Princess Private Equity Holding Ltd NAV increases by 4.8% in June (6637G)

28 Julio 2021 - 1:00AM

UK Regulatory

TIDMPEY TIDMPEYS

RNS Number : 6637G

Princess Private Equity Holding Ltd

28 July 2021

News Release

Guernsey, 28 July 2021

NAV increases by 4.8% in June

-- Princess Private Equity Holding Limited's (Princess or the

Company) net asset value increased by 4.8% to EUR 15.24 per

share

-- Portfolio developments (+4.8%) and currency movements (+0.1%) were positive

-- Princess invested EUR 6.4 million and received distributions of EUR 34.2 million

In June, Princess' NAV increased by 4.8%, bring performance for

the first half-year to +16.7%. The positive performance was driven

by a number of portfolio companies. Amongst the largest value

drivers was Foncia, a property management and real estate services

provider in France. The company continues to strengthen its

position in the French market via M&A, with close to 50

acquisitions closed in FY2021. Foncia has also hired new country

heads to lead the company's expansion in the German and Belgian

markets. SPi Global, a content and data solutions provider, was

positively revalued. Performance has been strong across all

divisions: the edtech solutions business unit has achieved strong

growth on the back of robust e-learning tailwinds continuing in

2021; the data solutions business has seen robust sales momentum

with several new account wins; and research content services

continues to outperform budget. SPi has been rebranded to

'Straive', which reflects the company's transformation from a

content services provider to a content, data, and edtech solutions

player.

Princess received distributions of EUR 34.2 million, including

proceeds of EUR 26.8 million following the exit of Cerba

HealthCare, a leading player in medical diagnostics. Over its

four-year period of ownership, Partners Group worked alongside

Cerba's management team to enhance its operations in new markets

and expand its international footprint . Further, Princess received

distributions of EUR 6.1 million which stemmed from SRS

Distribution, a US distributor of roofing products, supported by

strong same-store-sales growth. SRS remains highly acquisitive and

recently expanded its regional presence in Chicago with

acquisitions of three additional distributors, bringing the number

of locations to 460 across 44 states.

Princess invested EUR 6.4 million in Axia Women's Health, a

leading women's healthcare provider in the US. Axia provides a

highly integrated platform of non-clinical business and

administrative support services to its network of physician

practices across the US. Axia has partnered with more than 80 care

centers comprising 150 locations, which offer a wide range of care,

including obstetrics, gynecology, laboratory, mammography,

urogynecology, fertility, and other sub-specialties. Partners Group

will work closely with Axia's management team on a range of value

creation initiatives such as expanding in-demand ancillary

services; improving patient experience, outcomes, and engagement;

and continued accretive M&A in both its existing geographical

footprint and new regions.

Princess will hold a quarterly investor update on 17 August 2021

at 10:00 BST / 11:00 CET. During the webcast, Partners Group, the

Investment Manager to Princess, will give an update on the recent

developments of the Princess portfolio based on unaudited figures

as of 30 June 2021. Please find the registration details on the

Company's webpage or register directly here .

Further information is available in the monthly report, which

can be accessed via:

http://www.princess-privateequity.net/en/investor-relations/financial-reports/.

Ends.

About Princess

Princess is an investment holding company founded in 1999 and

domiciled in Guernsey. It invests, inter alia, in private equity

and private debt investments. Princess is managed in its investment

activities by Partners Group, a global private markets investment

management firm with USD 119 billion in investment programs under

management in private equity, private debt, private real estate and

private infrastructure. Princess aims to provide shareholders with

long-term capital growth and an attractive dividend yield. Princess

is traded on the Main Market of the London Stock Exchange (ticker:

PEY for the Euro Quote; PEYS for the Sterling Quote).

Contacts

Princess Private Equity Holding Limited:

princess@partnersgroup.com

www.princess-privateequity.net

Registered Number: 35241

LEI: 54930038LU8RDPFFVJ57

Investor relations contact

George Crowe

Phone: +44 20 7575 2771

Email: george.crowe@partnersgroup.com

Media relations contact

Jenny Blinch

Phone: +44 207 575 2571

Email: jenny.blinch@partnersgroup.com

www.partnersgroup.com

This document does not constitute an offer to sell or a

solicitation of an offer to buy or subscribe for any securities and

neither is it intended to be an investment advertisement or sales

instrument of Princess. The distribution of this document may be

restricted by law in certain jurisdictions. Persons into whose

possession this document comes must inform themselves about and

observe any such restrictions on the distribution of this document.

In particular, this document and the information contained therein

are not for distribution or publication, neither directly nor

indirectly, in or into the United States of America, Canada,

Australia or Japan.

This document may have been prepared using financial information

contained in the books and records of the product described herein

as of the reporting date. This information is believed to be

accurate but has not been audited by any third party. This document

may describe past performance, which may not be indicative of

future results. No liability is accepted for any actions taken on

the basis of the information provided in this document. Neither the

contents of Princess' website nor the contents of any website

accessible from hyperlinks on Princess' website (or any other

website) is incorporated into, or forms part of, this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STREAKXXAFAFEFA

(END) Dow Jones Newswires

July 28, 2021 02:00 ET (06:00 GMT)

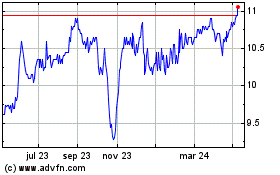

Princess Private Equity (LSE:PEY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

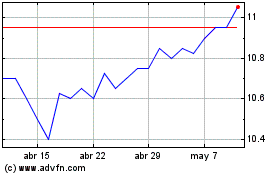

Princess Private Equity (LSE:PEY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024