TIDMCNR

RNS Number : 1769L

Condor Gold PLC

09 September 2021

Condor Gold plc

7/8 Innovation Place

Douglas Drive

Godalming

Surrey

GU7 1JX

9 September 2021

Condor Gold Plc

("Condor", "Condor Gold" or the "Company")

Condor Announces Details of Technical Report on its 100% La

India Gold Project

Post-Tax NPV(5) US$418M, IRR 54%, Average 150,000 oz Gold p.a

for 9 years, Payback 12 Months

Condor Gold (AIM: CNR; TSX: COG) is pleased to announce the key

findings of a technical report on its 100% owned La India Gold

Project (the "Project") prepared by SRK Consulting (UK) Limited

("SRK"). This technical report (the "Technical Report") presents

the results of a strategic mining study to Preliminary Economic

Assessment ("PEA") standards completed on the Project in 2021. The

strategic study covers two scenarios: Scenario A, in which the

mining is undertaken from four open pits, termed La India, America,

Mestiza and Central Breccia Zone ("CBZ"), which targets a plant

feed rate of 1.225 million tonnes per annum ("Mtpa"); and Scenario

B, where the mining is extended to include three underground

operations at La India, America and Mestiza, in which the

processing rate is increased to 1.4 Mtpa. The 2021 PEA Technical

Report will be issued within 45 days of the public disclosure to NI

43-101 standards.

Highlights: 1.4Mtpa PEA Open Pit + Underground Operations

-- Internal Rate of Return ("IRR") of 54% and a post-tax Net

Present Value ("NPV") of US$418 million, after deducting upfront

capex, at a discount rate of 5% and gold price of US$1,700/oz.

-- Average annual production of 150,000 oz of gold over the initial 9 years of production.

-- 1,469,000 oz of gold produced over 12-year Life Of Mine ("LOM").

-- Initial capital requirement of US$160 million (including

contingency), where the underground development is funded through

cash flow.

-- Pay back period 12 months.

-- All-in Sustaining Costs of US$958 per oz gold over LOM.

-- Robust Base Case presents an IRR of 43% and a post-tax NPV of

US$312 million at a discount rate of 5% and gold price of

US$1,550/oz.

Highlights 1.225 Mtpa PEA La India Open Pit + Feeder Pits:

-- IRR of 58% and a post-tax NPV of US$302 million, at a

discount rate of 5% and gold price of US$1,700/oz.

-- Average annual production of 120,000 oz of gold over the initial 6 years of production.

-- 862,000 oz of gold produced over 9 year Life of Mine ("LOM").

-- Initial capital requirement of US$153 million (including contingency).

-- Pay back period 12 months.

-- All-in Sustaining Costs of US$813 per oz gold.

-- Robust Base Case presents an IRR of 48% and a post-tax NPV of

US$236 million at a discount rate of 5% and gold price of

US$1,550/oz.

Mark Child, Chairman and CEO commented:

"I am delighted to announce robust economics for two mining

scenarios in an updated technical study on Condor's 100% owned La

India Project. The highlight of the technical study is a post-tax,

post upfront capital expenditure NPV of US$418 million, with an IRR

of 54% and 12 month pay-back period, assuming a US$1,700 per oz

gold price, with average annual production of 150,000 oz gold per

annum for the initial 9 years of gold production. The open pit mine

schedules have been optimised from designed pits, bringing higher

grade gold forward resulting in average annual production of

157,000 oz gold in the first 2 years from open pit material and

underground mining funded out of cashflow".

Background

The 2021 PEA reflects the January 2019 Mineral Resource Estimate

(as reported in the RNS dated 28 January 2019), incorporating

advances in understanding and technical study detail relating to a

number of areas of the Project (relative to the Pre-Feasibility

Study ("PFS") and PEA scenarios presented in the "Technical Report

on the La India Gold Project, Nicaragua, December 2014", reported

in the RNS dated 21 December 2014, updates provided in final

prospectus filed with the Ontario Securities Commission as

announced on 27 December 2017), as well as the incorporation of the

Mestiza open pit. The most significant area of advancement relates

to the mining studies conducted for each of the open pits, where

this has focused on producing optimised pit designs considering

maximising access to mineralised material and the opportunity to

maintain the grade profile through stockpiling, without requiring

the relocation of the village. The other technical disciplines,

namely open pit geotechnics, underground mining, hydrogeology,

tailings management and infrastructure remain relatively unchanged

compared to the 2014 PFS/PEA (accounting for the changes in

production), with minor updates relating to mineral processing and

hydrological. The environmental and social studies reflect Condor's

achievement of being granted an Environmental Permit to construct

and operate a processing plant with capacity of up to 2,800 tonnes

per day ("tpd") and develop the associated mine site infrastructure

for a new mine at the Project (the "Main Permit").

Condor has open pit Mineral Resources of 8,583Kt at 3.3g/t gold

for 903,000 oz gold in the Indicated category and 1,901Kt at 3.6g/t

gold for 220,000 oz gold in the Inferred category permitted for

extraction.

The 2021 PEA is the first Technical Report update since the 2014

PFS and PEAs. While the MRE has not changed materially during this

period there have been a number of changes to the infrastructure

designs and layout, which will be reflected in the 2021 PEA. These

include: no resettlement of the village of La Cruz de la India, the

elimination of a southern waste rock dump, the relocation of the

processing plant approximately 1.2Km to the East, no requirement to

relocate the main road, the purchase of the vast majority of the

surface rights and obtaining the Main Permit to construct and

operate a mine. Condor has developed a detailed knowledge of the

hydrology, the site wide water balance and surface water

management, where the water management plans have been aligned with

the updated pit designs, pit development, and incorporation of the

underground workings for the 2021 PEA. Furthermore, a gold price of

US$1,250 oz gold was used in the 2014 PFS and PEAs verses a base

case of US$1,550 oz gold in the 2021 PEA.

Thus the 2021 PEA provides an update on the current status of

the Project, while acknowledging a key part of Condor's strategy is

to prove up a 5M oz Gold District at the Project.

The PEA has been conducted in parallel to the on-going field

investigations being conducted by Condor inclusive of the recently

completed 3,370 m resource drilling programme at the La India open

pit, the resource infill drilling programme currently being

conducted at the Mestiza open pit and resource expansion drilling

being conducted on the Cacao deposit. Feasibility study level open

pit geotechnical drilling and investigations, hydrological studies,

metallurgical testwork, and tailings management and process plant

design are on going relating to the permitted La India open

pit.

It is Condor's intention that the new drilling data will be

incorporated in a further MRE update and that this will support the

development of a Feasibility Study, along with the other on-going

multi-disciplinary studies on the La India deposit.

PEA Inputs

SRK followed industry standard practices to derive the January

2019 MRE update, which remains consistent with SRK's approach for

the MREs previously completed. Table 3 presents the 2019 Mineral

Resource Statement for the Project, inclusive of all veins.

Different levels of geotechnical studies have been competed for the

four potential open pits considered in both Scenario A and B, where

these range from a detailed PFS investigation for La India, to

scoping and benchmark values for Mestiza, America and Central

Breccia. Scenario B considers the inclusion of underground mining

at the La India, America and Mestiza deposits. To support the

underground mining studies, SRK has reviewed and assessed the rock

mass classification, and assessed the requirements for crown pillar

design, sill pillar design and support at a PEA level. This study

is based on the summarised geotechnical information from earlier

studies including those referred to in the SRK 2014, 2017 NI 43-101

Technical Report, with no further drill core or logging data added

subsequently.

Table 1: Summarised Key Technical, Operational and Financial

Parameters for Scenario A and B

The key technical, operational, and financial parameters of the

two scenarios are summarised in Table 1. Both scenarios return

positive NPVs at the Company's base discount rate of 5%, of US$236M

and US$313M for Scenarios A and B, respectively at a gold price of

US$1,550/oz. Undiscounted payback is accomplished during operating

year 1 for both Scenario A and Scenario B.

Parameter Units Scenario A Scenario B

------------- -----------

Production

Ore Mined (kt) 10,634 15,702

Au Grade (g/t) 2.77 3.18

Ag Grade (g/t) 4.39 4.75

Recovered Metal

Au (koz) 862 1,469

Ag (koz) 1,031 1,662

Commodity Prices

Gold (USD/oz) 1,550 1,550

Silver (USD/oz) 20 20

Revenue

Gold (USDM) 1,335.28 2,275.24

Silver (USDM) 20.41 32.91

Gross Revenue (USDM) 1,355.69 2,308.15

Transportation Charges (USDM) (1.46) (2.10)

Smelter Charges (USDM) (1.42) (2.35)

Net Revenue (USDM) 1,352.81 2,303.70

Operating Costs

Mining (USDM) (336.17) (637.91)

Water Management (USDM) (4.25) (17.56)

Processing Plant (USDM) (208.09) (299.94)

Tailings (USDM) (2.13) (3.14)

G&A (USDM) (45.00) (60.00)

EMP (USDM) (8.56) (11.41)

Sub-total (USDM) (604.19) (1,029.96)

Royalty (USDM) (81.17) (138.22)

Total Operating Costs (USDM) (685.36) (1,168.18)

(USD/t RoM) 64.45 74.40

EBITDA and Tax

EBITDA (USDM) 667.45 1,135.52

Corporate Income

Tax (USDM) (144.87) (226.79)

Cashflow from Operations (USDM) 522.57 908.73

Capital Expenditure

Mining (USDM) (40.52) (252.65)

Water Management (USDM) (8.08) (19.16)

Processing Plant (USDM) (66.05) (72.14)

TSF (USDM) (24.85) (31.17)

Infrastructure (USDM) (10.85) (10.85)

Closure (USDM) (13.69) (14.83)

Other (USDM) (7.70) (7.80)

Contingency (USDM) (15.00) (19.68)

Total Capital Expenditure (USDM) (186.75) (428.28)

Results

Net Free Cashflow (USDM) 335.83 480.45

NPV (5%) (USDM) 235.95 312.55

IRR (%) 48.2% 43.2%

Payback year (undiscounted) (Prod year) Year 1 Year 1

All-in Sustaining

Costs (USD/oz) 813 958

All-in Costs (USD/oz) 990 1,067

----------------------------- ------------- ----------- ------------

Table 2: Sensitivity of Economic Outputs to Gold Price at 5%

discount rate

The NPV and IRR results at a 5% discount rate for the project

for both scenarios are presented in Table 2 for gold selling prices

between US$1,200 and US$2,200 per oz gold.

Gold Price Scenario A Scenario B

(US$/oz)

----------- --------------------- ---------------------

NPV (US$M) IRR (%) NPV (US$M) IRR (%)

----------- ----------- -------- ----------- --------

1,200 80.85 21.7% 62.91 14.1%

----------- -------- ----------- --------

1,300 125.31 29.9% 134.68 23.3%

----------- -------- ----------- --------

1,400 169.60 37.5% 206.40 31.6%

----------- -------- ----------- --------

1,500 213.84 44.7% 277.19 39.4%

----------- -------- ----------- --------

1,600 258.05 51.7% 347.63 46.9%

----------- -------- ----------- --------

1,700 301.99 58.4% 417.77 54.1%

----------- -------- ----------- --------

1,800 345.78 65.0% 487.92 61.0%

----------- -------- ----------- --------

1,900 389.57 71.4% 558.06 67.7%

----------- -------- ----------- --------

2,000 433.35 77.6% 628.21 74.2%

----------- -------- ----------- --------

2,100 477.14 83.7% 698.35 80.6%

----------- -------- ----------- --------

2,200 520.92 89.7% 768.50 86.8%

----------- -------- ----------- --------

The NPV results at discount rates between 0 and 15% for the

project for both scenarios are presented in Table 3 based on a gold

selling price of 1550 US$/oz.

Table 3: Sensitivity of NPV at range of Discount Rates at a gold

selling price of 1550 US$/oz

Discount Rate Scenario A Scenario B

NPV (US$M) NPV (US$M)

0% 335.83 480.45

----------- -----------

5% 235.95 312.55

----------- -----------

8% 191.61 243.06

----------- -----------

10% 166.91 205.86

----------- -----------

15% 118.13 135.99

----------- -----------

Table 4: Mineral Resource Estimate, Effective date 25 January

2019

SRK MINERAL RESOURCE STATEMENT as of January 2019 (4),(5),(6)

Category Area Name Vein Name Cut-Off gold silver

----------- -------------- ----------- ----------- ------------------------ --------------

Tonnes Au Au Ag Ag

(kt) Grade (koz) Grade (koz)

(g/t) (g/t) (7)

----------- -------------- ----------- ----------- ------- ------- ------ ------ ------

0.5g/t

Indicated Grand total All veins (OP) (1) 8,583 3.3 902 5.6 1,535

----------- -------------- ------- ------- ------ ------ ------

2.0 g/t

(UG) (2) 1,267 5.8 238 8.5 345

------- ------- ------ ------ ------

Subtotal Indicated 9,850 3.6 1,140 5.9 1,880

------------------------ ------- ------- ------ ------ ------

0.5g/t

Inferred Grand total All veins (OP) (1) 3,014 3.0 290 6.0 341

----------- -------------- ------- ------- ------ ------ ------

2.0 g/t

(UG) (2) 3,714 5.1 609 9.6 860

------- ------- ------ ------ ------

1.5 g/t

(3) 1,751 5.0 280

-------------------------------------------------- ------- ------- ------ ------ ------

Subtotal Inferred 8,479 4.3 1,179 8.2 1,201

------------------------ ------- ------- ------ ------ ------

(1) The La India, America, Central Breccia, Mestiza and

Cacao pits are amenable to open pit mining and the Mineral

Resource Estimates are constrained within Whittle optimised

pits, which SRK based on the following parameters: A gold

price of USD1,500 per ounce of gold with no adjustments.

Prices are based on experience gained from other SRK Projects.

Metallurgical recovery assumptions are between 91-96% for

gold, based on testwork conducted to date. Marginal costs

of USD19.36/t for processing, USD5.69/t G&A and USD2.35/t

for mining, slope angles defined by the Company Geotechnical

study which range from angle 40 - 48deg, a haul cost of

USD1.25/t was added to the Mestiza ore tonnes to consider

transportation to the processing plant.

-----------------------------------------------------------------------------------------------

(2) Underground Mineral Resources beneath the open pit

are reported at a cut-off grade of 2.0 g/t Au over a minimum

width of 1.0 m. Cut-off grades are based on a price of

USD1,500 per ounce of gold and gold recoveries of 91% for

resources, costs of USD19.36/t for processing, USD4.5/t

G&A and USD50.0/t for mining, without considering revenues

from other metals.

-----------------------------------------------------------------------------------------------

(3) Mineral Resources as previously quoted by SRK (22 December

2011) are reported at a cut-off grade of 1.5 g/t Au and

have not been updated as part of the current study due

to no further detailed exploration.

-----------------------------------------------------------------------------------------------

(4) Mineral Resources are not Ore Reserves and do not have

demonstrated economic viability. All figures are rounded

to reflect the relative accuracy of the estimate and have

been used to derive sub-totals, totals and weighted averages.

Such calculations inherently involve a degree of rounding

and consequently introduce a margin of error. Where these

occur, SRK does not consider them to be material. All composites

have been capped where appropriate. The Concession is wholly

owned by and exploration is operated by Condor Gold plc

-----------------------------------------------------------------------------------------------

(5) The reporting standard adopted for the reporting of

the MRE uses the terminology, definitions and guidelines

given in the Canadian Institute of Mining, Metallurgy and

Petroleum (CIM) Standards on Mineral Resources and Mineral

Reserves (May 2014) as required by NI 43-101.

-----------------------------------------------------------------------------------------------

(6) SRK Completed a site inspection to the deposit by Mr

Benjamin Parsons, MSc (MAusIMM(CP)), Membership Number

222568, an appropriate "independent qualified person" as

this term is defined in National Instrument 43-101.

-----------------------------------------------------------------------------------------------

(7) Back calculated Inferred silver grade based on a total

tonnage of 4569 Kt as no silver estimates for Teresa, Central

Breccia, Arizona, Agua Caliente, Guapinol, San Lucas, Cristalito-Tatescame

or El Cacao.

-----------------------------------------------------------------------------------------------

Both Scenario A and Scenario B consider open pit mining from the

four deposits: La India, America, Mestiza, and CBZ, where Scenario

B incorporates a greater milling capacity to accommodate feed from

the envisaged underground ("UG") mining operations at La India,

Mestiza and America.

The PEA open pit studies have incorporated optimised pit

designs, including the 2014 PFS level geotechnical pit angles, haul

roads and ramps (designed pits) that have focused on maximising

access to mineralised material and the opportunity to maintain the

grade profile and stockpiling.

The La India project site is expected to be run as a

conventional drill, blast, load and haul operation. Table 4

presents the open pit mineral inventory that supports both

Scenarios A and B.

Table 5: Open Pit PEA Inventory

Deposit Total Waste Mill Feed* Mill Feed Strip Ratio

Au

(Mt) (Mt) (Mt) (g/t) (t:t)

--------- ------------------------- ------- ---------- --------- -----------

La India 87.96 79.62 8.34 2.56 9.5

Mestiza 13.76 13.26 0.50 5.37 26.6

America 22.17 21.29 0.88 4.20 24.3

CBZ 5.09 4.17 0.92 1.89 4.5

Total 128.98 118.34 10.63 2.77 11.1

--------- ------------------------- ------- ---------- --------- -----------

The main UG mining method selected for all deposits is

mechanized cut and fill ("MCF") with unconsolidated rockfill. Where

the vein is much narrower than the required operating width of the

smallest available load, haul, dump machine ("LHD"), SRK has

considered the application of using MCF with resuing. The scope of

the UG mining assessment for the present study is limited to

scoping level work to exploit the La India, Mestiza and America

deposits, clipped below the open pit designs with appropriate

considerations for the geotechnical design considerations. Table 5

presents the UG mineral inventory that is incorporated into

Scenario B.

Table 6: Underground PEA Inventory

Deposit Mill Feed* Mill Feed Au

(Mt) (g/t)

--------- ------------------------------ ------------

La India 2.76 4.30

Mestiza 1.03 3.88

America 1.28 3.57

Total 5.07 4.03

--------- ------------------------------ ------------

The open pit operating cost estimates have been developed based

on two contractor quotes for the La India mine received from Esinsa

and Explotec in January 2019 and November 2017, respectively.

Additional mine owner costs have been developed by SRK based on

SRK's internal cost database and the Infomine cost database. In

order to match the level of selectivity required for the mining

approach proposed for America and Mestiza an additional grade

control cost element was included. SRK has updated the high-level

benchmarking exercise completed in 2014 to compare the Project with

existing UG operations of similar scale. A separate cost estimate

has been benchmarked for each UG mine.

All open pit mining is to be undertaken by a mining contractor,

and hence no capital expenditure is to be expected. Allowances for

mobilisation and demobilisation have been incorporated. The UG

capital cost estimate for each mine has been developed based on

previous work, SRK's internal cost database and the Infomine cost

database. Most of the capital cost for UG mining is the capital

development consisting of ramps, levels, ventilation raises, and

infrastructure.

The Project area is subject to intense rainfall events and a

river currently flows through the proposed La India pit footprint.

As such, mitigating the effects of the river is a significant

consideration with respect to the viability of the Project. The PEA

has considered the hydrology and surface water management,

groundwater and dewatering requirements, and the site wide water

balance. The water management plans and designs have been aligned

with the updated pit designs, pit development, and incorporation of

the UG workings in the case of Scenario B.

Metallurgical studies were originally conducted on master

composites and variability composites in 2013, formulated from

drill core from the La India and America, Mestiza and Central

Breccia vein sets. During 2019, confirmatory metallurgical studies

were conducted on test composites from La India, America and

Mestiza vein sets. The 2019 metallurgical program included

confirmatory comminution testwork and whole-ore cyanidation

testwork using optimized process conditions.

An 805,000 tpa process plant was designed by Lycopodium as part

of Condor's 2014 PFS for the La India stand-alone project. The

process plant included conventional unit operations that are

standard to the industry which include: primary crushing,

semi-autogenous (SAG) mill grinding, carbon-in-leach (CIL)

cyanidation, carbon elution, electrowinning, refining and final

tailings detoxification. The process plant was designed on the

basis of an ore that is clean, of high hardness, and extremely high

abrasion.

This technical study update has considered two alternative

process development scenarios. The process design criteria and

flowsheets for each scenario are identical to those developed for

the 2014 La India PFS. Scenario A includes the construction of a

1.225 Mtpa process plant and Scenario B includes the construction

of a 1.400 Mtpa process plant.

Process operating costs have been developed according to

industry standards applicable to a gold processing plant producing

doré. The 2014 PFS Opex estimate was used as the Base-case for

developing operating cost estimates for the two process development

scenarios. SRK has estimated the process plant capital expenditure

for Scenario A and Scenario B based on Lycopodium's 2014 capital

estimate by first escalating to 2020 by applying the Mine Cost

Services ("MCS") average mill capital expenditure indices. The

escalated plant capital was then adjusted for the plant capacities

in each scenario using a 0.6 exponent in a capacity versus capital

expenditure relationship.

The proposed site of the Tailings Storage Facility ("TSF")

remains the same as the previous studies 2014 PFS, to the east of

the main highway, and is consistent with the location included in

the latest ESIA documentation for the Project. The TSF includes

dams at the western and eastern ends of the valley to form the

impoundment void. The dams are constructed from waste rock derived

from the mining operation, which are sequentially raised in a

'downstream' manor in-line with tailings production. The

impoundment is proposed to be fully lined with HDPE to minimise

seepage of contact water to the receiving environment. The

scenarios reflect total tailings storage capacity of 7.6 Mm(3) and

11.2 Mm(3) for Scenario A and B, respectively.

Capital expenditure and operating costs have been derived on an

individual discipline basis. Overall accuracy of the cost estimates

is deemed to be +/-40-50%, in line with expectations from a PEA

level of study.

The Technical Report reflects a Preliminary Economic Assessment

("PEA") and partially utilises Inferred Mineral Resources. Inferred

Mineral Resources are considered too speculative, geologically, to

have the economic considerations applied to them that would enable

them to be categorized as Mineral Reserves and there is no

certainty that the PEA will be realized. Mineral Resources that are

not Mineral Reserves do not have demonstrated economic

viability.

Reporting Standards

The reporting standard adopted for the reporting of the Mineral

Resource Estimate ("MRE") uses the terminology, definitions and

guidelines given in the Canadian Institute of Mining, Metallurgy

and Petroleum ("CIM") Standards on Mineral Resources and Mineral

Reserves (May 2014) as required by NI 43-101 ("The CIM Code"). The

CIM Code is an internationally recognised reporting code as defined

by the Combined Reserves International Reporting Standards

Committee.

The 2021 PEA Technical Report will be issued within 45 days of

the public disclosure in accordance with the public disclosure to

NI 43-101 standards.

- Ends -

For further information please visit www.condorgold.com or

contact:

Condor Gold plc Mark Child, Chairman and CEO

+44 (0) 20 7493 2784

Beaumont Cornish Limited Roland Cornish and James Biddle

+44 (0) 20 7628 3396

SP Angel Corporate Finance Ewan Leggat

LLP +44 (0) 20 3470 0470

H&P Advisory Limited Andrew Chubb and Nilesh Patel

+44 207 907 8500

Blytheweigh Tim Blythe and Megan Ray

+44 (0) 20 7138 3204

About Condor Gold plc:

Condor Gold plc was admitted to AIM in May 2006 and dual listed

on the TSX in January 2018. The Company is a gold exploration and

development company with a focus on Nicaragua.

In August 2018, the Company announced that the Ministry of the

Environment in Nicaragua had granted the Environmental Permit

("EP") for the development, construction and operation of a

processing plant with capacity to process up to 2,800 tonnes per

day at its wholly-owned La India gold project ("La India Project").

The EP is considered the master permit for mining operations in

Nicaragua.

La India Project contains a Mineral Resource of 9,850 Kt at 3.6

g/t gold for 1.14 M oz gold in the Indicated category and 8,479 Kt

at 4.3 g/t gold for 1.18 M oz gold in the Inferred category. A gold

price of $1,500/oz and a cut-off grade of 0.5 g/t and 2.0 g/t gold

were assumed for open pit and underground resources, respectively.

A cut-off grade of 1.5 g/t gold was furthermore applied within a

part of the Inferred Resource. Mineral Resources are not Mineral

Reserves and do not have demonstrated economic viability. There is

no certainty that any part of the Mineral Resources will be

converted to Mineral Reserves.

Environmental Permits were granted in April and May 2020 for the

Mestiza and America open pits respectively, both located close to

La India. The Mestiza open pit hosts 92 Kt at a grade of 12.1 g/t

gold (36,000 oz contained gold) in the Indicated Mineral Resource

category and 341 Kt at a grade of 7.7 g/t gold (85,000 oz contained

gold) in the Inferred Mineral Resource category . The America open

pit hosts 114 Kt at a grade of 8.1 g/t gold (30,000 oz) in the

Indicated Mineral Resource category and 677 Kt at a grade of 3.1

g/t gold (67,000 oz) in the Inferred Mineral Resource category.

Following the permitting of the Mestiza and America open pits,

together with the La India open pit Condor has 1.12 M oz gold open

pit Mineral Resources permitted for extraction.

Disclaimer

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

Qualified Persons

The Mineral Resource Estimate has been completed by Ben Parsons,

a Principal Consultant (Resource Geology) with SRK Consulting

(U.S.) Inc, who is a Member of the Australian Institute of Mining

and Metallurgy, MAusIMM(CP). He has some nineteen years' experience

in the exploration, definition and mining of precious and base

metals. Ben Parsons is a full-time employee of SRK Consulting

(U.S.), Inc, an independent consultancy, and has sufficient

experience which is relevant to the style of mineralisation and

type of deposit under consideration, and to the type of activity

which he is undertaking to qualify as a "qualified person" as

defined under National Instrument 43-101 - Standards of Disclosure

for Mineral Projects ("NI 43-101") of the Canadian Securities

Administrators and as required by the June 2009 Edition of the AIM

Note for Mining and Oil & Gas Companies. Ben Parsons consents

to the inclusion in the announcement of the matters based on their

information in the form and context in which it appears and

confirms that this information is accurate and not false or

misleading.

The Qualified Persons responsible for the Technical Report are

Dr Tim Lucks of SRK Consulting (UK) Limited, and Mr Fernando

Rodrigues, Mr Stephen Taylor and Mr Ben Parsons of SRK Consulting

(U.S.) Inc. Mr Parsons assumes responsibility for the MRE, Mr

Rodrigues the open pit mining aspects, Mr Taylor the underground

mining aspects and Dr Lucks for the oversight of the remaining

technical disciplines and compilation of the report.

The technical and scientific information in this press release

has been reviewed, verified and approved by Gerald D. Crawford,

P.E., who is a "qualified person" as defined by NI 43-101 and is

the Chief Technical Officer of Condor Gold plc.

The technical and scientific information in this press release

has been reviewed, verified and approved by Andrew Cheatle, P.Geo.,

who is a "qualified person" as defined by NI 43-101.

Forward Looking Statements

All statements in this press release, other than statements of

historical fact, are 'forward-looking information' with respect to

the Company within the meaning of applicable securities laws,

including statements with respect to: the ongoing mining dilution

and pit optimisation studies, and the incorporation of same into

any mining production schedule, future development and production

plans at La India Project. Forward-looking information is often,

but not always, identified by the use of words such as: "seek",

"anticipate", "plan", "continue", "strategies", "estimate",

"expect", "project", "predict", "potential", "targeting",

"intends", "believe", "potential", "could", "might", "will" and

similar expressions. Forward-looking information is not a guarantee

of future performance and is based upon a number of estimates and

assumptions of management at the date the statements are made

including, among others, assumptions regarding: future commodity

prices and royalty regimes; availability of skilled labour; timing

and amount of capital expenditures; future currency exchange and

interest rates; the impact of increasing competition; general

conditions in economic and financial markets; availability of

drilling and related equipment; effects of regulation by

governmental agencies; the receipt of required permits; royalty

rates; future tax rates; future operating costs; availability of

future sources of funding; ability to obtain financing and

assumptions underlying estimates related to adjusted funds from

operations. Many assumptions are based on factors and events that

are not within the control of the Company and there is no assurance

they will prove to be correct.

Such forward-looking information involves known and unknown

risks, which may cause the actual results to be materially

different from any future results expressed or implied by such

forward-looking information, including, risks related to: mineral

exploration, development and operating risks; estimation of

mineralisation and resources; environmental, health and safety

regulations of the resource industry; competitive conditions;

operational risks; liquidity and financing risks; funding risk;

exploration costs; uninsurable risks; conflicts of interest; risks

of operating in Nicaragua; government policy changes; ownership

risks; permitting and licencing risks; artisanal miners and

community relations; difficulty in enforcement of judgments; market

conditions; stress in the global economy; current global financial

condition; exchange rate and currency risks; commodity prices;

reliance on key personnel; dilution risk; payment of dividends; as

well as those factors discussed under the heading "Risk Factors" in

the Company's annual information form for the fiscal year ended

December 31, 2020 dated March 31, 2021 and available under the

Company's SEDAR profile at www.sedar.com .

Although the Company has attempted to identify important factors

that could cause actual actions, events or results to differ

materially from those described in forward-looking information,

there may be other factors that cause actions, events or results

not to be as anticipated, estimated or intended. There can be no

assurance that such information will prove to be accurate as actual

results and future events could differ materially from those

anticipated in such statements. The Company disclaims any intention

or obligation to update or revise any forward-looking information,

whether as a result of new information, future events or otherwise

unless required by law.

Technical Glossary

Assay The laboratory test conducted to determine the proportion

of a mineral within a rock or other material. Usually

reported as parts per million which is equivalent

to grams of the mineral (i.e. gold) per tonne of rock

Ag Silver

--------------------------------------------------------------

Au Gold

--------------------------------------------------------------

Breccia A fragmental rock, composed of rounded to angular

broken rock fragments held together by a mineral cement

or in a fine-grained matrix. They can be formed by

igneous, tectonic, sedimentary or hydrothermal processes.

--------------------------------------------------------------

Down-dip Further down towards the deepest parts of an ore body

or zone of mineralisation.

--------------------------------------------------------------

Grade The proportion of a mineral within a rock or other

material. For gold mineralisation this is usually

reported as grams of gold per tonne of rock (g/t)

--------------------------------------------------------------

g/t grams per tonne

--------------------------------------------------------------

HDPE High Density Polyethylene - a common industrial plastic

used in piping and tailings pond lining material

--------------------------------------------------------------

Indicated Mineral That part of a Mineral Resource for which tonnage,

Resource densities, shape, physical characteristics, grade

and mineral content can be estimated with a reasonable

level of confidence. It is based on exploration, sampling

and testing information gathered through appropriate

techniques from locations such as outcrops, trenches,

pits, workings and drill holes. The locations are

too widely or inappropriately spaced to confirm geological

and/or grade continuity but are spaced closely enough

for continuity to be assumed.

--------------------------------------------------------------

Inferred Mineral That part of a Mineral Resource for which tonnage,

Resource grade and mineral content can be estimated with a

low level of confidence. It is inferred from geological

evidence and assumed but not verified geological and/or

grade continuity. It is based on information gathered

through appropriate techniques from locations such

as outcrops, trenches, pits, workings and drill holes

that may be limited, or of uncertain quality and reliability,

--------------------------------------------------------------

IRR The Internal Rate of Return (IRR) is the discount

rate that makes the net present value (NPV) of a project

zero. In other words, it is the expected compound

annual rate of return that will be earned on a project

or investment

--------------------------------------------------------------

Kt Thousand tonnes

--------------------------------------------------------------

LHD Load-Haul-Dump - a front-end loader designed for underground

operations

--------------------------------------------------------------

MCF Mechanized Cut and Fill - An underground mining method

employing heavy machinery for selective mining of

vein-type deposits. Post-mining voids are backfilled

with waste to improve ground stability.

--------------------------------------------------------------

MCS Mining Cost Service - a publication of current mine

equipment pricing and inflation indices

--------------------------------------------------------------

Mineral Resource A concentration or occurrence of material of economic

Estimate interest in or on the Earth's crust in such a form,

quality, and quantity that there are reasonable and

realistic prospects for eventual economic extraction.

The location, quantity, grade, continuity and other

geological characteristics of a Mineral Resource are

known, estimated from specific geological knowledge,

or interpreted from a well constrained and portrayed

geological model.

--------------------------------------------------------------

NI 43-101 Canadian National Instrument 43-101 a common standard

for reporting of identified mineral resources and

ore reserves

--------------------------------------------------------------

NPV Net Present Value (NPV) is the value of all future

cash flows (positive and negative) over the entire

life of an investment discounted to the present. NPV

analysis is a form of intrinsic valuation and is used

extensively across finance and accounting for determining

the value of a business, investment security, capital

project, new venture, cost reduction program, and

anything that involves cash flow . It is after deducting

the upfront capital cost

--------------------------------------------------------------

Open pit mining A method of extracting minerals from the earth by

excavating downwards from the surface such that the

ore is extracted in the open air (as opposed to underground

mining).

--------------------------------------------------------------

Payback Period The Payback Period shows how long it takes for a business

to recoup an investment

--------------------------------------------------------------

Resuing A selective mining technique that removes waste surrounding

an ore zone prior to mining the ore to minimize dilution

--------------------------------------------------------------

Strike length The longest horizontal dimension of an ore body or

zone of mineralisation.

--------------------------------------------------------------

Strip Ratio A common metric for open pit mining calculated as

waste tonnes divided by ore tonnes. Higher stripping

ratios indicate that more waste mining is required

per tonne of ore.

--------------------------------------------------------------

Vein A sheet-like body of crystallised minerals within

a rock, generally forming in a discontinuity or crack

between two rock masses. Economic concentrations of

gold are often contained within vein minerals.

--------------------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAKNPEAFFEFA

(END) Dow Jones Newswires

September 09, 2021 02:00 ET (06:00 GMT)

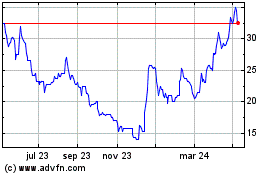

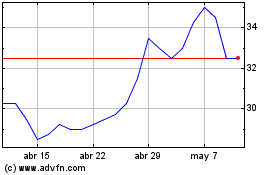

Condor Gold (LSE:CNR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Condor Gold (LSE:CNR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024