File No. 024-11669

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 1-A

TIER II OFFERING

OFFERING STATEMENT

UNDER THE SECURITIES ACT OF 1933 CURRENT REPORT

| ReoStar

Energy Corp. |

| (Exact name of registrant

as specified in its charter) |

Date: September

___, 2023

| Nevada |

|

1382 |

|

20-8428738 |

(State of

Other Jurisdiction

Of Incorporation) |

|

(Primary Standard

Industry Code) |

|

(IRS Employer

Identification

No.) |

| Peter

H. Koch |

(310)

999-3506

info@reostarenergycorp.com |

| www.reostarenergycorp.com

|

| 87

N. Raymond Ave |

| Suite

200 |

| Pasadena |

California

91103 |

| |

| |

Please send copies

of all correspondence to our corporate business address: X

THIS OFFERING STATEMENT

SHALL ONLY BE QUALIFIED UPON ORDER OF THE COMMISSION, UNLESS A SUBSEQUENT AMENDMENT IS FILED INDICATING THE INTENTION TO BECOME QUALIFIED

BY OPERATION OF THE TERMS OF REGULATION A.

PART I - NOTIFICATION

Part I should be read

in conjunction with the attached XML Document for Items 1-6

PART I - END

PRELIMINARY OFFERING

CIRCULAR DATED ________________, 2021

An Offering Statement pursuant to Regulation

A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary

Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the

Offering Statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or

the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or

sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation

to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains

the URL where the Final Offering Circular or the Offering Statement in which such Final Offering Circular was filed may be obtained.

REOSTAR

ENERGY CORP.

87 N. Raymond Ave

– Suite 200

Pasadena, California

91103

(310) 999-3506; info@reostarenergycorp.com

37,500,000 SHARES

OF COMMON STOCK $2.00 PER SHARE

This Post-Qualification

Offering Circular Amendment (the “PQA”) amends the Offering Circular of REOSTAR ENERGY CORPORATION, a Nevada corporation,

dated January 20, 2022, as qualified on January 19, 2022, and as may be amended and supplemented from time to time, to: extend the expiration

date of this offering to September 4, 2024; and (b) revise the amount of shares to be registered to 37,500,000 and revise the offering

price of the 37,500,000 shares of Company common stock (the “Remaining Shares”) to $2.00 per share. No shares were sold under

the formerly Qualified Offering.

This is the public

offering of securities of ReoStar Energy Corp., a Nevada corporation. We are offering up to 37,500,000 shares of our Common Stock, par

value $0.0001 (“Common Stock”), at an offering price of $2.00 per share (the “Offered Shares”) by the Company.

This offering will terminate twelve months from the day the offering is qualified, subject to extension for up to thirty (30) days as

defined below or the date on which the maximum offering amount is sold (such earlier date, the “Termination Date”). The minimum

purchase requirement per investor is 5,000 Offered Shares ($10,000); however, we can waive the minimum purchase requirement on a case-by-case

basis in our sole discretion. The Company reserves the right to sell shares under this Offering at $1.00 per share for any investor who

invest a minimum of $1,000,000.

These securities

are speculative securities. Investment in the Company’s stock involves significant risk. You should purchase these securities only

if you can afford a complete loss of your investment. See the “Risk Factors” section on page 5 of this Offering Circular.

The proceeds of this

offering will not be placed into an escrow account. We will offer our Common Stock on a “best efforts” basis. As there is

no minimum offering, upon the approval of any subscription to this Offering Circular, the Company shall immediately deposit said proceeds

into the bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds.

Subscriptions are

irrevocable and the purchase price is non-refundable as expressly stated in this Offering Circular. The Company, by determination of

the Board of Directors, in its sole discretion, may issue the Securities under this offering for cash, promissory notes, services, and/or

other consideration without notice to subscribers. All proceeds received by the Company from subscribers for this offering will be available

for use by the Company upon acceptance of subscriptions for the Securities by the Company.

Sale of these shares

will commence within two calendar days of the qualification date and it will be a continuous offering pursuant to Rule 251(d)(3)(i)(F).

This offering will

be conducted on a “best-efforts” basis, which means our officers will use their commercially reasonable best efforts in an

attempt to offer and sell the Shares. Our officers will not receive any commission or any other remuneration for these sales. In offering

the securities on our behalf, the Officers will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the

Securities Exchange Act of 1934, as amended.

This Offering Circular

shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sales of these securities in any

state or jurisdiction in which such offer, solicitation or sale would be unlawful, prior to registration or qualification under the laws

of any such state.

The Company is using

the Offering Circular format in its disclosure in this Offering Circular.

Investing in our

Common Stock involves a high degree of risk. See “Risk Factors” beginning on page 5 for a discussion of certain risks

that you should consider in connection with an investment in our Common Stock.

| |

|

Price

to Public(1) |

|

Underwriting

Discount and Commissions(2) |

|

Proceeds

to Issuer(3) |

|

Proceeds

to Other Persons |

| Per share |

$ |

2.00 |

$ |

0.00 |

$ |

2.00 |

$ |

0.00 |

| Total Maximum |

$ |

37,500,000 |

$ |

0.00 |

$ |

37,500,000 |

$ |

0.00 |

| (1) | We

do not intend to use commissioned sales agents or underwriters. |

| (2) | The

amounts

shown are before deducting offering costs to us, which

include legal, accounting, printing, due diligence, marketing, consulting, selling, and other

costs incurred in this offering, which we estimate will be $0 in the aggregate. See

the section entitled “Plan of Distribution.” |

Our Board of Directors used its business

judgment in setting a value of $2.00 per share to the Company as consideration for the stock to be issued under the offering. The sales

price per share bears no relationship to our book value or any other measure of our current value or worth.

We are offering to sell, and seeking offers

to buy, our securities only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained

in this Offering Circular. We have not authorized anyone to provide you with any information other than the information contained in

this Offering Circular. The information contained in this Offering Circular is accurate only as of its date, regardless of the time of

its delivery or of any sale or delivery of our securities. Neither the delivery of this Offering Circular nor any sale or delivery of

our securities shall, under any circumstances, imply that there has been no change in our affairs since the date of this Offering Circular.

This Offering Circular will be updated and made available for delivery to the extent required by the federal securities laws.

NEITHER THE SECURITIES

AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY

OR ACCURACY OF THE OFFERING CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

AN OFFERING STATEMENT

PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING

CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING

STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION

OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL

BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL

OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF A SALE TO YOU THAT CONTAINS THE URL WHERE

THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

GENERALLY, NO

SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME

OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT

DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING,

WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

THESE SECURITIES

ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD THE COMPLETE LOSS OF YOUR INVESTMENT.

PLEASE REFER TO ‘RISK FACTORS’ BEGINNING ON PAGE 7.

THE

COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT

PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT

TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES

OFFERED ARE EXEMPT FROM REGISTRATION.

You should rely only

on the information contained in this offering circular and the information we have referred you to. We have not authorized any person

to provide you with any information about this Offering, the Company, or the shares of our Common Stock offered hereby that is different

from the information included in this offering circular. If anyone provides you with different information, you should not rely on it.

This offering circular is following

the offering circular format described in Part II (a)(1)(i) of Form 1-A.

The date of this offering

circular is ________, 2021

The following table of contents has been

designed to help you find important information contained in this offering circular. We encourage you to read the entire offering circular.

TABLE OF CONTENTS

You should rely only

on the information contained in this offering circular. We have not authorized anyone to provide you with additional information or information

different from that contained in this offering circular. We take no responsibility for and can provide no assurance as to the reliability

of, any other information that others may give you. We are offering to sell, and seeking offers to buy, our common stock only in jurisdictions

where offers and sales are permitted. The information contained in this offering circular is accurate only as of the date of this offering

circular, regardless of the time of delivery of this offering circular or any sale of shares of our common stock. Our business, financial

condition, results of operations and prospects may have changed since that date.

PART - II

OFFERING CIRCULAR

SUMMARY

In this offering

circular, ‘‘REOSTAR ENERGY CORP.,’’ the “Company,’’ ‘‘we,’’, ‘‘us,’’

and ‘‘our,’’ refer to REOSTAR ENERGY CORP., unless the context otherwise requires. Unless otherwise indicated,

the term ‘‘fiscal year’’ refers to our fiscal year ending December 31. Unless otherwise indicated, the term ‘‘common

stock’’ refers to shares of the Company’s common stock.

This offering circular,

and any supplement to this offering circular include “forward-looking statements”. To the extent that the information presented

in this offering circular discusses financial projections, information or expectations about our business plans, results of operations,

products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements

can be identified using words such as “intends”, “anticipates”, “believes”, “estimates”,

“projects”, “forecasts”, “expects”, “plans” and “proposes”. Although we believe

that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks

and uncertainties that could cause actual results to differ materially from such forward-looking statements. These include, among others,

the cautionary statements in the “Risk Factors” section and the “Management’s Discussion and Analysis of Financial

Position and Results of Operations” section in this offering circular.

This summary only

highlights selected information contained in greater detail elsewhere in this offering circular. This summary may not contain all of

the information that you should consider before investing in our common stock. You should carefully read the entire offering circular,

including “Risk Factors” beginning on Page 6, and the financial statements, before making an investment decision.

The Company

We were originally

incorporated in the State of Nevada on November 29, 2004

Our corporate business

address is: 87 N. Raymond Ave, Suite 200, Pasadena, CA 91103. Our phone number is (310) 999-3506. Our E-Mail address info@reostarenergycorp.com

we maintain a website at www.reostarenergycorp.com information available on our website is not incorporated by reference in and is not

deemed a part of this offering circular.

Our company

Our independent auditor has expressed

substantial doubt about our ability to continue as a going concern given our lack of operating history and the fact to date, we have

had no revenues. The Company has not generated any revenues since inception and sustained an accumulated net loss of $(114,433) for the

period from inception to December 31, 2022. These factors, among others, raise substantial doubt about the ability of the Company to

continue as a going concern for a reasonable period.

The Offering

All dollar amounts

refer to US dollars unless otherwise indicated.

Through this offering,

we intend to qualify 37,500,000 shares for offering to the public. We are offering these shares at a price per share of $2.00. We will

receive all proceeds from the sale of the common stock.

| Securities

being offered by the Company |

|

37,500,0000

shares of common stock at a price of $2.00 per share. Our offering will terminate upon the earliest of (i) such time as all the common

stock has been sold pursuant to the Offering Statement or (ii) 365 days from the qualified date of this offering circular unless

extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering.

For more information, please refer to Item 14, page 27 of the Offering. |

| |

|

|

| Offering price per share |

|

We

will sell the shares at price per share of $2.00. The Company reserves the right to sell shares for $1.00 per share to an investor

who invest a minimum of $1,000,000. |

| |

|

|

| Number of shares of

common stock outstanding before the offering of common stock |

|

88,343,919

common shares are currently issued and outstanding. |

| |

|

|

| Number of shares of

common stock outstanding after the offering of common stock |

|

125,843,919

common shares will be issued and outstanding if we sell all the shares we are offering herein. |

| |

|

|

| The minimum number of

shares to be sold in this offering |

|

None. |

| |

|

|

| Best efforts offering: |

|

We

are offering shares on a “best efforts” basis through our Chief Executive Officer, Mr. Koch, who will not receive any

discounts or commissions for selling the shares. There is no minimum number of shares that must be sold in order to close this offering. |

| |

|

|

| Market for the common

shares |

|

Our

common stock is not listed for trading on any exchange or automated quotation system. There can be no assurance that any

market for our common stock or any of our other securities will ever develop. |

| |

|

|

| Use of Proceeds |

|

We

intend to use the net proceeds to us for working capital. |

| |

|

|

| Termination of the Offering |

|

This

offering will terminate upon the earlier to occur of (i) 365 days after this Offering Statement becomes qualified with the Securities

and Exchange Commission, or (ii) the date on which all 37,500,0000 shares registered hereunder have been sold. We may, at our discretion,

extend the offering for an additional 90 days. At any time and for any reason we may also terminate the offering. |

| |

|

|

| Subscriptions: |

|

All

subscriptions once accepted by us are irrevocable. |

| |

|

|

| Risk

Factors: |

|

See

“Risk Factors” and the other information in this offering circular for a discussion of the factors you should consider

before deciding to invest in shares of our common stock. |

| |

|

|

| Restrictions

on Investment: |

|

Generally,

no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual

income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that

your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(c) of Regulation A. For general

information on investing, we encourage you to refer to www.investor.gov. |

Item 1: Risk Factors

An investment

in our shares involves a high degree of risk and many uncertainties. You should carefully consider the specific factors listed below,

together with the cautionary statement that follows this section and the other information included in this Offering Circular, before

purchasing our shares in this offering. If one or more of the possibilities described as risks below actually occur, our operating results

and financial condition would likely suffer and the trading price, if any, of our shares could fall, causing you to lose some or all

of your investment. The following is a description of what we consider the key challenges and material risks to our business and an investment

in our securities.

Risks Related

to our Business

Our independent

auditor has expressed substantial doubt about our ability to continue as a going concern given our lack of operating history and the

fact that to date, we have generated no revenues.

The accompanying financial statements

have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the

normal course of business. The Company has not generated any revenues since inception and sustained an accumulated net loss of

($114,433) for the period from inception to December 31, 2022. These factors, among others, raise substantial doubt about the ability

of the Company to continue as a going concern for a reasonable period. The Company’s continuation as a going concern

is dependent upon, among other things, its ability to generate revenues and its ability to obtain capital from third parties. No

assurance can be given that the Company will be successful in these efforts. If the Company ceases to continue as a going concern, you

will lose your entire investment.

This offering

is being conducted by the Company without the benefit of an underwriter, who could have confirmed the accuracy of the disclosures in

our prospectus.

We have self-underwritten

our offering on a “best efforts” basis, which means: No underwriter has engaged in any due diligence activities to confirm

the accuracy of the disclosure in the prospectus or to provide input as to the offering price; the Company will attempt to sell the shares

and there can be no assurance that all of the shares offered under the prospectus will be sold or that the proceeds raised from the offering,

if any, will be sufficient to cover the costs of the offering; and there is no assurance that we can raise the intended offering amount.

As

a growing company, we have yet to achieve a profit and may not achieve a profit in the near future, if at all.

We

have not yet produced a net profit and may not in the near future, if at all. While we expect our revenue to grow, we have not achieved

profitability and cannot be certain that we will be able to sustain our current growth rate or realize sufficient revenue to achieve

profitability. Further, many of our competitors have a significantly larger user base and revenue stream but have yet to achieve profitability.

Our ability to continue as a going concern may be dependent upon raising capital from financing transactions, increasing revenue throughout

the year and keeping operating expenses below our revenue levels in order to achieve positive cash flows, none of which can be assured.

We are dependent

upon the proceeds of this offering to fund our business. If we do not sell enough shares in this offering to continue operations, this

could have a negative effect on the value of the common stock.

We must raise approximately

$12,500,000 of the $75,000,000 offered in this offering unless we begin to generate enough revenues to finance operations as a going

concern, we may experience liquidity and solvency problems. Such liquidity and solvency problems may force us to cease operations if

additional financing is not available.

Our minimal

operating history gives no assurances that our future operations will result in profitable revenues, which could result in the suspension

or end of our operations.

We have a limited

operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability

and positive cash flow is dependent upon the completion of this offering and our ability to generate revenues.

There is substantial

doubt as to our ability to continue as a going concern. We have incurred significant operating losses since our formation and expect

to incur significant losses in the foreseeable future. We also expect to experience negative cash flow for the foreseeable future as

we fund our operating losses and capital expenditures. As a result, we will need to generate significant revenues in order to achieve

and maintain profitability. We may not be able to generate these revenues or achieve profitability in the future. Our failure to achieve

or maintain profitability could negatively impact the value of our business and may cause us to go out of business.

We are a new

company with limited operating history, and we face a high risk of business failure that could result in the loss of your investment.

We are a development

stage company formed to carry out the activities described in this offering circular and thus have only a limited operating history upon

which an evaluation of our business can be made. We have limited business operations.

Accordingly, our

future revenue and operating results are difficult to forecast. As of the date of this Offering Circular, we have earned no revenue.

Failure to generate revenue in the future will cause us to go out of business, which could result in the complete loss of your investment.

Our officers

and directors control our company and may unilaterally make decisions regarding corporate transactions that are contrary to investor

interests.

Our officers and

directors currently own 100% of our outstanding voting securities. If less than $10 million is raised in this offering, our executive

officers and directors will continue to control our company. Our officers and directors have the ability to control the voting power

of our outstanding capital stock. Investors may find that his decisions are contrary to their interests. You should not purchase shares

unless you are willing to entrust all aspects of management to our officers and directors, or their successors. Management will have

the ability to make decisions regarding: (i) changing the business without shareholder notice or consent, (ii) make changes to the articles

of incorporation whether to issue additional common and preferred stock, including themselves, (iii) make employment decisions, including

compensation arrangements; and (iv) whether to enter into material transactions with related parties.

As a result, our

officers and directors will have control of the Company and be able to choose all our directors. Their interests may differ from the

ones of other stockholders. Factors that could cause their interests to differ from the other stockholders include the impact of corporate

transactions on the timing of business operations and their ability to continue to manage the business given the amount of time they

are able to devote to us.

Purchasers of the

offered shares may not participate in our management and, therefore, are dependent upon their management abilities. The only assurance

that our shareholders, including purchasers of the offered shares, have that our officers and directors will not abuse their discretion

in executing our business affairs, as their fiduciary obligation and business integrity. Such discretionary powers include, but are not

limited to, decisions regarding all aspects of business operations, corporate transactions, and financing.

Accordingly, no person

should purchase the offered shares unless willing to entrust all aspects of management to the officers and directors, or their successors.

Potential purchasers of the offered shares must carefully evaluate the personal experience and business performance of our management.

The price of

our common stock may continue to be volatile.

The trading price

of our common stock has been and is likely to remain highly volatile and could be subject to wide fluctuations in response to various

factors, some of which are beyond our control or unrelated to our operating performance. In addition to the factors discussed in this

“Risk Factors” section and elsewhere, these factors include: the operating performance of similar companies; the overall

performance of the equity markets; the announcements by us or our competitors of acquisitions, business plans, or commercial relationships;

threatened or actual litigation; changes in laws or regulations relating to our businesses; any major change in our board of directors

or management; publication of research reports or news stories about us, our competitors, or our industry or positive or negative recommendations

or withdrawal of research coverage by securities analysts; large volumes of sales of our shares of common stock by existing stockholders;

and general political and economic conditions.

In addition, the

stock market in general, and the market for developmental related companies in particular, has experienced extreme price and volume fluctuations

that have often been unrelated or disproportionate to the operating performance of those companies’ securities. This litigation,

if instituted against us, could result in very substantial costs; divert our management’s attention and resources; and harm our

business, operating results, and financial condition.

Adverse developments

that develop in the global economy restricting the credit markets may materially and negatively impact our business.

Though current global

economic conditions appear stable and it has been several years from the last downturn in the world’s major economies which constrained

the credit markets, we must be aware that similar events could occur quickly and could heighten a number of material risks to our business,

cash flows, and financial condition, as well as our future prospects. Any such current or future issues involving liquidity and capital

adequacy affecting lenders could affect our ability to access credit facilities or obtain debt financing and could affect the ability

of lenders to meet their funding requirements when we need to borrow. Further, in the uncertain event that a public market for our stock

develops, any current or future volatility in the equity markets may make it difficult in the future for us to access the equity markets

for additional capital at attractive prices, if at all. Should a credit crisis develop in other countries, for example, which could create

concerns over any number of economic indicators, it could increase volatility in global credit and equity markets. If we are unable to

obtain credit or access capital markets, our business could be negatively impacted. For example, we may be unable to raise sufficient

capital from this offering.

Our operating

results may prove unpredictable, which could negatively affect our profit.

Our operating results

are likely to fluctuate significantly in the future due to a variety of factors, many of which we have no control. Factors that may cause

our operating results to fluctuate significantly include: our inability to generate enough working capital from operations our inability

to secure long-term service contract with the utilities that benefit from the installed technology; the level of commercial acceptance

of our technology; fluctuations in the demand for our technology; the amount and timing of operating costs and capital expenditures relating

to expansion of our business, operations and infrastructure and general economic conditions. If realized, any of these risks could have

a material adverse effect on our business, financial condition, and operating results.

Key management

personnel may leave the Company, which could adversely affect the ability of the Company to continue operations.

Because we are entirely

dependent on the efforts of our officers and directors, any one of their departure or the loss of other key personnel in the future,

could have a material adverse effect on the business. We believe that all commercially reasonable efforts have been made to minimize

the risks attendant with the departure by key personnel from service.

However, there is

no guarantee that replacement personnel, if any, will help the Company to operate profitably. We do not maintain key-person life insurance

on any of our officers and directors.

If our Company

is dissolved, it is unlikely that there will be sufficient assets remaining to distribute to our shareholders.

In the event of the

dissolution of our company, the proceeds realized from the liquidation of our assets, if any, will be used primarily to pay the claims

of our creditors, if any, before there can be any distribution to the shareholders. In that case, the ability of purchasers of the offered

shares to recover all or any portion of the purchase price for the offered shares will depend on the amount of funds realized and the

claims to be satisfied there from.

If we are unable

to manage our future growth, our business could be harmed, and we may not become profitable.

Significant growth

may place a significant strain on management, financial, operating and technical resources. Failure to manage growth effectively could

have a material adverse effect on the Company’s financial condition or the results of its operations.

You are not expected to have any

protection under the Investment Company Act.

The Company will not register and does

not expect in the future to be required to register as an investment company under the Investment Company Act of 1940, as amended (the

“40 Act”), in reliance upon an exemption therefrom under Section 3(c)(9). Among other things, the 40 Act generally requires

investment companies to have a minimum of forty percent (40%) independent directors and regulates the relationship between the investment

adviser (i.e., the Manager) and the investment company (i.e., the Company), in particular with regard to affiliated transactions. Such

protections, and others afforded by the 40 Act, are not expected to be applicable to the Company. Should the 40 Act become applicable

to the Company, these protections may be implemented in a manner that alters other rights and obligations of the Company and/or you with

respect to other matters.

You may not have any protection

under the Investment Advisers Act.

The Manager is not registered as an investment

adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”) but may register in the future. The

Advisers Act contains many provisions designed to protect clients of investment advisers, including, among other things, restrictions

on the charging by registered investment advisers of performance-based compensation. Such protections, and others afforded by the Advisers

Act, are not expected to be applicable to the Manager and to the Company. Should the Advisers Act become applicable to the Manager and

to the Company, these protections may be implemented in a manner that alters other rights and obligations of the Company and/or you with

respect to other matters.

Competitors

may enter this sector with superior infrastructure and backing, infringing on our customer base, and affecting our business adversely.

We have identified

a market opportunity for our services. Competitors may enter this sector with superior service. This would infringe on our customer base,

having an adverse effect upon our business and the results of our operations.

Since we anticipate

operating expenses will increase prior to earning revenue, we may never achieve profitability.

There is no history

upon which to base any assumption as to the likelihood that we will prove successful. We cannot provide investors with any assurance

that our products and services will attract potential buyers, generate any operating revenue, or ever achieve profitable operations.

If we are unable to address these risks, there is a high probability that our business can fail, which will result in the loss of your

entire investment.

COVID-19 and

similar health epidemics and contagious disease outbreaks could significantly disrupt our operations and adversely affect our business,

results of operations, cash flows or financial condition.

In December 2019,

a novel strain of coronavirus (“COVID-19”) was identified, and on March 11, 2020, the World Health Organization declared

COVID-19 as a global pandemic. Numerous state and local jurisdictions have imposed, and others in the future may impose, “shelter-in-place”

orders, quarantines, executive orders and similar government orders and restrictions for their residents to control the spread of COVID-19.

In particular, the governments in jurisdictions where our employees are located have imposed limitations on gatherings, social distancing

measures and restrictions on movement, only allowing essential businesses to remain open. Such restrictions have resulted in temporary

store closures, work stoppages, slowdowns and delays, travel restrictions and cancellation of events, among other restrictions, any of

which may negatively impact workforces, customers, consumer sentiment and economies in many markets and, along with decreased consumer

spending, have led to an economic downturn throughout much of the world.

Our business is largely

tied to the disposable income of our subscribers and clients. The global economic and financial uncertainty may result in significant

declines to the number of clients using our products. See “— A reduction in discretionary consumer spending could have

an adverse impact on our business.”

In response to the

COVID-19 outbreak, we will transition many of our future employees to remote working arrangements. It is possible that this could have

a negative impact on the execution of our business plans and operations. If a natural disaster, power outage, connectivity issue, or

other event occurred that impacted our employees’ ability to work remotely, it may be difficult or, in certain cases, impossible,

for us to continue our business for a substantial period of time. The increase in remote working may also result in player privacy, IT

security and fraud concerns as well as increase our exposure to potential wage and hour issues.

The degree to which

COVID-19 affects our financial results and operations will depend on future developments, which are highly uncertain and cannot be predicted,

including, but not limited to, the duration and spread of the outbreak, its severity, the governmental actions and regulations imposed

to contain the virus or treat its impact, how quickly and to what extent pre-pandemic economic and operating conditions can resume and

overall changes in players’ behavior. To the extent the COVID-19 pandemic could affect our business and financial results, it may

also have the effect of heightening other risks described in this “Risk Factors” section.

Risks Related

to This Offering

Due to the

lack of a current public market for our common stock, investors may have difficulty in selling stock they purchase.

Prior to this offering,

no public trading market existed for our securities. There can be no assurance that a public trading market for our common stock will

develop or that a public trading market, if developed, will be sustained. Because there is none and may be no public market for our stock,

we may not be able to secure future equity financing which would have a material adverse effect on our company

Furthermore, when

and if our common stock is eligible for quotation on the OTC Market, there can also be no assurance as to the depth or liquidity of any

market for the common stock or the prices at which holders may be able to sell the shares.

As a result, investors

could find it more difficult to trade, or to obtain accurate quotations of the market value of, the stock as compared to securities that

are traded on the NASDAQ trading market or on an exchange. Moreover, an investor may find it difficult to dispose of any shares purchased

hereunder.

Investors may

have difficulty in reselling their shares due to the lack of market or state Blue Sky laws.

Our common stock

is currently not quoted on any market. No market may ever develop for our common stock, or if developed, may not be sustained in the

future. The holders of our shares of common stock and persons who desire to purchase them in any trading market that might develop in

the future should be aware that there may be significant state law restrictions upon the ability of investors to resell our shares. Accordingly,

even if we are successful in having our securities available for trading on the OTC Market, investors should consider any secondary market

for our securities to be a limited one. We intend to seek coverage and publication of information regarding the Company in an accepted

publication which permits a “manual exemption.” This manual exemption permits a security to be distributed in a particular

state without being registered if the company issuing the security has a listing for that security in a securities manual recognized

by the state. However, it is not enough for the security to be listed in a recognized manual. The listing entry must contain (1) the

names of issuers, officers, and directors, (2) an issuer’s balance sheet, and (3) a profit and loss statement for either the fiscal

year preceding the balance sheet or for the most recent fiscal year of operations. We may not be able to secure a listing containing

all of this information. Furthermore, the manual exemption is a non-issuer exemption restricted to secondary trading transactions, making

it unavailable for issuers selling newly issued securities. Most of the accepted manuals are those published in Standard and Poor’s,

Moody’s Investor Service, Fitch’s Investment Service, and Best’s Insurance Reports, and many states expressly recognize

these manuals. A smaller number of states declare that they “recognize securities manuals” but do not specify the recognized

manuals. The following states do not have any provisions and therefore do not expressly recognize the manual exemption: Alabama, Georgia,

Illinois, Kentucky, Louisiana, Montana, South Dakota, Tennessee, Vermont, and Wisconsin. Accordingly, our shares should be considered

totally illiquid, which inhibits investors’ ability to resell their shares.

Investing in

our company is highly speculative and could result in the entire loss of your investment.

Purchasing the offered

shares is highly speculative and involves significant risk. The offered shares should not be purchased by any person who cannot afford

to lose their entire investment. Our business objectives are also speculative, and it is possible that we would be unable to accomplish

them. Our shareholders may be unable to realize a substantial or any return on their purchase of the offered shares and may lose their

entire investment. For this reason, each prospective purchaser of the offered shares should read this prospectus and all of its exhibits

carefully and consult with their attorney, business and/or investment advisor.

Investing in

our company may result in an immediate loss because buyers will pay more for our common stock than what the pro rata portion of the assets

are worth.

The offering price

and other terms and conditions regarding our shares have been arbitrarily determined and do not bear any relationship to assets, earnings,

book value or any other objective criteria of value. No investment banker, appraiser or other independent third party has been consulted

concerning the offering price for the shares or the fairness of the offering price used for the shares.

The price of per

share as determined herein is substantially higher than the net tangible book value per share of our common stock. Our assets do not

substantiate a share price of $2.00. This premium in share price applies to the terms of this offering. The offering price will not change

for the duration of the offering even if a market develops in our securities.

We have 200,000,000

authorized shares of common stock, of which 88,343,919 shares are currently issued and outstanding and 125,843,919 shares will be issued

and outstanding after this offering terminates (assuming all shares have been sold). Our management could, with the consent of the existing

shareholders, issue substantially more shares, causing a large dilution in the equity position of our current shareholders.

We may, in

the future, issue additional shares of common stock, which would reduce investors’ percent of ownership and may dilute our share

value.

Our articles of incorporation

authorize the issuance of 200,000,000 shares of common stock. Upon completion of this offering, we will have approximately 125,843,919

shares of common stock issued and outstanding if all shares offered are sold. Accordingly, we may issue up to an additional 74,156,081

shares of common stock after this offering. The future issuance of common stock may result in substantial dilution in the percentage

of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis.

The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value

of the shares held by our investors and might have an adverse effect on any trading market for our common stock.

As we do not

have an escrow or trust account with the subscriptions for investors, if we file for or are forced into bankruptcy protection, investors

will lose their entire investment.

Invested funds for

this offering will not be placed in an escrow or trust account and if we file for bankruptcy protection or a petition for involuntary

bankruptcy is filed by creditors against us, your funds will become part of the bankruptcy estate and administered according to the bankruptcy

laws. As such, you will lose your investment and your funds will be used to pay creditors.

We do not anticipate

paying dividends in the foreseeable future, so there will be less ways in which you can make a gain on any investment in us.

We have never paid

dividends and do not intend to pay any dividends for the foreseeable future. To the extent that we may require additional funding currently

not provided for in our financing plan, our funding sources may prohibit the declaration of dividends. Because we do not intend to pay

dividends, any gain on your investment will need to result from an appreciation in the price of our common stock. There will therefore

be fewer ways in which you are able to make a gain on your investment.

In the event

that our shares are traded, they may trade under $5.00 per share, and thus will be considered a penny stock. Trading penny stocks has

many restrictions and these restrictions could severely affect the price and liquidity of our shares.

In the event that

our shares trade below $5.00 per share, our stock would be known as a “penny stock”, which is subject to various regulations

involving disclosures to be given to you prior to the purchase of any penny stock. The U.S. Securities and Exchange Commission (the “SEC”)

has adopted regulations which generally define a “penny stock” to be any equity security that has a market price of less

than $5.00 per share, subject to certain exceptions. Depending on market fluctuations, our common stock could be considered to be a “penny

stock”. A penny stock is subject to rules that impose additional sales practice requirements on broker/dealers who sell these securities

to persons other than established customers and accredited investors. For transactions covered by these rules, the broker/dealer must

make a special suitability determination for the purchase of these securities. In addition, he must receive the purchaser’s written

consent to the transaction prior to the purchase. He must also provide certain written disclosures to the purchaser. Consequently, the

“penny stock” rules may restrict the ability of broker/dealers to sell our securities and may negatively affect the ability

of holders of shares of our common stock to resell them. These disclosures require you to acknowledge that you understand the risks associated

with buying penny stocks and that you can absorb the loss of your entire investment. Penny stocks are low priced securities that do not

have a very high trading volume. Consequently, the price of the stock is often volatile, and you may not be able to buy or sell the stock

when you want to.

Governing Law

and Legal Venue

This Agreement shall be construed in accordance

with, and governed by, the laws of the District Court of the Clark County Judicial District of the State of Nevada for any claim as to

which the Clark County District Court of the State of Nevada has jurisdiction. Unless any claim as to which the Clark County District

Court of the State of Nevada determines there is an indispensable party not subject to the jurisdiction of the Clark County District

Court of the State of Nevada (and the indispensable party does not consent to the personal jurisdiction of the Clark County District

Court of the State of Nevada within ten days following such determination), which is vested in the exclusive jurisdiction of a court

or forum other than the Clark County District Court of the State of Nevada, or for which the Clark County District Court of the State

of Nevada does not have subject matter jurisdiction. This provision does not, nor is intended to, apply to claims under the Federal securities

laws. This exclusive legal forum provision could add significant cost, discourage claims, and limits the ability of investors to

bring a claim in a more favorable legal forum or jurisdiction. This provision does not apply to purchasers in secondary transactions.

This provision also does apply to the Subscription Agreement for this Offering. This provision is not in the Company’s Articles

or By-Laws at this time.

Financial Industry

Regulatory Authority (“FINRA”) sales practice requirements may also limit your ability to buy and sell our common stock,

which could depress the price of our shares.

FINRA rules require

broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment

to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make

reasonable efforts to obtain information about the customer’s financial status, tax status and investment objectives, among other

things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities

will not be suitable for at least some customers. Thus, FINRA requirements make it more difficult for broker-dealers to recommend that

their customers buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for

our shares, and thereby depress our share price.

Status as Not a

Shell Company

The Company it is

not a “shell company” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, The Company is a “start-up”

company which the Commission explicitly differentiates in Footnote 172 to SEC Release No. 33-8869 from “shell” companies

covered under Rule 144(i)(1)(i) (the “Rule”). In adopting the definition of a shell company in SEC Release

No. 33-8587 (the “Release”), the Commission stated that it intentionally did not define the term “nominal”

and it did not set a quantitative threshold of what constitutes a shell company. Indeed, under the Rule, the threshold for what is considered

“nominal” is, to a large degree, subjective and based upon facts and circumstances of each individual case.

The Company is actively

engaged in the implementation and deployment of its business plan. These activities include:

The Company’s

operations are more than just “nominal.” As the Commission points out in its Release, there are no established quantitative

thresholds to determine whether a company’s operations are in-fact “nominal”. Instead, the determination is to be made

on a case-by-case basis, with significant regards to a subjective analysis aimed at preventing serious problems from allowing scheming

promoters and affiliates to evade the definition of a “shell” company (as well as the intent of the Rule). As described in

Footnote 32 to the Release, the Commission expounds its rationale for declining to quantitatively define the term “nominal”

regarding a shell company.

It is reasonably

commonplace that development stage or “start-up” companies have limited assets and resources, as well as having a going concern

explanatory paragraph in the report of its independent registered public accounting firm. The Company is considering all possible avenues

to develop its business model. The Company believes that by being a company this should increase its image and credibility in the marketplace

and provide possible sources of funding for its business.

The Company’s

management has been working at implementing the Company’s core business strategy, including, but not limited to, and business development

in anticipation of its progressing operations and the development of its business model. The Company’s operations are more than

“nominal” and that it does not fall within the class of companies for which the Commission was aiming to prevent as referenced

in Release Footnote 32.

The price of the

current offering is fixed a $2.00 per share. This price is significantly higher than the price paid by the Company’s officers and

directors and early investors which was $0.0021.

An early-stage company

typically sells its shares (or grants options over its shares) to its founders and early employees at a very low cash cost because they

are, in effect, putting their “sweat equity” into the company. When the company seeks cash from outside investors, the new

investors typically pay a much larger sum for their shares than the founders or earlier investors, which means that the cash value of

the new investors stake is diluted because each share of the same type is worth the same amount, and the new investor has paid more for

the shares than earlier investors did for theirs.

We intend to sell

37,500,0000 shares of our Common Stock. We were initially capitalized by the sale of our Common Stock. The following table sets forth

the number of shares of Common Stock purchased from us, the total consideration paid and the price per share. The table assumes all 37,500,0000

shares of Common Stock will be sold.

| | |

Shares

Issued | |

Total

Consideration | |

Price |

| | |

Number | |

Percent | |

Amount | |

Percent | |

Per Share |

| Existing Shareholders | |

| 88,343,919 | | |

| 70 | % | |

$ | 185,522 | | |

| 1 | % | |

$ | 0.0021 | |

| Purchasers of Shares | |

| 37,500,000 | | |

| 30 | % | |

$ | 75,000,000 | | |

| 99 | % | |

$ | 2.0000 | |

| Total | |

| 125,843,919 | | |

| 100.0 | % | |

$ | 75,185,522 | | |

| 100 | % | |

$ | 0.6000 | |

Note: The offering

price of $2.00 was used as the baseline for dilution.

The following table

sets forth the difference between the offering price of the shares of our Common Stock being offered by us (If all 37.5 million shares

are sold and the full $75 million is raised), the net tangible book value per share, and the net tangible book value per share after

giving effect to the offering by us, assuming that 25%, 50%, 75% and 100% of the offered shares are sold. Net tangible book value per

share represents the amount of total tangible assets less total liabilities divided by the number of shares outstanding as of December

31, 2022. Totals may vary due to rounding.

| |

|

25%

of offered |

|

50%

of offered |

|

75%

of offered |

|

100%

of offered |

| shares

are sold |

shares

are sold |

shares

are sold |

shares

are sold |

| Offering

Price |

$ |

$ 2.00

|

|

$ 2.00

|

|

$ 2.00

|

|

$ 2.00

|

| |

|

|

|

|

|

|

|

|

| Net

tangible book value at May 31, 2021 |

$ |

0.00 |

|

0.00 |

|

0.00 |

|

0.00 |

| |

|

|

|

|

|

|

|

|

| Net

tangible book value after giving effect to the offering |

$ |

0.19 |

|

0.350 |

|

0.483 |

|

0.596 |

| |

|

|

|

|

|

|

|

|

| Increase

in net tangible book value per share attributable to cash payments made by new investors |

$ |

0.192 |

|

0.350 |

|

0.483 |

|

0.596 |

| |

|

|

|

|

|

|

|

|

| Per

Share Dilution to New Investors |

$ |

1.81 |

|

1.65 |

|

1.52 |

|

1.40 |

| |

|

|

|

|

|

|

|

|

| Percent

Dilution to New Investors |

|

90.43 |

|

82.51 |

|

75.87 |

|

70.22 |

Note: The Company has reserved the right

to sell shares at $1.00 to investors who invest $1.0M or more into the Offering. Since the Company has no way of foreseeing how many,

if any, shares will be sold at the $1.00 price the Dilution Table assumes a $2.00 share price.

| Item 3: | SELLING

SHAREHOLDERS |

None

| Item 4: | DETERMINATION

OF OFFERING PRICE |

The offering price

of the common stock is not fixed and has been arbitrarily determined and bears no relationship to any objective criterion of value. The

price does not bear any relationship to our assets, book value, historical earnings, or net worth. No valuation or appraisal has been

prepared for our business. We cannot assure you that a public market for our securities will develop or if developed, it will continue

or that the securities will ever trade at a price higher than the offering price.

| Item 5: | PLAN

OF DISTRIBUTION |

Our common stock

offered through this offering is being made by the Company through a direct offering. Our Common Stock may be sold or distributed from

time to time by the Company utilizing general solicitation through the internet, social media, and any other means of widespread communication.

The sale of our common stock offered by us through this offering may be effected by one or more of the following methods: internet, social

media, and any other means of widespread communication including but not limited to crowdfunding sites, ordinary brokers’ transactions;·

transactions involving cross or block trades; through brokers, dealers, or underwriters who may act solely as agents; in other ways not

involving market makers or established business markets, including direct sales to purchasers or sales effected through agents;·

in privately negotiated transactions; or· any combination of the foregoing. Brokers, dealers, underwriters, or agents participating

in the distribution of the shares as agents may receive compensation in the form of commissions, discounts, or concessions from the Company

and/or purchasers of the common stock for whom the broker-dealers may act as agent. The Company has 88,343,919 shares of common stock

issued and outstanding as of the date of this offering circular. The Company is registering an additional 37,500,0000 shares of its common

stock for sale at $2.00 per share.

Our offering will

terminate upon the earliest of (i) such time as all the common stock has been sold pursuant to the Offering Statement or (ii) 365 days

from the qualified date of this offering circular unless extended by our Board of Directors for an additional 90 days. We may however,

at any time and for any reason terminate the offering.

There is no arrangement

to address the possible effect of the offering on the price of the stock.

In connection with

the Company’s selling efforts in the offering, our officers and directors will not register as a broker-dealer pursuant to Section

15 of the Exchange Act, but rather will rely upon the “safe harbor” provisions of SEC Rule 3a4-1, promulgated under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”).

Generally speaking,

Rule 3a4-1 provides an exemption from the broker-dealer registration requirements of the Exchange Act for persons associated with an

issuer that participate in an offering of the issuer’s securities. Peter Koch is not subject to any statutory disqualification,

as that term is defined in Section 3(a)(39) of the Exchange Act. Peter Koch will not be compensated in connection with his participation

in the offering by the payment of commissions or other remuneration based either directly or indirectly on transactions in our securities.

Peter Koch will not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance

on Exchange Act Rule 3a4-1(a)(4)(i) or (iii).

In

the following states we cannot offer or sell our shares of common stock unless we register as an issuer dealer: Alabama, Arizona, Florida,

Nebraska, Delaware, New Jersey, New York, North Dakota, Texas, and Washington. If we wish to offer and sell our shares of common stock

in these states, we will hire an SEC registered broker-dealer to serve as our placement agent. We may, however, decide to comply with

a particular state’s issuer dealer registration requirements, in New York, for example, if we deem it appropriate.

The Company will

receive all proceeds from the sale of the 37,500,0000 shares being offered on behalf of the company itself. The Company’s shares

may be sold to purchasers from time to time directly by and subject to the discretion of the Company. The shares of common stock sold

by the Company may be occasionally sold in one or more transactions; all shares sold under this offering circular will be sold at a fixed

price of $2.00 per share.

The Company will

pay all expenses incidental to the registration of the shares (including registration pursuant to the securities laws of certain states),

which we expect to be no more than $50,000.

Procedures for

Subscribing

If you decide to

subscribe for any shares in this offering, you must

| · | Execute

and deliver a subscription agreement; and |

| · | Deliver

a check or certified funds to us for acceptance or rejection. |

All checks for subscriptions

must be made payable to “REOSTAR ENERGY CORP.”. The Company will deliver stock certificates attributable to shares of common

stock purchased directly to the purchasers within ninety (90) days of the close of the offering.

Right to Reject

Subscriptions

We have the right

to accept or reject subscriptions in whole or in part, for any reason or for no reason. All money from rejected subscriptions will be

returned immediately by us to the subscriber, without interest or deductions. Subscriptions for securities will be accepted or rejected

with letter by mail within 48 hours after we receive them.

Investment

Limitations

As set forth

in Title IV of the JOBS Act, there are limits on how many shares an investor may purchase if the offering does not result in a listing

on a national securities exchange. The following would apply unless we are able to obtain a listing on a national securities exchange.

Generally,

in the case of trading on the over-the-counter markets, no sale may be made to you in this offering if the aggregate purchase price you

pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural

persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule

251(d)(2)(i)c of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov .

| (viii) | Because

this is a Tier 2, Regulation A offering, most investors in the case of trading on the over-the-counter

markets must comply with the 10% limitation on investment in the offering. The only investor

in this offering exempt from this limitation is an “accredited investor” as defined

under Rule 501 of Regulation D under the Securities Act. If you meet one of the following

tests you should qualify as an accredited investor) You are a natural person who has had

individual income in excess of $200,000 in each of the two most recent years, or joint income

with your spouse in excess of $300,000 in each of these years and have a reasonable expectation

of reaching the same income level in the current year. |

(ii)

You are a natural person and your individual net worth, or joint net worth with your spouse, exceeds $1,000,000 at the time you purchase

shares of our common stock in the offering.

(iii)

You are an executive officer or general partner of the issuer or a manager or executive officer of the general partner of the issuer.

(iv)

You are an organization described in Section 501(c)(3) of the Internal Revenue Code of 1986, as amended, or the Code, a corporation,

a Massachusetts or similar business trust or a partnership, not formed for the specific purpose of acquiring the shares in this offering,

with total assets in excess of $5,000,000.

(v)

You are a bank or a savings and loan association or other institution as defined in the Securities Act, a broker or dealer registered

pursuant to Section 15 of the Exchange Act, an insurance company as defined by the Securities Act, an investment company registered under

the Investment Company Act of 1940, or a business development company as defined in that act, any Small Business Investment Company licensed

by the Small Business Investment Act of 1958 or a private business development company as defined in the Investment Advisers Act of 1940;

(vi)

You are an entity (including an Individual Retirement Account trust) in which each equity owner is an accredited investor.

(vii)

You are a trust with total assets in excess of $5,000,000, your purchase of shares of our common stock in the offering is directed by

a person who either alone or with his purchaser representative(s) (as defined in Regulation D promulgated under the Securities Act) has

such knowledge and experience in financial and business matters that he is capable of evaluating the merits and risks of the prospective

investment, and you were not formed for the specific purpose of investing in the shares in this offering; or

(viii)

You are a plan established and maintained by a state, its political subdivisions, or any agency or instrumentality of a state or its

political subdivisions, for the benefit of its employees, if such plan has assets in excess of $5,000,000.

Blue Sky

Law Considerations

The holders

of our shares of common stock and persons who desire to purchase them in any trading market that might develop in the future should be

aware that there may be significant state law restrictions upon the ability of investors to resell our shares. Accordingly, even if we

are successful in having the shares available for trading on the OTC Market, investors should consider any secondary market for our securities

to be a limited one. There is no guarantee that our stock will ever be quoted on the OTC Market. We intend to seek coverage and publication

of information regarding our company in an accepted publication, which permits a “manual exemption”. This manual exemption

permits a security to be distributed in a particular state without being registered if the company issuing the security has a listing

for that security in a securities manual recognized by the state. However, it is not enough for the security to be listed in a recognized

manual. The listing entry must contain (1) the names of issuers, officers, and directors, (2) an issuer’s balance sheet, and (3)

a profit and loss statement for either the fiscal year preceding the balance sheet or for the most recent fiscal year of operations.

We may not be able to secure a listing containing all of this information. Furthermore, the manual exemption is a non-issuer exemption

restricted to secondary trading transactions, making it unavailable for issuers selling newly issued securities. Most of the accepted

manuals are those published in Standard and Poor’s, Moody’s Investor Service, Fitch’s Investment Service, and Best’s

Insurance Reports, and many states expressly recognize these manuals. A smaller number of states declare that they “recognize securities

manuals” but do not specify the recognized manuals. The following states do not have any provisions and therefore do not expressly

recognize the manual exemption: Alabama, Georgia, Illinois, Kentucky, Louisiana, Montana, South Dakota, Tennessee, Vermont, and Wisconsin.

We currently

do not intend to and may not be able to qualify securities for resale in other states, which require shares to be qualified before they

can be resold by our shareholders.

Item 6: USE OF PROCEEDS

Our offering is being

made on a self-underwritten basis: no minimum number of shares must be sold in order for the offering to proceed. The offering price

per share is $2.00. The following table sets forth the uses of proceeds assuming the sale of 100%, 75%, 50%, and 25% of the securities

offered for sale by the Company. There is no assurance that we will raise the full $75,000,000 as anticipated.

If 37,500,0000

shares (100%) are sold:

Next 12 months

| Planned

Actions |

Estimated

Cost to Complete |

| Salary

for current or future employees |

$

5,625,000 |

| Development

costs associated with identified projects |

16,875,000 |

| Development

costs for future projects |

22,500,000 |

| Marketing

and public relations |

18,750,000 |

| General

operating capital |

11,250,000

|

| TOTAL |

$75,000,0000 |

If 28,125,000

shares (75%) are sold:

Next 12 months

| Planned

Actions |

Estimated

Cost to Complete |

| Salary

for current or future employees |

$4,218,750 |

| Development

costs associated with identified projects |

12,656,250 |

| Development

costs for future projects |

16,875,000 |

| Marketing

and distribution costs of service(s) |

14,062,500 |

| General

operating capital |

8,437,500

|

| TOTAL |

$

56,250,000 |

If 18,750,000

shares (50%) are sold:

Next 12 months

| Planned

Actions |

Estimated

Cost to Complete |

| Salary

for current or future employees |

$2,812,500 |

| Development

costs associated with identified projects |

8,437,500 |

| Development

costs for future projects |

11,250,000 |

| Marketing

and distribution costs of service(s) |

9,375,000 |

| General

operating capital |

5,625,000

|

| TOTAL |

$

37,500,000 |

If 9,375,000 shares

(25%) are sold:

Next 12 months

| Planned

Actions |

Estimated

Cost to Complete |

| Salary

for current or future employees |

$

1,406,250 |

| Development

costs associated with identified projects |

4,218,750 |

| Development

costs for future projects |

5,625,000

|

| Marketing

and distribution costs of service(s) |

4,687,500 |

| General

operating capital |

2,812,500 |

| TOTAL |

$

18,750,000 |

The above figures

represent only estimated costs for the next 12 months.

Notes: 1.

Development cost related “Future projects” include potential new product development or acquisition with the additional expense

of travel to potential suppliers and educational consumer related developments.

2.

“Marketing and distribution costs” includes, but is not limited to, preparation of printed materials, digital marketing,

webinars, travel to meet with potential investors/consumers, etc. Initially the print and digital marketing work will be outsourced,

but the Company may elect to hire a full-time marketing director.

3. “Identified

Projects” include, but is not limited to, the following: establishing logistics centers with third parties, payment processing

arrangements, inventory control and management systems.

Item 7: Description

of Business

Our Company

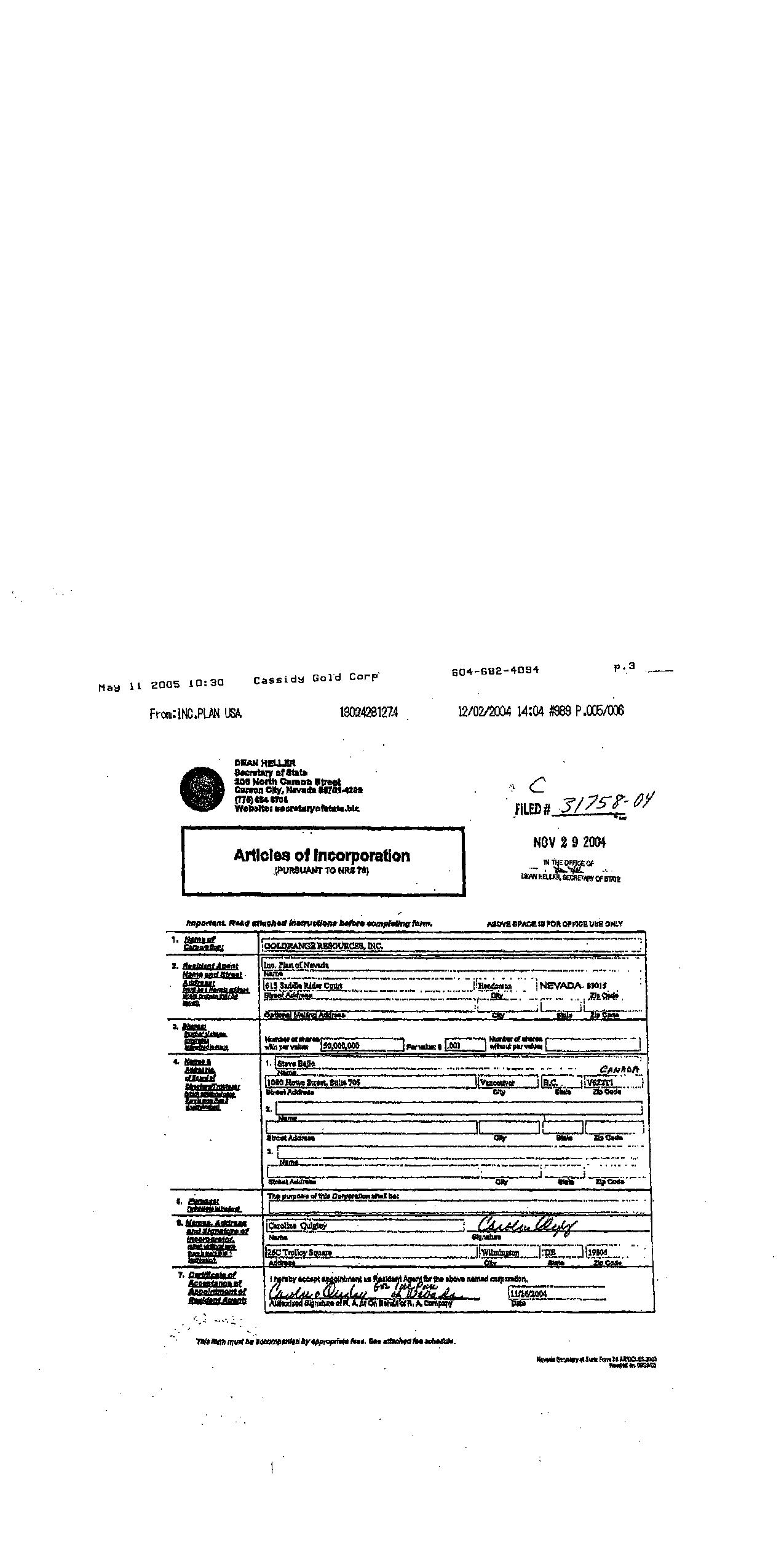

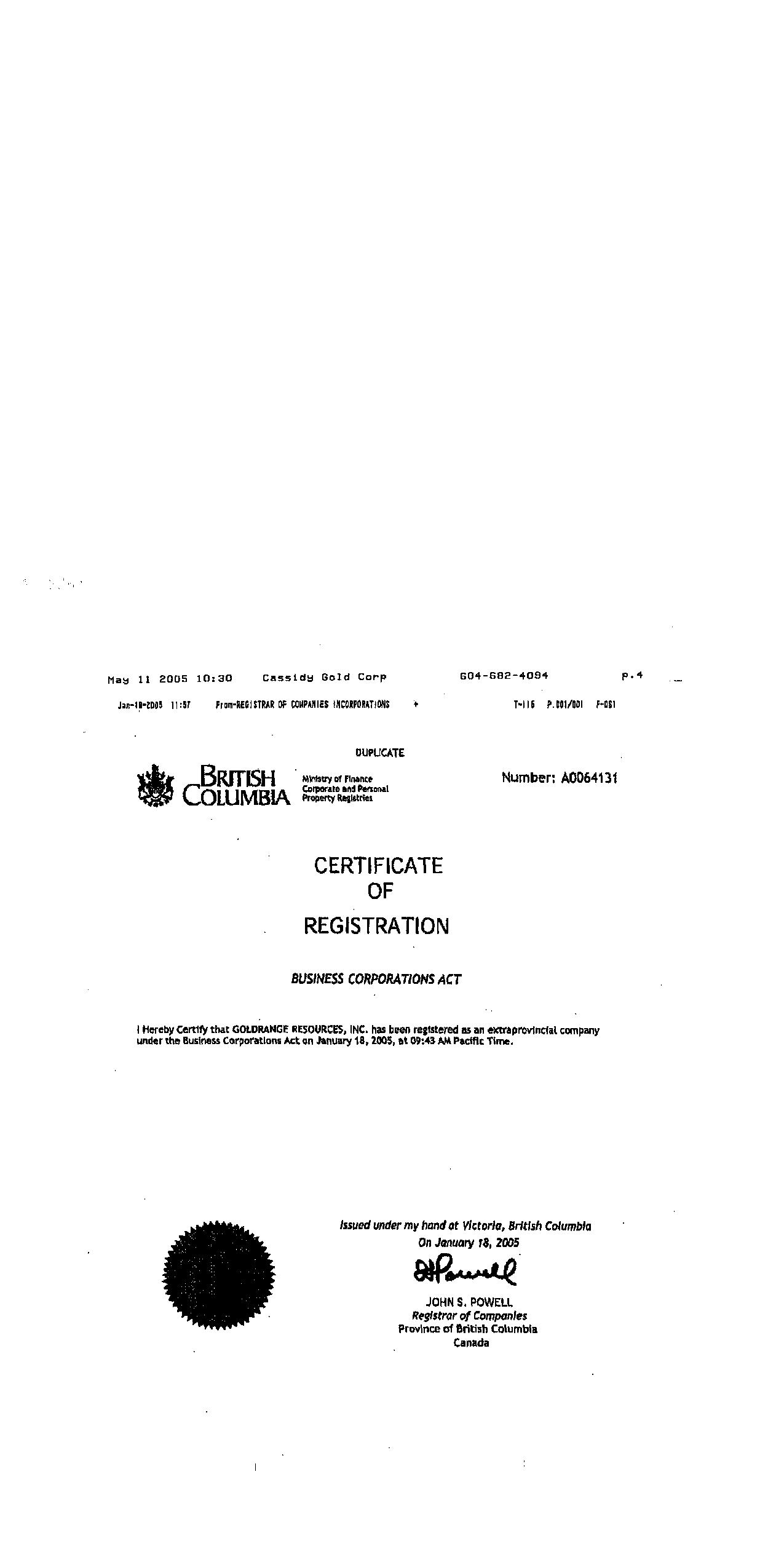

We were originally

incorporated in the State of Nevada on November 29, 2004, as Goldrange Resources Inc. and the name was changed to Reostar Energy Corporation

on 02/07/2007

Our corporate business

address is: 87 N. Raymond Ave, Suite 200, Pasadena CA 91103. Our telephone number is 626-569-9688. Our E-Mail address is info@reostarenergycorp.com.

The address for our

web site is www.reostarenergycorp.com The information on our web site is general information and is a marketing outlet It is not part

of this report due to disclosure purposes of liability under the federal securities laws.

About

the Company

Interested in

Our Interested in are

anyone of any age, background and ethnicity that are interested the oil and gas sector.

Future of the Company

ReoStar energy

corporation plans to impact the environment by helping fund projects that lead towards a Net Zero Carbon Neutral future. We plan to acquire

companies in the future to expand our vision and impact the environment positively. ReoStar plans to follow the Carbon Neutral

protocols to be a Net Zero Carbon Neutral Energy Company by 2050. This will generate an immediate strong asset and cash flow basis

for REOS.

Legal Structure

REOSTAR ENERGY CORP. is a corporation,

incorporated in Nevada, United States.

Market Outlook and Opportunity

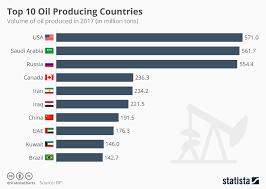

Industry

ReoStar Energy Corp. understands

that the gas and oil industry are the two largest sectors in the world in terms of dollar value. Generating an estimate of about 1 trillion

of dollars of revenue every year. The United States have over 600,000 oil wells producing over 9,000,000 barrels of oil every day worldwide.

With the US being the largest oil producer, we believe it is crucial to the economy of the country.

Competition

ReoStar Energy Corp. is a company that

is seeking oil/ and or natural gas properties with exiting production as well as proven undeveloped reserves to develop and produce.

Because many of the companies in the market are privately owned, we understand that we can only attain minimal information about our

competitors. Majority of competitors in the market have larger operations and have more resources. Our competitors are OQ Cheniere Energy,

Chevron, ExxonMobil Chemical, MOL Group, Air Liquide, ENGIE, Shell, BP, and OMV Group.

Regulations

ReoStar Energy Corp. must

meet all Federal and state regulations concerning oil and gas businesses.

Intellectual Property

There is currently no intellectual

property. The Company does plan to trademark name ReoStar Energy Corp and its logo under ReoStar with the USPTO. We have also registered

our domain name and parked relevant social media accounts for future use.

Reports to Security

Holders

After the completion

of this Tier II, Regulation A offering, we intend to become subject to the information and periodic reporting requirements of the Exchange

Act. If we become subject to the reporting requirements of the Exchange Act, we will file periodic reports, proxy statements and other

information with the Commission. Such periodic reports, proxy statements and other information will be available for inspection and copying

at the public reference room and on the Commission’s website at: http://www.sec.gov/cgi-bin/browse-edgar?company=vortex+brands&owner=exclude&action=getcompany