Quisitive Technology Solutions Inc.

(“Quisitive” or the “Company”) (TSXV: QUIS, OTCQX:

QUISF), a premier Microsoft solutions provider and

payments solutions provider, announced that it has entered into a

definitive stock purchase agreement dated November 28, 2023 with

Fulcrum IT Partners (“Fulcrum”) pursuant to which Quisitive has

agreed to sell its LedgerPay, Inc (“PayiQ”) subsidiary which

includes the PayiQ cloud-enabled payment processing platform,

operations and team (the “Transaction”). The details of the

Transaction are set forth in a definitive share purchase agreement

between the Company, a wholly-owned subsidiary of the Company, and

a wholly-owned subsidiary of Fulcrum (“Fulcrum Payments”), that was

negotiated at arm's length. Completion of the Transaction is

subject to a number of standard conditions and is expected to close

on or about December 31, 2023.

Fulcrum and its related companies are leaders in the IT services

and solutions industry with operations throughout North America and

Europe. Fulcrum, a private holding company, specializes in

investing in companies poised for significant growth and industry

leadership through organic expansion and strategic consolidations.

The planned divestiture opens doors for PayiQ's platform to rapidly

advance towards commercialization. The Transaction leverages

Fulcrum’s substantial resources and its strong retail industry

customer relationships, providing PayiQ with avenues for growth,

including payments-focused mergers and acquisitions. The

longstanding history and existing rapport between key leaders of

Fulcrum and Quisitive, coupled with Fulcrum’s profound expertise

and relationships, position them as the ideal catalysts to

spearhead the next stage of the PayiQ business, ensuring rapid

growth and uncovering new opportunities.Moving forward, Quisitive

will forge a close strategic alliance with Fulcrum to support the

commercialization of PayiQ as well as leverage Quisitive’s

partnership with Microsoft, and the Company’s Microsoft IT

solutions capabilities, creating incremental synergies between

Fulcrum’s IT Services companies and Quisitive’s Cloud Solutions

business. Additionally, Quisitive will provide transition support

services for a period of time, including IT, finance and human

resources to assist with Fulcrum’s PayiQ commercialization

efforts."This shift allows Quisitive to realign resources and focus

on our primary revenue-generating activities, which are central to

our organization,” stated Quisitive CEO Mike Reinhart.

“Concurrently, it provides PayiQ with the necessary space, funding,

and additional expertise to bring the product’s full potential to

realization. We are confident that this move will greatly benefit

our company as we refocus and grow our core business areas.”

Upon closing of the Transaction, Quisitive will secure a

position on the Board of Directors of Fulcrum’s Payments business,

with CEO Mike Reinhart assuming a role as a board member.

“Fulcrum is excited to be acquiring PayiQ and looks forward to

moving ahead as quickly as possible towards commercialization of

its payment solutions,” said Kyle Lanzinger, President of Fulcrum.

“PayiQ’s strong team and unique value proposition in the market set

the stage for PayiQ to be a leader in the payment solutions space

for years to come.”The divestiture of the PayiQ platform provides

several benefits to Quisitive. In addition to reducing the capital

allocation of the Company annually by nearly US$12 million,

Quisitive will further consolidate time and resources towards

continuing its vision of becoming the premier, global Microsoft

partner through transformative solution services, high-value

M&A, and superior customer service. More specifically, the

Company will deepen its focus in key strategic areas of the Cloud

Solutions business, including artificial intelligence and

industry-focused services.

Acquisition Terms

The consideration for the sale of the PayiQ

subsidiary will consist of the issuance of 27,000 preferred shares

of Fulcrum Payments (the “Consideration Shares”) to Quisitive. On

the third anniversary of the effective date of the Transaction, the

Consideration Shares shall be automatically converted into common

shares of Fulcrum Payments with a value equal to US$1,000 per

share, provided that the common shares of Fulcrum are listed and

posted for trading on a recognized stock exchange in Canada or the

United States. If Fulcrum’s common shares are not publicly traded

at such time, Quisitive shall have the right to require Fulcrum to

purchase all or a portion of the Consideration Shares for a

purchase price equal to US$1,000 per share, for aggregate

consideration of up to US$27 million.

The consideration for the sale of the PayiQ

subsidiary will consist of the issuance of 27,000 preferred shares

of Fulcrum Payments (the “Consideration Shares”) to Quisitive. On

the third anniversary of the effective date of the Transaction, the

Consideration Shares shall be automatically converted into common

shares of Fulcrum Payments with a value equal to US$1,000 per

share, provided that the common shares of Fulcrum Payments are

listed and posted for trading on a recognized stock exchange in

Canada or the United States. If Fulcrum Payments’ common shares are

not publicly traded at such time, Quisitive shall have the right to

require Fulcrum Payments to purchase all or a portion of the

Consideration Shares for a purchase price equal to US$1,000 per

share, for aggregate consideration of up to US$27 million.

Quisitive may also be entitled to additional

contingent consideration in the form of performance earn-outs if

PayiQ achieves certain financial thresholds during the three-year

period following the closing of the Transaction. The amount of the

earn-out is a maximum of US$18,000,000 payable in cash based on

PayiQ exceeding revenue growth targets.

Immediately prior to entering into the stock

purchase agreement, former minority shareholders of PayiQ exercised

their put right and were issued an aggregate of 4,238,000 common

shares of Quisitive in exchange for their equity interests in

PayiQ, resulting in Fulcrum agreeing to acquire 100% of PayiQ from

Quisitive.

About Quisitive:Quisitive

(TSXV: QUIS, OTCQX: QUISF) is a premier, global Microsoft partner

that harnesses the Microsoft cloud platform and complementary

technologies, including custom solutions and first-party offerings,

to generate transformational impact for enterprise customers. Our

Cloud Solutions business focuses on helping enterprises move,

operate, and innovate in the three Microsoft clouds. For more

information, visit www.Quisitive.com and follow @BeQuisitive on X

(formerly known as Twitter).About Fulcrum IT

PartnersFulcrum IT Partners is the parent company of an

expanding portfolio of established and successful IT solution

companies in the UK, Canada, and the U.S., with proven expertise in

cybersecurity, cloud, consumption-based IT and managed services.

Fulcrum is dedicated to using technology to deliver better business

outcomes to vertically focused industries through its breadth of

expertise and longstanding relationships with respected industry

partners.

Quisitive Investor ContactMatt Glover and John

YiGateway Investor RelationsQUIS@gatewayir.com 949-574-3860

Tami AndersChief of

Stafftami.anders@quisitive.com972.573.0995

Cautionary Note Regarding Forward Looking

Information

This news release contains certain

“forward‐looking information” and “forward‐looking statements”

(collectively, “forward‐looking statements”) within the meaning of

applicable Canadian securities legislation regarding Quisitive and

its business. Any statement that involves discussions with respect

to predictions, expectations, beliefs, plans, projections,

objectives, assumptions, future events or performance (often but

not always using phrases such as “expects”, or “does not expect”,

“is expected”, “anticipates” or “does not anticipate”, “plans”,

“budget”, “scheduled”, “forecasts”, “estimates”, “believes” or

“intends” or variations of such words and phrases or stating that

certain actions, events or results “may” or “could, “would”,

“might” or “will” be taken to occur or be achieved) are not

statements of historical fact and may be forward‐looking

statements. Forward‐looking statements are necessarily based upon a

number of estimates and assumptions that, while considered

reasonable, are subject to known and unknown risks, uncertainties,

and other factors which may cause the actual results and future

events to differ materially from those expressed or implied by such

forward‐looking statements. These forward-looking statements

include, but are not limited to, statements relating to: the

completion of the Transaction; the anticipated benefits of the

Transaction to Quisitive and its shareholders; the future growth

potential of the Company on a post-Transaction basis; and future

financial performance.

These forward-looking statements are based on

reasonable assumptions and estimates of management of the Company

at the time such statements were made. Actual future results may

differ materially as forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to

materially differ from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such factors, among other things, include: the expected

results from the completion of the Transaction; fluctuations in

general macroeconomic conditions; fluctuations in securities

markets; the Company’s limited operating history; future capital

needs and uncertainty of additional financing; the competitive

nature of the technology industry; unproven markets for the

Company’s product offerings; lack of regulation and customer

protection; the need for the Company to manage its planned growth

and expansion; the effects of product development and need for

continued technology change; protection of proprietary rights;

network security risks; the ability of the Company to maintain

properly working systems; foreign currency trading risks; use and

storage of personal information and compliance with privacy laws;

use of the Company’s services for improper or illegal purposes;

global economic and financial market conditions; uninsurable risks;

changes in project parameters as plans continue to be evaluated;

and those factors described under the heading "Risks Factors" in

the Company's annual information form dated May 23, 2023 available

on SEDAR+ at www.sedarplus.ca. Although the forward-looking

statements contained in this news release are based upon what

management of the Company believes, or believed at the time, to be

reasonable assumptions, the Company cannot assure shareholders that

actual results will be consistent with such forward-looking

statements, as there may be other factors that cause results not to

be as anticipated, estimated or intended. Accordingly, readers

should not place undue reliance on forward-looking statements and

information. There can be no assurance that forward-looking

information, or the material factors or assumptions used to develop

such forward-looking information, will prove to be accurate. The

Company does not undertake any obligations to release publicly any

revisions for updating any voluntary forward-looking statements,

except as required by applicable securities law.

Neither the TSX Venture Exchange nor its

Regulation Services provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

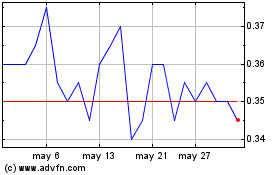

Quisitive Technology Sol... (TSXV:QUIS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Quisitive Technology Sol... (TSXV:QUIS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024