Picton Prop Inc Ltd Portfolio Update

17 Diciembre 2020 - 1:00AM

UK Regulatory

TIDMPCTN

17 December 2020

Picton Property Income Limited

("Picton")

LEI: 213800RYE59K9CKR4497

Portfolio Update

Retail disposal, office lettings and industrial rental uplifts

Picton is pleased to announce a series of asset management transactions which

have completed since the interim results announcement of 12 November 2020.

Retail

Further to the announcement dated 21 September 2020, Picton confirms the

completion of a retail disposal in Peterborough for GBP3.98 million. The proceeds

will be reinvested into ongoing projects within the portfolio. As a result of

this transaction, the high street retail exposure in the portfolio reduces from

4% to 3% on a proforma basis.

At Parc Tawe, Swansea, Picton secured JD Sports Gyms to take the former

Xercise4Less unit after the company was put into administration in July. The

new rent is 14% below the previous passing rent and 6% below the September ERV;

however, it is subject to an annualised RPI uplift in 2023 and has been agreed

with no further incentives.

Office

The Company has let an office suite in Tower Wharf, Bristol to a financial

planning specialist at GBP0.2 million p.a., on a 10-year term with a five-year

break, which is in line with the September 2020 ERV. This transaction follows

an assignment of the 4th floor, to a cloud-based finance software company which

completed earlier this year.

Industrial

Two rent reviews have been completed at our multi-let industrial estates in

Radlett and Harlow, increasing the passing rent to GBP0.3 million p.a. and

providing a 24% average uplift, in line with the September 2020 ERV.

A further portfolio update will be provided late in January, concurrently with

the December 2020 NAV announcement

Enquiries:

Picton

Michael Morris 0207 011 9980, michael.morris@picton.co.uk

Note to Editors

Picton, established in 2005, is a UK REIT. It owns and actively manages a GBP662

million diversified UK commercial property portfolio, invested across 47 assets

and with around 350 occupiers (as at 30 September 2020). Through an occupier

focused, opportunity led approach to asset management, Picton aims to be one of

the consistently best performing diversified UK focused property companies

listed on the main market of the London Stock Exchange

For more information please visit: www.picton.co.uk.

-END-

END

(END) Dow Jones Newswires

December 17, 2020 02:00 ET (07:00 GMT)

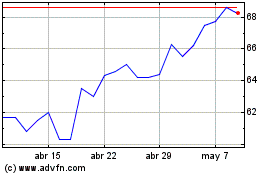

Picton Property Income Ld (LSE:PCTN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

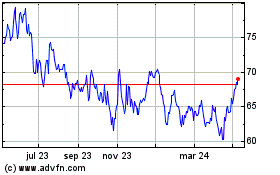

Picton Property Income Ld (LSE:PCTN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024