THIS DOCUMENT IS NOT INTENDED FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED

STATES.

Questor Technology Inc. ("Questor" or the "Company") (TSX VENTURE:QST) announced

today its financial and operating results for the three and six month periods

ended June 30, 2010

The Company reported net income of $167,156 ($0.007 per basic share) for the

second quarter of 2010 compared to net income of $21,031 ($0.001 per basic

share) for the same quarter of 2009. The net income increase of $146,125 is

primarily attributable to the higher margin sales and services revenue mix

occurring in the three months ended June 30, 2010 and the foreign exchange gain

recorded in second quarter 2010 compared to the foreign exchange loss recognized

in the same period of 2009. Partially offsetting these impacts are higher income

tax expense and lower other revenue in second quarter 2010.

Net income for the six months ended June 30, 2010 is $2,136 ($0.000 per basic

share) compared to net income of $103,720 ($0.004 per basic share) for the six

months ended June 30, 2009. The decrease in net income of $101,584 is

attributable to lower incinerator sales and other revenues, partially offset by

higher foreign exchange gains and incinerator rentals and services margins and

by lower general and administrative and income tax expenses in the first half of

2010.

Financial Results Summary

($ unless otherwise noted)

Three months ended Six months ended June

June 30 June 30

For the 2010 2009 2010 2009

----------------------------------------------------------------------------

Total revenue 1,161,202 1,228,584 1,650,830 2,391,780

Gross margin(1) 475,812 369,863 636,354 813,838

EBITDA(1) 277,413 94,532 100,288 249,692

Net income 167,156 21,031 2,136 103,720

Funds generated from

operations(1) 128,881 122,761 36,896 328,601

Total assets 6,929,694 6,434,159 6,929,694 6,434,159

Long-term liabilities 87,698 44,596 87,698 44,596

Shares outstanding

(thousands)(2)

Basic 24,067 24,007 24,037 24,007

Diluted 24,603 24,710 24,615 24,554

Net income per share -

Basic and diluted $ 0.007 $ 0.001 $ 0.000 $ 0.004

(1) Non-GAAP financial measure. Please see discussion in the Non-GAAP

Financial Measures section of the Company's Management's Discussion and

Analysis for the three and six months ended June 30, 2010.

(2) Weighted average.

"Questor has confirmed incinerator sales orders of $2.4 million of which

approximately $1.6 million will be delivered in third quarter 2010 and the

balance in fourth quarter 2010 in accordance with the current customer-specified

schedule," said Audrey Mascarenhas, President and Chief Executive Officer. "The

combined value of the confirmed incinerator sales orders and total revenue

generated in the first half of the year means we are already on track to achieve

total revenue in 2010 that is slightly ahead of 2009 total revenue results. We

continue to actively pursue new business opportunities and currently have

proposals outstanding in excess of $41 million which is approximately $9 million

more than the bids outstanding at this time last year."

"The heightened focus on the environment continues to hold promise for Questor's

technology solutions and services," concluded Ms. Mascarenhas.

The Company continues to build market awareness for its expertise in matters

relating to clean air technologies. Ms. Mascarenhas has been invited to lecture

as part of the Departmental Seminars in Mechanical and Industrial Engineering at

the University of Toronto. She will present on the topic of "Air Pollution: The

Daily Spills That We Ignore" on September 10, 2010 at 2:10 p.m. in Toronto,

Ontario, Canada. As previously announced, Ms. Mascarenhas is serving as a

Society of Petroleum Engineering ("SPE") Distinguished Lecturer for the

2010-2011 lecture season. In that capacity she will be presenting on the topic

of "A Sustainable Solution to the Climate Change Dilemma: Eliminate the Flare"

to audiences in Santa Clara, California, USA, Rock Springs, Wyoming, USA and

Salt Lake City, Utah, USA on September 13, 15 and 16, 2010, respectively.

Questor's second quarter 2010 financial statements and notes thereto and

Management's Discussion and Analysis for the three and six months ended June 30,

2010 will be available shortly on the Company's website at www.questortech.com

and through SEDAR at www.sedar.com.

ABOUT QUESTOR TECHNOLOGY INC.

Questor is an international environmental oilfield service company founded in

late 1994 and headquartered in Calgary, Alberta, Canada with a field office

located in Grande Prairie, Alberta, Canada. The Company is focused on clean air

technologies with activities in Canada, the United States, Europe and Asia.

Questor designs and manufactures high efficiency waste gas incinerators for sale

or for use on a rental basis and also provides combustion-related oilfield

services. The Company's proprietary incinerator technology destroys noxious or

toxic hydrocarbon gases which ensures regulatory compliance, environmental

protection, public confidence and reduced operating costs for customers. Questor

is recognized for its particular expertise in the combustion of sour gas (H2S).

While the Company's current customer base is primarily in the oil and gas

industry, this technology is applicable to other industries such as landfills,

water and sewage treatment, tire recycling and agriculture.

Questor trades on the TSX Venture Exchange under the symbol "QST".

Certain information in this news release constitutes forward-looking statements.

When used in this news release, the words "may", "would", "could", "will",

"intend", "plan", "anticipate", "believe", "seek", "propose", "estimate",

"expect", and similar expressions, as they relate to the Company, are intended

to identify forward-looking statements. In particular, this news release

contains forward-looking statements with respect to, among other things,

business objectives, expected growth, results of operations, performance,

business projects and opportunities and financial results. These statements

involve known and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those anticipated in such

forward-looking statements. Such statements reflect the Company's current views

with respect to future events based on certain material factors and assumptions

and are subject to certain risks and uncertainties, including without

limitation, changes in market, competition, governmental or regulatory

developments, general economic conditions and other factors set out in the

Company's public disclosure documents. Many factors could cause the Company's

actual results, performance or achievements to vary from those described in this

news release, including without limitation those listed above. These factors

should not be construed as exhaustive. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying forward-looking

statements prove incorrect, actual results may vary materially from those

described in this news release and such forward-looking statements included in,

or incorporated by reference in this news release, should not be unduly relied

upon. Such statements speak only as of the date of this news release. The

Company does not intend, and does not assume any obligation, to update these

forward-looking statements. The forward-looking statements contained in this

news release are expressly qualified by this cautionary statement.

QUESTOR TECHNOLOGY INC.

BALANCE SHEETS

(unaudited)

June 30 December 31

As at 2010 2009

----------------------------------------------------------------------------

ASSETS

Current assets

Cash $ 3,056,440 $ 3,080,997

Accounts receivable 968,580 864,260

Income and other taxes receivable 291,091 306,850

Inventory 1,036,708 433,145

Prepaid expenses and deposits 137,633 101,072

Deferred expenses - 2,356

Future income tax asset 50,113 50,113

----------------------------------------------------------------------------

5,540,565 4,838,793

Property and equipment 1,377,761 1,418,524

Intangibles 11,368 15,682

----------------------------------------------------------------------------

$ 6,929,694 $ 6,272,999

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities

Accounts payable and accrued liabilities $ 613,712 $ 348,150

Current portion of long-term debt 5,077 15,232

Income and other taxes payable 21,822 19,034

Deferred revenue and deposits 485,618 198,641

Future income tax liability 691 2,281

----------------------------------------------------------------------------

1,126,920 583,338

Future income tax liability 87,698 74,057

----------------------------------------------------------------------------

1,214,618 657,395

----------------------------------------------------------------------------

Shareholders' equity

Share capital 5,300,544 5,265,736

Contributed surplus 510,179 447,651

Retained earnings (deficit) (95,647) (97,783)

----------------------------------------------------------------------------

5,715,076 5,615,604

----------------------------------------------------------------------------

$ 6,929,694 $ 6,272,999

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

STATEMENTS OF INCOME (LOSS), COMPREHENSIVE INCOME (LOSS) AND RETAINED

EARNINGS (DEFICIT)

(unaudited)

Three months ended Six months ended

June 30 June 30

For the 2010 2009 2010 2009

----------------------------------------------------------------------------

Revenue

Incinerator sales and

services $ 761,998 $ 932,382 $ 851,324 $ 1,504,974

Incinerator rentals

and services 302,265 132,024 547,891 571,294

Combustion services 96,307 115,169 249,472 261,175

----------------------------------------------------------------------------

1,160,570 1,179,575 1,648,687 2,337,443

Less: Direct costs 684,758 809,712 1,012,333 1,523,605

----------------------------------------------------------------------------

475,812 369,863 636,354 813,838

----------------------------------------------------------------------------

Other revenue 632 49,009 2,143 54,337

Expenses

General and

administrative 328,903 333,592 653,058 698,219

Foreign exchange loss

(gain) (98,224) 20,980 (50,929) (21,359)

Depreciation and

amortization 3,704 10,369 10,634 20,626

----------------------------------------------------------------------------

234,383 364,941 612,763 697,486

----------------------------------------------------------------------------

Income before interest

expense and

income tax expense 242,061 53,931 25,734 170,689

Interest expense 504 504 1,008 1,330

----------------------------------------------------------------------------

Income before income

tax expense 241,557 53,427 24,726 169,359

Income tax expense

(recovery)

Current income tax 10,539 33,532 10,539 62,111

Future income tax 63,862 (1,136) 12,051 3,528

----------------------------------------------------------------------------

Net income and

comprehensive income 167,156 21,031 2,136 103,720

Retained earnings

(deficit), beginning

of period (262,803) 86,869 (97,783) 4,180

----------------------------------------------------------------------------

Retained earnings

(deficit), end of

period $ (95,647) $ 107,900 $ (95,647) $ 107,900

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income per share

Basic and diluted $ 0.007 $ 0.001 $ 0.000 $ 0.004

Weighted average number

of shares outstanding

Basic 24,067,260 24,007,370 24,037,480 24,007,370

Diluted 24,603,163 24,709,526 24,614,993 24,553,537

QUESTOR TECHNOLOGY INC.

STATEMENTS OF CASH FLOWS

(unaudited)

Three months ended Six months ended

June 30 June 30

For the 2010 2009 2010 2009

----------------------------------------------------------------------------

Operating activities

Net income $ 167,156 $ 21,031 $ 2,136 $ 103,720

Items not affecting

cash:

Depreciation 35,048 33,351 70,240 64,503

Amortization 304 7,250 4,314 14,500

Unrealized foreign

exchange loss (gain) (178,938) 20,954 (131,681) 62,839

Future income tax

(recovery) 63,862 (1,136) 12,051 3,528

Share-based

compensation 41,449 41,311 79,836 79,511

----------------------------------------------------------------------------

128,881 122,761 36,896 328,601

Net change in non-cash

working capital (464,400) (150,896) (171,538) (290,954)

----------------------------------------------------------------------------

(335,519) (28,135) (134,642) 37,647

----------------------------------------------------------------------------

Investing activities

Additions of property

and equipment (24,921) (30,303) (28,360) (100,823)

----------------------------------------------------------------------------

(24,921) (30,303) (28,360) (100,823)

----------------------------------------------------------------------------

Financing activities

Repayment of long-term

debt (5,078) (9,883) (10,155) (19,766)

Exercise of share

options 17,500 - 17,500 -

----------------------------------------------------------------------------

12,422 (9,883) 7,345 (19,766)

----------------------------------------------------------------------------

Effect of exchange

rates on cash 176,035 (24,945) 131,100 (68,268)

----------------------------------------------------------------------------

Decrease in cash (171,983) (93,266) (24,557) (151,210)

Cash, beginning of

period 3,228,423 3,201,093 3,080,997 3,259,037

----------------------------------------------------------------------------

Cash, end of period $ 3,056,440 $ 3,107,827 $ 3,056,440 $ 3,107,827

----------------------------------------------------------------------------

----------------------------------------------------------------------------

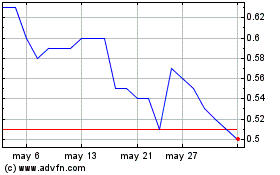

Questor Technology (TSXV:QST)

Gráfica de Acción Histórica

De Mar 2025 a Abr 2025

Questor Technology (TSXV:QST)

Gráfica de Acción Histórica

De Abr 2024 a Abr 2025