Questor Technology Inc. (“Questor” or the “Company”) (TSX-V: QST)

announced today its financial and operating results for the year

ended December 31, 2020.

2020 FINANCIAL RESULTS

(Stated in Canadian dollars except per share and

unit data)

|

|

|

|

|

|

For the years ended December 31, |

2020 |

2019 |

Change |

|

(stated in CDN$) |

($) |

($) |

(%) |

|

|

|

|

|

|

Revenue |

9,210,718 |

30,194,235 |

(69) |

|

Gross Profit |

1,805,410 |

16,262,157 |

(89) |

|

Profit (Loss) for the year |

(1,829,876) |

7,428,590 |

>(100) |

|

Per share — basic |

(0.07) |

0.28 |

>(100) |

|

Per share — diluted |

(0.07) |

0.27 |

>(100) |

|

|

|

|

|

|

As at December 31, |

|

|

|

|

Working capital |

19,300,453 |

17,425,861 |

11 |

|

Total assets |

38,014,911 |

42,110,012 |

(9) |

|

Total equity |

33,989,100 |

35,333,667 |

(4) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding during the year |

27,371,647 |

27,048,432 |

1 |

Questor’s Audited Consolidated Financial Statements

and Management’s Discussion and Analysis for the year ended

December 31, 2020 are available on the Company’s website at

www.questortech.com and through SEDAR at www.sedar.com.

PRESIDENT’S MESSAGE

Questor’s 2020 financial results were

dramatically impacted by the significant slowdown in global

economic activity as a result of the pandemic, further impacted by

the price war between OPEC and other oil and gas producing nations

early in the year. Our revenue for the year decreased to $9.2

million from $30.2 million in 2019. Notwithstanding the 2020

financial performance, Questor maintains a strong financial

position accomplished through managing costs and maintaining

capital discipline. We have continued to live within our cash flow

in 2020, finishing the year with a cash balance of $16.3 million

which was a $2.8 million increase from December 31, 2019. Our focus

has not changed and remains consistent despite this downturn. We

will continue to provide exceptional service to our customers by

providing best in class equipment and clean green solutions while

efficiently managing our costs. Commodity prices had begun to

recover in the fourth quarter of 2020 as the global economy started

to recuperate. The recovery in commodity prices, combined with

significant overall industry cost reductions has led to improved

cash flows for some of our customers and we are confident this will

lead us to improved results in 2021.

The opportunity for Questor in 2021 is the

global focus on environmental, social and governance (“ESG”)

mandates. ESG and climate change are dominant themes and

governments across the globe have responded by introducing more

climate focused regulations particularly in regard to methane. The

Biden administration has a strong mandate to secure environmental

justice and equitable economic opportunity for all. Many companies

have made commitments to net zero by the end of the decade and

investors with trillions of dollars under management, have signaled

their intent to invest in companies focused on reducing emissions

and actively participating in the energy system transition.

Questor’s clean combustion and waste heat to power technology

solutions are integral components to our client’s successful

achievement of their net zero goals.

Leveraging our strong financial position, we are

expanding our sales and engineering teams to solidify our

foundation so that we are ready to serve a rapidly growing global

market focused on eliminating methane emissions and improving

energy efficiency. Both of these initiatives are seen as the

easiest path to greenhouse gas emission reductions. We completed an

internal diagnostic assessment of the sales and marketing function

in the fourth quarter of 2020 and identified opportunities to

enhance the Company’s ability to target regions with the highest

level of activity, improve the Company’s inbound customer journey,

and strengthen our outbound presence. We have implemented a new

gated sales process that evaluates highest potential opportunities

prior to engaging, using sales automation. The process redesign

combined with enhancements that have been implemented through

technology and automation set the stage for the next step of the

initiative. During the first half of 2021, we will recruit

additional sales and marketing resources to support proactive,

strategic, rapid penetration of existing basins and new markets for

both our combustion and heat to power generation technologies.

In 2020, we continued to build our digital

capability by developing an emissions platform that will eventually

enable us to credibly quantify emission reductions for our clients

and guarantee a zero emissions site, with the end goal of

monetizing the emission reduction offsets and certifying the

molecule produced is low carbon through the entire value chain. Our

2021 and 2022 strategic priorities are continuing to grow our clean

combustion business to eliminate methane emissions, data as a

service, customer diversification, industry expansion and the

growth of our waste heat to power product offering.

The previously disclosed delivery of our Q-Power

equipment in the southern United States (“US”) is an example of

product and market diversification. When fully installed this

project will be supplying our ClearPower technology to generate 200

kW of clean emission free power at our client’s glass recycling

plant. In the US, the conversion of waste heat to power is seen as

green, clean energy with tax and pricing incentives that have made

these projects very economically attractive.

There is growing global recognition that

eliminating methane emissions is one of the most effective ways to

arrest the temperature rise related to Climate Change as methane is

86 times worse than carbon dioxide (“CO2”) from a global warming

perspective over a 25 year timeframe. Additionally, methane

emissions from industry, particularly the oil and gas industry,

have been significantly underestimated. In 2020, the Canadian

Federal Government established a $750 million fund to support the

deployment of methane abatement technologies. The Alberta

Provincial government has earmarked an additional $750 million to

invest in projects to reduce greenhouse gas (“GHG”) emissions.

Specifics on the deployment of these funds are evolving and we are

taking a proactive role and are currently working with our clients,

targeting methane reduction projects to access the funding. The US

and the European Union (“EU”) have also taken a proactive approach

through regulation and funding for technology adoption.

“2020 brought with it many challenges that we

are turning into opportunities. We weathered the storm well by

focusing on what we could control. We concentrated our efforts

internally and improved processes, added bench strength and

improved our financial liquidity. We believe our technology,

people, assets and operational experience will continue to

strengthen Questor even through these difficult times,” said Ms.

Mascarenhas, Questor’s President and CEO.

2020 OVERVIEW

- During 2020, the global pandemic

had a major impact on businesses across various sectors. The energy

industry was further impacted by the oil supply war between the

Organization of the Petroleum Exporting Countries (“OPEC”). The

negative economic events affected the Company’s 2020 financial

results which substantially represents the primary driver for the

activity decreases and performance decline compared to the prior

year.

- The Company

continued to be in a strong financial position at December 31,

2020:

- Cash increased

to $16.3 million from $13.5 million at December 31, 2019;

- The Company has

an undrawn $1.0 million revolving demand loan facility and an

undrawn $5.0 million capital loan facility;

- The Company

entered into a repayable government assistance agreement with

Western Economic Diversification Canada which provided $1 million

to help fund its operating costs. Repayment commences in 2023;

- Cash reserves

provide the working capital to thrive during tough market

cycles;

- A strong balance

sheet will serve as a foundation to launch new products and

into new markets once the economy rebounds;

- Capital

expansion plans are deferred until there is a sustained economic

recovery. This strategy preserves our liquidity while improving

capital efficiency; and,

- Increased focus

on operating efficiencies to manage cash flow by working with our

service providers to further reduce costs.

- Revenue

decreased $21.0 million for the year ended December 31, 2020 versus

the same period in 2019:

- Incinerator

equipment sales decreased from $11.8 million in 2019 to $4.1

million in 2020;

- Revenue from

incinerator rentals decreased from $15.7 million in 2019 to $4.1

million in 2020;

- Incinerator

service revenue decreased from $2.6 million in 2019 to $1.0 million

in 2020;

- Gross profit of

$1.8 million in 2020 compared to a gross profit of $16.3 million in

2019:

- The Company

continued its mitigation strategy, revolving around;

- Managing

operations infrastructure ensuring indirect operational resources

are consistent with activity; and,

- Commitment to

supply chain management focused on procuring quality materials at

competitive prices.

- Administrative expenses during the

year ended December 31, 2020 decreased $1.2 million compared to

2019. The decrease is attributable to lower headcount versus the

prior year, reduced work schedules, compensation reductions and

travel reductions and funding ($0.5 million) from the Canadian

Emergency Wage Subsidy (“CEWS”).

FOURTH QUARTER 2020

OVERVIEW

|

For the years ended December 31, |

2020 |

2019 |

Change |

|

(stated in CDN$) |

($) |

($) |

(%) |

|

Revenue |

2,623,673 |

6,816,530 |

(62) |

|

Gross profit |

297,542 |

3,242,431 |

(91) |

|

Profit (loss) for the period |

(885,949) |

1,062,384 |

>(100) |

|

Gross profit (%) |

11 |

48 |

(77) |

|

Earnings (loss) per share |

|

Basic |

(0.03) |

0.04 |

>(100) |

|

Diluted |

(0.03) |

0.04 |

>(100) |

Revenue for the three months ended December 31,

2020 was $2.6 million versus $6.8 million in 2019. Equipment sales

for the three months ended December 31, 2020 was $1.6 million

versus $3.8 million in 2019, a decrease of $2.2 million. Revenue

received from incinerator rentals for the three months ended

December 31, 2020 was $0.7 million versus $2.5 million in 2019, a

decrease of $1.8 million. Incinerator service revenue for the three

months ended December 31, 2020 was $0.3 million versus $0.5 million

in 2019, a decrease of $0.2 million.

Gross Profit for the three months ended December

31, 2020 was $0.3 million versus $3.2 million for the three months

ended December 31, 2019.

Earnings decreased $1.9 million for the three

months ending December 31, 2020 versus 2019.

OUTLOOK

During the first three months of 2021, economies

around the world have started to open up and we are seeing improved

commodity prices; however, the economic malaise brought on by

COVID-19 nationally and globally has had, and will likely continue

to have, a material adverse effect on our business, operations and

financial results.

Higher commodity prices which began in the

fourth quarter of 2020 have continued into 2021. Currently the

price for a barrel of West Texas Intermediate (“WTI”) is over US

$60 suggesting that North American energy producers have

significantly improved economics. The recovery in commodity prices,

combined with significant overall industry cost reductions has led

to improved cash flows for some of our customers. The Company

expects 2021 activity will be modestly higher than 2020.

ESG is a set of standards for how companies

operate regarding the planet and its people. ESG is becoming a

critical criterion for socially conscious investors to screen

potential investments. Environmental principles examine how a

company performs as a steward of the planet. Numerous institutions,

such as the Sustainability Accounting Standards Board (“SASB”), the

Global Reporting Initiative (“GRI”), and the Task Force on

Climate-related Financial Disclosures (“TCFD”) are working to form

standards and define materiality to facilitate inclusion of these

factors into the investment process. The Company’s products are

focused on providing solutions to existing and potential clients to

allow then to address their stewardship by reducing emissions with

a specific target of methane, improve air quality, reduce waste and

improve energy efficiency. The ESG movement is putting pressure on

companies and also driving availability of capital and funding. ESG

is an integral part of the Company’s business strategies.

The Company feels that a strong balance sheet is

imperative for success. Having a strong balance sheet not only

protects the Company in economic turmoil but enables growth when

market confidence improves. The Company currently has substantial

cash reserves, a large company owned rental fleet, and no debt

except for a repayable government grant due commencing in 2023.

ABOUT QUESTOR TECHNOLOGY

INC.

Headquartered in Calgary, Alberta, with

operations across North America, the Company provides three

specialized clean technology solutions to its customers. The

product line is Q-Series, which consists of incineration optimized

based upon waste gas composition and flow rate to achieve a

combustion efficiency of greater than 99.99 percent. The second

product line is Q-Power, which is our power generation solution

designed to efficiently transform otherwise wasted high and low

temperature heat into valuable electricity power. The third

solution is Q-Insights, which is the first highly affordable,

cloud-based product to provide continuous and real-time emissions

data monitoring and analysis. All of these solutions enable our

clients to meet emission regulations, address community concerns

and improve safety at industrial sites.

There are several methods for handling waste

gases at industrial facilities, the most common being combustion.

Flaring and incineration are two methods of combustion accepted by

many provincial and state regulators. Historically, the most common

type of combustion has been flaring which is the igniting of

natural gas at the end of a long metal tube or flare stack. This

action causes the characteristic flame associated with flaring.

Q-Series collects waste gas through its patented

natural flow design. This design has no fans, blowers, or moving

parts and is capable of accepting multiple gas streams to ensure

lower maintenance and higher efficiency. Incineration is the mixing

and combusting of waste gas streams, air, and fuel in an enclosed

chamber which are mixed at a controlled rate and ignited so that no

flame is visible when operating properly. A correctly designed and

operated incinerator can yield higher combustion efficiencies

through proper mixing, gas composition, retention time, and

combustion temperature. Combustion efficiency, generally expressed

as a percentage, is represented by the amount of methane converted

to CO2, or H2S converted to SO2. The more converted, the better the

efficiency. The incinerators vary in size, ranging from 20 mcf/d to

5,000 mcf/d, to accommodate small to large amounts of gas handling.

The incinerators also vary in automation and instrumentation

depending on the client’s requirements.

The Company has three primary incinerator

related revenue streams: sales, rentals and services. Incinerator

services include hauling, commissioning, repairs, maintenance and

decommissioning. The Company’s current key incineration markets are

Colorado, North Dakota, Mexico, Pennsylvania, Texas, Alberta and

North East BC. Over 90 percent of the Company’s incinerator rental

fleet is in Colorado and North Dakota where regulation supports

demand for its proprietary high efficiency waste gas incineration

systems.

Q-Power is based on Organic Rankine Cycle

(“ORC”) technology utilize an axial turbine expander coupled to a

synchronous generator via a gearbox and have an evaporator,

condenser, economizer-heat exchanger, centrifugal refrigerant pump,

and Programmable Logic Controller (“PLC”). The Q-Power organization

is supported from our Brooksville, Florida field location. The

Company is focusing on gaining market share, educating our

customers around our solutions for combating emissions,

diversifying our business to lessen our dependence on oil and gas

and expanding our Q-Power systems offerings. The Company’s Q-Power

products have been installed at petroleum and manufacturing client

sites; however, the solutions can be used in many other industries

to process all types of waste gas including agriculture, rail car

loading, mining, water treatment, landfill biogas, syngas, waste

engine exhaust, geothermal and solar, cement plant waste heat and

more.

Q-Insights via our product line called Gas

Emissions Methane Monitoring and Analysis (“GEMMA”), provides

monitoring and emissions tracking continuously and in real-time for

distributed waste gas systems of various types. This helps small

and mid-sized waste gas producers more effectively monetize

pollution reduction activities through carbon offsets and trading,

as well as reducing equipment issues and maintenance costs. The

Company is focused on completing the development during 2021.

The Company services its customers from field

locations in Brighton and Fort Lupton, Colorado; Watford City,

North Dakota; Grande Prairie, Alberta; and Brooksville, Florida.

The infrastructure at the field locations consists of field and

maintenance technicians and technical sales staff. The facilities

generally include, office space, maintenance shop and storage yard.

Personnel based out of Company’s head office in Calgary, Alberta

include Officers of the Corporation, management, engineering,

technical sales, accounting and administration.

QUESTOR TRADES ON THE TSX VENTURE

EXCHANGE UNDER THE SYMBOL ‘QST’.

|

Audrey Mascarenhas |

Dan Zivkusic |

|

President and Chief Executive Officer |

Chief Financial Officer |

|

Phone: |

(403) 571-1530 |

Phone: |

(403) 539-4371 |

|

Facsimile: |

(403) 571-1539 |

Facsimile: |

(403) 571-1539 |

|

Email: |

amascarenhas@questortech.com |

Email: |

dzivkusic@questortech.com |

Certain information in this news release

constitutes forward-looking statements. When used in this news

release, the words "may", "would", "could", "will", "intend",

"plan", "anticipate", "believe", "seek", "propose", "estimate",

"expect", and similar expressions, as they relate to the Company,

are intended to identify forward-looking statements. In particular,

this news release contains forward-looking statements with respect

to, among other things, business objectives, expected growth,

results of operations, performance, business projects and

opportunities and financial results. These statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements. Such statements

reflect the Company’s current views with respect to future events

based on certain material factors and assumptions and are subject

to certain risks and uncertainties, including without limitation,

changes in market, competition, governmental or regulatory

developments, general economic conditions and other factors set out

in the Company’s public disclosure documents. Many factors could

cause the Company’s actual results, performance or achievements to

vary from those described in this news release, including without

limitation those listed above. These factors should not be

construed as exhaustive. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying

forward-looking statements prove incorrect, actual results may vary

materially from those described in this news release and such

forward-looking statements included in, or incorporated by

reference in this news release, should not be unduly relied upon.

Such statements speak only as of the date of this news release. The

Company does not intend, and does not assume any obligation, to

update these forward-looking statements. The forward-looking

statements contained in this news release are expressly qualified

by this cautionary statement.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This document is not intended for dissemination

or distribution in the United States.

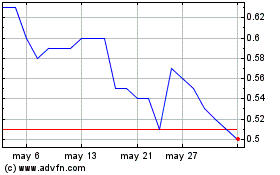

Questor Technology (TSXV:QST)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Questor Technology (TSXV:QST)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024