TIDMPPH

RNS Number : 9241C

PPHE Hotel Group Limited

24 June 2021

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014, as it

forms part of domestic law by virtue of The European Union

(Withdrawal) Act 2018.

On publication of this information such information shall be

considered to be in the public domain.

24 June 2021

PPHE Hotel Group Limited

(the "Group" or the "Company")

PPHE unlocks GBP113.7 million of equity through a joint venture

with Clal Insurance

PPHE Hotel Group, the international hospitality real estate

group which develops, owns and operates hotels and resorts, is

pleased to announce that it has agreed terms to enter into a joint

venture with Clal Insurance ("Clal"), one of Israel's leading

insurance and long-term savings companies, in respect of two of the

Group's prime London assets. PPHE will receive a cash consideration

of GBP113.7 million as part of this transaction, enabling the Group

to pursue new opportunities to accelerate growth.

Boris Ivesha, President & CEO of PPHE Hotel Group, comments:

"We are excited to partner with Clal on Park Plaza London Riverbank

and our art'otel london hoxton development, which reflects our

mutual confidence in the strength of the London hospitality real

estate market. The agreement values its assets at the Group's

latest EPRA NAV level and the proceeds will enable the Group to

pursue new growth opportunities as the pandemic period

subsides."

On completion of the transaction, Clal will become a minority

partner and owner of 49% of the shares in one joint venture company

("JVCo") holding indirectly the real estate and operations of both

the 646-room Park Plaza London Riverbank ("Riverbank") and the

343-room art'otel london hoxton development project ("Hoxton"),

which is scheduled to open in 2024. The Group remains the majority

owner of the hotels by retaining a 51% holding in JVCo and through

its management company has secured a 20-year hotel management

agreement in respect of both hotels.

The total price paid by Clal in connection with the transaction

amounts to GBP113.7 million in cash and a further cash injection of

GBP12.1 million to fund their portion of the remaining equity

commitments of the art'otel london hoxton development project. This

consideration, taking into account existing bank debt and remaining

development costs, is based on a GBP263 million property valuation

for Riverbank and an all in development budget cost, which includes

the fair value of the land, of GBP279.3 million for Hoxton. A

further breakdown of the purchase price is provided in the table

below.

Clal will also be granted 5 million share appreciation rights

('SAR') to have a value upside if the gap between the Group's

latest reported EPRA NAV and its' current market price narrows over

the maturity period. The SAR has a 7-year maturity with a strike

price of GBP16 per share and the upside is capped at GBP21 per

share. Settlement of the SAR will be in either Company shares or

cash. As an example, should the market price of the Company's

shares increase by 27% from its current price of GBP16.50 to

GBP21.00, Clal will be entitled to approximately 1.2 million shares

(2.8% of the currently outstanding share capital), or GBP25

million.

The transaction largely reflects the values that have been

included in the Group's EPRA NAV per 31 December 2020 of GBP22.08

per share.

Total price GBPm

Market value Riverbank 263.0

--------

Market value Hoxton land and remaining development

cost 279.3

--------

542.3

--------

Bank debt (146.0)

--------

Remaining development costs Hoxton (166.2)

--------

Working capital adjustments 2.0

--------

Equity value 232.1

--------

CLAL's investment in connection with the

transaction (49%) 113.7

--------

Remaining equity commitment GBPm

Remaining development costs Hoxton 166.2

--------

Undrawn part of the GBP180m construction

facility (141.5)

--------

Remaining equity commitment Hoxton 24.7

--------

Cash injection CLAL (49% of equity commitment) 12.1

--------

The transaction will result in an increase of the Group's cash

position of GBP113.7 million. The Group is currently analysing the

accounting treatment for the transaction and will report this in

its' interim financial statements. In 2020, Riverbank and Hoxton

contributed a GBP10.7 million loss to the consolidated loss of the

Group. The book value of the properties as at 31 December 2020

amounted to GBP271.2 million.

The joint venture arrangements between the Group and Clal

contain customary exit provisions which include a right for Clal to

require a sale of either or both of the companies which own the

hotels following 7 years from completion or earlier in a change of

control of PPHE and certain events of default. If triggered, such

provisions afford the Group a pre-emption right in respect of such

companies.

The Group has also given certain guarantees to Clal regarding

completion of the art'otel london hoxton development project.

PPHE's obligations under all of the above arrangements are, to the

extent they are not within PPHE's sole discretion subject to a cap

which is below the threshold for a class 1 transaction (as defined

by the UK Financial Conduct Authority's Listing Rules).

The transaction is expected to complete on or before 30 June

2021.

The transaction constitutes a Class 2 transaction for the

purposes of the UK Financial Conduct Authority's Listing Rules,

and, as such does not require PPHE shareholders' approval.

Enquiries

PPHE Hotel Group Limited

Daniel Kos, Chief Financial Officer and Executive Tel: +31 (0)20 717

Director 8600

Inbar Zilberman, Chief Corporate & Legal Officer

Robert Henke, Executive Vice President of Commercial

Affairs

Hudson Sandler

Wendy Baker/ Lucy Wollam Tel: +44 (0)20 7796

4133

pphe@hudsonsandler.com

Notes to Editors

PPHE Hotel Group is an international hospitality real estate

company, with a GBP1.7 billion portfolio, valued as at December

2020 by Savills and Zagreb nekretnine Ltd (ZANE), of primarily

prime freehold and long leasehold assets in Europe.

Through its subsidiaries, jointly controlled entities and

associates it owns, co-owns, develops, leases, operates and

franchises hospitality real estate. Its primary focus is

full-service upscale, upper upscale and lifestyle hotels in major

gateway cities and regional centres, as well as hotel, resort and

campsite properties in select resort destinations.

PPHE Hotel Group benefits from having an exclusive and perpetual

licence from the Radisson Hotel Group, one of the world's largest

hotel groups, to develop and operate Park Plaza(R) branded hotels

and resorts in Europe, the Middle East and Africa. In addition,

PPHE Hotel Group wholly owns, and operates under, the art'otel(R)

brand and its Croatian subsidiary owns, and operates under, the

Arena Hotels & Apartments(R) and Arena Campsites(R) brands.

PPHE Hotel Group is a Guernsey registered company with shares

listed on the London Stock Exchange. PPHE Hotel Group also holds a

controlling ownership interest in Arena Hospitality Group, whose

shares are listed on the Prime market of the Zagreb Stock

Exchange.

Company websites: PPHE Hotel Group | Arena Hospitality Group

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

JVEEAAKDAANFEAA

(END) Dow Jones Newswires

June 24, 2021 02:00 ET (06:00 GMT)

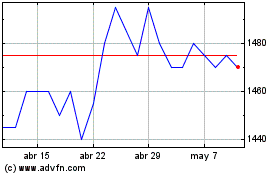

Pphe Hotel (LSE:PPH)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

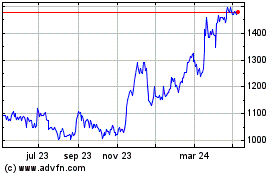

Pphe Hotel (LSE:PPH)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024