TIDMQQ.

RNS Number : 0066P

QinetiQ Group plc

14 October 2021

News release

QinetiQ Group plc

Trading Update

14 October 2021 - QinetiQ Group plc ("QinetiQ" or "the Group")

today issues a trading update covering its second quarter to 30

September 2021, ahead of publishing its interim results on 11

November 2021.

Strong underlying operating performance - continued strategic

momentum

Group half year performance is in line with market consensus

expectations, subject to audit. We have delivered strong underlying

operating performance at Group level with excellent order intake at

GBP700m, 25% higher than the first half of FY21. For the full year,

we expect to deliver mid-single digit organic revenue growth at

c.5% and underlying operating profit margin at the lower end of our

11-12% expected range (prior to any one-off write down, see below).

This expectation includes short-term effects of the customer's

mission shifting from Afghanistan and COVID related delivery and

supply chain challenges in the US. Operating cash flow has been

good and we retain a strong balance sheet with net cash at 30

September 2021 of approximately GBP140m.

We are experiencing technical and supply chain issues on a large

complex programme, which, if unmitigated, could result in the need

for a one-off write down to our short-term guidance. We are working

closely with our customer and are making progress, jointly with our

supply chain, towards recovery of the programme and mitigating this

risk to less than GBP15m.

We are maintaining our medium to long-term guidance: we continue

to target mid-single digit percentage compound annual organic

revenue growth over the next 5 years, with strategic acquisitions

further enhancing this growth. Similarly, we continue to target

operating profit margin of 12-13%, although in the short-term we

continue to anticipate margins being c.100bps lower, driven by

increased investment on our digital transformation programme and by

the evolution of our business mix. Capital expenditure remains in

the region of GBP90m to GBP120m per annum for the next two

years.

EMEA Services

EMEA Services has continued to perform particularly strongly

during the first half, with good orders, revenue, profit and cash

flow delivering excellent growth in Australia and the UK. Across

the division, we are well placed to continue this strong

growth.

Global Products

Strong EMEA Services performance has offset short-term weaker

performance in the US, which reduced first half revenue, profit and

cash flow in Global Products. US revenue reduced by 15% compared to

the second half of FY21 as a result of entering the year with lower

orders due to short-term effects of COVID, transition to the new US

administration and the customer's priorities shifting from

counter-insurgency missions in Afghanistan to emerging near-peer

threats in the Indo-Pacific. This also included COVID related

delivery and supply chain challenges in our legacy QNA business

e.g. initial production ramp-up of Common Robotic System-Individual

(CRS-I) robots.

Positively, we achieved excellent order intake in the US at

$184m compared to $83m in the second half of FY21. This provides a

solid foundation to deliver a stronger second half, enhanced by

changes to leadership and organisation focus made under our new

Special Security Agreement (SSA) Board following dissolution of the

Proxy Agreement.

Strategic progress

Our strategy to build an integrated global defence and security

company delivering for our customers' advantage continues at pace.

We remain focused on our six home and priority countries and our

six distinctive offerings, using our balance sheet to support

growth into our >GBP20bn addressable market through both strong

organic growth and strategically aligned acquisitions. With

c.GBP450m orders won in the second quarter, we achieved a number of

successes that demonstrate our strategic momentum:

-- $64m CRS-I Full-Rate Production (FRP) contract - we have secured

a $64m FRP contract in the US for over 1,200 CRS-I units with a

multi-year delivery schedule for the US Army. CRS-I enables a heightened

capability for organic tactical reconnaissance, surveillance and

target acquisition to enhance manoeuvres and protection for dismounted

forces. The small advanced robotic platform is lightweight and

highly mobile offering unprecedented capability in multi-domain

environments including special payloads, advanced sensors and mission

modules.

-- AU$27m Major Service Provider (MSP) contract - alongside our MSP

partners, we have secured an AU$27m order to assist the Australian

Department of Defence in delivering its largest and most complex

Land projects. This contract positions us for future growth as

a trusted partner able to provide sovereign Australian industry

capability, while leveraging our global capabilities.

-- GBP68m Weapons Sector Research Framework (WSRF) orders - we have

won orders totalling GBP68m on the WSRF contract for development

and deployment of directed energy weapons for UK MOD, an important

capability as identified in the Integrated Review earlier in the

year. We were appointed to lead the WSRF in June 2020 by DSTL,

alongside industry partners MBDA and Thales. The framework, which

we expect to be worth GBP300m over five years, brings together

more than 100 industry and academic partners to research and develop

technologies for the benefit of UK MOD.

-- Building a disruptive mid-tier company in the US - our ambition

is to more than double the size of the US business over the next

5 years through both organic growth and strategy-led acquisitions.

Having supported the first phase of growth, Mary Williams has chosen

to step back from day-to-day operations and remains as a strategic

advisor to the company. We have taken this opportunity to make

a number of changes to leadership and organisation focus to create

the capability to drive operational performance and accelerate

our growth ambition. We are actively recruiting a new US CEO and

have appointed two senior leaders for our newly named C5ISR Solutions

and Technology Solutions business units, formerly known as MTEQ

and QNA respectively. In addition, we appointed Lawrence (Larry)

Prior III to the QinetiQ Plc Board in July bringing a wealth of

US experience from aerospace, defence and government services,

making him ideal to support our global ambition.

On 2 July 2021, we announced that David Smith, Chief Financial

Officer, intended to retire. David's successor, Carol Borg, has now

joined the company and will take over from 1 December 2021.

Steve Wadey, Group Chief Executive Officer said:

"Overall the Group has delivered strong operational performance

in the first half of the year. We continue to deliver for our

customers around the world, with EMEA Services delivering very

strong performance to offset short-term weaker US performance in

Global Products, due to the changing customer mission and COVID. We

remain focused on delivering our strategy to build an integrated

global defence and security company, through both organic growth

and acquisitions. I am pleased with our continued strategic

momentum, demonstrated by excellent order intake including a range

of significant contract wins."

Investor and analyst call:

Management will host a call for investors and analysts at 08.00

BST on 14 October 2021. Please join using the following details:

+44 (0) 33 0551 0200, Password: QinetiQ

Interim results

QinetiQ will announce its interim results on 11 November 2021.

We will be hosting a virtual results presentation, details of which

will be available on our website shortly at:

www.QinetiQ.com/investors .

About QinetiQ

QinetiQ (QQ.L) is a leading science and engineering company

operating primarily in the defence, security and critical

infrastructure markets. We work in partnership with our customers

to solve real world problems through innovative solutions

delivering operational and competitive advantage. Visit our website

www.QinetiQ.com . Follow us on LinkedIn and Twitter @QinetiQ. Visit

our blog www.QinetiQ-blogs.com .

Inside information

This announcement contains inside information and the person

responsible for making this announcement is Jon Messent, Company

Secretary.

For further information please contact :

John Haworth, Group Head of Investor Relations: +44 (0) 7920 545841

Chris Barrie, Citigate Dewe Rogerson (Media enquiries): +44 (0) 7968 727289

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUOONRANURAAA

(END) Dow Jones Newswires

October 14, 2021 02:00 ET (06:00 GMT)

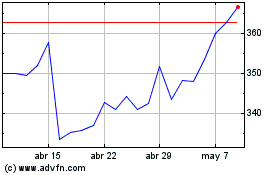

Qinetiq (LSE:QQ.)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Qinetiq (LSE:QQ.)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024