TIDMELLA

RNS Number : 2951N

Ecclesiastical Insurance Office PLC

28 September 2021

2021 INTERIM RESULTS

Ecclesiastical Insurance Office plc 28 September 2021

Ecclesiastical Insurance Office plc ("Ecclesiastical"), the

specialist financial services group, today announces its 2021

interim results. A copy of the results will be available on the

Company's website at www.ecclesiastical.com

Group overview

-- Profit before tax of GBP46.5m (H1 2020: loss before tax

GBP59.7m), primarily driven by investment returns as a result of

improving market conditions.

-- Gross Written Premiums (GWP) grew 12% to GBP226.5m (H1 2020:

GBP202.5m) , supported by strong retention and rate increases as

well as new business wins.

-- Underwriting profit of GBP2.5m (H1 2020: loss of GBP1.3m).

The overall underwriting result was impacted by a strengthening of

reserves in our Australian business.

-- We remained in a robust and strong capital position with AM

Best and S&P affirming our excellent and strong ratings.

-- We continued to prioritise the wellbeing of our colleagues

and in June, we were awarded Best Companies' 2 star accreditation

demonstrating 'outstanding' levels of employee engagement.

-- Continued external recognition of the Group as a trusted and

specialist financial services organisation. This included being

named as the UK's most trusted home insurer for the 13th time by

independent ratings agency Fairer Finance, and our Canadian team

was named one of the Top Employers for Young People for the ninth

consecutive year. Ecclesiastical UK won Digital Insurance

Innovation of the Year Award at the British Insurance Awards for

Smart Properties, while EdenTree was named Best Ethical Investment

Provider at the 2021 Investment Life and Pensions Moneyfacts Awards

for the 13th time.

Mark Hews, Group Chief Executive Officer of Ecclesiastical,

said:

"After a challenging year in 2020 due to the impact of the

COVID-19 pandemic, I'm delighted that the Group has made an

excellent start to 2021 and reports a profit before tax of GBP46.5m

(H1 2020: loss before tax GBP59.7m). Our decision to hold to our

long-term investment strategy was validated as financial markets

recovered from the lows of last year, helping us to deliver

impressive investment returns and outperform the indices for most

asset classes. We remain in a robust and strong capital position

with AM Best and S&P affirming our excellent and strong

ratings.

"In the UK and Canada, our GI businesses have reported robust

growth due to rate increases, solid retention and new business. In

Australia, we have strengthened our reserving following a rise in

historic liability claims in the first half of the year. This has

resulted in an overall underwriting performance of GBP2.5m (H1

2020: underwriting loss GBP1.3m).

"Increasing investor confidence saw strong inflows of money into

our award-winning investment management business EdenTree.

Bolstered by new recruits, EdenTree maintained its reputation as

one of the leading responsible and sustainable investment firms

with the launch of three new funds in July.

"With an ambition to grow our business to give more to those in

need, the Group has remained committed to supporting charities and

communities throughout the pandemic and we're proposing to make a

donation to our charitable owner in the weeks ahead . We launched

our third annual Movement for Good awards, which will see us give

GBP1m to charities across the UK and Ireland. On behalf of all our

charitable beneficiaries, I would like to thank all those who

continue to support the Group's work.

"The first half of 2021 continued to be a challenging period for

our colleagues and customers due to the ongoing pandemic

restrictions. I'm proud of the way our teams across the business

have continued to show great resilience and adaptability to deliver

for our customers, brokers and communities. For the first time in

May, we ran the b-Heard survey to give colleagues an opportunity to

have their say on working at Ecclesiastical. I'm delighted that we

were awarded Best Companies' 2 star accreditation demonstrating

'outstanding' levels of employee engagement. As we return to a more

normal way of life, we will continue to prioritise the health,

safety and wellbeing of our employees as we embrace new and more

flexible ways of working.

"The easing of restrictions and the improving economic

conditions are helping many of our customers recover from the

financial impact of successive lockdowns and we are settling the

small number of business interruption claims, where cover exists,

as quickly as possible.

"We continue to make good progress against our strategic

priorities. We launched a new visual identity for the

Ecclesiastical Insurance brand and opened our head office in

Gloucestershire, which is now welcoming colleagues with flexible

ways of working. We are also continuing to invest in new systems to

improve our efficiency and enhance the customer experience.

"As a responsible insurer, we are not only supporting and

protecting customers, but we are also building our climate change

commitments for the long-term too. We've been members of voluntary

initiative ClimateWise for a number of years, and have established

a climate strategy group that is considering how we can best

respond to the climate crisis. Already, as part of our strategy we

have committed to managing our portfolio of investments in a

responsible and sustainable way. In January of this year, we

adopted a new investment strategy that not only avoids investment

in businesses that cause social harm but also proactively seeks to

invest in markets that have positive impacts, as well as

considering environmental, social and governance factors in every

investment case.

"Another way we support our climate change commitments is by

helping our customers reduce their impact through our risk

management advice and guidance. We recently launched our

Ecclesiastical Smart Properties proposition, which uses

cutting-edge technology to protect properties. This technology not

only protects customers from fires and escape of water, but can

also help to save money and reduce the building's carbon footprint

as well.

"Looking ahead, I'm excited about the future of the business. In

the UK, we are investing significantly and have the appetite and

capacity to grow across all the sectors we operate in, with an

ambition to be the first choice for brokers placing business in our

specialist markets. By growing our business and generating profits

to donate to charity, we are fulfilling our purpose as an

organisation committed to the greater good of society."

Results summary

H1 2021 H1 2020

Gross written premiums GBP226.5m GBP202.5m

Group underwriting profit/(loss)* GBP2.5m (GBP1.3m)

Group combined operating ratio* 98.1% 101.1%

Investment return/(losses) GBP58.2m (GBP48.9m)

Profit/(loss) before tax GBP46.5m (GBP59.7m)

30 June 2021 31 Dec 2020

Net asset value GBP621m GBP569m

Solvency II capital cover (solo) 224% 197%

*The Group uses APMs to help explain performance. More

information on APMs is included in note 16.

Financial highlights

General Insurance - UK and Ireland

UK and Ireland GWP grew by 7% to GBP143m in the six months to 30

June 2021 (H1 2020: GBP134m). This has been driven by rate growth

and new business, particularly across education and our regions.

The business reported an underwriting profit of GBP15.3m and a net

combined ratio of 81.5% (H1 2020: GBP2.7m profit, COR 96.7%)

representing the strong performance in both property and casualty

accounts.

The property result benefited from relatively benign weather

conditions, despite some storm and freeze events earlier in the

year. Our liability business has continued to perform well into

2021 with prior year claims broadly as expected and a current year

claims experience similar to last year.

General Insurance - Canada

The Canadian business has reported GWP of GBP32.4m (H1 2020:

GBP28.3m), delivering premium growth of 15.1% in local currency,

driven by high retention and rate strengthening.

Adverse development of prior year liability claims has resulted

in a small underwriting loss of GBP0.4m (H1 2020: GBP0.1m profit)

and a COR of 101.5% (H1 2020: 99.9%). However, benign weather in

2021 has led to good returns in the property portfolio, helping to

offset the adverse development of prior year liability claims.

General Insurance - Australia

Our Australian business continues to be successful in generating

new business and strengthening rate, with premium growth of 21.9%

in local currency leading to reported GWP of GBP49.6m (H1 2020:

GBP38.3m).

The business reported an underwriting loss of GBP3.9m (H1 2020:

GBP2.1m). The result was impacted by the Western Australia

bushfires and New South Wales storms, as well as strengthening of

historic liability claims.

Investment Returns

Our Investment portfolio has performed exceptionally well in the

first half of the year, with the markets bouncing back from 2020

where worldwide markets were impacted by COVID-19. The Group's net

investment return was a profit of GBP58.2m (H1 2020: GBP48.9m loss)

predominantly driven by unrealised fair value gains as markets

returned to close to pre-pandemic levels together with a change to

valuation inputs for some unlisted equities. Income from financial

assets was GBP14.2m (H1 2020: GBP16.8m) reflecting the continued

low interest rate environment and downwards pressure on yields.

We discount some of our liability claims reserves at a rate that

reflects the yield on long-term investment grade bonds. The

reserves relate to liability policies, written over many decades,

and represent very long-tail risks. The movement in yields from the

year end resulted in a gain of GBP7.6m in the first six months of

the year.

As economic reopening continues after the dual headwinds from

the pandemic and Brexit, this has continued to be beneficial for

our investment return. We continue to take a long-term view of risk

and our approach to the management of risks resulting from the

Group's exposure to financial markets is outlined in note 4 to our

latest annual report.

Asset Management - EdenTree

In our investment management business, EdenTree, fee income grew

by 9.8% to GBP6.8m (H1 2020: GBP6.2m) reflecting positive market

movements and new flows. As expected, our emphasis on the continued

investment in the business and people contributed to a loss of

GBP1.2m (H1 2020: GBP0.2m) . EdenTree were pleased to report net

new money for funds not held by the Group of GBP46.8m.

Broking and Advisory - SEIB Insurance Brokers

Despite the competitive market, SEIB has continued to perform

well and reported a half year profit before tax of GBP1.7m (H1

2020: GBP1.4m). SEIB general commission and fees, excluding profit

share commission, has increased by 17.0% in the first half of the

year to GBP5.6m (H1 2020: GBP4.8m) as a result of new business.

Life Business

Our life insurance business, reported a profit before tax of

GBP0.7m at the half year (H1 2020: GBP0.2m loss). Assets and

liabilities are well matched, though we expect small variances as

the margins in reserves unwind.

Taxation

The Group's taxation charge in the period of GBP18.1m (H1 2020:

GBP8.3m credit) is principally due to deferred tax charges from a

change in the carrying value of the Group's pension obligations and

as a result of the UK corporation tax rate changing to 25% from 1

April 2023 and its impact on the calculation of deferred tax

liabilities.

Balance Sheet and Capital Position

Total shareholders' equity increased by GBP51.6m to GBP620.8m in

the first six months of the year. Profits in the period were

primarily driven by the investment return. There were also

actuarial gains, net of tax of GBP28.2m, on retirement benefit

plans. In February 2021 the Group raised EUR 30m in nominal amount

of Tier 2 Capital by way of a privately-placed issue of 20-year

subordinated bonds.

Strategic highlights

Despite the challenges of the pandemic, the Group continued to

focus on its ambition to become the most trusted and ethical

specialist financial services group. Our charitable purpose remains

at the core of our Group, offering distinctive positioning and

support for our customers and our communities. This is evident in

our strategy which was adapted in mid-2020 to respond to the

challenges faced by customers, brokers and wider society as a

result of the pandemic.

We have continued to invest in our Group and people to drive

business benefit and enable charitable giving to our communities.

This is underpinned by our resilience and financial strength that

support our trusted and ethical approach which is central to our

strategy. Our current strategy is based on three themes, which

encompass our longer-term ambitions, our short term priorities and

our response to the pandemic.

Support and protect: the first strategic theme seeks to support

and protect our customers, communities and our colleagues. This is

a key focus area given the backdrop of the pandemic and provides a

range of commercial and business activities that support our

customers and our core purpose. This theme also focuses on our

people, our teams and their well-being.

Innovate and grow: the world around us has changed over the past

few decades and the needs of our customers and communities continue

to change as part of this evolution. The Group continues to

innovate to find new ways to meet the changing needs of our

customers and communities. We have been building new propositions,

including new product launches in our risk management and loss

prevention solutions which support our growth ambitions. Together

these propositions also deepen understanding of our portfolio which

drive underwriting actions and improve profitability as well as

improving outcomes for our customers.

Transform and thrive: the third strategic theme focuses on

investment in our Group, helping our businesses to transform and

thrive by investing in new technology, our people and our premises.

Our new head office building enables flexible ways of working and

highlights our drive to provide opportunities to increase our

efficiency across the Group. Some of our investment spans several

years, particularly the development of our new strategic platform

for the UK & Ireland general insurance businesses. This new

platform will provide improved processes and capacity, enabling an

enhanced experience for our customers and broker partners.

The Group continues to evolve and its Next Chapter strategy is

expected to be launched shortly. This refreshed strategy builds on

our existing strategy and will consider some exciting new

opportunities for the Group. It supports our ambitions to give even

more to those in need and will enable us to continue our support

for charities and communities in all our geographies.

Principal Risks and Uncertainties

The principal risks and uncertainties faced by the Group and our

approach to managing them are outlined in our latest annual report

and in note 4 to these condensed financial statements. There has

been no change to the principal risks and uncertainties since the

year end.

Group Outlook

In the first half of the year we have seen a strong performance

in our investment result, reflecting the economic reopening seen

since the start of the year. We recognise that whilst there has

been a strong rebound there remains economic uncertainty and this

has the potential to create short-term volatility. The Group

remains well placed to withstand such potential future volatility

and continues to take a long-term view of risk. Throughout the

pandemic the Group has proven to be both operationally and

financially resilient and expects this to continue.

As restrictions in the UK gradually ease we are optimistic about

the opportunities to continue to grow and evolve our business. We

continue to invest in our people and technology, streamlining our

processes and providing a more agile and responsive service for our

customers and brokers.

Owned by a charity, Ecclesiastical is a commercial business with

a purely charitable purpose. Core to our purpose is to deliver

strong and sustainable returns to our ultimate shareholder, and to

benefit not only our customers but also the wider communities we

serve. Our third Movement for Good awards are currently underway

and we will grant a further GBP500,000 to 10 charities during the

second half of the year. We will also make a donation to our

charitable owner in the weeks ahead.

Despite the challenges we face, we will continue to pursue our

long-term charitable objective and fulfil our purpose as an

organisation committed to the greater good of society.

By order of the Board

Mark Hews

Group Chief Executive

28 September 2021

CONSOLIDATED INTERIM FINANCIAL STATEMENTS

CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS

For the 6 months to 30 June 2021

30.06.21 30.06.20 31.12.20

6 months 6 months 12 months

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

Revenue

Gross written premiums 226,529 202,487 437,299

Outward reinsurance premiums (97,571) (80,313) (173,074)

Net change in provision for unearned premium 2,444 (980) (16,562)

Net earned premiums 131,402 121,194 247,663

------------ ------------ ----------

Fee and commission income 37,275 33,444 69,582

Other operating income 1,000 1,960 2,126

Net investment return 58,177 (48,859) (4,298)

Total revenue 227,854 107,739 315,073

------------ ------------ ----------

Expenses

Claims and change in insurance liabilities (151,188) (139,152) (222,794)

Reinsurance recoveries 77,711 68,104 94,581

Fees, commissions and other acquisition costs (45,211) (38,826) (85,444)

Other operating and administrative expenses (61,613) (57,319) (116,393)

Total operating expenses (180,301) (167,193) (330,050)

------------ ------------ ----------

Operating profit/(loss) 47,553 (59,454) (14,977)

Finance costs (1,090) (258) (769)

Profit/(loss) before tax 46,463 (59,712) (15,746)

Tax (expense)/credit (18,050) 8,275 526

------------ ------------ ----------

Profit/(loss) for the financial period from

continuing operations attributable to equity

holders of the Parent 28,413 (51,437) (15,220)

------------ ------------ ----------

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the 6 months to 30 June 2021

30.06.21 30.06.20 31.12.20

6 months 6 months 12 months

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

Profit/(loss) for the period 28,413 (51,437) (15,220)

------------ ------------ ----------

Other comprehensive expense

Items that will not be reclassified subsequently

to profit or loss:

Fair value losses on property - - (15)

Actuarial gains/(losses) on retirement benefit

plans 35,510 (15,433) (17,318)

Attributable tax (7,314) 3,100 3,521

28,196 (12,333) (13,812)

Items that may be reclassified subsequently

to profit or loss:

(Losses)/gains on currency translation differences (1,491) 2,283 1,980

Gains/(losses) on net investment hedges 1,258 (2,653) (2,339)

Attributable tax (183) 367 265

(416) (3) (94)

------------ ------------ ----------

Other comprehensive income/(expense) 27,780 (12,336) (13,906)

------------ ------------ ----------

Total comprehensive income/(expense) attributable

to equity holders of the Parent 56,193 (63,773) (29,126)

------------ ------------ ----------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the 6 months to 30 June 2021

Translation

Share Share Revaluation and hedging Retained

capital premium reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

2021 (Unaudited)

At 1 January 120,477 4,632 599 18,230 425,290 569,228

Profit for the period - - - - 28,413 28,413

Other net (expense)/income - - (21) (416) 28,217 27,780

--------- -------- ------------ ------------ ---------- ----------

Total comprehensive

(expense)/income - - (21) (416) 56,630 56,193

Dividends on preference

shares - - - - (4,591) (4,591)

Reserve transfers - - (313) - 313 -

At 30 June 120,477 4,632 265 17,814 477,642 620,830

--------- -------- ------------ ------------ ---------- ----------

2020 (Unaudited)

At 1 January 120,477 4,632 565 18,324 463,537 607,535

Loss for the period - - - - (51,437) (51,437)

Other net expense - - (14) (3) (12,319) (12,336)

--------- -------- ------------ ------------ ---------- ----------

Total comprehensive

expense - - (14) (3) (67,756) (63,773)

Dividends on preference

shares - - - - (4,591) (4,591)

At 30 June 120,477 4,632 551 18,321 395,190 539,171

--------- -------- ------------ ------------ ---------- ----------

2020 (Audited)

At 1 January 120,477 4,632 565 18,324 463,537 607,535

Loss for the year - - - - (15,220) (15,220)

Other net income/(expense) - - 34 (94) (13,846) (13,906)

--------- -------- ------------ ------------ ---------- ----------

Total comprehensive

income/(expense) - - 34 (94) (29,066) (29,126)

Dividends on preference

shares - - - - (9,181) (9,181)

At 31 December 120,477 4,632 599 18,230 425,290 569,228

--------- -------- ------------ ------------ ---------- ----------

The revaluation reserve represents cumulative net fair value

gains on owner-occupied property. Further details of the

translation and hedging reserve are included in note 11.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 30 June 2021

30.06.21 30.06.20 31.12.20

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

Assets

Goodwill and other intangible assets 59,277 46,197 54,353

Deferred acquisition costs 42,082 39,075 41,989

Deferred tax assets 3,028 2,973 1,078

Pension assets 25,241 - 1,053

Property, plant and equipment 37,973 18,487 38,316

Investment property 146,266 143,331 142,142

Financial investments 847,561 779,619 820,777

Reinsurers' share of contract liabilities 258,464 210,079 208,677

Current tax recoverable 7,981 7,322 7,986

Other assets 252,836 226,651 216,570

Cash and cash equivalents 108,148 94,574 104,429

Total assets 1,788,857 1,568,308 1,637,370

------------ ------------ -----------

Equity

Share capital 120,477 120,477 120,477

Share premium account 4,632 4,632 4,632

Retained earnings and other reserves 495,721 414,062 444,119

Total shareholders' equity 620,830 539,171 569,228

------------ ------------ -----------

Liabilities

Insurance contract liabilities 921,131 855,630 868,649

Lease obligations 24,319 11,688 25,450

Provisions for other liabilities 9,350 7,424 6,499

Pension liabilities - 7,226 10,406

Retirement benefit obligations 6,283 6,166 6,530

Deferred tax liabilities 54,641 24,569 29,846

Current tax liabilities 104 1,005 1,293

Deferred income 26,867 24,217 25,908

Subordinated liabilities 24,981 - -

Other liabilities 100,351 91,212 93,561

Total liabilities 1,168,027 1,029,137 1,068,142

------------ ------------ -----------

Total shareholders' equity and liabilities 1,788,857 1,568,308 1,637,370

------------ ------------ -----------

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

For the 6 months to 30 June 2021

30.06.21 30.06.20 31.12.20

6 months 6 months 12 months

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

Profit/(loss) before tax 46,463 (59,712) (15,746)

Adjustments for:

Depreciation of property, plant and equipment 3,128 2,511 5,486

Revaluation of property, plant and equipment - - (10)

Loss on disposal of property, plant and equipment 28 - 172

Amortisation of intangible assets 413 477 1,468

Net fair value (gains)/losses on financial

instruments and investment property (34,285) 54,641 18,602

Dividend and interest income (9,733) (12,080) (21,814)

Finance costs 1,090 258 769

Adjustment for pension funding 713 455 1,003

7,817 (13,450) (10,070)

Changes in operating assets and liabilities:

Net increase in insurance contract liabilities 58,895 78,161 94,180

Net increase in reinsurers' share of contract

liabilities (52,761) (45,280) (45,101)

Net increase in deferred acquisition costs (317) (152) (3,352)

Net increase in other assets (37,376) (44,557) (35,369)

Net increase in operating liabilities 9,452 7,142 16,642

Net increase in other liabilities 2,778 2,562 1,298

Cash (used)/generated by operations (11,512) (15,574) 18,228

Purchases of financial instruments and investment

property (60,478) (36,735) (121,754)

Sale of financial instruments and investment

property 62,504 76,313 151,531

Dividends received 2,929 3,940 6,255

Interest received 6,689 7,170 14,519

Tax paid (4,042) (2,076) (2,756)

Net cash (used by)/from operating activities (3,910) 33,038 66,023

------------ ------------ ----------

Cash flows from investing activities

Purchases of property, plant and equipment (3,380) (405) (6,028)

Proceeds from the sale of property, plant

and equipment 27 - 1

Acquisition of business, net of cash acquired - - (822)

Purchases of intangible assets (5,557) (7,813) (15,602)

Proceeds from the sale of intangible assets 62 - -

Net cash used by investing activities (8,848) (8,218) (22,451)

------------ ------------ ----------

Cash flows from financing activities

Interest paid (1,090) (258) (769)

Payment of principal element of lease liabilities (1,560) (1,455) (5,090)

Proceeds from issue of subordinate debt, net 25,014 - -

of expenses

Dividends paid to Company's shareholders (4,591) (4,591) (9,181)

Net cash from/(used by) financing activities 17,773 (6,304) (15,040)

------------ ------------ ----------

Net increase in cash and cash equivalents 5,015 18,516 28,532

Cash and cash equivalents at the beginning

of the period 104,429 74,775 74,775

Exchange (losses)/gains on cash and cash equivalents (1,296) 1,283 1,122

Cash and cash equivalents at the end of the

period 108,148 94,574 104,429

------------ ------------ ----------

NOTES TO THE CONDENSED SET OF FINANCIAL STATEMENTS

1. General information and basis of preparation

Ecclesiastical Insurance Office plc (hereafter referred to as

the "Company"), a public limited company incorporated and domiciled

in England, together with its subsidiaries (collectively the

"Group") operates principally as a provider of general insurance

and in addition offers a range of financial services, with offices

in the UK & Ireland, Australia and Canada.

The annual financial statements are prepared in accordance with

International Financial Reporting Standards (IFRSs) applicable at

31 December 2020 issued by the International Accounting Standards

Board (IASB) in conformity with the requirements of the Companies

Act 2006 and pursuant to Regulation (EC) No 1606/2002 as it applies

in the European Union (EU). The condensed set of financial

statements included in the 2021 interim results has been prepared

in accordance with UK adopted IAS 34, Interim Financial

Reporting.

The information for the year ended 31 December 2020 does not

constitute statutory accounts as defined in section 434 of the

Companies Act 2006. A copy of the statutory accounts for that year

has been delivered to the Registrar of Companies. The auditor

reported on those accounts: its report was unqualified, did not

draw attention to any matters by way of emphasis without qualifying

the report, and did not contain a statement under section 498(2) or

(3) of the Companies Act 2006.

These condensed consolidated interim financial statements were

approved by the Board on 28 September 2021 and were reviewed by the

Group's statutory auditor but not audited.

The Directors have assessed the going concern status of the

Group. The Directors have considered the Group's plans and

forecasts, financial resources, investment portfolio and solvency

position. The Directors have also had consideration of the possible

challenging market conditions due to the impact of the COVID-19

pandemic on the economy, pricing and customers. The Group's

forecasts and projections, taking into account plausible scenarios,

show that the group will have adequate resources to continue

operating over a period of at least 12 months from the approval of

the condensed consolidated interim financial statements.

Accordingly, the Directors continue to adopt the going concern

basis in preparing the consolidated interim financial

statements.

2. Accounting policies

The same accounting policies and methods of computation are

followed in the consolidated interim financial statements as

applied in the Group's latest audited annual financial

statements.

The following standards were in issue but not yet effective and

have not been applied to these condensed financial statements.

IFRS 17, Insurance Contracts, was issued in May 2017 and is

effective for periods beginning on or after 1 January 2023. The

standard establishes revised principles for the recognition,

measurement, presentation and disclosure of insurance contracts.

The Group's long-term business is expected to be the most affected

by the new standard. The Group expects to be able to use the

simplified premium allocation approach to the majority of its

general business insurance contracts, which applies mainly to

short-duration contracts.

IFRS 9, Financial Instruments, which provides a new model for

the classification and measurement of financial instruments, is

effective for periods beginning on or after 1 January 2018. The

Group has taken the option available to insurers to defer the

application of IFRS 9 until the implementation of IFRS 17, which is

now on or after 1 January 2023.

The Group continues to assess the impact of the application of

both IFRS 17 and IFRS 9. As of 30 June 2021, it was not practicable

to quantify what the potential impact would be on the Group's

financial position or performance once these standards are

adopted.

Other standards in issue but not yet effective are not expected

to materially impact the Group.

3. Critical accounting estimates and judgements

In preparing these interim financial statements and applying the

Group's accounting policies, the Directors have made judgements and

estimates based on their best knowledge of current circumstances

and expectation of future events. The judgements made in applying

the Group's accounting policies and the key sources of estimation

uncertainty were the same as those that applied to the 31 December

2020 consolidated financial statements. In 2020, the COVID-19

global pandemic had a significant impact on market conditions and

the business. Estimates and their underlying assumptions continue

to be reviewed on an ongoing basis with revisions to estimates

being recognised prospectively. There have been no significant

changes since 31 December 2020, however, as the pandemic continues,

the following areas are those where specific consideration

continues to be given:

- Valuation of insurance contract liabilities: the assumptions

used in the estimated ultimate cost of all claims incurred but not

settled include any suitable adjustments for the potential impact

of COVID-19.

- Measurement of pension liabilities: although COVID-19 has

impacted on the key assumptions in the valuation, the methodology

used to determine key actuarial assumptions has remained

consistent. A 0.6% increase in the discount rate, partially offset

by a 0.3% increase in the inflation assumption at 30 June 2021,

resulted in a net pension asset of GBP25.2m (31 December 2020: net

pension liability of GBP9.4m).

- Valuation of investment properties: the emergence of COVID-19

increased the uncertainty surrounding the valuation of properties,

leading to the valuation of investment properties to be considered

a critical accounting estimate at 31 December 2020. The carrying

value of investment properties has been updated as at 30 June 2021

and a gain of GBP3.1m (H1 2020: loss of GBP4.8m) has been

recognised.

4. Risk management

The principal risks and uncertainties, together with details of

the financial risk management objectives and policies of the Group,

are disclosed in the latest annual report.

5. Segment information

The Group segments its business activities on the basis of

differences in the products and services offered and, for general

insurance, the underwriting territory. Expenses relating to Group

management activities are included within 'Corporate costs'. This

reflects the management and internal Group reporting structure.

The activities of each operating segment are described

below.

- General business

United Kingdom and Ireland

The Group's principal general insurance business operation is in the UK, where it operates

under the Ecclesiastical and Ansvar brands. The Group also operates an Ecclesiastical branch

in the Republic of Ireland underwriting general business across the whole of Ireland.

Australia

The Group has a wholly-owned subsidiary in Australia underwriting general insurance business

under the Ansvar brand.

Canada

The Group operates a general insurance Ecclesiastical branch in Canada.

Other insurance operations

This includes the Group's internal reinsurance function and operations that are in run-off

or not reportable due to their immateriality.

- Investment management

The Group provides investment management services both internally and to third parties through

EdenTree Investment Management Limited.

- Broking and Advisory

The Group provides insurance broking through SEIB Insurance Brokers Limited and financial

advisory services through Ecclesiastical Financial Advisory Services Limited.

- Life business

Ecclesiastical Life Limited provides long-term policies to support funeral planning products.

- Corporate costs

This includes costs associated with Group management activities.

Inter-segment and inter-territory transfers or transactions are

entered into under normal commercial terms and conditions that

would also be available to unrelated third parties.

Segment revenue

The Group uses gross written premiums as the measure for

turnover of the general and life insurance business segments.

Turnover of the non-insurance segments comprises fees and

commissions earned in relation to services provided by the Group to

third parties. Segment revenues do not include net investment

return or general business fee and commission income, which are

reported within revenue in the consolidated statement of profit or

loss.

Revenue is attributed to the geographical region in which the

customer is based.

6 months ended 6 months ended

30.06.21 30.06.20

Gross Non- Gross Non-

written insurance written insurance

premiums services Total premiums services Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

General business

United Kingdom and

Ireland 142,751 - 142,751 133,735 - 133,735

Australia 49,594 - 49,594 38,263 - 38,263

Canada 32,399 - 32,399 28,255 - 28,255

Other insurance operations 1,784 - 1,784 2,225 - 2,225

Total 226,528 - 226,528 202,478 - 202,478

Life business 1 - 1 9 - 9

Investment management - 6,848 6,848 - 6,238 6,238

Broking and Advisory - 5,624 5,624 - 4,556 4,556

--------- ---------- --------- --------- ---------- ---------

Group revenue 226,529 12,472 239,001 202,487 10,794 213,281

--------- ---------- --------- --------- ---------- ---------

12 months ended

31.12.20

Gross Non-

written insurance

premiums services Total

GBP000 GBP000 GBP000

General business

United Kingdom and

Ireland 276,618 - 276,618

Australia 80,178 - 80,178

Canada 75,953 - 75,953

Other insurance operations 4,538 - 4,538

Total 437,287 - 437,287

Life business 12 - 12

Investment management - 12,382 12,382

Broking and Advisory - 9,458 9,458

--------- ---------- ---------

Group revenue 437,299 21,840 459,139

--------- ---------- ---------

Segment result

General business segment results comprise the insurance

underwriting profit or loss, investment activities and other

expenses of each underwriting territory. The Group uses the

industry standard net combined operating ratio (COR) as a measure

of underwriting efficiency. The COR expresses the total of net

claims costs, commission and underwriting expenses as a percentage

of net earned premiums. Further details on the underwriting profit

or loss and COR, which are alternative performance measures that

are not defined under IFRS, are detailed in note 16.

The life business segment result comprises the profit or loss on

insurance contracts (including return on assets backing liabilities

in the long-term fund), shareholder investment return and other

expenses.

All other segment results consist of the profit or loss before

tax measured in accordance with IFRS.

6 months ended Combined

30 June 2021 operating Insurance Investments Other Total

ratio GBP000 GBP000 GBP000 GBP000

General business

United Kingdom and Ireland 81.5% 15,349 51,179 (952) 65,576

Australia 180.5% (3,929) 104 (19) (3,844)

Canada 101.5% (446) 349 (80) (177)

Other insurance operations (8,466) - - (8,466)

---------- ------------ --------- ---------

98.1% 2,508 51,632 (1,051) 53,089

Life business 719 3,108 - 3,827

Investment management - - (1,249) (1,249)

Broking and Advisory - - 1,681 1,681

Corporate costs - - (10,885) (10,885)

Profit/(loss) before tax 3,227 54,740 (11,504) 46,463

---------- ------------ --------- ---------

6 months ended Combined

30 June 2020 operating Insurance Investments Other Total

ratio GBP000 GBP000 GBP000 GBP000

General business

United Kingdom and Ireland 96.7% 2,680 (48,701) (108) (46,129)

Australia 115.8% (2,054) (213) (16) (2,283)

Canada 99.9% 24 2,037 (91) 1,970

Other insurance operations (1,964) - - (1,964)

---------- ------------ --------- ---------

101.1% (1,314) (46,877) (215) (48,406)

Life business (233) (3,031) - (3,264)

Investment management - - (200) (200)

Broking and Advisory - - 1,373 1,373

Corporate costs - - (9,215) (9,215)

Loss before tax (1,547) (49,908) (8,257) (59,712)

---------- ------------ --------- ---------

12 months ended Combined

31 December 2020 operating Insurance Investments Other Total

ratio GBP000 GBP000 GBP000 GBP000

General business

United Kingdom and Ireland 92.5% 12,254 (12,123) (479) (348)

Australia 102.2% (620) 1,678 (31) 1,027

Canada 91.2% 4,521 3,003 (176) 7,348

Other insurance operations (4,103) - - (4,103)

---------- ------------ --------- ---------

95.1% 12,052 (7,442) (686) 3,924

Life business 468 29 - 497

Investment management - - (1,031) (1,031)

Broking and Advisory - - 2,397 2,397

Corporate costs - - (21,533) (21,533)

Profit/(loss) before tax 12,520 (7,413) (20,853) (15,746)

---------- ------------ --------- ---------

6. Tax

Income tax for the six month period is calculated at rates

representing the best estimate of the average annual effective

income tax rate expected for the full year, applied to the pre-tax

result of the six month period.

7. Preference shares

Interim dividends paid on the 8.625% Non-Cumulative Irredeemable

Preference shares amounted to GBP4.6m (H1 2020: GBP4.6m). At the

point these dividends were paid, consideration was given to the

distributable reserves and capital position.

8. Financial investments

Financial investments summarised by measurement category are as

follows:

30.06.21 30.06.20 31.12.20

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

Financial investments at fair value through

profit or loss

Equity securities

- listed 280,270 238,225 262,598

- unlisted 68,499 47,544 59,288

Debt securities

- government bonds 165,705 152,142 160,381

- listed 330,016 331,195 334,732

- unlisted 551 270 552

Derivative financial instruments

- options 790 4,388 1,407

- forwards 628 - 672

846,459 773,764 819,630

Financial investments at fair value through

other comprehensive income

Derivative financial instruments

- forwards 475 - 401

Total financial investments at fair value 846,934 773,764 820,031

Loans and receivables

Cash held on deposit - 5,032 -

Other loans 627 823 746

Total financial investments 847,561 779,619 820,777

------------ ------------ ----------

9. Financial instruments' held at fair value disclosures

IAS 34 requires that interim financial statements include

certain of the disclosures about the fair value of financial

instruments set out in IFRS 13, Fair Value Measurement and IFRS 7,

Financial Instruments Disclosures.

The fair value measurement basis used to value those financial

assets and financial liabilities held at fair value is categorised

into a fair value hierarchy as follows:

Level 1: fair values measured using quoted prices (unadjusted)

in active markets for identical assets or liabilities. This

category includes listed equities in active markets, listed debt

securities in active markets and exchange-traded derivatives.

Level 2: fair values measured using inputs other than quoted

prices included within level 1 that are observable for the asset or

liability, either directly (i.e. as prices) or indirectly (i.e.

derived from prices). This category includes listed debt or equity

securities in a market that is not active and derivatives that are

not exchange-traded.

Level 3: fair values measured using inputs for the asset or

liability that are not based on observable market data

(unobservable inputs). This category includes unlisted debt and

equities, including investments in venture capital, and suspended

securities. Where a look-through valuation approach is applied,

underlying net asset values are sourced from the investee,

translated into the Group's functional currency and adjusted to

reflect current market conditions.

There have been no transfers between investment categories in

the current period.

Fair value measurement

at the

end of the reporting period

based on

--------------------------------

Level 1 Level Level Total

2 3

30 June 2021 GBP000 GBP000 GBP000 GBP000

Financial assets at fair value through

profit or loss

Financial investments

Equity securities 279,688 183 68,898 348,769

Debt securities 494,253 1,467 551 496,271

Derivative securities - 1,418 - 1,418

773,941 3,068 69,449 846,458

Financial assets at fair value through

other comprehensive income

Financial assets

Derivative securities - 475 - 475

Total financial assets at fair value 773,941 3,543 69,449 846,933

----------- --------- -------- ---------

30 June 2020

Financial assets at fair value through

profit or loss

Financial investments

Equity securities 237,620 205 47,944 285,769

Debt securities 482,307 898 402 483,607

Derivative securities - 4,388 - 4,388

----------- --------- -------- ---------

Total financial assets at fair value 719,927 5,491 48,346 773,764

----------- --------- -------- ---------

Financial liabilities at fair value

through profit or loss

Financial liabilities

Derivative securities - (3,327) - (3,327)

Financial liabilities at fair value

through other comprehensive income

Other liabilities

Derivative securities - (3,194) - (3,194)

Total financial liabilities at fair

value - (6,521) - (6,521)

----------- --------- -------- ---------

31 December 2020

Financial assets at fair value through

profit or loss

Financial investments

Equity securities 262,014 185 59,687 321,886

Debt securities 493,601 1,512 552 495,665

Derivative securities - 2,079 - 2,079

755,615 3,776 60,239 819,630

Financial assets at fair value through

other comprehensive income

Financial assets

Derivative securities - 401 - 401

----------- --------- -------- ---------

Total financial assets at fair value 755,615 4,177 60,239 820,031

----------- --------- -------- ---------

The derivative liabilities of the Group at the end of the

current period and prior year were measured at fair value through

profit or loss and categorised as level 2.

Fair value measurements in level 3 consist of financial assets,

analysed as follows:

Financial assets at fair

value

through profit or loss

-----------------------------------

Equity Debt

securities securities Total

GBP000 GBP000 GBP000

2021

At 1 January 59,688 551 60,239

Total gains/(losses) recognised in profit

or loss 9,210 - 9,210

At 30 June 68,898 551 69,449

----------- ----------- ---------

Total gains for the period included in profit

or loss for assets held at the end of the

reporting period 9,210 - 9,210

----------- ----------- ---------

2020

At 1 January 66,703 404 67,107

Total losses recognised in profit or loss (18,759) (2) (18,761)

At 30 June 47,944 402 48,346

----------- ----------- ---------

Total gains/(losses) for the period included

in profit or loss for assets held at the end

of the reporting period (18,759) (2) 18,761

----------- ----------- ---------

2020

At 1 January 66,703 404 67,107

Total (losses)/gains recognised in profit

or loss (7,015) 147 (6,868)

At 31 December 59,688 551 60,239

----------- ----------- ---------

Total (losses)/gains for the period included

in profit or loss for assets held at the end

of the reporting period (7,015) 147 (6,868)

----------- ----------- ---------

All the above gains included in profit or loss for the period

are presented in net investment return within the statement of

profit or loss.

The valuation techniques used for instruments categorised in

Levels 2 and 3 are described below.

Listed debt and equity securities not in active market (Level

2)

These financial assets are valued using third party pricing

information that is regularly reviewed and internally calibrated

based on management's knowledge of the markets.

Non exchange-traded derivative contracts (Level 2)

The Group's derivative contracts are not traded in active

markets. Foreign currency forward contracts are valued using

observable forward exchange rates corresponding to the maturity of

the contract and the contract forward rate. Over-the-counter equity

or index options and futures are valued by reference to observable

index prices.

Unlisted equity securities (Level 3)

These financial assets are valued using observable net asset

data, adjusted for unobservable inputs including comparable

price-to-book ratios based on similar listed companies, and

management's consideration of constituents as to what exit price

might be obtainable.

The valuation is sensitive to the level of underlying net

assets, the Euro exchange rate, the price-to-book ratio chosen, an

illiquidity discount and a credit rating discount applied to the

valuation to account for the risks associated with holding the

asset. If the illiquidity discount or credit rating discount

applied changes by +/-10%, the value of unlisted equity securities

could move by +/-GBP8m (H1 2020: +/-GBP5m).

Unlisted debt (Level 3)

Unlisted debt is valued using an adjusted net asset method

whereby management uses a look-through approach to the underlying

assets supporting the loan, discounted using observable market

interest rates of similar loans with similar risk, and allowing for

unobservable future transaction costs.

The valuation is most sensitive to the level of underlying net

assets, but it is also sensitive to the interest rate used for

discounting and the projected date of disposal of the asset, with

the exit costs sensitive to an expected return on capital of any

purchaser and estimated transaction costs. Reasonably likely

changes in unobservable inputs used in the valuation would not have

a significant impact on shareholders' equity or the net result.

10. Changes in estimates

The estimation of the ultimate liability arising from claims

made under general insurance business contracts is a critical

accounting estimate. There are various sources of uncertainty as to

how much the Group will ultimately pay with respect to such

contracts. There is uncertainty as to the total number of claims

made on each class of business, the amounts that such claims will

be settled for and the timing of any payments.

During the six month period, changes to claims reserve estimates

made in prior years as a result of reserve development resulted in

a net increase of GBP20.0m (H1 2020: GBP10.8m) partially offset by

a GBP7.6m decrease (H1 2020: GBP6.5m increase) in reserves due to

discount rate movements.

The estimation of the ultimate liability arising from claims

made under life insurance business contracts is also a critical

accounting estimate. Estimates are made as to the expected number

of deaths in each future year until claims have been paid on all

policies, as well as expected future real investment returns from

assets backing life insurance contracts. During the six month

period there was a GBP2.1m decrease (H1 2020: GBP4.5m increase) in

reserves due to discount rate movements.

11. Translation and hedging reserve

Translation Hedging

reserve reserve Total

GBP000 GBP000 GBP000

2021

At 1 January 15,552 2,678 18,230

Losses on currency translation differences (1,491) - (1,491)

Gains on net investment hedges - 1,258 1,258

Attributable tax - (183) (183)

At 30 June 14,061 3,753 17,814

------------ -------- --------

2020

At 1 January 13,572 4,752 18,324

Gains on currency translation differences 2,283 - 2,283

Losses on net investment hedges - (2,653) (2,653)

Attributable tax - 367 367

At 30 June 15,855 2,466 18,321

------------ -------- --------

2020

At 1 January 13,572 4,752 18,324

Gains on currency translation differences 1,980 - 1,980

Losses on net investment hedges - (2,339) (2,339)

Attributable tax - 265 265

At 31 December 15,552 2,678 18,230

------------ -------- --------

The translation reserve arises on consolidation of the Group's

foreign operations. The hedging reserve represents the cumulative

amount of gains and losses on hedging instruments in respect of net

investments in foreign operations.

12. Insurance contract liabilities and reinsurers' share of

contract liabilities

30.06.21 30.06.20 31.12.20

6 months 6 months 12 months

GBP000 GBP000 GBP000

Gross

Claims outstanding 614,960 565,121 560,992

Unearned premiums 233,808 210,916 230,800

Life business provision 72,363 79,593 76,857

Total gross insurance contract liabilities 921,131 855,630 868,649

--------- --------- ----------

Recoverable from reinsurers

Claims outstanding 173,042 135,565 129,284

Unearned premiums 85,422 74,514 79,393

Total reinsurers' share of contract liabilities 258,464 210,079 208,677

--------- --------- ----------

Net

Claims outstanding 441,918 429,556 431,708

Unearned premiums 148,386 136,402 151,407

Life business provision 72,363 79,593 76,857

Total net insurance liabilities 662,667 645,551 659,972

--------- --------- ----------

13. Subordinated debt

In February 2021 the Group raised EUR 30m in nominal amount of

Tier 2 Capital by way of a privately-placed issue of 20-year

subordinated bonds, callable after year 10. The rate of interest

until the call date is fixed at 6.3144%.

14. Related party transactions

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation.

Charitable grants to the ultimate parent company are disclosed

in the condensed consolidated statement of changes in equity.

There have been no material related party transactions in the

period or changes thereto since the latest annual report which

require disclosure.

15. Holding company

The ultimate holding company is Allchurches Trust Limited, a

company limited by guarantee and a registered charity incorporated

in England and Wales.

16. Reconciliation of Alternative Performance Measures

The Group uses alternative performance measures (APM) in

addition to the figures which are prepared in accordance with IFRS.

The financial measures in our key financial performance data

include the combined operating ratio (COR). This measure is

commonly used in the industries we operate in and we believe it

provides useful information and enhances the understanding of our

results.

Users of the accounts should be aware that similarly titled APM

reported by other companies may be calculated differently. For that

reason, the comparability of APM across companies might be

limited.

In line with the European Securities and Markets Authority

guidelines, we provide a reconciliation of the combined operating

ratio to its most directly reconcilable line item in the financial

statements.

30.06.21

Broking

Invt. Invt. and Corporate

Insurance return mngt Advisory costs Total

-------------------

General Life

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Gross written premiums 226,528 1 - - - - 226,529

Outward reinsurance premiums (97,571) - - - - - (97,571)

Net change in provision

for unearned premiums 2,444 - - - - - 2,444

Net earned premiums [1] 131,401 1 - - - - 131,402

---------- ------- -------- -------- --------- ---------- ----------

Fee and commission income 24,803 - - 6,848 5,624 - 37,275

Other operating income 1,000 - - - - - 1,000

Net investment return - 1,528 56,276 (5) 378 - 58,177

Total revenue 157,204 1,529 56,276 6,843 6,002 - 227,854

---------- ------- -------- -------- --------- ---------- ----------

Expenses

Claims and change in insurance

liabilities (150,545) (643) - - - - (151,188)

Reinsurance recoveries 77,711 - - - - - 77,711

Fees, commissions and other

acquisition costs (45,027) - - (481) 297 - (45,211)

Other operating and administrative

expenses (36,835) (167) (1,536) (7,611) (4,579) (10,885) (61,613)

Total operating expenses (154,696) (810) (1,536) (8,092) (4,282) (10,885) (180,301)

---------- ------- -------- -------- --------- ---------- ----------

Operating profit/(loss) [2] 2,508 719 54,740 (1,249) 1,720 (10,885) 47,553

Finance costs (1,051) - - - (39) - (1,090)

---------- ------- -------- -------- --------- ---------- ----------

Profit/(loss) before tax 1,457 719 54,740 (1,249) 1,681 (10,885) 46,463

---------- ------- -------- -------- --------- ---------- ----------

Underwriting profit [2] 2,508

Combined operating ratio

( = ( [1] - [2] ) / [1]

) 98.1%

The underwriting profit of the Group is defined as the operating

profit of the general insurance business.

The Group uses the industry standard net combined operating

ratio as a measure of underwriting efficiency. The COR expresses

the total of net claims costs, commission and underwriting expenses

as a percentage of net earned premiums. It is calculated as

( [1] - [2] ) / [1].

30.06.20

Broking

Invt. Invt. and Corporate

Insurance return mngt Advisory costs Total

-------------------

General Life

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Gross written premiums 202,478 9 - - - - 202,487

Outward reinsurance premiums (80,313) - - - - - (80,313)

Net change in provision

for unearned premiums (980) - - - - - (980)

Net earned premiums [1] 121,185 9 - - - - 121,194

---------- ------- --------- -------- ------------- -------- -----------

Fee and commission income 22,650 - - 6,238 4,556 - 33,444

Other operating income 1,960 - - - - - 1,960

Net investment return - (660) (48,595) (13) 409 - (48,859)

Total revenue 145,795 (651) (48,595) 6,225 4,965 - 107,739

---------- ------- --------- -------- ------------- -------- -----------

Expenses

Claims and change in

insurance

liabilities (139,715) 563 - - - - (139,152)

Reinsurance recoveries 68,104 - - - - - 68,104

Fees, commissions and other

acquisition costs (38,448) - - (535) 157 - (38,826)

Other operating and

administrative

expenses (37,050) (145) (1,313) (5,890) (3,706) (9,215) (57,319)

Total operating expenses (147,109) 418 (1,313) (6,425) (3,549) (9,215) (167,193)

---------- ------- --------- -------- ------------- -------- -----------

Operating

(loss)/profit [2] (1,314) (233) (49,908) (200) 1,416 (9,215) (59,454)

Finance costs (215) - - - (43) - (258)

---------- ------- --------- -------- ------------- -------- -----------

(Loss)/profit before tax (1,529) (233) (49,908) (200) 1,373 (9,215) (59,712)

---------- ------- --------- -------- ------------- -------- -----------

Underwriting loss [2] (1,314)

Combined operating ratio

( = ( [1] - [2] ) / [1]

) 101.1%

31.12.20

Broking

Invt. Invt. and Corporate

Insurance return mngt Advisory costs Total

-------------------

General Life

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Gross written premiums 437,287 12 - - - - 437,299

Outward reinsurance premiums (173,074) - - - - - (173,074)

Net change in provision

for unearned premiums (16,562) - - - - - (16,562)

Net earned premiums [1] 247,651 12 - - - - 247,663

---------- ------- -------- --------- --------- ---------- ----------

Fee and commission income 47,742 - - 12,382 9,458 - 69,582

Other operating income 2,126 - - - - - 2,126

Net investment return - (484) (4,600) (25) 811 - (4,298)

Total revenue 297,519 (472) (4,600) 12,357 10,269 - 315,073

---------- ------- -------- --------- --------- ---------- ----------

Expenses

Claims and change in insurance

liabilities (224,127) 1,333 - - - - (222,794)

Reinsurance recoveries 94,581 - - - - - 94,581

Fees, commissions and other

acquisition costs (84,852) (13) - (939) 360 - (85,444)

Other operating and administrative

expenses (71,069) (380) (2,813) (12,449) (8,149) (21,533) (116,393)

Total operating expenses (285,467) 940 (2,813) (13,388) (7,789) (21,533) (330,050)

---------- ------- -------- --------- --------- ---------- ----------

Operating profit/(loss) [2] 12,052 468 (7,413) (1,031) 2,480 (21,533) (14,977)

Finance costs (686) - - - (83) - (769)

---------- ------- -------- --------- --------- ---------- ----------

Profit/(loss) before tax 11,366 468 (7,413) (1,031) 2,397 (21,533) (15,746)

---------- ------- -------- --------- --------- ---------- ----------

Underwriting profit [2] 12,052

Combined operating ratio

( = ([1] - [2]) / [1] ) 95.1%

RESPONSIBILITY STATEMENT

We confirm that to the best of our knowledge:

(a) the consolidated interim financial statements have been

prepared in accordance with UK adopted International Accounting

Standard 34, 'Interim Financial Reporting';

(b) the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

(c) the interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related party

transactions and changes therein).

The Board of Directors is as per the latest audited annual

financial statements, with the following changes:

- Mrs Rita Bajaj was appointed as a Non-Executive Director on 15 July 2021

- Mrs Caroline Taylor resigned as a Non-Executive Director on 8 September 2021

By order of the Board,

Mark Hews David Henderson

Group Chief Executive Chairman

28 September 2021

INDEPENDENT REVIEW REPORT TO ECCLESIASTICAL INSURANCE OFFICE

PLC

Report on the condensed consolidated interim financial

statements

Our conclusion

We have reviewed Ecclesiastical Insurance Office plc's condensed

consolidated interim financial statements (the "interim financial

statements") in the 2021 Interim Results of Ecclesiastical

Insurance Office plc for the 6 month period ended 30 June 2021 (the

"period").

Based on our review, nothing has come to our attention that

causes us to believe that the interim financial statements are not

prepared, in all material respects, in accordance with UK adopted

International Accounting Standard 34, 'Interim Financial Reporting'

and the Disclosure Guidance and Transparency Rules sourcebook of

the United Kingdom's Financial Conduct Authority.

What we have reviewed

The interim financial statements comprise:

-- the Condensed Consolidated Statement of Financial Position as at 30 June 2021;

-- the Condensed Consolidated Statement of Profit or Loss and

Condensed Consolidated Statement of Comprehensive Income for the

period then ended;

-- the Condensed Consolidated Statement of Cash Flows for the period then ended;

-- the Condensed Consolidated Statement of Changes in Equity for the period then ended; and

-- the explanatory notes to the interim financial statements.

The interim financial statements included in the 2021 Interim

Results of Ecclesiastical Insurance Office plc have been prepared

in accordance with UK adopted International Accounting Standard 34,

'Interim Financial Reporting' and the Disclosure Guidance and

Transparency Rules sourcebook of the United Kingdom's Financial

Conduct Authority.

Responsibilities for the interim financial statements and the

review

Our responsibilities and those of the directors

The 2021 Interim Results, including the interim financial

statements, is the responsibility of, and has been approved by the

directors. The directors are responsible for preparing the 2021

Interim Results in accordance with the Disclosure Guidance and

Transparency Rules sourcebook of the United Kingdom's Financial

Conduct Authority.

Our responsibility is to express a conclusion on the interim

financial statements in the 2021 Interim Results based on our

review. This report, including the conclusion, has been prepared

for and only for the company for the purpose of complying with the

Disclosure Guidance and Transparency Rules sourcebook of the United

Kingdom's Financial Conduct Authority and for no other purpose. We

do not, in giving this conclusion, accept or assume responsibility

for any other purpose or to any other person to whom this report is

shown or into whose hands it may come save where expressly agreed

by our prior consent in writing.

What a review of interim financial statements involves

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity' issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and,

consequently, does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

We have read the other information contained in the 2021 Interim

Results and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the interim financial statements.

PricewaterhouseCoopers LLP

Chartered Accountants

Bristol

28 September 2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KVLFLFKLXBBD

(END) Dow Jones Newswires

September 29, 2021 01:59 ET (05:59 GMT)

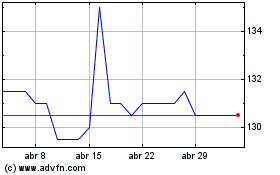

Ecclesiastl.8fe (LSE:ELLA)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Ecclesiastl.8fe (LSE:ELLA)

Gráfica de Acción Histórica

De May 2023 a May 2024