.0

million with $8.0 million generated during the quarter. EBITDA of

$11.7 million for the quarter brings EBITDA for the year to date to

a total of $24.7 million, a 42 per cent improvement compared with

the second quarter.

"We benefited from inventory realisation to the

sum of approximately $3.0M, boosting quarter sales, and whilst I do

not expect similar additional inventory sales for Q4, I do

anticipate cash growth to continue to the end of the year

notwithstanding the cyclical effects of tax payments and 13th

salary accruals that are due. The ability of the business to

produce healthy cash flow is being further supported by the Coringa

classification plant which is now operational and in the final

stages of commissioning. We are already passing run of mine ore

through this plant and will also start to work our way through the

lower grade stockpiles that have been accumulated at Coringa. As a

result of processing this stockpiled material we hope that this

final quarter will continue the pattern of increasing production

quarter on quarter that we have so far experienced in 2024.

"During the quarter we announced the results of

the Preliminary Economic Assessment for Coringa which indicate an

average project AISC of $1,241 over the project life from 1 January

2025 onwards. The full NI 43-101 compliant Technical Report was

published on 21 November 2024."

Financial Highlights (all

currency amounts are expressed in US Dollars unless otherwise

stated)

- Gold production for the first nine

months of 2024 of 27,499 ounces (2023: 25,262 ounces).

- Cash held on 30 September 2024 of

$20.0 million (31 December 2023: $11.6 million including US$0.6

million relating to the exploration alliance with Vale).

- EBITDA for the nine-month period of

$24.7 million (2023: $8.8 million).

- Post-tax profit for the nine-month

period of $17.8 million (2023: $4.6 million),

- Profit per share of 23.55 cents

compared with a profit per share of 6.10 cents for the same nine

month period of 2023.

- Net cash inflow from operations for

the nine-month period (after mine development expenditure of US$4.9

million) of US$18.2 million (2023: US$10.7 million inflow, after

mine development expenditure of US$2.6 million).

- Average gold price of US$2,338 per

ounce received on gold sales during the nine month period (2023:

US$1,940).

- Cash Cost for the nine month period

to 30 September 2024 of US$1,405 per ounce (nine months 2023:

US$1,253 per ounce).

- All-In Sustaining Cost for the

nine-month period to 30 September 2024 of US$1,790 per ounce (nine

months 2023: US$1,553 per ounce).

Overview of the financial

results

In the first nine months of 2024, the Group has

reported revenue and operating costs related to the sale of 28,912

ounces in the period (27,499 ounces produced). This compares to

sales reported of only 23,733 ounces in the first nine months of

2023. Reported revenues and costs reflect the ounces sold in each

period and as a result total costs for the nine-month period are

significantly higher than for the corresponding period of 2023.

During the month of January 2024, the Group also

completed and drew down a new US$5 million loan with Itaú Bank in

Brazil. This new arrangement has an interest coupon of 8.47 per

cent and is repayable as a bullet payment on 6 January 2025. This

replaced a similar loan arranged with Santander Bank in Brazil that

was repaid during the month of February 2024.

Final commissioning of the ore sorter and

crushing plant for Coringa is almost complete, with the crushing

plant operational during October and the ore-sorter starting up

during November. During the remainder of the fourth quarter in

addition to passing run of mine ore extracted from Coringa, the

Company will also be processing some of the lower grade material

that has been stockpiled at Coringa providing an additional boost

to gold production in the remainder of the fourth quarter.

Key Financial Information

|

SUMMARY FINANCIAL STATISTICS FOR THE THREE-AND NINE MONTHS

ENDING 30 SEPTEMBER 2024 |

|

|

9 months to30 September

2024US$(unaudited) |

9 months to30 September 2023US$(unaudited) |

3 months to30 September

2024US$(unaudited) |

3 months to30 September 2023US$(unaudited) |

|

|

|

Revenue |

70,290,641 |

47,897,264 |

27,626,034 |

17,373,682 |

|

|

|

Cost of sales |

(39,840,803) |

(34,405,882) |

(14,160,734) |

(13,341,448) |

|

|

|

Gross operating profit |

30,449,838 |

13,491,382 |

13,465,300 |

4,032,234 |

|

|

|

Administration and share based payments |

(5,728,359) |

(4,702,467) |

(1,719,359) |

(1,864,200) |

|

|

|

EBITDA |

24,721,479 |

8,788,915 |

11,745,941 |

2,168,034 |

|

|

|

Depreciation and amortisation charges |

(3,297,323) |

(3,409,994) |

(1,056,517) |

(1,384,957) |

|

|

|

Operating profit before finance and tax |

21,424,156 |

5,378,921 |

10,689,424 |

783,077 |

|

|

|

|

|

|

|

|

|

|

|

Profit after tax |

17,837,221 |

4,620,779 |

8,615,387 |

(359,112) |

|

|

|

Earnings per ordinary share (basic) |

23.55c |

6.10c |

11.38c |

0.47c |

|

|

|

|

|

|

|

|

|

|

|

Average gold price received (US$/oz) |

US$2,338 |

US$1,940 |

US$2,478 |

US$1,930 |

|

|

|

|

|

|

As at30

September2024US$(unaudited) |

As at31 December2023US$(audited) |

|

Cash and cash equivalents |

|

|

20,029,407 |

11,552,031 |

|

Net funds (after finance debt obligations) |

|

|

14,007,367 |

5,148,947 |

|

Net assets |

|

|

103,439,147 |

92,792,049 |

|

|

|

|

|

|

|

Cash Cost and All-In Sustaining Cost (“AISC”) |

|

|

|

|

|

|

|

9 months to 30 September

2024 |

9 months to 30 September2023 |

12 months to 31 December 2023 |

|

Gold production for cash cost and AISC

purposes |

|

27,499 ozs |

25,262 ozs |

33,152 ozs |

|

|

|

|

|

|

|

Total Cash Cost of production (per ounce) |

|

US$1,405 |

US$1,253 |

US$1,300 |

|

Total AISC of production (per ounce) |

|

US$1,790 |

US$1,553 |

US$1,635 |

Engage Investor Presentation – 3

December 2024

Shareholders and investors are advised that Mike Hodgson, Chief

Executive Officer of the Company will provide a live interactive

presentation via the Engage Investor platform, on the 3rd of

December at 2:30pm GMT.

Serabi Gold plc welcomes all current shareholders and

interested investors to join and encourages investors to pre-submit

questions. Investors can also submit questions at any

time during the live presentation.

Investors can sign up to Engage Investor at no cost and

follow Serabi Gold plc from their personalised investor

hub.

Shareholders and investors can register interest in this event

using the following link - https://engageinvestor.news/SRB_Ei

The information contained within this

announcement is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014 as it forms part of UK Domestic Law by virtue of the

European Union (Withdrawal) Act 2018.

The person who arranged for the release of this

announcement on behalf of the Company was Clive Line, Director.

Enquiries

SERABI GOLD plcMichael

Hodgson t

+44 (0)20 7246 6830Chief

Executive m

+44 (0)7799 473621

Clive

Line t

+44 (0)20 7246 6830Finance

Director m

+44 (0)7710 151692

Andrew Khov

m

+1 647 885 4874Vice President, Investor Relations & Business

Development e

contact@serabigold.com

www.serabigold.com

BEAUMONT CORNISH LimitedNominated

Adviser & Financial AdviserRoland Cornish / Michael

Cornish t

+44 (0)20 7628 3396

PEEL HUNT LLPJoint UK

BrokerRoss

Allister t

+44 (0)20 7418 9000

TAMESIS PARTNERS LLPJoint UK

BrokerCharlie Bendon/ Richard

Greenfield t

+44 (0)20 3882 2868

CAMARCOFinancial PR -

EuropeGordon Poole / Emily

Hall t

+44 (0)20 3757 4980

HARBOR ACCESS Financial PR – North

AmericaJonathan Patterson / Lisa

Micali t

+1 475 477 9404

Copies of this announcement are available from

the Company's website at www.serabigold.com.

Forward-looking statementsCertain statements in

this announcement are, or may be deemed to be, forward looking

statements. Forward looking statements are identified by their use

of terms and phrases such as ‘‘believe’’, ‘‘could’’, “should”

‘‘envisage’’, ‘‘estimate’’, ‘‘intend’’, ‘‘may’’, ‘‘plan’’, ‘‘will’’

or the negative of those, variations or comparable expressions,

including references to assumptions. These forward-looking

statements are not based on historical facts but rather on the

Directors’ current expectations and assumptions regarding the

Company’s future growth, results of operations, performance, future

capital and other expenditures (including the amount, nature and

sources of funding thereof), competitive advantages, business

prospects and opportunities. Such forward looking statements reflect

the Directors’ current beliefs and assumptions and are based on

information currently available to the Directors. A number of

factors could cause actual results to differ materially from the

results discussed in the forward-looking statements including risks

associated with vulnerability to general economic and business

conditions, competition, environmental and other regulatory

changes, actions by governmental authorities, the availability of

capital markets, reliance on key personnel, uninsured and

underinsured losses and other factors, many of which are beyond the

control of the Company. Although any forward-looking statements

contained in this announcement are based upon what the Directors

believe to be reasonable assumptions, the Company cannot assure

investors that actual results will be consistent with such forward

looking statements.

Qualified Persons StatementThe scientific and

technical information contained within this announcement has been

reviewed and approved by Michael Hodgson, a Director of the

Company. Mr Hodgson is an Economic Geologist by training with over

35 years' experience in the mining industry. He holds a BSc (Hons)

Geology, University of London, a MSc Mining Geology, University of

Leicester and is a Fellow of the Institute of Materials, Minerals

and Mining and a Chartered Engineer of the Engineering Council of

UK, recognizing him as both a Qualified Person for the purposes of

Canadian National Instrument 43-101 and by the AIM Guidance Note on

Mining and Oil & Gas Companies dated June 2009.

NoticeBeaumont Cornish Limited, which is

authorised and regulated in the United Kingdom by the Financial

Conduct Authority, is acting as nominated adviser to the Company in

relation to the matters referred herein. Beaumont Cornish Limited

is acting exclusively for the Company and for no one else in

relation to the matters described in this announcement and is not

advising any other person and accordingly will not be responsible

to anyone other than the Company for providing the protections

afforded to clients of Beaumont Cornish Limited, or for providing

advice in relation to the contents of this announcement or any

matter referred to in it.

Neither the Toronto Stock Exchange, nor any other securities

regulatory authority, has approved or disapproved of the contents

of this news release.

See

www.serabigold.com for more information

and follow us on twitter @Serabi_Gold

The following information, comprising, the

Income Statement, the Group Balance Sheet, Group Statement of

Changes in Shareholders’ Equity, and Group Cash Flow, is extracted

from the unaudited interim financial statements for the three and

nine months to 30 September 2024.

Statement of Comprehensive IncomeFor the three

and nine-month periods ended 30 September 2024.

|

|

|

For the three months ended30 September |

For the nine months ended30 September |

| |

|

2024 |

2023 |

2024 |

2023 |

|

(expressed in US$) |

Notes |

(unaudited) |

(unaudited) |

(unaudited) |

(unaudited) |

|

CONTINUING OPERATIONS |

|

|

|

|

|

| Revenue |

|

27,626,034 |

17,373,682 |

70,290,641 |

47,897,264 |

| Cost of sales |

|

(14,160,734) |

(11,769,256) |

(39,840,803) |

(32,463,690) |

| Stock impairment

provision |

|

— |

— |

— |

(370,000) |

|

Depreciation and amortisation charges |

2 |

(1,056,517) |

(2,957,149) |

(3,297,323) |

(4,982,186) |

|

Total cost of sales |

|

(15,217,251) |

(14,726,405) |

(43,138,126) |

(37,815,876) |

|

Gross profit |

|

12,408,783 |

2,647,277 |

27,152,515 |

10,081,388 |

| Administration expenses |

|

(1,679,357) |

(1,934,235) |

(5,484,788) |

(4,834,129) |

| Share-based payments |

|

(65,010) |

(52,151) |

(183,902) |

(138,017) |

| Gain on

disposal of assets |

|

25,008 |

122,186 |

(59,669) |

269,679 |

|

Operating profit |

|

10,689,424 |

783,077 |

21,424,156 |

5,378,921 |

| Other income – exploration

receipts |

3 |

__ |

1,992,344 |

351,186 |

3,042,879 |

| Other expenses – exploration

expenses |

3 |

__ |

(1,856,520) |

(317,746) |

(2,876,431) |

| Foreign exchange

gain/(loss) |

|

129,429 |

(43,421) |

(690,927) |

56,645 |

| Finance expense |

4 |

(127,729) |

(381,478) |

(438,032) |

(500,588) |

| Finance

income |

4 |

109,262 |

199,792 |

345,727 |

703,823 |

|

Profit/(loss) before taxation |

|

10,800,386 |

693,794 |

20,674,364 |

5,805,249 |

| Income

tax expense |

5 |

(2,184,999) |

(1,052,906) |

(2,837,143) |

(1,184,470) |

|

Profit/(loss) after taxation |

|

8,615,387 |

(359,112) |

17,837,221 |

4,620,779 |

|

|

|

|

|

|

|

| Other comprehensive

income (net of tax) |

|

|

|

|

|

| |

|

|

|

|

|

|

Exchange differences on translating foreign operations |

|

808,689 |

(2,952,047) |

(7,374,025) |

1,751,104 |

|

Total comprehensive profit/(loss) for the

period(1) |

|

9,424,076 |

(3,311,159) |

10,463,196 |

6,371,883 |

|

|

|

|

|

|

|

|

Profit/(loss) per ordinary share (basic) |

6 |

11.38c |

(0.47c) |

23.55c |

6.10c |

|

Profit/(loss) per ordinary share (diluted) |

6 |

11.38c |

(0.47c) |

23.55c |

6.10c |

(1)

The Group has no

non-controlling interest and all profits are attributable to the

equity holders of the Parent Company

Balance Sheet as at 30 September

2024

|

(expressed in US$) |

|

|

As at30 September

2024(unaudited) |

As at30 September 2023(unaudited) |

As at31 December 2023(audited) |

|

Non-current assets |

|

|

|

|

|

| Deferred exploration

costs |

|

|

20,211,858 |

19,775,603 |

20,499,257 |

| Property, plant and

equipment |

|

|

56,310,566 |

49,107,705 |

53,340,903 |

| Right of use assets |

|

|

4,928,263 |

5,214,315 |

5,316,330 |

| Deferred taxes |

|

|

7,110,445 |

1,520,710 |

4,653,063 |

| Taxes

receivable |

|

|

1,903,307 |

3,891,201 |

1,791,983 |

|

Total non-current assets |

|

|

90,464,439 |

79,509,534 |

85,601,536 |

|

Current assets |

|

|

|

|

|

| Inventories |

|

|

12,338,958 |

9,819,171 |

12,797,951 |

| Trade and other

receivables |

|

|

2,100,956 |

1,579,886 |

2,858,072 |

| Derivative financial

assets |

|

|

— |

197,864 |

115,840 |

| Prepayments and accrued

income |

|

|

1,633,602 |

1,750,470 |

2,320,256 |

| Cash

and cash equivalents |

|

|

20,029,407 |

15,352,099 |

11,552,031 |

|

Total current assets |

|

|

36,102,923 |

28,699,490 |

29,644,150 |

|

Current liabilities |

|

|

|

|

|

| Trade and other payables |

|

|

10,672,705 |

7,798,873 |

8,626,292 |

| Interest bearing

liabilities |

|

|

5,886,714 |

6,211,791 |

6,403,084 |

| Accruals |

|

|

431,716 |

593,435 |

649,225 |

|

Total current liabilities |

|

|

16,991,135 |

14,604,099 |

15,678,601 |

|

Net current assets |

|

|

19,111,788 |

14,095,391 |

13,965,549 |

|

Total assets less current liabilities |

|

|

109,576,227 |

93,604,925 |

99,567,085 |

|

Non-current liabilities |

|

|

|

|

|

| Trade and other payables |

|

|

3,676,181 |

3,884,102 |

3,960,920 |

| Interest bearing

liabilities |

|

|

135,326 |

304,262 |

150,224 |

| Deferred tax liability |

|

|

— |

130,967 |

— |

| Provisions |

|

|

2,325,573 |

1,252,631 |

2,663,892 |

|

Total non-current liabilities |

|

|

6,137,080 |

5,571,962 |

6,775,036 |

|

Net assets |

|

|

103,439,147 |

88,032,963 |

92,792,049 |

| Equity |

|

|

|

|

|

| Share capital |

|

|

11,213,618 |

11,213,618 |

11,213,618 |

| Share premium reserve |

|

|

36,158,068 |

36,158,068 |

36,158,068 |

| Option reserve |

|

|

359,475 |

116,246 |

175,573 |

| Other reserves |

|

|

17,609,380 |

16,167,780 |

15,960,006 |

| Translation reserve |

|

|

(69,154,766) |

(64,525,667) |

(61,780,741) |

|

Retained surplus |

|

|

107,253,372 |

88,902,918 |

91,065,525 |

|

Equity shareholders’ funds |

|

|

103,439,147 |

88,032,963 |

92,792,049 |

Statements of Changes in Shareholders’

EquityFor the nine-month period ended 30 September

2024

|

(expressed in US$) |

|

|

|

|

|

|

|

|

(unaudited) |

Sharecapital |

Sharepremium |

Share option reserve |

Other reserves (1) |

Translation reserve |

Retained Earnings |

Total equity |

|

Equity shareholders’ funds at 31 December

2022 |

11,213,618 |

36,158,068 |

1,324,558 |

14,459,255 |

(66,276,771) |

84,644,335 |

81,523,063 |

| Foreign currency

adjustments |

— |

— |

— |

— |

1,751,104 |

— |

1,751,104 |

| Profit

for the period |

— |

— |

— |

— |

— |

4,620,779 |

4,620,779 |

|

Total comprehensive income for the period |

— |

— |

— |

— |

1,751,104 |

4,620,779 |

6,371,883 |

| Transfer to taxation

reserve |

— |

— |

— |

1,708,525 |

— |

(1,708,525) |

— |

| Share Options Expired |

— |

— |

(1,346,329) |

— |

— |

1,346,329 |

— |

| Share

incentives expense |

— |

— |

138,017 |

— |

— |

— |

138,017 |

|

Equity shareholders’ funds at 30 September

2023 |

11,213,618 |

36,158,068 |

116,246 |

16,167,780 |

(64,525,667) |

88,902,918 |

88,032,963 |

|

Foreign currency adjustments |

— |

— |

— |

— |

2,744,926 |

— |

2,744,926 |

| Profit

for the period |

— |

— |

— |

— |

— |

1,954,833 |

1,954,833 |

|

Total comprehensive income for the period |

— |

— |

— |

— |

2,744,926 |

1,954,833 |

4,699,759 |

| Transfer to taxation

reserve |

— |

— |

— |

(207,774) |

— |

207,774 |

— |

| Share Options Expired |

— |

— |

— |

— |

— |

— |

— |

| Share

incentives expense |

— |

— |

59,327 |

— |

— |

— |

59,327 |

|

Equity shareholders’ funds at 31 December

2023 |

11,213,618 |

36,158,068 |

175,573 |

15,960,006 |

(61,780,741) |

91,065,525 |

92,792,049 |

|

Foreign currency adjustments |

— |

— |

— |

— |

(7,374,025) |

— |

(7,374,025) |

| Profit

for the period |

— |

— |

— |

— |

— |

17,837,221 |

17,837,221 |

|

Total comprehensive income for the period |

— |

— |

— |

— |

(7,374,025) |

17,837,221 |

10,463,196 |

| Transfer to taxation

reserve |

— |

— |

— |

1,649,374 |

— |

(1,649,374) |

— |

| Share incentives expense |

— |

— |

183,902 |

— |

— |

— |

183,902 |

|

Equity shareholders’ funds at 30 September

2024 |

11,213,618 |

36,158,068 |

359,475 |

17,609,380 |

(69,154,766) |

107,253,372 |

103,439,147 |

(1) Other reserves comprise a merger

reserve of US$361,461 and a taxation reserve of US$17,247,919 (31

December 2023: merger reserve of US$361,461 and a taxation reserve

of US$15,598,545).Condensed Consolidated Cash Flow

StatementFor the three and nine-month periods ended 30

September 2024

| |

For the three months

ended30 September |

For the nine months

ended30 September |

| |

2024 |

2023 |

2024 |

2023 |

| (expressed

in US$) |

(unaudited) |

(unaudited) |

(unaudited) |

(unaudited) |

|

|

|

|

|

|

| Post tax

profit/(loss) for period |

8,615,387 |

(359,112) |

17,837,221 |

4,620,779 |

| Depreciation –

plant, equipment and mining properties |

1,056,517 |

2,957,149 |

3,297,323 |

4,982,186 |

| Provision for

inventory impairment |

— |

— |

— |

370,000 |

| Gain on asset

disposals |

(25,008) |

(122,186) |

59,669 |

(269,679) |

| Net financial

expense |

(110,962) |

225,107 |

749,792 |

(259,880) |

| Provision for

taxation |

2,184,999 |

1,052,906 |

2,837,143 |

1,184,470 |

| Share-based

payments |

65,010 |

52,151 |

183,902 |

138,017 |

| Taxation paid |

(347,589) |

(415,722) |

(789,287) |

(811,612) |

| Interest paid |

(10,091) |

(22,900) |

(39,599) |

(408,714) |

| Foreign exchange

(loss) / gain |

(291,702) |

(45,098) |

(343,986) |

(117,170) |

| Changes in

working capital |

|

|

|

|

| |

Decrease/(increase) in

inventories |

217,474 |

(696,001) |

(1,049,888) |

(696,782) |

| |

Decrease/(increase)/decrease

in receivables, prepayments and accrued income |

1,238,492 |

(1,477) |

(1,002,244) |

2,763,565 |

|

|

Increase/(decrease) in payables, accruals and provisions |

979,209 |

1,550,835 |

1,384,012 |

1,798,796 |

|

Net cash inflow from operations |

13,571,736 |

4,175,652 |

23,124,058 |

13,293,976 |

|

|

|

|

|

|

| Investing

activities |

|

|

|

|

| Purchase of

property, plant and equipment and assets in construction |

(2,219,242) |

(706,419) |

(6,231,132) |

(1,686,505) |

| Mine development

expenditure |

(1,977,182) |

(1,274,305) |

(4,913,351) |

(2,613,395) |

| Geological

exploration expenditure |

(922,400) |

(101,611) |

(1,835,856) |

(459,035) |

| Pre-operational

project costs |

(393,044) |

— |

(865,728) |

— |

| Proceeds from sale

of assets |

21,474 |

123,408 |

73,955 |

314,923 |

|

Interest received |

109,262 |

101,574 |

338,895 |

181,373 |

|

Net cash outflow on investing activities |

(5,381,132) |

(1,857,353) |

(13,433,217) |

(4,262,639) |

|

|

|

|

|

|

| Financing

activities |

|

|

|

|

| Receipt of

short-term loan |

— |

— |

5,000,000 |

5,000,000 |

| Repayment of

short-term loan |

— |

— |

(5,000,000) |

(5,096,397) |

| Payment of finance

lease liabilities |

(210,366) |

(295,583) |

(708,816) |

(906,565) |

|

Net cash (outflow) / inflow from financing

activities |

(210,366) |

(295,583) |

(708,816) |

(1,002,962) |

|

|

|

|

|

|

| Net

increase / (decrease) in cash and cash equivalents |

7,980,238 |

2,022,716 |

8,982,025 |

8,028,375 |

| Cash and

cash equivalents at beginning of period |

12,041,017 |

13,285,447 |

11,552,031 |

7,196,313 |

|

Exchange difference on cash |

8,152 |

43,936 |

(504,649) |

127,411 |

|

Cash and cash equivalents at end of period |

20,029,407 |

15,352,099 |

20,029,407 |

15,352,099 |

Notes

-

Basis of preparation

1. Basis of preparationThese

interim condensed consolidated financial statements are for the

three and nine month periods ended 30 September 2024. Comparative

information has been provided for the unaudited three and nine

month periods ended 30 September 2023 and, where applicable, the

audited twelve month period from 1 January 2023 to 31 December

2023. These condensed consolidated financial statements do not

include all the disclosures that would otherwise be required in a

complete set of financial statements and should be read in

conjunction with the 2023 annual report.The condensed consolidated

financial statements for the periods have been prepared in

accordance with International Accounting Standard 34 “Interim

Financial Reporting” and the accounting policies are consistent

with those of the annual financial statements for the year ended 31

December 2023 and those envisaged for the financial statements for

the year ending 31 December 2024.

The interim financial information has not been

audited and does not constitute statutory accounts as defined in

Section 434 of the Companies Act 2006. Whilst the financial

information included in this announcement has been compiled in

accordance with International Financial Reporting Standards

(“IFRS”) this announcement itself does not contain sufficient

financial information to comply with IFRS. The Group statutory

accounts for the year ended 31 December 2023 prepared in accordance

with international accounting standards in conformity with the

requirements of the Companies Act 2006 have been filed with the

Registrar of Companies. The auditor’s report on these accounts was

unqualified. The auditor’s report did not contain a statement under

Section 498 (2) or 498 (3) of the Companies Act 2006.

Accounting standards, amendments and

interpretations effective in 2024

The Group has not adopted any standards or

interpretations in advance of the required implementation

dates.

The following Accounting Standards have not yet been ratified in

UK law but are expected to be ratified during 2024. The Group

expects to make appropriate compliant disclosures in its Annual

Report for the year needed 31 December 2024.

| IFRS S1 General Requirements for

Disclosure of Sustainability-related Financial Information |

|

| IFRS S2 Climate-related

Disclosures |

|

Amendments IAS 1 – Classification of Liabilities

as Current or Non-Current and Non Current Liabilities with

CovenantsThe IASB issued amendments to IAS 1 Presentation of

Financial Statements (“IAS 1”). The amendments clarify that the

classification of liabilities as current or non-current is based on

rights that are in existence at the end of the reporting period.

Classification is unaffected by the entity’s expectation or events

after the reporting date. Covenants of loan arrangements will

affect the classification of a liability as current or non-current

if the entity must comply with a covenant either before or at the

reporting date, even if the covenant is only tested for compliance

after the reporting date. There was no significant impact on the

Company’s consolidated interim financial statements as a result of

the adoption of these amendments.

Management do not consider that the following

other amendments to existing standards are applicable to the

current operations of the Group or will have any material impact on

the financial statements.

|

Lease Liability in a Sale and Leaseback (amendments to IFRS

16) |

|

|

Supplier Finance Arrangements (amendments to IAS 7 and IFRS

17)) |

|

Certain new accounting standards and

interpretations have been published that are not mandatory for the

current period and have not been early adopted. These standards are

not expected to have a material impact on the Company’s current or

future reporting periods.

These financial statements do not constitute

statutory accounts as defined in Section 434 of the Companies Act

2006.

(i) Going

concernOn 30 September 2024 the Group held cash of

US$20.03 million which represents an increase of US$8.45 million

compared to 31 December 2023.

On 7 January 2024, the Group completed a US$5.0

million unsecured loan arrangement with Itaú Bank in Brazil. The

loan is repayable as a bullet payment on 6 January 2025 and carries

an interest coupon of 8.47 per cent. The proceeds raised from the

loan are being used for working capital and secure adequate

liquidity to repay a similar arrangement which was repaid on 22

February 2024.

Management prepares, for Board review, regular

updates of its operational plans and cash flow forecasts based on

their best judgement of the expected operational performance of the

Group and using economic assumptions that the Directors consider

are reasonable in the current global economic climate. The current

plans assume that during 2024 the Group will continue gold

production from its Palito Complex operation as well as increase

production from the Coringa mine and will be able to increase gold

production to exceed the levels of 2023.

The Directors will limit the Group’s

discretionary expenditures, when necessary, to manage the Group’s

liquidity.

The Directors acknowledge that the Group remains

subject to operational and economic risks and any unplanned

interruption or reduction in gold production or unforeseen changes

in economic assumptions may adversely affect the level of free cash

flow that the Group can generate on a monthly basis. The Directors

have a reasonable expectation that, after taking into account

reasonably possible changes in trading performance, and the current

macroeconomic situation, the Group has adequate resources to

continue in operational existence for the foreseeable future. Thus,

they continue to adopt the going concern basis of accounting in

preparing the Financial Statements.

2.

Depreciation

and amortisation

Whilst the Coringa Gold Project has been in

production for some time, it is still in a development and ramp-up

stage and has not yet attained the operational scale that the Board

considers is required to be considered in Commercial Production. As

a result no amortisation charge in respect of the underlying mine

asset costs has been reflected in the financial statements to

date.

3.

Other

Income and Expenses

Under the copper exploration alliance with Vale

announced on 10 May 2023, the related exploration activities

undertaken by the Group under the management of a working committee

(comprising representatives from Vale and Serabi), were funded in

their entirety by Vale during Phase 1 of the programme. Following

the completion of Phase 1, Vale advised the Group, in April 2024,

that it did not wish to continue the exploration alliance.

Exploration and development of copper deposits

is not the core activity of the Group and further funding beyond

the Phase 1 commitment would be required before a judgment could be

made as to a project being commercially viable. There is a

significant cost involved in developing new copper deposits and it

is unlikely that, without the financial support of a partner, the

Group would independently seek to develop a copper project in

preference to any of its existing gold projects and discoveries. As

a result, both the funding received from Vale and the related

exploration expenditures has been recognised through the income

statement. As this is not a principal business activity of the

Group these receipts and expenditures are classified as other

income and other expenses.

4.

Finance

expense and income

|

|

3 monthsended30 September

2024(unaudited) |

3 monthsended30 September 2023(unaudited) |

9 monthsended30 September

2024(unaudited) |

9 monthsended30 September 2023(unaudited) |

|

|

US$ |

US$ |

US$ |

US$ |

| Loss on revaluations of

hedging derivatives |

— |

(226,883) |

— |

— |

| Interest expense on short term

loan |

(93,486) |

(106,197) |

(335,563) |

(349,515) |

| Interest expense on trade

finance |

(22,120) |

(24,267) |

(54,333) |

(66,158) |

| Interest expense on finance

leases |

— |

— |

— |

— |

| Total Financial

expense |

(12,123) |

(24,131) |

(48,136) |

(84,915) |

| |

(127,729) |

(381,478) |

(438,032) |

(500,588) |

| Gain on revaluation of hedging

derivatives |

— |

— |

— |

385,512 |

| Realised gain on hedging

derivatives |

— |

98,217 |

6,832 |

136,938 |

| Interest income |

109,262 |

101,575 |

338,895 |

181,373 |

| Total Financial

income |

109,262 |

199,792 |

345,727 |

703,823 |

| Net finance (expense)

/ income |

(18,467) |

(181,686) |

(92,305) |

203,235 |

5.

Taxation

The Group has recognised a deferred tax asset to

the extent that the Group has reasonable certainty as to the level

and timing of future profits that might be generated and against

which the asset may be recovered. The deferred tax liability

arising on unrealised exchange gains has been eliminated in the

nine-month period to 30 September 2024 reflecting the movement in

the Brazilian Real exchange rate at the end of the period and

resulting in deferred tax income of US$946,220 (nine months to 30

September 2023 – income of US$23,113).

The Group has also incurred a tax charge in

Brazil for the six-month period of US$3,783,403 (nine months to 30

September 2023 tax charge - US$1,207,583).

6. Earnings

per Share

|

|

6 months ended 30 June

2024(unaudited) |

6 months ended 30 June 2023(unaudited) |

3 months ended 30 June

2024(unaudited) |

3 months ended 30 June 2023(unaudited) |

|

Profit/(loss) attributable to ordinary shareholders (US$) |

8,615,387 |

(359,112) |

17,837,221 |

4,620,779 |

|

Weighted average ordinary shares in issue |

75,734,551 |

75,734,551 |

75,734,551 |

75,734,551 |

|

Basic profit/(loss) per share (US cents) |

11.38c |

(0.47c) |

23.55c |

6.10c |

|

Diluted ordinary shares in issue (1) |

75,734,551 |

75,734,551 |

75,734,551 |

75,734,551 |

| Diluted

profit/(loss) per share (US cents) |

11.38c |

(0.47c) |

23.55c |

6.10c |

(1) On 30 September 2024 there were 2,814,541

conditional share awards in issue (30 September 2023 – 2,075,400).

These are subject to performance conditions which may or not be

fulfilled in full or in part. These CSAs have not been included in

the calculation of the diluted earnings per share.

7. Post

balance sheet events

There has been no item, transaction or event of

a material or unusual nature likely, in the opinion of the

Directors of the Company to affect significantly the continuing

operation of the entity, the results of these operations, or the

state of affairs of the entity in future financial periods.

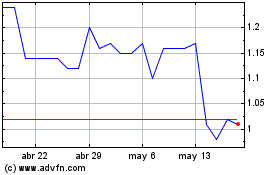

Serabi Gold (TSX:SBI)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Serabi Gold (TSX:SBI)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024