Harvest Minerals Limited Completed Expansion & Credit Financing for Clients (0742E)

03 Noviembre 2020 - 2:00AM

UK Regulatory

TIDMHMI

RNS Number : 0742E

Harvest Minerals Limited

03 November 2020

To view the announcement with the illustrative maps and diagrams

please use the following link:

http://www.rns-pdf.londonstockexchange.com/rns/0742E_1-2020-11-3.pdf

Harvest Minerals Limited / Index: LSE / Epic: HMI / Sector:

Mining

3 November 2020

Harvest Minerals Limited ('Harvest' or the 'Company')

Completed Product Storage Capacity Expansion at Arapua

Fertiliser Project

& Agreed Credit Financing Facility for KPFértil Clients

Harvest Minerals Limited, the AIM listed remineraliser producer,

is pleased to announce that it has concluded the expansion of the

Mining and Storage Areas at its 100% owned Arapua Fertiliser

Project in Brazil ('Arapua') (see RNS dated 22 September 2020).

Harvest is also pleased to announce that it has signed an agreement

with Banco do Brasil, Brazil's largest rural credit provider,

whereby the bank will provide credit lines for Harvest's clients to

fund their KPFértil orders.

Highlights:

-- Expansion work concluded and now operating on a 24-hour,

three-shift production scale to meet peak demand

o Product Storage capacity expanded by 300% or 30,000 tonnes of

product over a 6,000m(2) total storage covered area

o Mining Area increased four-fold to 78.8km(2) to provide

greater production flexibility according to demand

-- Agreement signed with Banco do Brasil, Brazil's largest rural

credit provider, allowing Harvest's clients to access to the bank's

line of credit to fund orders of KPFértil product

Brian McMaster, Chairman of Harvest, said: "We are pleased to

have completed, on time and under budget, the significant expansion

of both the Product Storage Facility and Mining Area at Arapua.

Both are key to providing us the necessary capacity and flexibility

to meet the growing demand for KPFértil and I would like to thank

our engineering and operational team for such an achievement. On

the marketing side, Harvest has secured an important agreement with

Banco do Brasil, which now has its door open to our clients for

their working capital needs, allowing them to access the bank's

rural line of credit to place their KPFértil orders with us; this

is a great marketing tool for our sales team."

Further Information:

Harvest has completed the Product Storage Facility expansion to

30,000 tonnes, a three-fold increase in finished product storage

capacity, and the Mining Area expansion to 78.8km(2) , a four-fold

increase. As detailed in previous press releases, this expansion

will allow the flexibility to increase production, dry ore and

provide additional run of mine at times of peak demand for the

Company's product.

Work completed:

-- Expansion of the Mining Area

-- Expansion of the Product Storage Area

-- Addition of Manoeuvre Area for Bigger Trucks

-- Maintenance of the Access Roads

-- Improvements at the Processing Plant

-- Infrastructure Improvements

With the completion of the expansion, Harvest is now working on

a three-shift production scale (24 hours per day) in order to meet

growing demand and delivery of products sold in the third quarter

of 2020.

Expanded Product Storage Facility (Completed in October 2020) -

see PDF for image

Expansion of the Mining Area (in m2) - see PDF for image

Agreement with Banco do Brasil

An agreement has been signed with Banco do Brasil, whereby

Harvest's clients will now be able to access the bank's rural line

of credit to fund their orders of KPFértil up to a total amount of

R$5.0 million per client (about US$1.0 million). It is expected

that with the continuous relationship with Banco do Brasil, the

size of the line of credit should increase over time.

Banco do Brasil is the country's largest provider of rural

credit to the giant Brazilian agriculture industry. The benefit of

the line of credit to Harvest is threefold: not only will it assist

the sales strategy of the Company's commercial department providing

an important marketing tool to offer clients, but it will also

provide additional working capital flexibility with a decreased

credit risk profile of its clients' portfolio.

**ENDS**

For further information, please visit www.harvestminerals.net or

contact:

Harvest Minerals Limited Brian M cMaster (Chairman) Tel: +44 (0) 203

940 6625

Strand Hanson Limited James Spinney Tel: +44 (0) 20

Nominated & Financial Ritchie Balmer 7409 3494

Adviser Jack Botros

Shard Capital Partners Damon Heath Tel: +44 (0) 20 7186 9900

Broker

St Brides Partners Charlotte Page Tel: +44 (0) 20 7236 117

Ltd Beth Melluish

Financial PR

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBJBRTMTAMMIM

(END) Dow Jones Newswires

November 03, 2020 03:00 ET (08:00 GMT)

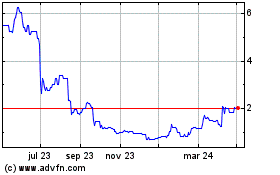

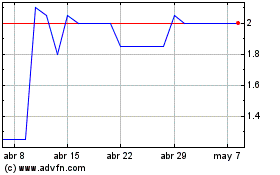

Harvest Minerals (LSE:HMI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Harvest Minerals (LSE:HMI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024