UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the

Securities Exchange Act of 1934

| Check the appropriate box: |

| ¨ |

|

Preliminary Information Statement |

| ¨ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| x |

|

Definitive Information Statement |

CARDIFF LEXINGTON CORPORATION

(Name of Registrant as Specified In Its Charter)

| Payment of Filing Fee (Check all boxes that apply): |

| |

|

| x |

|

No fee required |

| |

|

| ¨ |

|

Fee paid previously with preliminary materials |

| |

|

|

| ¨ |

|

Fee computed on table in exhibit required by Item 25(b) of Schedule 14A per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-11 |

3753 Howard Hughes Parkway, Suite 200

Las Vegas, NV 89169

Notice of Action Taken Pursuant to Written Consent

of Stockholders

Dear Stockholder:

The accompanying information statement is furnished

to holders of shares of common stock of Cardiff Lexington Corporation (“we,” “us,” “our”

or “our company”) pursuant to Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and Regulation 14C and Schedule 14C thereunder, in connection with an approval by written consent of the holders of our

voting stock.

The purpose of this Notice and Information Statement

is to notify our stockholders that, on April 4, 2024, we received written consents from stockholders to approve an amendment of our amended

and restated articles of incorporation to reduce our authorized common stock to 300,000,000 shares and preferred stock to 50,000,000 shares

(the “Charter Amendment”).

Our board of directors approved the Charter Amendment

and recommended that our stockholders approve it as well. In connection with the adoption of the Charter Amendment, our board of directors

elected to seek the written consent of the holders of our outstanding voting shares in order to reduce associated costs and implement

the Charter Amendment in a timely manner.

This Notice and the accompanying Information

Statement are being furnished to you to inform you that the Charter Amendment has been approved by stockholders. The board of directors is

not soliciting your proxy in connection with the Charter Amendment and proxies are not requested from stockholders.

The Charter

Amendment will become effective upon filing with the Nevada Secretary of State’s Office, which will occur promptly following the

20th day after this Information Statement is first mailed to our stockholders. You are urged to read the Information Statement in its

entirety for a description of the Charter Amendment.

| |

BY ORDER OF THE BOARD OF DIRECTORS, |

| |

|

| |

/s/ Daniel Thompson |

| |

Daniel Thompson |

| |

Chairman of the Board |

April 17, 2024

THE ACCOMPANYING INFORMATION STATEMENT IS BEING

MAILED

TO STOCKHOLDERS ON OR ABOUT APRIL 17,

2024

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

CARDIFF LEXINGTON CORPORATION

3753 Howard Hughes Parkway, Suite 200

Las Vegas, NV 89169

INFORMATION STATEMENT

NO VOTE OR OTHER ACTION OF THE COMPANY’S

STOCKHOLDERS

IS REQUIRED IN CONNECTION WITH THIS INFORMATION

STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is first being mailed

on or about April 17, 2024 to the holders of record of the outstanding common stock of Cardiff Lexington Corporation, a Nevada corporation

(“we,” “us,” “our” or “our company”), as of the close of business

on April 4, 2024 (the “Record Date”), pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of 1934,

as amended (the “Exchange Act”). This Information Statement relates to a written consent in lieu of a meeting, dated

April 4, 2024 (the “Written Consent”), of stockholders owning as of the Record Date at least a majority of the outstanding

shares of our common stock and preferred stock, voting together as a single class.

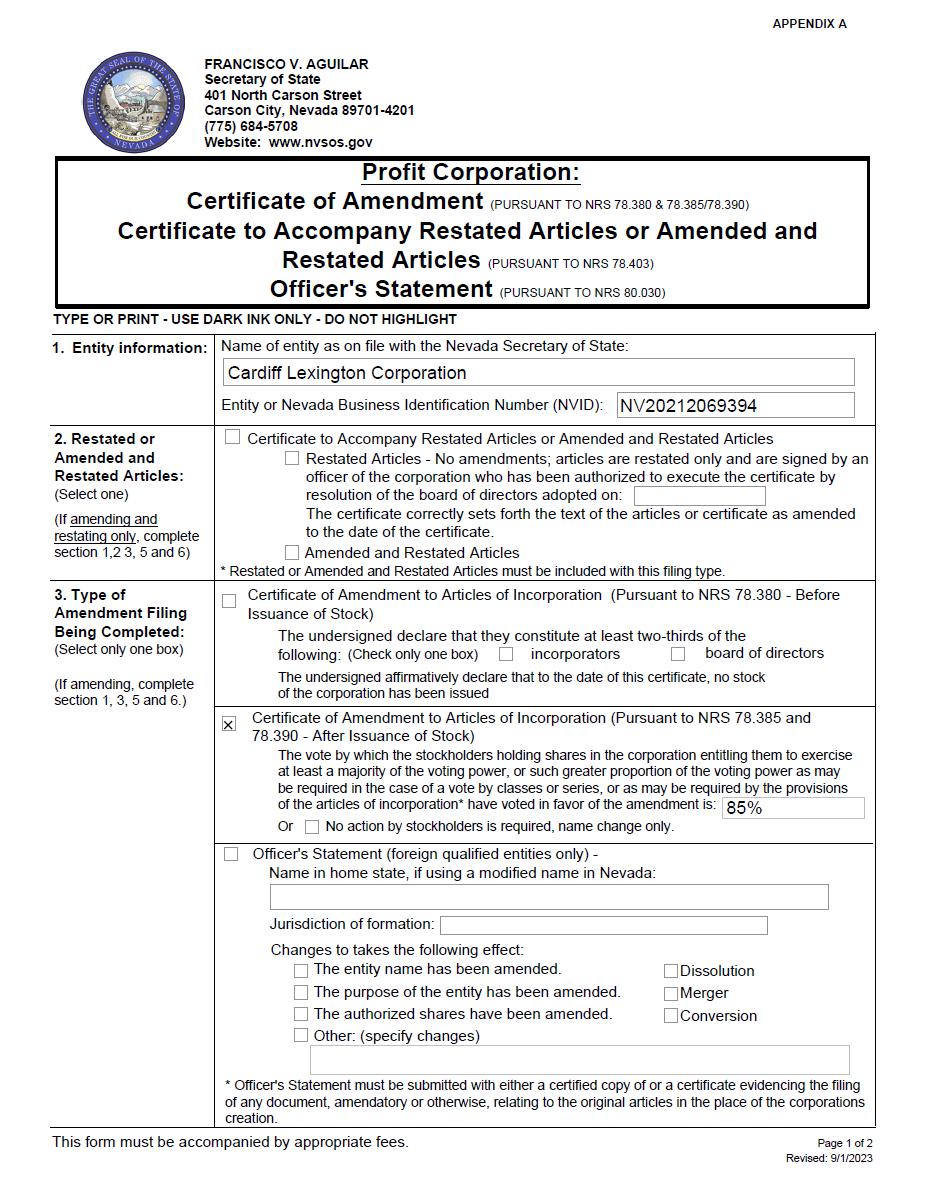

The Written Consent authorized and approved an

amendment of our current amended and restated articles of incorporation (the “Current Charter”) to reduce our authorized

common stock to 300,000,000 shares and preferred stock to 50,000,000 shares (the “Charter Amendment”). A copy of the

Charter Amendment is attached to this Information Statement as Appendix A.

The Written Consent is sufficient under the Nevada

Revised Statutes, the Current Charter and our bylaws to approve the Charter Amendment. Accordingly, the Charter Amendment will not

be submitted to the other stockholders for a vote, and this Information Statement is being furnished to such other stockholders to provide

them with certain information concerning the Written Consent in accordance with the requirements of the Exchange Act, and the regulations

promulgated under the Exchange Act, including Regulation 14C.

We will, when permissible following the expiration

of the 20-day period mandated by Rule 14c of the Exchange Act and the provisions of the Nevada Revised Statutes, file the Charter Amendment

with the Nevada Secretary of State’s Office. The Charter Amendment will become effective upon such filing.

AUTHORIZATION BY THE BOARD OF DIRECTORS AND

STOCKHOLDERS

On April 4, 2024, our board of directors unanimously

adopted resolutions approving the Charter Amendment and recommended that our stockholders approve it. In connection with the adoption

of these resolutions, our board of directors elected to seek the written consent of stockholders in order to reduce associated costs and

implement the Charter Amendment in a timely manner. On April 4, 2024, the Chairman of the Board, Daniel Thompson and our Chief Executive

Officer, Alex Cunningham (the “Majority Stockholders”), executed and delivered the Written Consent to us.

Pursuant to the Nevada Revised Statutes and our

bylaws, any action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting if, before or after

the action, a written consent thereto is signed by stockholders holding at least a majority of the voting power of our outstanding voting

stock, except that if a different proportion of voting power is required for such an action at a meeting, then that proportion of written

consents is required.

Pursuant to the Nevada Revised Statutes, our amended

and restated articles of incorporation and our bylaws, approval of the Charter Amendment at a meeting would require the affirmative vote

of at least a majority of the total number of shares of our outstanding common stock, series A preferred stock, series B preferred stock,

series C preferred stock, series E preferred stock, series I preferred stock, series J preferred stock, series L preferred stock and series

R convertible preferred stock, voting together as a single class.

Holders of shares of our common stock, series

B preferred stock, series C preferred stock, series E preferred stock, series J preferred stock and series L preferred stock are entitled

to one (1) vote per share. Holders of shares of our series I preferred stock are entitled to five (5) votes per share. Holders of our

series R convertible preferred stock are entitled to a number of votes equal to the number of shares into which the series R convertible

preferred stock is convertible (estimated to be 30,462 votes per share as of the Record Date). Each share of series A preferred stock

is entitled to a number of votes at any time equal to (i) 25% of the number of votes then held or entitled to be made by all other equity

securities of our company, including, without limitation, the common stock, plus (ii) one (1).

As of the Record Date, we had issued and outstanding

10,902,495 shares of common stock, 2 shares of series A preferred stock, 1,336,929 shares of series B preferred stock, 96 shares of series

C preferred stock, 155,750 shares of series E preferred stock, 12,086,500 shares of series I preferred stock, 171,359 shares of series

J preferred stock, 319,493 shares of series L preferred stock and 165 shares of series R convertible preferred stock. Accordingly, a total

of 110,023,628 votes were entitled to be cast on the approval of the Charter Amendment. As of the Record Date, Daniel Thompson owned (i)

1,000,337 shares of common stock, (ii) 1 share of series A preferred stock, (iii) 1 share of series C preferred stock and (iv) 5,302,500

shares of series I preferred stock, which entitled Mr. Thompson to 45,850,110 votes, or approximately 41.67% of the total votes eligible

to be cast. As of the Record Date, Alex Cunnigham owned (i) 1,000,338 shares of common stock, (ii) 1 share of series A preferred stock,

(iii) 6,250 shares of series B preferred stock, (iv) 1 share of series C preferred stock and (v) 5,743,000 shares of series I preferred

stock, which entitled Mr. Cunningham to 48,058,861 votes, or approximately 43.68% of the total votes eligible to be cast.

Accordingly, we have obtained all necessary corporate

approvals in connection with the Charter Amendment. We are not seeking written consent from any other stockholder, and other stockholders

will not be given an opportunity to vote with respect to the actions described in this Information Statement. All necessary corporate

approvals have been obtained. This Information Statement is furnished solely for the purposes of advising stockholders of the action taken

by Written Consent and giving stockholders notice of such actions taken as required by the Exchange Act.

As the action taken by the Majority Stockholders

was by written consent, there will be no security holders’ meeting and representatives of the principal accountants for the current

year and for the most recently completed fiscal year will not have the opportunity to make a statement if they desire to do so and will

not be available to respond to appropriate questions from our stockholders.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding

beneficial ownership of our common stock as of the Record Date by (i) each of our executive officers and directors; (ii) all of our executive

officers and directors as a group; and (iii) each person who is known by us to beneficially own more than 5% of our common stock. Unless

otherwise specified, the address of each of the persons set forth below is in care of our company, 3753 Howard Hughes Parkway, Suite 200

Las Vegas, NV 89169.

| Name of Beneficial Owner |

Title of Class |

Amount and Nature of Beneficial Ownership(1) |

Percent of Voting Stock(2) |

| Daniel Thompson, Chairman of the Board(3) |

Common Stock |

45,976,237 |

41.74% |

| Alex Cunningham, Chief Executive Officer and Director(4) |

Common Stock |

48,165,110 |

43.73% |

| Matthew T. Shafer, Chief Financial Officer(5) |

Common Stock |

25,000 |

* |

| Zia Choe, Chief Accounting Officer(6) |

Common Stock |

18,800 |

* |

| Gillard B. Johnson, III, Director |

Common Stock |

30,000 |

* |

| Cathy Pennington, Director |

Common Stock |

30,000 |

* |

| L. Jack Staley, Director |

Common Stock |

30,000 |

* |

| All executive officers and directors (7 persons above) |

Common Stock |

94,275,147 |

85.50% |

* Less than 1%

| (1) | Beneficial Ownership is determined in accordance with the rules of the Securities and Exchange Commission

(the “SEC”) and generally includes voting or investment power with respect to securities. Each of the beneficial owners

listed above has direct ownership of and sole voting power and investment power with respect to the shares of our common stock. |

| (2) | Based on 10,902,495 shares of common stock, 2 shares of series A preferred stock (with each share entitled

to an estimated 18,337,272 votes), 1,336,929 shares of series B preferred stock, 96 shares of series C preferred stock, 155,750 shares

of series E preferred stock, 12,086,500 shares of series I preferred stock, 171,359 shares of series J preferred stock, 319,493 shares

of series L preferred stock and 165 shares of series R convertible preferred stock (entitled to an estimated 30,462 votes) issued and

outstanding as of the Record Date. |

| (3) | Includes (i) 1,000,337 shares of common stock held directly, (ii) 4 shares of common stock held by the

2007 Thompson Family Trust, (iii) 1 share of series A preferred stock held directly, (iv) 26,124 shares of common stock issuable upon

the conversion of 13,062 shares of series B preferred stock held by the 2007 Thompson Family Trust, (v) 100,000 shares of common stock

issuable upon the conversion of 1 share of series C preferred stock held directly and (vi) 5,302,500 shares of series I preferred stock

held directly as of the Record Date. |

| (4) | Includes (i) 1,000,338 shares of common stock, (ii) 1 share of series A preferred stock, (iii) 12,500

shares of common stock issuable upon the conversion of 6,250 shares of series B preferred stock, (iv) 100,000 shares of common stock issuable

upon the conversion of 1 share of series C preferred stock and (v) 5,743,000 shares of series I preferred stock as of the Record Date. |

| (5) | Represents 5,000 shares of series I preferred stock as of the Record Date. |

| (6) | Includes (i) 6,300 shares of common stock issuable upon the conversion of 3,150 shares of series B preferred

stock and (ii) 2,500 shares of series I preferred stock as of the Record Date. |

We do not currently have any arrangements which

if consummated may result in a change of control of our company.

THE CHARTER AMENDMENT

On April 4, 2024, our board of directors and the

Majority Stockholders approved the Charter Amendment, the form of which is attached to this Information Statement as Appendix A.

Under the Current Charter, we are authorized to

issue 7,500,000,000 shares of common stock and 1,000,000,000 shares of preferred stock. Following our recent 1-for-75,000 reverse stock

split, we no longer require such a large number of authorized but unissued shares. Accordingly, our board of directors and the Majority

Stockholders determined that it would be in the best interests of our company and its stockholders to reduce our authorized stock. The

Charter Amendment amends the Current Charter to reduce our authorized common stock to 300,000,000 shares and our authorized preferred

stock to 50,000,000 shares.

The Charter Amendment will become effective upon

filing with the Nevada Secretary of State’s Office, which will occur promptly following the 20th day after this Information

Statement is first mailed to our stockholders.

INTERESTS OF CERTAIN PERSONS

IN MATTERS TO BE ACTED UPON

Our directors and executive officers, and each

associate of the foregoing persons, have no substantial interests, directly or indirectly, in the Charter Amendment.

DISSENTER’S RIGHTS

OF APPRAISAL

Neither the Nevada Revised Statutes nor our Current

Charter provides holders of our common stock with dissenters’ or appraisal rights in connection with the Charter Amendment.

STOCKHOLDERS ENTITLED TO

INFORMATION STATEMENT

This information statement is being mailed to

you on or about April 17, 2024. We will pay all costs associated with the distribution of this information statement, including

the costs of printing and mailing. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable

expenses incurred by them in sending this information statement to the beneficial owners of our common stock.

Our board of directors established April 4, 2024

as the record date for the determination of stockholders entitled to receive this information statement.

DELIVERY OF DOCUMENTS TO

STOCKHOLDERS SHARING AN ADDRESS

We may deliver only one information statement

to multiple stockholders sharing an address, unless we have received contrary instructions from one or more of the stockholders. We will

promptly deliver a separate copy of this information statement to a stockholder at a shared address to which a single copy was delivered,

upon written or oral request to us at the following address and telephone number:

Cardiff Lexington Corporation

3753 Howard Hughes Parkway, Suite 200

Las Vegas, NV 89169

Attn: Corporate Secretary

Phone: (844) 628-2100

In addition, a stockholder can direct a notification

to us at the phone number and mailing address listed above that the stockholder wishes to receive a separate information statement in

the future. Stockholders sharing an address that receive multiple copies can request delivery of a single copy of the information statements

by contacting us at the phone number and mailing address listed above.

WHERE YOU CAN FIND MORE

INFORMATION

We file periodic reports, proxy statements and

other information with the SEC. Our SEC filings are available from the SEC’s website at www.sec.gov, which contains reports, proxy

and information statements and other information regarding issuers that file electronically with the SEC. Additionally, we will make

these filings available, free of charge, on our website at www.cardifflexington.com as soon as reasonably practicable after we electronically

file such materials with, or furnish them to, the SEC. The information on our website, other than these filings, is not, and should not

be, considered part of this information statement and is not incorporated by reference into this information statement.

Appendix A

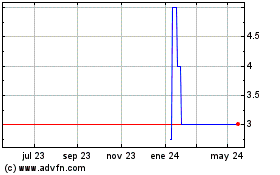

Cardiff Lexington (PK) (USOTC:CDIXD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cardiff Lexington (PK) (USOTC:CDIXD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024