TIDMCLX

RNS Number : 1913T

Calnex Solutions PLC

23 November 2021

23 November 2021

Calnex Solutions plc

("Calnex", the "Company" or the "Group")

Interim Results

Calnex Solutions plc (AIM: CLX), a leading provider of test and

measurement solutions for the global telecommunications sector, is

pleased to announce its unaudited results for the six months ended

30 September 2021 ("H1 FY22" or "the Period").

The Board is pleased to report that the Group has experienced

continued strong levels of trading in the first half of the year

and expects this trend to continue through the second half of the

year. The Group's robust cash position has allowed the Group to

bring forward planned investment in the team to increase

operational capability, in line with order growth.

The Group continues to successfully deliver on its stated growth

strategy and the Board is confident in Calnex's ability to continue

benefitting from the underlying market growth drivers in the

telecoms market.

Financial Highlights

GBP000 H1 FY22 H1 FY21 FY21 H1 YOY

(*) % change

Unaudited Unaudited Audited

Revenue 9,251 7,721 17,978 +19.8%

Underlying EBITDA (1) 2,479 2,593 5,496 -4.4%

Adjusted Profit before

tax (2) 2,308 2,319 5,068 -0.5%

Adjusted basic EPS (pence)

(3) 2.05 3.02 5.83 -32.1%

Adjusted diluted EPS

(pence) (3) 1.99 2.42 5.21 -17.8%

Closing cash 13,643 4,511 12,668 +66.8%

Statutory measures:

EBITDA 3,877 3,424 6,554 +13.2%

Profit before tax 2,308 1,950 3,647 +18.4%

Basic EPS (pence) 2.05 2.41 4.68 -14.9%

Diluted EPS (pence) 1.99 1.93 4.18 3.1%

(*) Prior to the Company's Admission to trading on AIM, which

took place on 5th October 2020

-- Revenue growth of 20% on prior year to GBP9.3m (H1 FY21:

GBP7.7m) as a result of strong demand for telecoms testing

equipment, ahead of management's expectations at the start of

FY22

-- Planned and previously highlighted investment in product

development and operational scalability, to support future

growth

-- All profit measures ahead of management expectations at the

start of FY22, as a result of the strong revenue performance

-- Closing cash balance of GBP13.6m (H1 FY21: GBP4.5m before 5

October 2020 IPO net proceeds of GBP4.9m) after positive cash flow

of GBP0.9m in the half year driven by strong trading

performance

-- Movement in EPS compared with H1 FY21 is as a result of a

change in the number of shares in issue pre and post IPO, as well

as the subsequent issue of share options in the plc business with

no corresponding direct economic value

-- Maiden interim dividend of 0.28 pence per share in line with

the Board's intention to implement a progressive dividend policy in

the year to 31 March 2022

Operational Highlights:

-- Continued strong demand for testing instrumentation, with new

product launches having been well received

-- The Group has seen a return to pre-COVID customer spending

patterns in all regions, other than in China where demand has been

in line with the previous year

-- Industry regulation such as the new O-RAN standards continue

to drive the requirement for performance testing

-- Increased staffing levels across business development, sales,

R&D and support roles, to support new product development and

maximise exposure in new and existing territories

-- Maintained timely shipments to customers, whilst navigating

the semi-conductor component shortage

Outlook:

-- Strong levels of trading seen in H1 have continued into the second half of the year

-- Demand for telecoms testing equipment remains strong

-- Global semiconductor shortage is being closely monitored by

the Board but no negative impacts to date

-- The Board is confident in meeting the upgraded (**) market forecasts for the year

(**) Upgraded forecasts issued on 12 October 2021, following the

Company's Trading Update.

Tommy Cook, Chief Executive Officer, and founder of Calnex,

said: "These results mark another considerable step forward for

Calnex, as we continue to capitalise on the global telecom

industry's transition to 5G and the growth of cloud computing. The

results for the first half of FY22 are materially ahead of the

Board's expectations at the start of the year, as indicated in the

Company's Trading Update issued in October 2021, and confidence

levels remain high with the early signs being that sales momentum

will continue in the second half of the year . We have invested in

our team and resources and the continued positive response to the

new product launches provides optimism towards the long-term demand

for our offering.

"The breadth of our customer base across multiple regions,

combined with the ongoing successful expansion of the team, our

customer relationships and industry connections, places us in a

strong position to continue to benefit from the underlying market

growth drivers in the telecoms market."

(1) EBITDA after charging R&D amortisation, adjusted in

comparative periods also to exclude IPO costs and IPO related share

based payments

(2) Adjusted in comparative periods to exclude IPO costs and IPO

related share based payments

(3) Adjusted in comparative periods to exclude IPO costs and IPO

related share based payments, and the tax effect of these

adjustments

For more information, please contact:

Calnex Solutions plc Via Alma PR

Tommy Cook, Chief Executive Officer

Ashleigh Greenan, Chief Financial Officer

+44 (0)131 220

Cenkos Securities plc - NOMAD 6939

Derrick Lee, Peter Lynch

+ 44(0) 20 3405

Alma PR 0213

Caroline Forde, Harriet Jackson, Joe Pederzolli

Overview of Calnex

Calnex designs, produces and markets test instrumentation and

solutions for network synchronization and network emulation,

enabling its customers to validate the performance of the critical

infrastructure associated with telecoms networks. To date, Calnex

has secured and delivered orders to over 600 customer sites in 68

countries across the world. Customers include BT, China Mobile,

NTT, Ericsson, Nokia, Intel, Qualcomm, IBM and Facebook.

Founded in 2006, Calnex is headquartered in Linlithgow,

Scotland, with additional locations in Belfast, Northern Ireland

and California in the US, supported by sales teams in China and

India. Calnex has a global network of partners, providing worldwide

distribution capability.

Operational Review

Calnex experienced strong trading during the Period. The 20%

growth in revenue to GBP9.3m (H1 FY21: GBP7.7m) is a result of the

continued strong demand for telecoms testing equipment across the

Group's core markets. Revenues from the Americas region increased

22%, whilst the Rest of the World experienced a 33% uplift. North

Asia remained flat due in part to the ongoing geopolitical tensions

between the US and China. Given the overall growth in revenues, the

geographical revenue split has shifted slightly in the first six

months, with Americas now accounting for 35% of total revenues

(FY21: 32%), ROW 41% (FY21: 35%) and North Asia 24% (FY21:

33%).

The transition to 5G and growth in cloud computing continue to

drive demand for test instrumentation, from both new and existing

customers, across each of the Group's customer categories. Factors

driving the strong performance include a sustained positive

response to the launch of the enhanced Paragon-Neo, Calnex's Lab

Sync platform which is being adopted both by existing customers and

new customers looking to deliver products addressing the new O-RAN

standards. The latest version of Sentinel, Calnex's Field Sync

platform, has also seen strong uptake from the telecoms customer

base, plus hyperscale and enterprise customers who are investing in

their own data centre operations.

The Group's adjusted profit before tax held steady at GBP2.3m

(H1 FY21: GBP2.3m), ahead of the Board's expectations for the

Period at the start of FY22, reflecting the uplift in revenues and

the Group's on-going investment in the business. During the first

six months the Group has invested in business development

resources, placing more sales team members in regions that are

experiencing strong growth, such as the US and India, as well as

adding to the operational teams to support growth.

The Group has not experienced any negative impact on product

shipments from the ongoing global semiconductor shortage to date,

however the Board continues to monitor the situation closely.

Calnex's ability to maintain shipments on time in the current

climate is testament to the strong partnership with the Group's

contract manufacturer, Kelvinside Electronics, as well as the

abilities and skills of the Calnex team who are successfully

navigating this dynamic situation.

Strategy

Product development

Continued product innovation has allowed the Group to execute on

its growth strategy to capitalise on the transition to 5G. Calnex

has experienced strong demand for its Lab Synchronisation

solutions, with its newly launched enhanced Paragon-Neo Lab Sync

Platform, a very high-speed interface, seeing strong early orders

as existing customers and new customers look to deliver products

addressing the new O-RAN (Radio Access Network) standards. O-RAN is

an industry initiative designed to open the RAN (Open Radio Access

Network) network to wider vendor competition, which is leading to

new companies entering the market, as well as additional

developments with the established vendors creating products aligned

to the O-RAN Implementation Recommendations.

The release in June of the new 5G OTA (Over-the-air) capability

in Sentinel, Calnex's Field Sync solution, has experienced

significant uptake from the telecoms customer base. This

second-generation OTA implementation addresses 3G, 4G and the

emerging 5G signal formats, and is driving growth in the telecoms

market space. In addition, sales to hyperscale customers who are

investing in their data centre operations continue to grow. The

implementation of time distribution across data centres is creating

a secondary market for testing of time distribution accuracy inside

data centres. Together, both have meant that Calnex's Sentinel

product has delivered ahead of target performance with a positive

outlook moving forward.

The O-RAN initiative is also having a positive impact on Cloud

& IT product lines as it requires testing using Network

Emulators to prove interoperation between the various network

elements defined by O-RAN.

Select M&A opportunities

Targeted acquisitions remain a favourable route to growth to

complement the Group's organic growth. The Board continually

assesses the market for select M&A opportunities, against

strict criteria to ensure that any acquisitions are strategic and

earnings enhancing. Opportunities that the Board would consider

include complementary products or technologies that can enhance

Calnex's existing portfolio, or where the acquisition target

provides the Group with access to a related or adjacent growth

market.

Market Opportunity

The requirement for design validation, and conformance and

maintenance testing is more prevalent than ever as new standards

and technology movements drive the need for network operators,

equipment and component vendors and hyperscale/enterprise customers

to validate equipment and network performance. Such evolutionary

trends affecting the telecoms sector underpin Group-wide confidence

in making further progress during the current financial year and

beyond.

At present, a considerable market opportunity lies within the

role that 5G will have to play in supporting the introduction of

new services that need higher quality connections, such as

autonomous vehicles, as well as mobile phones and smart devices.

Additionally, the testing market will grow in influence hand in

hand with the growth in the number of data centres operated by

enterprise and hyperscale companies.

People

We continue to invest in talent globally, to support and enhance

the fantastic work of our team, whose commitment continues to drive

the business forward. Such investment in talent, particularly

within the R&D division, is part of the Group's on-going growth

strategy and will continue to be a big part of our investment over

the coming period. We have hired 19 new staff over the last 12

months, bringing our total headcount to 113. The recruitment market

remains challenging with many companies seeking to hire; however,

at present Calnex continues to be able to attract talent. The

Company is also utilising its overseas sponsor license to hire from

outside of the UK to strengthen its teams.

In August, the Company recruited a new Vice President of

Operations who is tasked with advancing Calnex's internal

manufacturing capabilities. These activities will enhance processes

and procedures to ensure the Group's manufacturing capacity

continues to evolve in a sustainable way. Such investment is

aligned with our growth strategy, and we expect this to continue in

the coming period as we scale the business.

Our staff are gradually returning to the office under the hybrid

model and our experiences from the enforced lockdowns have allowed

us to enhance our working environment for all. Whilst travel costs

associated with customer site visits have remained low during the

Period, the sales team are slowly starting to hold face-to-face

customer interaction again.

The Board is delighted to report that the Company was awarded a

Gold standard accreditation from Investors in People in June 2021,

a rare achievement for companies from their first assessment by

IIP. This provides recognition of Calnex as an organisation with

the very best in people management excellence.

Outlook

These results mark another considerable step forward for Calnex,

as the Group continues to capitalise on the global telecom

industry's transition to 5G and the growth of cloud computing.

Confidence levels are high throughout the Group, with an

anticipation that sales momentum will continue in the second half

of the year. The continued positive response to the new product

launches provides optimism towards the long-term demand for our

offering.

While Calnex has not experienced any negative impact from the

ongoing global semiconductor shortage on the ability to manufacture

and ship product, the Board continues to monitor the situation

closely.

The breadth of Calnex's customer base across multiple regions,

combined with the ongoing successful expansion of the team, the

Group's customer relationships and industry connections, places

Calnex in a strong position to continue to benefit from the

underlying market growth drivers in the telecoms market.

The Board is confident in meeting the upgraded(**) market

forecasts for the year

(**) upgraded forecasts issued on 12 October 2021, following the

Company's Trading Update

Financial Review

The Group delivered a strong financial performance in the six

months to 30 September 2021, with results materially exceeding

management revenue and profit expectations set out at the start of

FY22.

Key performance indicators

GBP000 H1 FY22 H1 FY21 FY21

Unaudited Unaudited Audited

Revenue 9,251 7,721 17,978

Gross Profit 7,046 6,031 13,965

Gross Margin 76% 78% 78%

Underlying EBITDA (1) 2,479 2,593 5,496

Underlying EBITDA % 27% 34% 31%

Adjusted Profit before tax

(2) 2,308 2,319 5,068

Adjusted Profit before tax

% 25% 30% 28%

Closing cash 13,643 4,511 12,668

Capitalised R&D 1,904 1,484 3,326

Adjusted basic EPS (pence)

(3) 2.05 3.02 5.83

Adjusted diluted EPS (pence)

(3) 1.99 2.42 5.21

Statutory measures:

EBITDA 3,877 3,424 6,554

EBITDA % 42% 44% 36%

Profit before tax 2,308 1,950 3,647

Profit before tax % 25% 25% 20%

Basic EPS (pence) 2.05 2.41 4.68

Diluted EPS (pence) 1.99 1.93 4.18

(1) EBITDA after charging R&D amortisation, adjusted in

comparative periods also to exclude IPO costs and IPO related share

based payments.

(2) Adjusted in comparative periods to exclude IPO costs and IPO

related share based payments.

(3) Adjusted in comparative periods to exclude IPO costs and IPO

related share based payments and the tax effect of these

adjustments

The table below shows the reconciliation between the statutory

reported income statement and the adjusted income statement:

Reconciliation of statutory figures to alternative performance

measures

H1 FY22 H1 FY21 FY21

GBP000 Unaudited Unaudited Audited

Revenue 9,251 7,721 17,978

Cost of sales (2,205) (1,689) (4,013)

Gross Profit 7,046 6,031 13,965

Other income 93 103 530

Administrative expenses

(excl depreciation & amortisation) (3,262) (2,710) (7,941)

------------------------------------- ---------------- ---------- --------

EBITDA 3,877 3,424 6,554

Amortisation of development

costs (1,398) (1,200) (2,479)

Add back exceptional items:

IPO costs - 171 1,057

IPO related share based

payments - 198 198

Issue of SIP Free Shares

on IPO - - 166

------------------------------------- ---------------- ---------- --------

Underlying EBITDA 2,479 2,593 5,496

Other depreciation & amortisation (160) (135) (273)

Operating Profit 2,319 2,458 5,223

Finance expense (11) (139) (155)

------------------------------------- ---------------- ---------- --------

Adjusted profit before tax 2,308 2,319 5,068

Exceptional items - (369) (1,421)

------------------------------------- ---------------- ---------- --------

Profit before tax 2,308 1,950 3,647

Tax (512) (505) (194)

------------------------------------- ---------------- ---------- --------

Profit for the Period 1,796 1,444 3,453

Revenue

Revenue recognised in first half of the year was GBP9.3m,

representing 20% growth on H1 FY21 revenue of GBP7.7m and a

significant increase on targets set at the beginning of the

financial year. Order intake and revenue increased across all three

product lines. R evenues to the Americas and Rest of the World

increased, with North Asia experiencing a flattening of revenues in

the Period reflecting the ongoing US-China geopolitical tensions,

which are also exacerbating the component shortage issues in the

region . Revenue in H2 FY22 is expected to grow further on the

first half of the year, as a result of the healthy closing backlog

at 30 September 2021 and the strong pipeline of orders for H2

FY22.

Gross Margin

Gross margin in the Period was 76% (H1 FY21: 78%) and is in line

with management expectations for this point in the year. This gross

margin is net of commissions payable to our channel partners. Gross

margins can fluctuate by 1-2% through the year depending on the mix

of products and the mix of the hardware and software bundles

shipped, so can differ slightly when comparing the half year

periods.

Underlying EBITDA

Underlying EBITDA is stated after charging R&D amortisation,

also adjusted in the comparative periods to exclude IPO costs and

IPO related share based payments.

Underlying EBITDA was GBP2.5m in the Period (H1 FY21: GBP2.6m)

which represents a material increase on initial management

expectations at the beginning of FY22, driven by the strong revenue

performance. Underlying EBITDA margin was 27% (H1 FY21: 34%),

several percentage points above the original target for this point

in the year. The variance against the prior period is driven by the

planned step change in our cost base for FY22 as a result of

investment to support the continued growth of the business.

Administration costs excluding depreciation and amortisation

(adjusted in prior periods to exclude IPO costs and IPO related

share based payments) were GBP3.3m in H1 FY22 (H1 FY21: GBP2.3m).

This variance in costs predominantly relates to the planned

increase in sales, support and executive management headcount in

line with our growth strategy. New hires, in line with growth

expectations at the start of the year, are predominantly to support

the expansion of our internal manufacturing capacity and to further

enhance our sales team across the regions.

We initially expected travel costs to increase in H1 this year

as a result of COVID restrictions being eased. This increase did

not materialise as travel restrictions were predominantly still in

place throughout the Period. We expect travel costs to increase in

H2 FY22 as restrictions ease and an increase in face to face

customer meetings return.

Amortisation of R&D costs in H1 FY22 were GBP1.4m (H1 FY21:

GBP1.2m). The increase on the prior period is due to planned

increases in R&D headcount to support new and ongoing

projects.

Adjusted Profit before tax

Adjusted Profit before tax (with comparative periods adjusted to

exclude IPO costs and IPO related share based payments) was GBP2.3m

in the Period (H1 FY21 GBP2.3m).

Tax

The tax charge for the Period was GBP0.5m (H1 FY21: GBP0.5m)

representing an effective tax rate of 22.2% (H1 FY21: 25.9%).

The Finance Act 2021, now substantively enacted, increases the

UK corporation tax rate from 19% to 25% effective 1 April 2023. As

a result, the Company's deferred tax assets and liabilities have

been measured using the tax rates that are expected to apply when

the reversal of the timing differences takes place. Using this

methodology, a n effective hybrid tax rate has been calculated

(offset partially by the availability of R&D tax credits) and

we expect this rate to be aligned to the effective tax rate for the

full year.

Earnings per share

Basic earnings per share (adjusted in the comparative periods to

exclude IPO costs and IPO related share based payments and the tax

effect of these adjustments) was 2.05 pence in the Period (H1 FY21:

3.02 pence) and diluted earnings per share (adjusted in the

comparative periods to exclude IPO costs and IPO related share

based payments and the tax effect of these adjustments) was 1.99

pence (H1 FY21: 2.42 pence).

The reduction in earnings per share compared with the prior

period is as a result of a change in the weighted average number of

shares in issue pre and post the 5 October 2020 listing of the

Company's Ordinary Shares on the AIM market of the London Stock

Exchange, and the issue of share options since the listing. The

weighted average number of shares in issue at 30 September 2021

takes into account the 27,475,897 shares issued on IPO, of which

14,975,897 were issued in exercise of share options and warrants

with no corresponding direct economic value. There were also

3,122,500 share options issued since the listing (472,500 issued

since 31 March 2021), with no corresponding direct economic value,

further increasing the weighted average diluted share capital at

the end of the Period.

Cashflows

The Group generated GBP0.9m cash in H1 FY22 (H1 FY21: GBP0.9m),

reflecting the strong trading in the Period and was, as with the

performance in the income statement, significantly ahead of

management expectations at the start of FY22.

Net cash from operating activities was GBP3.1m in the Period (H1

FY21: GBP2.9m). Working capital movements represented a cash

outflow of GBP0.7m (H1 FY21: GBP0.7m), largely driven by movements

in trade and other receivables as a result of timing and volume of

shipping and invoicing to customers.

Cash used in investing activities is principally cash spent on

R&D activities which is capitalised and amortised over five

years. Investment in R&D in the Period was GBP1.9m (H1 FY21:

GBP1.5m), reflecting the growth in the team as R&D project

resource demands increased as planned.

Cash spend on financing activities in the Period was GBP0.1m (H1

FY21: GBP0.6m), representing payment of lease obligations. There is

currently no debt on the balance sheet, leading to no borrowings

related cashflows in the current period.

Closing cash at 30 September 2021 was GBP13.6m (30 September

2020: GBP4.5m; 31 March 2021: GBP12.7m).

Dividend

The Board has resolved to pay a maiden interim dividend of 0.28

pence per ordinary share on 17 December 2021 to those shareholders

on the register as at 3 December 2021 (FY21 Interim dividend 0p).

The ex-dividend date is 2 December 2021.

Calnex Solutions plc

Consolidated income statement

For the period ended 30 September 2021

6 months 6 months Year ended

to to

30 Sep 30 Sep 31 Mar

2021 2020 2021

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Revenue 5 9,251 7,721 17,978

Cost of sales (2,205) (1,690) (4,013)

------------ ------------ -----------

Gross profit 7,046 6,031 13,965

Other income 93 103 530

Administrative expenses (4,820) (4,045) (10,693)

------------ ------------ -----------

Operating profit 2,319 2,089 3,802

Presented as:

EBITDA 3,877 3,424 6,554

Depreciation and amortisation of non-R&D

assets (160) (135) (273)

Amortisation of R&D asset (1,398) (1,200) (2,479)

Operating profit 2,319 2,089 3,802

============ ============ ===========

Finance costs 6 (11) (139) (155)

------------ ------------ -----------

Profit before taxation 2,308 1,950 3,647

Taxation 7 (512) (505) (194)

------------ ------------ -----------

Profit and total comprehensive income for

the year 1,796 1,445 3,453

============ ============ ===========

Earnings per share (pence)

Basic earnings per share 8 2.05 2.41 4.68

Diluted earnings per share 8 1.99 1.93 4.18

Calnex Solutions plc

Consolidated statement of financial position

For the period ended 30 September 2021

6 months 6 months Year ended

to to

30 Sep 30 Sep 31 Mar

2021 2020 2021

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 9 7,982 7,009 7,525

Property, plant and equipment 10 158 19 22

Right of use assets 11 541 602 522

Deferred tax asset 730 250 613

------------ ------------ -----------

9,411 7,880 8,682

Current assets

Inventory 12 1,189 1,226 1,111

Trade and other receivables 13 2,414 2,148 1,819

Cash and cash equivalents 14 13,643 4,511 12,668

------------ ------------ -----------

17,246 7,885 15,598

Total assets 26,657 15,765 24,280

------------ ------------ -----------

Current liabilities

Borrowings - 719 -

Trade and other payables 15 4,182 2,582 4,181

Lease liability payable within

one year 11 175 162 130

Financial liabilities - 52 -

Provisions 16 291 298 291

------------ ------------ -----------

4,648 3,813 4,602

Non-current liabilities

Borrowings - 1,217 -

Trade and other payables 15 868 349 749

Lease liabilities payable later

than one year 11 417 469 436

Deferred tax liability 1,650 1,260 1,321

Provisions 16 15 15 15

------------ ------------ -----------

2,950 3,310 2,521

Total liabilities 7,598 7,123 7,123

------------ ------------ -----------

Net assets 19,059 8,642 17,157

============ ============ ===========

Equity

Share capital 109 75 109

Share premium 7,484 1,138 7,484

Share option reserve 232 266 126

Retained earnings 11,234 7,163 9,438

Total equity 19,059 8,642 17,157

============ ============ ===========

Calnex Solutions plc

Consolidated statement of cashflows

For the period ended 30 September 2021

6 months 6 months Year ended

to to

30 Sep 30 Sep 31 Mar

2021 2020 2021

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Cashflow from operating activities

Profit before tax from continuing

operations 2,308 1,950 3,647

Adjusted for

IPO professional fees and commissions - 171 1,057

Finance costs 11 139 155

Foreign exchange differences - 34 (65)

Government grant income (93) (103) (204)

R&D tax credit income - - (326)

Change in fair value of assets

& liabilities - - 144

Movement in obsolescence provision (16) 89 25

Movement in provisions - 9 (14)

Share based payment transactions 105 198 275

Depreciation 160 82 167

Amortisation 1,398 1,253 2,585

Movement in inventories (63) (356) (178)

Movement in trade and other receivables (595) 141 818

Movement in trade and other payables (74) (356) 1,271

Net cash used in discontinued

operations - (202) (201)

Cash generated from operations 3,141 3,049 9,156

Interest paid (11) (154) (107)

------------ ------------ -----------

Net cash from operating activities 3,130 2,895 9,049

------------ ------------ -----------

Investing activities

Purchase of intangible assets (1,904) (1,484) (3,332)

Purchase of property, plant and

equipment (154) (3) (10)

Net cash used in investing activities (2,058) (1,487) (3,342)

------------ ------------ -----------

Financing activities

Repayment of borrowings - (340) (2,276)

Payment of lease obligations (97) (64) (193)

Share issue proceeds - - 6,000

Share options proceeds - - 328

IPO professional fees and commissions - (171) (1,057)

Payment of deferred consideration - (82) (83)

Government grant income - 96 578

------------ ------------ -----------

Net cash from financing activities (97) (561) 3,297

------------ ------------ -----------

Net increase in cash and cash

equivalents 975 847 9,004

Cash and cash equivalents at the beginning

of the period 12,668 3,664 3,664

Cash and cash equivalents at the

end of the period 13,643 4,511 12,668

============ ============ ===========

Calnex Solutions plc

Consolidated statement of changes in equity

For the period ended 30 September 2021

Share

Share Share option Retained Total

capital premium reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 30 September

2020 75 1,138 266 7,163 8,642

Share options 18 362 (140) 266 506

Share Issue 16 5,984 - - 6,000

Profit for period ended

31 March 2021 - - - 2,009 2,009

--------- --------- ---------- ---------- --------

Balance at 31 March 2021 109 7,484 126 9,438 17,157

Share options - - 106 - 106

Profit for period ended

30 September 2021 - - - 1,796 1,796

--------- --------- ---------- ---------- --------

Balance at 30 September

2021 109 7,484 232 11,234 19,059

========= ========= ========== ========== ========

Calnex Solutions plc

Notes to the interim consolidated financial statements

For the period ended 30 September 2021

1. General information

The interim consolidated financial statements cover the

consolidated entity Calnex Solutions plc and the entities it

controlled at the end of, or during, the interim period to 30

September 2021 ("the Group").

Calnex Solutions plc ("the Company") is a public limited company

and is domiciled and incorporated in Scotland.

The registered office is:

Oracle Campus

Linlithgow

West Lothian

EH49 7LR

The principal activity of the Group is the design, production

and marketing of test instrumentation and solutions for network

synchronisation and network emulation.

The interim consolidated financial statements for the period

ended 30 September 2021 are unaudited, and do not constitute

statutory accounts as defined in section 434 of the Companies Act

2006. They do not therefore include all the information and

disclosures required in annual statutory financial statements and

should be read in conjunction with the

Group annual report and accounts for the year ended 31 March

2021.

The Group annual report and accounts for the year ended 31 March

2021 were approved by the Board of Directors on 24 May 2021 and

have been delivered to the Registrar of Companies. The auditor's

report on those accounts was unqualified, did not draw attention to

any matters by way of emphasis and did not contain a statement made

under Section 498(2) or (3) of the Companies Act 2006.

The interim consolidated financial statements for the period

ended 30 September 2021 were approved by the Board of Directors on

22 November 2022.

2. Basis of preparation

The interim consolidated financial statements for the period

ended 30 September 2021 have been prepared in accordance with IAS

34 'Interim Financial Reporting' as issued by the International

Accounting Standards Board, endorsed by and adopted for use in the

United Kingdom.

The accounting policies and methods of computation adopted are

consistent with those applied in the Group's consolidated financial

statements for the year ended 31 March 2021 and have been applied

consistently to all periods presented.

There have been no new standards or amendments to existing

standards effective from 1 April 2021 that are applicable to the

Group or that has had any material impact on the financial

statements and related notes as at 30 September 2021. The Directors

do not anticipate that the adoption of any of the new standards and

interpretations issued by the IASB and IFRIC with an effective date

for the Group after the date of these interim financial statements

will have a material impact on the Group's interim financial

statements in the period of initial application.

3. Going concern

The interim consolidated financial statements have been prepared

on the basis that the Company will continue as a going concern.

The business has not seen any detrimental impact on trading as a

result of the COVID-19 pandemic and the Group has not required the

assistance of government funding. Appropriate safety measures have

been put in place to protect staff while the Group continues to

operate in line with government guidance across our various

locations. The Directors continue to closely monitor the situation,

with rolling cashflow forecasting and visibility over the order

pipeline being key to provide early indication of required action

in order to mitigate against any future risk of further lockdowns

or new virus threats.

The Board has reviewed financial profit and cashflow forecasts

for the current and succeeding financial years to 31 March 2023.

Based on this review, along with regular oversight of the Company's

risk management framework, the Board has concluded that given the

Company's cash reserves available and access to additional

liquidity through banking facilities, the Company will continue to

trade as a going concern.

4. Operating segments

Operating segments are based on the internal reports that are

reviewed and used by the Board of Directors (who are identified as

the Chief Operating Decision Makers) in assessing performance and

determining the allocation of resources. As the Group has a central

cost structure and a central pool of assets and liabilities, the

Board of Directors do not consider segmentation in their review of

costs or the balance sheet. The only operating segment information

reviewed, and therefore disclosed, are the revenues derived from

different geographies.

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2021 2020 2021

GBP'000 GBP'000 GBP'000

Americas 3,293 2,704 5,767

North Asia 2,140 2,145 5,945

ROW 3,818 2,872 6,266

Total revenue 9,251 7,721 17,978

========= ========= ===========

5. Revenue

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2021 2020 2021

GBP'000 GBP'000 GBP'000

Sale of goods 8,268 7,173 16,509

Rendering of services 983 548 1,469

Total revenue 9,251 7,721 17,978

========= =========== ===============

6. Finance costs

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2021 2020 2021

GBP'000 GBP'000 GBP'000

Interest expense for borrowings at

amortised cost - 120 107

Interest expense on lease liabilities 11 34 63

Unwinding on discount for deferred

consideration - (15) (15)

Total finance costs 11 139 155

========= =========== ===============

7. Taxation

6

months 6 months Year

to to ended

30 Sep 30 Sep 31 Mar

2021 2020 2021

GBP'000 GBP'000 GBP'000

Current taxation

UK corporation tax on profits for

the period 291 - 67

Foreign current tax expense 5 32 12

Adjustments relating to prior years - - (9)

Deferred taxation

Effect of timing differences 104 473 61

Adjustments relating to prior years - - 63

Effects of changes in tax rate 112 - -

Taxation charge 512 505 194

======== ========== ==========

Profit before tax for the year 2,308 1,950 3,647

Effective tax rate 22% 26% 5%

The effective tax rate forecast at 30 September 2020 for the

year ended 31 March 2021 was 26%, influenced predominantly by

significant non-allowable expenditure projected ahead of the

Company listing on the AIM on 5(th) October 2020.

The actual effective tax rate for the year ended 31 March 2021

was 5%. The delta between the rates at half year and year end being

driven by:

-- Tax relief on exercise of share options on IPO, on which no

deferred tax asset had previously been recognised (reduction of 16%

on effective tax rate)

-- Availability of R&D SME enhanced deduction which had not

been claimed in the prior period (reduction of 4% on effective tax

rate)

-- Other cumulative variances (1% reduction on the effective tax rate)

The effective tax rate forecast at 30 September 2021 for the

year ended 31 March 2022 is 22%. The Finance Act 2021, now

substantively enacted, increases the UK corporation tax rate from

19% to 25% effective 1 April 2023. In accordance with IAS 12:

(Income Taxes) the deferred tax assets and liabilities have been

measured using the tax rates that are expected to apply when the

reversal of the timing differences takes place.

8. Earnings per share

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of Ordinary Shares in issue during the year.

Diluted earnings per share is calculated by dividing the

earnings attributable to ordinary shareholders by the total of the

weighted average number of Ordinary Shares in issue during the year

and adjusting for the dilutive potential Ordinary Shares relating

to share options.

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2021 2020 2021

GBP'000 GBP'000 GBP'000

Profit after tax attributable to shareholders 1,796 1,445 3,453

Weighted average number of shares

used in calculation:

Basic earnings per share 87,500 60,024 73,672

Diluted earnings per share 90,375 75,000 82,575

Earnings per share - basic (pence) 2.05 2.41 4.68

Earnings per share - diluted (pence) 1.99 1.93 4.18

9. Intangible Assets

Included within intangible assets are the following significant

items:

-- Intellectual property representing the cost of patent

applications and on-going patent maintenance fees.

-- Capitalised development costs representing expenditure

relating to technological advancements on the core product base of

the Group. These costs meet the requirement of IAS 38 (Intangible

Assets) and will be amortised over the future commercial life of

the related product. Amortisation is charged to administrative

expenses.

Intellectual Development

property Costs Total

GBP'000 GBP'000 GBP'000

Cost

At 1 April 2021 2,348 24,438 26,786

Additions 4 1,904 1,908

Disposals - - -

------------- -------------- ----------

At 30 September 2021 2,352 26,342 28,694

------------- -------------- ----------

Amortisation

Balance at 1 April 2021 2,140 17,121 19,261

Charge for the period 53 1,398 1,451

Eliminated on disposal - - -

------------- -------------- ----------

At 30 September 2021 2,193 18,519 20,712

------------- -------------- ----------

Net book value

31 March 2021 208 7,317 7,525

============= ============== ==========

30 September 2021 159 7,823 7,982

============= ============== ==========

10. Property, plant and equipment

The Group annually reviews the carrying value of tangible fixed

assets recognising the expected working lives of the plant and

equipment available to the Group and known requirements.

Depreciation is charged to administrative expenses.

Plant and

equipment

total

GBP'000

Cost

At 1 April 2021 120

Additions 151

Disposals (35)

-----------

At 30 September 2021 236

-----------

Amortisation

Balance at 1 April 2021 98

Charge for the period 15

Eliminated on disposal (35)

-----------

At 30 September 2021 78

-----------

Net book value

31 March 2021 22

===========

30 September 2021 158

===========

11. Leases

The Group has recognised a right-of use asset and a lease

liability for the lease of land and buildings for its head office

in Linlithgow, Scotland.

The Group leases IT equipment with contract terms ranging

between 1 to 2 years. The Group has recognised right-of use assets

and lease liabilities for these leases.

The Group also leases land and buildings in Belfast and one

motor vehicle. These leases are low-value, so have been expensed as

incurred. The Group has elected not to recognise right -- of -- use

assets and lease liabilities for these leases.

Information about the right of use assets and leases for which

the Group is a lessee is presented below:

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2021 2020 2021

GBP'000 GBP'000 GBP'000

Right of use assets

NBV brought forward in the period 522 660 660

Additions to right of use assets

for the period 112 20 20

Depreciation charge for the period (93) (78) (158)

NBV carried forward for the period 541 602 522

========= ========= =============

6 months 6 months 6 months

to to to

30 Sep 30 Sep 30 Sep

2021 2020 2021

GBP'000 GBP'000 GBP'000

Lease liabilities

Balance brought forward in the period 566 676 676

Lease additions for the period 112 20 20

Payment of lease expense (97) (99) (193)

Interest on lease expense 11 34 63

--------- ---------

Balance carried forward for the period 592 631 566

========= ========== ===========

Represented as:

Due within 1 year 175 162 130

Due in more than 1 year 417 469 436

--------- ---------- -----------

Total amounts due 592 631 566

========= ========== ===========

12. Inventory

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2021 2020 2021

GBP'000 GBP'000 GBP'000

Finished goods 1,452 1,568 1,390

Provision for obsolescence (263) (342) (279)

1,189 1,226 1,111

========= =========== ================

Group inventories reflect the following movement in provision for

obsolescence:

At start of the financial year 279 253 253

Utilised (48) (98) (98)

Provided 32 187 124

--------- ----------- ----------------

At end of the financial year 263 342 279

========= =========== ================

13. Trade and other receivables

Trade receivables are consistent with trading levels across the

Group and are also affected by exchange rate fluctuations.

No interest is charged on the trade receivables.

The Group has reviewed for estimated irrecoverable amounts in

accordance with its accounting policy, and at the balance sheet

date, there are no amounts outstanding beyond agreed credit

terms.

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2021 2020 2021

GBP'000 GBP'000 GBP'000

Trade receivables 1,538 1,670 988

Less provision for bad debt - (16) -

Other receivables 691 110 700

Prepayments and accrued income 185 384 131

2,414 2,148 1,819

========= ========= ===========

The Directors consider that the carrying amount of trade and

other receivables approximates their fair value.

14. Cash and cash equivalents

Cash and cash equivalent amounts included in the Consolidated

Statement of Cashflows comprise the following:

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2021 2020 2021

GBP'000 GBP'000 GBP'000

Cash at bank 7,131 4,511 7,668

Cash on short term deposit 6,512 - 5,000

Total cash and cash equivalents 13,643 4,511 12,668

========= ========= ===========

Short term cash deposits of GBP6,511,647 are callable on a

notice of 95 days.

15. Trade and other payables

Trade and other payables are consistent with trading levels

across the Group but are also affected by exchange rate

fluctuations. Trade payables and accruals principally comprise

amounts outstanding for trade purchases and ongoing costs. The

Group has financial risk management policies in place to ensure all

payables are paid within the agreed credit terms.

Deferred income relates to fees received for ongoing services to

be recognised over the life of the service rendered.

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2021 2020 2021

GBP'000 GBP'000 GBP'000

Trade payables 884 909 944

Taxes 131 112 126

Other payables 172 50 51

Accruals 1,481 312 1,561

Deferred income 1,514 1,199 1,499

4,182 2,582 4,181

Amounts due in more than one year

Deferred income 868 349 749

Total amounts due 5,050 2,931 4,930

========= ========= ===========

The Directors consider that the carrying amount of trade and

other payables approximates their fair value.

16. Provisions

Current provisions are recognised in respect of potential

payments to be made to overseas tax authorities, and potential

payments to be made in respect of dilapidations on leased assets.

No discount is recorded on recognition of the provisions or unwound

due to the short-term nature of the expected outflow and the low

value and estimable nature of the non-current element.

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2021 2020 2021

GBP'000 GBP'000 GBP'000

Current provisions

Overseas tax 291 298 291

========= =========== ===============

Non-current provisions

Dilapidations 15 15 15

========= =========== ===============

Total provisions 306 313 306

========= =========== ===============

17. Alternative performance measures

The performance of the Group is assessed using a variety of

performance measures, including APMs which are presented to provide

users with additional financial information that is regularly

reviewed by the Board of Directors. These APMs are not defined

under IFRS and therefore may not be directly comparable with

similarly identified measures used by other companies.

6 months 6 months

to to Year ended

30 Sep 30 Sep 31 Mar

2021 2020 2021

GBP'000 GBP'000 GBP'000

Underlying EBITDA 2,480 2,593 5,496

Underlying EBITDA % 27% 34% 31%

Adjusted profit before tax 2,308 2,319 5,068

Adjusted profit before tax % 25% 30% 28%

Adjusted basic EPS (pence) 2.05 3.02 5.83

Adjusted diluted EPS (pence) 1.99 2.42 5.21

Capitalised R&D spend 1,904 1,484 3,326

-- Underlying EBITDA: EBITDA including R&D amortisation,

adjusted to exclude discontinued operations and IPO transaction

costs and IPO related share based payments

-- Adjusted profit before tax: Adjusted to exclude discontinued

operations, IPO transaction costs and IPO related share based

payments

-- Adjusted basic and diluted EPS Adjusted to exclude

discontinued operations, IPO related costs and the tax effect of

these adjustments

18. Post balance sheet event

The Board has resolved to pay a maiden interim dividend of 0.28

pence per ordinary share on 17 December 2021 to those shareholders

on the register as at 3 December 2021 (FY21 Interim dividend 0p).

The ex-dividend date is 2 December 2021.

19. Availability of Interim Report

The Company's Interim Report for the six months ended 30

September 2021 will be available to view on the Company's website

(www.calnexsol.com).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KLLFLFFLFFBF

(END) Dow Jones Newswires

November 23, 2021 02:00 ET (07:00 GMT)

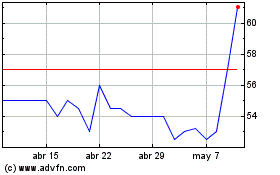

Calnex Solutions (LSE:CLX)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Calnex Solutions (LSE:CLX)

Gráfica de Acción Histórica

De May 2023 a May 2024