TIDMHEAD

RNS Number : 5106T

Headlam Group PLC

25 November 2021

25 November 2021

Headlam Group plc

('Headlam' or the 'Company')

Trading and ESG Update

On track to deliver profit marginally ahead of expectations

Headlam Group plc (LSE: HEAD), Europe's leading floorcoverings

distributor, is pleased to provide an update on trading, and

Environmental, Social and Governance ('ESG') actions.

Trading Update

Revenue for the year to date is tracking broadly in line with

current market expectations* which were significantly upgraded in

July 2021. A robust performance in the residential sector has

helped to offset a persisting subdued commercial sector, with other

features of the market being the ongoing industry wide supply

issues, and associated inflationary pressures, all of which the

Company has been largely able to mitigate.

Profit performance has been pleasing and reflects the previous

and ongoing actions to improve operating efficiency and margin. As

a consequence, the Company expects to deliver underlying profit

before tax for the year ending 31 December 2021 marginally ahead of

current market expectations*.

The Company will announce its Pre-Close Trading Update on 27

January 2022 ahead of announcing final results for the year ending

31 December 2021 in early March 2022.

ESG Update

Introduction

Following the publication of the Company's first ESG Strategy

Report in May 2021, which set out initial focuses and broader

ambitions in sustainability and ESG, the Company is pleased to

provide an update on its recent actions.

Through collaborating and working with its employees and

external stakeholders, the Company is focused on:

i) reducing its contribution to Greenhouse Gas ('GHG') emissions and climate change;

ii) becoming a more sustainable business, including through

cultural development and increasing oversight of ESG related risks

and opportunities; and

iii) increasing the sustainability of the overall floorcoverings

industry through engagement and example, and supporting the future

transition to a circular economy.

Environmental

GHG emissions from its transportation activities (both

commercial and non-commercial fleet) are the Company's most

material direct impact on the environment and therefore an area of

immediate focus. The Company's Transport Integration project

centred around more efficient delivery fleet utilisation has thus

far resulted in a 35 reduction in fleet number to 353.

In relation to its non-commercial fleet, the Company has this

month introduced a plug-in hybrid vehicle for drivers so that

during 2022 over 50% of the non-commercial fleet will be plug-in

hybrids. Currently there are no viable options to move the

commercial fleet to electric powered vehicles, but the Company will

continue to actively monitor the situation.

In support of promoting sustainable products into the industry

and increasing awareness by the end consumer, the Company recently

launched a sustainable 'Wool Britannia' product range, with other

launches planned as part of an ongoing campaign.

Social

The Company's current focus in this area is on improving the

support to its workforce, including through cultural development,

engagement, and review of rewards and benefits. During the last few

months, 'Values and Behaviours' and 'Leading through Change'

workshops have been rolled-out across the group, as well as

conferences and training being held on strategic projects. In

addition, enhancements to rewards and benefits are being

implemented from the beginning of 2022 along with a locally focused

community programme, which will be detailed within the 2021 Annual

Report being published in March 2022.

Governance

One of the material issues identified through consultation with

stakeholders was 'Supply Chain Risk', and it forms an area of key

near-term focus. Actions to mitigate risk in this area include the

commencement of an engagement programme with key suppliers on

industry sustainability issues, including on any changes to

regulation and potential sustainability partnerships. Additionally,

the Company has recently signed a contract with an independent

party to conduct a full Supply Chain Risk Assessment.

Disclosure, Targets and Measurement of Progress

The Board of Headlam is committed to developing the Company's

ESG Strategy, and has oversight and overall responsibility for the

ESG Strategy and performance. To provide a tool to measure

progress, KPIs and targets will be introduced for certain

environmental related and other actions within the 2021 Annual

Report which will incorporate a full form ESG Report aligned with

both the Task Force on Climate-related Financial Disclosures

('TCFD') and the Sustainability Accounting Standards Board

('SASB'). The 2021 Annual Report will also articulate the Company's

initial strategy in relation to Diversity and Inclusion.

*Company compiled consensus market expectations for 2021 revenue

and underlying profit before tax are GBP684.8 million and GBP35.0

million respectively (on a mean and post IFRS 16 adoption

basis).

Enquiries:

Headlam Group plc Tel: 01675 433 000

Chris Payne, Interim Chief Executive Email: headlamgroup@headlam.com

Catherine Miles, Director of IR

and ESG

Investec Bank plc (Corporate Broker) Tel: 020 7597 5970

David Flin / Alex Wright

Panmure Gordon (UK) Limited (Corporate Tel: 020 7886 2500

Broker)

Erik Anderson / Edward Walsh /

Ailsa MacMaster

Alma PR (Financial PR) Tel: 020 3405 0205

Susie Hudson / Harriet Jackson headlam@almapr.co.uk

/ Faye Calow

Notes for Editors:

Headlam is Europe's leading floorcoverings distributor,

providing the channel between suppliers and trade customers of

floorcoverings.

Headlam works with suppliers across the globe manufacturing a

diverse range of floorcovering products, and provides them with a

cost efficient and effective route to market for their products

into the highly fragmented customer base. Alongside long

established processing and distribution expertise, suppliers

benefit from Headlam's marketing and customer servicing into the

most extensive customer base.

To maximise customer reach, Headlam operates 66 businesses

across the UK and Continental Europe (France and the Netherlands).

Each business operates under its own trade brand and utilises

individual sales teams while being supported by the Company's

network and centralised resources.

The Company's customer base covers both the residential and

commercial sectors, with the principal customer groups being

independent retailers and smaller flooring contractors alongside

other groups such as larger retailers, housebuilders, specifiers,

and local authorities.

Headlam is focused on providing customers with a market leading

service through:

-- the broadest product offering;

-- unrivalled product knowledge and tailored solutions;

-- sales team and marketing support;

-- ecommerce support; and

-- nationwide delivery and collection service.

www.headlam.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBIBRTMTBTBMB

(END) Dow Jones Newswires

November 25, 2021 01:59 ET (06:59 GMT)

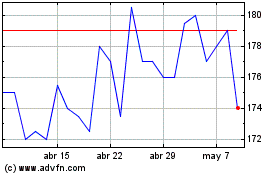

Headlam (LSE:HEAD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Headlam (LSE:HEAD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024