Troilus Gold Corp. (TSX:TLG; OTCQX:CHXMF; FSE:

CM5R) (“Troilus” or the “Company”) announces that it has

closed today its previously announced bought deal financing (the

“Offering”). Pursuant to the Offering, Troilus issued (i)

28,580,000 units (the “Units”) of Troilus at a price of $0.35 per

Unit, for gross proceeds of C$10,003,000, (ii) 7,150,000 common

shares in the capital of the Company issued as “flow-through

shares” (the “Traditional FT Shares”) within the meaning of

subsection 66(15) of the Income Tax Act (Canada) (the “Tax Act”) at

a price of $0.42 per Traditional FT Share for gross proceeds of

C$3,003,000, and (iii) 4,550,000 common shares in the capital of

the Company issued as “flow-through shares” (the “Québec FT

Shares”) within the meaning of subsection 66(15) of the Tax Act and

section 359.1 of the Taxation Act (Québec) (the “Québec Tax Act”)

at a price of $0.44 per Québec FT Share for gross proceeds of

C$2,002,000, for aggregate combined gross proceeds of C$15,008,000.

Each Unit consists of one common share in the

capital of the Company (a “Unit Share”) and one-half of one common

share purchase warrant of the Company (each whole common share

purchase warrant, a “Warrant”). Each Warrant entitles the holder

thereof to acquire, subject to adjustment in certain circumstances,

one common share in the capital of the Company (each, a “Warrant

Share”) at an exercise price of $0.50 per Warrant Share for a

period of 24 months following the closing of the Offering.

The Units, Traditional Flow-Through Shares, and

Québec Flow-Through Shares are collectively referred to herein as

the “Offered Securities”.

The Offering was completed through a syndicate

of underwriters, led by Haywood Securities Inc. and Cormark

Securities Inc. as co-lead underwriters, and Laurentian Bank

Securities Inc., Red Cloud Securities Inc., SCP Resource Finance

LP, BMO Nesbitt Burns Inc., and Velocity Trade Capital Ltd.

The Company intends to use the majority of the

net proceeds of the Offering towards completing work in 2023 and

2024 on its ongoing feasibility study, planned exploration program

at the Troilus Project, environmental related work and for general

and administrative costs, as more fully described in the short form

prospectus of the Company dated November 13, 2023.

The Offered Securities have been offered by way

of short form prospectus in each of the provinces of Canada,

pursuant to National Instrument 44-101 – Short Form Prospectus

Distributions. The Units were also be offered for sale into the

United States pursuant to an exemption from the registration

requirements of the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”) and in such other jurisdictions

outside of Canada and the United States as agreed, in each case in

accordance with all applicable laws and provided that no

prospectus, registration statement or similar document is required

to be filed in such jurisdiction.

The Offered Securities have not been, and will

not be, registered under the United States Securities Act of 1933,

as amended (the “U.S. Securities Act”), or any U.S. state

securities laws, and may not be offered or sold in the United

States or to, or for the account or benefit of, United States

persons absent registration or any applicable exemption from the

registration requirements of the U.S. Securities Act and applicable

U.S. state securities laws. This press release shall not constitute

an offer to sell or the solicitation of an offer to buy securities

in the United States, nor will there be any sale of these

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful.

About Troilus

Troilus is a Canadian-based junior mining

company focused on the systematic advancement and de-risking of the

former gold and copper Troilus Mine towards production. From 1996

to 2010, the Troilus Mine produced +2 million ounces of gold and

nearly 70,000 tonnes of copper. Troilus is located in the top-rated

mining jurisdiction of Quebec, Canada, where is holds a strategic

land position of 435 km² in the Frôtet-Evans Greenstone Belt. Since

acquiring the project in 2017, ongoing exploration success has

demonstrated the tremendous scale potential of the gold system on

the property with significant mineral resource growth. Led by an

experienced team with a track-record of successful mine

development, Troilus is positioned to become a cornerstone project

in North America.

For Further Information, Please

Contact:

Caroline

ArsenaultVP Corporate Communications+1 (647)

276-0050info@troilusgold.com

Cautionary Note Regarding

Forward-Looking Statements and Information

This press release contains forward-looking

statements and forward-looking information (collectively,

“forward-looking statements”) within the meaning of applicable

securities laws. Such forward-looking statements include, without

limitation, statements regarding the use of proceeds from the

Offering and future results of operations, performance and

achievements of the Company. Although the Company believes that

such forward-looking statements are reasonable, it can give no

assurance that such expectations will prove to be correct.

Forward-looking statements are typically identified by words such

as: believe, expect, anticipate, intend, estimate, postulate and

similar expressions, or are those, which, by their nature, refer to

future events. The Company cautions investors that any

forward-looking statements by the Company are not guarantees of

future results or performance, and that actual results may differ

materially from those in forward-looking statements as a result of

various factors and risks, including, uncertainties of the global

economy, market fluctuations, the discretion of the Company in

respect to the use of proceeds discussed above, any exercise of

termination by counterparties under applicable agreements, the

Company’s inability to obtain any necessary permits, consents or

authorizations required for its activities, to produce minerals

from its properties successfully or profitably, to continue its

projected growth, to raise the necessary capital or to be fully

able to implement its business strategies and other risks

identified in its disclosure documents filed at www.sedarplus.ca.

This press release is not, and is not to be construed in any way

as, an offer or recommendation to buy or sell securities in Canada

or in the United States.

Although the Company believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance and actual events, results and/or developments

may differ materially from those in the forward-looking statements.

Readers should not place undue reliance on the Company's

forward-looking statements. The Company does not undertake to

update any forward-looking statement that may be made from time to

time by the Company or on its behalf, except in accordance with and

as required by applicable securities laws.

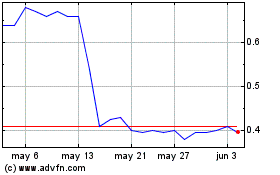

Troilus Gold (TSX:TLG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Troilus Gold (TSX:TLG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025