TIDMJUST

RNS Number : 3678I

Just Group PLC

12 August 2021

12 August 2021

Just Group plc (the "Company" or "Just")

Publication of Circular Convening a General Meeting

Introduction

As set out in the Chair's Statement in the 2020 Annual Report,

in 2019 Just embarked on a programme to adapt its business model

with a view to reducing the overall capital intensity of the

business, strengthening the headline capital position and

increasing its organic capital generation. During 2020 and

continuing into the first half of 2021, the Company has

demonstrated the success of this repositioning and has continued to

strengthen its capital position, both in terms of the Solvency II

capital coverage ratio and its overall resilience, while also

delivering an improved operating performance.

Alongside the improving headline levels of Solvency II capital,

the Board has also been monitoring the optimal capital mix in order

to provide a prudent and effective base to support Just's business

and its expected growth going forward.

Overall, the Board is comfortable with the current capital

position of the Group. Nevertheless, the Board is proposing that

Shareholders delegate to the Board additional flexibility to manage

the capital position on an ongoing basis by authorising the issue

of further Solvency II-compliant restricted tier 1 bonds,

structured as contingent convertible securities ("Restricted Tier 1

Bonds"), in addition to other forms of subordinated debt.

Accordingly, the Board wishes to seek authority from

Shareholders to issue new Restricted Tier 1 Bonds that are

convertible into ordinary shares of the Company ("Ordinary Shares")

upon the occurrence of certain trigger events ("Trigger Events").

Under the prudential rules applicable to the Group, Restricted Tier

1 Bonds must either be converted to equity or written off upon the

occurrence of certain Trigger Events. The conversion feature is

more tax and solvency capital efficient for the Group.

The circumstances in which the Restricted Tier 1 Bonds may

convert into Ordinary Shares would be limited to the occurrence of

a Trigger Event. A Trigger Event will occur if the Group

determines, in consultation with the PRA, that it has ceased to

comply with its capital requirements under Solvency II in a

significant way. This may occur if the amount of capital held by

the Group falls below 75% of its capital requirements, if the Group

fails to comply with its capital requirements for a continuous

period of three months or more or if the Group fails to comply with

other minimum capital requirements applicable to it. Only if a

Trigger Event occurs (and not under any other circumstances) will

any Restricted Tier 1 Bonds issued by the Company convert into new

Ordinary Shares. The holders of any Restricted Tier 1 Bonds would

not have the option to require conversion of the Restricted Tier 1

Bonds at their discretion.

The Board continues to monitor the Company's and the Group's

capital position, including in respect of a possible issue of

Restricted Tier 1 Bonds or other forms of subordinated debt

instruments, as part of its overall capital management. If passed,

the Board will look to exercise the authorities and powers granted

by the resolutions to be proposed at the General Meeting (as

defined below) in support of any such issue of Restricted Tier 1

Bonds.

Circular and Notice of General Meeting

Accordingly, Just has today made available to Shareholders a

circular (the "Circular") containing a notice convening, and

explaining the reasons for, a general meeting of the Company (the

"General Meeting"), which will take place at Enterprise House,

Bancroft Road, Reigate, Surrey, RH2 7RP on Tuesday, 31 August 2021

at 10:00 am.

The Circular is now available on the Company's website at

www.justgroupplc.co.uk/investors/shareholder-information. Printed

copies of the Circular together with a Form of Proxy will be posted

today to those Shareholders who have requested it.

The General Meeting is being held for the purpose of considering

and, if thought fit, passing the resolutions summarised below (the

"Resolutions"):

Resolution 1: Allotment Resolution: an ordinary resolution

seeking the approval of Shareholders to provide the Directors with

the necessary authority and power to allot Ordinary Shares and

grant rights to subscribe for or convert any security into Ordinary

Shares up to an aggregate nominal amount equal to GBP50,000,000

(representing approximately 48% of the issued Ordinary Share

Capital as at the Latest Practicable Date) in connection with any

issue(s) of Restricted Tier 1 Bonds. This authority will apply

until the end of the Company's next Annual General Meeting (or, if

earlier, at the close of business on 30 June 2022); and

Resolution 2: Disapplication Resolution : a special resolution

seeking the approval of Shareholders to confer on the Directors the

power to allot Ordinary Shares and grant rights to subscribe for or

convert any security into Ordinary Shares in connection with any

issue(s) of Restricted Tier 1 Bonds pursuant to Resolution 1

without first offering them to existing Shareholders in proportion

to their existing shareholdings. This authority will apply until

the end of the Company's next Annual General Meeting (or, if

earlier, at the close of business on 30 June 2022).

The Directors believe it is in the best interests of the Company

for the Board to have the additional flexibility to issue further

convertible Restricted Tier 1 Bonds, in addition to other forms of

subordinated debt instruments, in order to optimise its capital

structure and may use the authority sought in the Allotment

Resolution if, in the opinion of the Directors at the relevant

time, such an issuance of Restricted Tier 1 Bonds would be

desirable to improve the capital structure of the Company and

market conditions allow.

The Disapplication Resolution would permit the Company the

flexibility necessary to allot equity securities pursuant to any

proposal to issue Restricted Tier 1 Bonds without the need to

comply with the strict pre-emption requirements of the UK statutory

regime. Together with the Allotment Resolution, the Disapplication

Resolution is intended to provide the Directors with the

flexibility to issue Restricted Tier 1 Bonds which may convert into

Ordinary Shares. This will enhance the Company's ability to manage

its capital.

The explanatory letter from John Hastings-Bass, the Chair of

Just, which forms part of the Circular, provides further

information on Restricted Tier 1 Bonds and sets out the Directors'

reasoning for putting the Resolutions to Shareholders.

Recommendation

The Board considers the Resolutions to be in the best interests

of the Company and its Shareholders taken as a whole. Accordingly,

the Board unanimously recommends that Shareholders vote in favour

of both Resolutions, as the Directors intend to do in respect of

their own beneficial holdings, which amount in aggregate to

2,023,566 Ordinary Shares and represent approximately 0.19% of the

Company's issued ordinary share capital as at 9 August 2021, being

the Latest Practicable Date prior to issuing the Circular.

COVID-19

Although the UK Government has lifted the COVID-19 restrictions

as of 19 July 2021, the situation is still evolving. We are closely

monitoring the situation and if circumstances should change

materially before the date of the General Meeting, we may adapt our

proposed arrangements in accordance with UK Government guidelines

and mindful of public health concerns. If these arrangements do

change, we will notify any changes as early as possible before the

date of the General Meeting. Shareholders should continue to

monitor our website

www.justgroupplc.co.uk/investors/shareholder-information) and our

regulatory announcements for any updates in relation to the General

Meeting.

National Storage Mechanism

Copies of the Circular and Form of Proxy will be submitted to

the National Storage Mechanism and will shortly be available for

viewing at https://data.fca.org.uk/#/nsm/nationalstoragemechanism

.

Capitalised terms used in this announcement have the meanings

given to them in the Circular, which is available on the Company's

website ( www.justgroupplc.co.uk )

Enquiries

General Media

Simon Watson, Group Company Secretary Stephen Lowe, Group Communications

Telephone: +44 (0) 20 7444 8400 Director

Telephone: +44 (0) 1737 827 301

Investors / Analysts press.office@wearejust.co.uk

Alistair Smith, Head of Investor

Relations Temple Bar Advisory

Telephone: +44 (0) 1737 232 792 Alex Child-Villiers

alistair.smith@wearejust.co.uk William Barker

Telephone: +44 (0) 20 7183 1190

Paul Kelly, Investor Relations

Manager

Telephone: +44 (0) 20 7444 8127

paul.kelly@wearejust.co.uk

A copy of this announcement will be available on the Group's

website www.justgroupplc.co.uk.

JUST GROUP PLC

GROUP COMMUNICATIONS

Enterprise House

Bancroft Road, Reigate

Surrey RH2 7RP

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOGDKDBBOBKDKFD

(END) Dow Jones Newswires

August 12, 2021 02:05 ET (06:05 GMT)

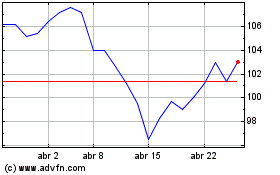

Just (LSE:JUST)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

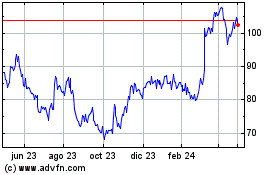

Just (LSE:JUST)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024