TIDMSRT

RNS Number : 8235G

SRT Marine Systems PLC

29 July 2021

SRT MARINE SYSTEMS PLC

(AIM: SRT)

("SRT" or the "Company")

FINAL RESULTS FOR THE YEARED 31 MARCH 2021

SRT Marine Systems PLC, a provider of maritime surveillance,

monitoring and management systems, announces its results for the

financial year ending 31 March 2021.

FINANCIAL SUMMARY

-- Revenues of GBP8.3m, mostly generated by transceivers

division. No material revenue contribution from systems business

due to Covid delays.

-- Improved gross profit margin of 38%.

-- GBP550m systems division validated system sales opportunity

pipeline, of which GBP71m are very near term.

-- GBP5.3m gross cash as at year end.

OPERATIONAL HIGHLIGHTS

-- Significant progress of development of new dual application

AIS transceiver product (NEXUS) scheduled to commence shipping

early 2023.

-- Specialist marine data analytics lab established within systems division.

-- Systems delivery model evolved to enable efficient project

delivery even when international travel of SRT support engineers is

restricted.

-- Substantial new functionality implementation in SRT-MDA System GeoVS software platform.

Commenting on today's results, Simon Tucker, CEO of SRT

said:

"These are obviously very disappointing results and I personally

apologise to our shareholders who had expected this year to be our

take-off year. I hope and expect us to return to our expected

growth path, starting this year. We have made best use of the

forced delay by materially improving our products, in-country

relationships and market position. The demand for maritime domain

awareness solutions from both boat owners and government agencies

is strong and growing and underpins our business. And because of

our investments and activities over many years, SRT is today a

global leader at the centre of this emerging market opportunity,

which I expect to be soon confirmed as a number of customers

complete their contracting formalities and our transceivers

business moves forward."

Contacts:

SRT Marine Systems plc www.srt-marine.com

+ 44 (0) 1761 409500

Simon Tucker (CEO) simon.tucker@srt-marine.com

Louise Coates (Marketing Manager) louise.coates@srt-marine.com

finnCap Ltd

Jonny Franklin-Adams / Teddy Whiley (Corporate

Finance) +44 (0) 20 7220 0500

Tim Redfern / Charlotte Sutcliffe (Corporate

Broking)

About SRT:

SRT Marine Systems plc (SRT) is an established marine-tech business

that specialises in providing solutions that deliver enhanced

maritime safety, security and management to vessel owners/operators

and national maritime authorities around the world such as coast

guards, fishery authorities and infrastructure owners. We generate

revenues and profits from the sale of individual hardware products,

software licenses and ongoing long term data and system service

contracts.

The information contained within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulation (EU) No. 596/2014 which is part of UK law by

virtue of the European Union (Withdrawal) Act 2018. Upon the

publication of this announcement, this inside information is

now considered to be in the public domain.

CHAIRMAN'S STATEMENT

Despite many positive developments and much progress across

our business during the year that have significantly strengthened

our business, including significant engagement with new and

existing system customers and improved products, Covid has

caused significant delays to expected new system contracts.

Therefore, as we reported in our post year end trading update

issued in April 2021, these delays have caused a contraction

of revenues and a loss for the financial year ending March

2021.

However, during the first quarter of the new financial year,

we have seen unexpectedly strong trading in our transceivers

division and slow but steadily accelerating progress with

new system contract opportunities. Of particular note are

four system contracts worth an aggregate of GBP71m which had

been expected to commence last year, where the customers are

now actively pushing to complete their internal procurement

processes as quickly as possible, boding well for the new

financial year.

As reported in our post year end trading update (April 2021),

year on year group revenues decreased from GBP18.9m to GBP8.3m,

resulting in a loss after tax of GBP5.9m (2020: loss of GBP3.0m)

with gross cash as at the year-end of GBP5.3m. During the

year, the vast majority of the revenues (GBP8.2m) were generated

by our transceivers division which grew 1%. Our systems business

did not complete any revenue milestones, however GBP13.0m

of cash payments from existing customers were received in

accordance with contracted payment schedules and subsequent

to year end a further GBP2.3m has been received, with further

amounts due in the coming months.

Given the circumstances, our transceivers business performed

better than expected during the year, delivering 1% growth.

We saw steady demand across both leisure and commercial vessel

transceiver segments, as well as continuing increased demand

for our Digital AIS Aids to Navigation (what we now call 'DAS'

- Digital AtoN System'). All driven by a fundamental long-term

macro trend of digitising the monitoring and management of

the marine domain. Our product development focus has been

the improvement in the mobile device connectivity of existing

products that will make it more convenient for users to wirelessly

connect to their navigation app enabled smart phones and tablets.

And the creation and launch of more integrated DAS products

to meet growing demand from ports and waterway authorities

wanting to enhance navigation safety and marine environment

monitoring. A new and very significant transceiver product

(NEXUS) is also under development that integrates AIS with

other technologies and I am pleased to report excellent progress

with our plan to complete and start shipping this product

from early 2023.

Looking forward, during the first quarter of the new year

our transceivers business has exceeded our expected 10% annual

growth target, with stronger demand for both DAS and vessel

transceivers, which as of the date of this report seems likely

to continue into the future, along with stable profit margins

with good cash generation. We believe this is because of the

combined effects of the well-known quality of our products,

established and growing sales channels that value good product

and reliable supply, along with continued growing demand for

AIS. Our forthcoming NEXUS product will add a very significant

new complementary product segment to our transceivers business

which we hope will result in a material increase in revenues

from 2023.

Our systems business is ultimately underpinned by a long-term

macro-trend of countries wanting to have the autonomous ability

to monitor, control and manage their marine territories. Having

identified this strategic long-term opportunity early, we

have been able to develop a sophisticated turn-key system

solution, the SRT-MDA System, which is built around our GeoVS

maritime enterprise application which delivers a fully integrated

and feature rich maritime surveillance and management system

that is attractive to coast guards, fishery authorities and

owners of critical infrastructure. The SRT-MDA System is now

in use around the world, for example in Malaysia, Philippines,

Bahrain and Panama, providing important proven references

for new customers.

During the year we continued to invest in the development

of our system to both enhance existing functionality and performance,

as well as implement new functionality. Of particular note

is the growing sophistication of our system's backbone data

networking and fusion capabilities, and intelligent analytics

which is able to automatically identify illegal and suspicious

activities from hundreds of thousands of vessels and alert

system operators who can then instigate appropriate response

actions. This is work that is accelerating and will continue

into the future, adding significant value to our core systems

product.

These temporary delays, whilst extremely frustrating, have

given us the time to make very significant operational progress

that I believe will make a material difference to the business

both in the near term and years ahead. These have included

remodelling our systems delivery method such that our systems

are more modular and easier for our local partners to install,

commission and support efficiently with much less in-country

support from our delivery support engineers. New and innovative

system functionalities, such as dynamic analytics, multi-source

data fusion and alert response action management within the

fully integrated operating environment of the SRT-MDA System

that set us apart from potential future competition and will

deliver a material difference and added value to our customers

During the year, in conjunction with our local partners, we

have continued to make good progress with the implementation

of the SRT-MDA System in The Philippines for BFAR. In December

2018, we entered a four year PHP2.1 billion (GBP30m) value

contract to build the first phase of the world's largest and

most sophisticated national scale fisheries monitoring system.

Much of the infrastructure has now been completed and the

multiple monitoring centres are systematically being commissioned,

BFAR staff in training, with commercial fishing vessels equipped

with our VMS-100 now being tracked once every 15 minutes and

electronically reporting fishing catches. Following completion

of the project we expect a long-term system sustainability

contract which will include a subscription to our S-MDA satellite

data product, along with further system expansion contracts.

As we reported, new system contract discussions have been

significantly affected by Covid restrictions which have caused

customer project planning and procurement processing departments

to regularly close or suffer a significant capacity reduction,

resulting in extended contract finalisation processing timelines.

Whilst these issues persist in many jurisdictions and the

nature of government business means forecasting of precise

sales cycles is challenging, in recent months we have experienced

renewed engagement from customers to progress discussions

coupled with a steady increase in meaningful activity from

a subset of customers who appear eager to complete their contracting

processes as quickly as possible.

In our April 2021 post year end update we reported that the

value of our pipeline of validated system opportunities now

stands at GBP550m, with contract opportunities that range

from a few hundred thousand dollars to tens of millions, spread

across the world at different stages in the sales and contracting

cycle. Of these, seven worth an aggregate of GBP125m, located

in countries in SE Asia and Middle East, we consider to be

in their final stage prior to contracting. Due to the complexities

of government contracting processes and differences between

the processes of each customer, it is impossible for us to

forecast with absolute surety the date upon which these will

be signed. However, based upon received information and activities

we expect that four of these contracts worth approximately

GBP71m over an average two year delivery period, should be

under contract and delivering meaningful revenues within the

new financial year. The other three, worth GBP54m, likely

some months later, thus being contracted during the latter

half of the new financial year or early next year, and therefore

depending on exact timing may not contribute meaningful revenues

until the next financial year. I am also pleased to report

that some other significant opportunities in our pipeline

which are at an earlier stage in the sales development cycle,

have recently materially progressed with the customers indicating

a likely contracting timescale towards the end of 2022, although

these timescales are likely to change.

Our quick action at the beginning of Covid to develop and

execute a Covid resilience plan, coupled with ongoing careful

financial and operational management of the business has enabled

us to successfully weather this temporary storm and be in

our current positive position with an array of significant

opportunities ahead of us. In our new financial year, we expect

to see our transceiver business revert back to its long-term

growth trajectory, thus generating increasing revenues and

profits, and our systems business to enter multiple new contracts,

and thus drive a substantial and sustained financial turnaround.

I would like to thank everyone at SRT, all of whom have continued

to work fulltime throughout, even travelling and enduring

weeks of solitary isolation in hotel rooms around the world

to deliver essential tasks when possible, and our patient

shareholders for their long term and exceptional support for

the company.

Kevin Finn

Chairman

Date: 28 July 2021

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME FOR THE YEARED 31 MARCH 2021

Note 2021 2020

GBP GBP

Revenue 8,275,022 18,908,062

Cost of sales (5,097,419) (14,537,092)

Gross profit 3,177,603 4,370,970

Administrative costs (8,048,640) (7,717,677)

Foreign exchange (losses) / gains (486,675) 834,416

------------------------------------- ------- -------------- --------------

Total administrative costs and

foreign exchange (losses) / gains (8,535,315) (6,883,261)

Operating loss before exceptional

item (5,357,712) (2,512,291)

Impairment charge - (3,922,029)

Operating loss after exceptional

item (5,357,712) (6,434,320)

Finance expenditure (574,248) (464,539)

Finance income 1,057 1,430

Loss before tax (5,930,903) (6,897,429)

Income tax credit 797,060 818,407

Loss for the year after tax (5,133,843) (6,079,022)

Total comprehensive expense for

the year (5,133,843) (6,079,022)

Loss per share:

Basic 4 (3.13)p (3.93)p

Diluted (3.13)p (3.93)p

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 MARCH

2021

2021 2020

Note GBP GBP

Assets

Non-current assets

Intangible assets 8,274,170 7,776,882

Property, plant and equipment 1,688,512 1,782,048

Deferred tax 793,602 670,778

Total non-current assets 10,756,284 10,229,708

Current assets

Inventories 2,368,283 1,928,730

Trade and other receivables 3,600,187 15,958,534

Cash and cash equivalents 5,286,432 918,808

Total current assets 11,254,902 18,806,072

Liabilities

Current liabilities

Trade and other payables (1,648,983) (9,044,454)

Financial liabilities 5 (8,515,000) (4,990,000)

Lease liabilities (262,011) (202,445)

Total current liabilities (10,425,994) (14,236,899)

Net current assets 828,908 4,569,173

Total assets less current liabilities 11,585,192 14,798,881

Non-current liabilities

Lease liabilities (861,409) (1,067,741)

------------- -------------

Net assets 10,723,783 13,731,140

Shareholders' equity

Share capital 164,252 154,844

Share premium account 13,431,735 11,543,989

Retained loss (8,362,800) (3,458,289)

Other reserves 5,490,596 5,490,596

Total shareholders' equity 10,723,783 13,731,140

CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEARED 31 MARCH

2021

2021 2020

GBP GBP

Cash generated from operating

activities 2,164,982 857,765

Corporation tax received 674,236 201,926

-------------- --------------

Net cash generated from operating

activities 2,839,218 1,059,691

-------------- --------------

Investing activities

Expenditure on product development (2,770,455) (2,970,033)

Purchase of property, plant

and equipment (341,875) (523,530)

Interest received 1,057 1,430

Net cash used in investing

activities (3,111,273) (3,492,133)

-------------- --------------

Financing activities

Gross proceeds on issue of

shares 2,000,005 34,837

Costs of issue of shares (102,851) -

New loans issued 3,525,000 -

Lease repayments (267,749) (225,149)

Loan interest paid (514,726) (400,605)

Net cash generated from / (used 4,639,679 (590,917)

in) financing activities

Net increase / (decrease) in

cash and cash equivalents 4,367,624 (3,023,359)

-------------- --------------

Net cash and cash equivalents

at beginning of year 918,808 3,942,167

-------------- --------------

Net cash and cash equivalents

at end of year 5,286,432 918,808

============== ==============

Notes

1. Status of financial information

SRT is a public limited company incorporated in England and

Wales whose ordinary shares of 0.1p each are traded on the AIM

Market of the London Stock Exchange. The Company's registered

office is Wireless House, Westfield Industrial Estate, Midsomer

Norton, Bath BA3 4BS.

The Board of Directors approved this preliminary announcement on

28 July 2021. This announcement does not itself contain sufficient

information to comply with all the disclosure requirements of IFRS

and does not constitute statutory accounts of the Company for the

years ended 31 March 2021 or 31 March 2020.

The financial information has been extracted from the statutory

accounts of the Company for the years ended 31 March 2021 and 31

March 2020. The report of the auditors on those statutory accounts

was unqualified and did not contain a statement under section

498(2) or (3) of the Companies Act 2006. The audit report drew

attention by way of emphasis to a material uncertainty relating to

going concern and recoverability of certain assets.

The statutory accounts for the year ended 31 March 2020 have

been delivered to the Registrar of Companies, whereas those for the

year ended 31 March 2021 will be delivered to the Registrar of

Companies following the Company's Annual General Meeting.

2. Basis of preparation

The financial statements have been prepared in accordance with

international accounting standards in conformity with the

requirements of the Companies Act 2006. For the purposes of the

preparation of the consolidated financial information, the Group

has applied all standards and interpretations that are effective

for accounting periods beginning on or after 1 April 2020. The

financial information has been prepared under the historical cost

convention unless otherwise stated.

3. Dividends

The Board is not recommending the payment of a final

dividend.

4. Loss per ordinary Share

The basic loss per share has been calculated on the loss on

ordinary activities after taxation of GBP5,133,843 (2020: loss

GBP6,079,022) divided by the weighted number of ordinary shares in

issue of 163,728,344 (2020: 154,742,293).

During the current and previous years, the Group incurred a loss

on ordinary activities after taxation and therefore there is no

dilution of the impact of the share options granted.

5. Financial liabilities

Bank loan

The bank loan (amount owed at 31 March 2021: GBP2,500,000) was

drawn down in April 2020 as a one year loan provided under the UK

government Coronavirus Business Interruption Loan Scheme (CBILS) at

an interest rate of 0%. Subsequent to the year end, the renewal of

this facility has been agreed with quarterly repayments commencing

in July 2021 through to April 2023 at an interest rate of 2.59%

above base rate. As the loan renewal documentation, whilst agreed

prior to the year end, was signed subsequent to the year end, IAS1

requires that the loan be classified in full as repayable in less

than one year despite the loan renewal and the revised maturity

date.

Other loans

As of 31 March 2021, the total of other loans outstanding is

GBP6,015,000. These all relate to a GBP10 million secured loan

programme which has been arranged by LGB Capital Markets and which

is secured by a floating charge over the Group's assets. In total

the group has drawn down GBP9,215,000 of the available GBP10

million, and repaid GBP3,200,000, leaving the current outstanding

balance of GBP6,015,000 which is due for repayment on various dates

over the next 3 years. (A note may only be issued once, and then

once repaid is cancelled). As the group has existing head room of

GBP785,000 on the existing program, for further draw downs the

process has commenced to increase the head room by a further GBP10

million.

During the year ended 31 March 2021 the covenant in relation to

debt service cover was breached and a waiver from loan note holders

was obtained subsequent to the year end on 28 April 2021. Due to

the waiver not being received prior to the year end, IAS 1 requires

that the loans are all classified as being repayable in less than

one year, despite GBP2,025,000 of loans having maturity dates in

excess of one year.

The gearing covenant was not breached as at 31 March 2021.

6. Annual Report and AGM

The Annual Report will be available from the Company's website,

www.srt-marine.com once it is published. To locate the report,

click "Investors" and then scroll down the page to "Reports and

Presentations". The Annual Report and Notice of AGM will be posted

to shareholders on 23 August, 2021.

The AGM will be held at the Centurion Hotel, Charlton Lane,

Radstock BA3 4BD at 11.00am on September 22, 2021. Prior to the

commencement of the formal AGM there will be an Open Morning at

SRT's offices, commencing at 9.00am.

In light of the current relaxation of COVID-19 restrictions and

social distancing rules, our current intention is for all

shareholders who wish to attend the AGM to be able to do so in

person. However, changes in public health guidance and legislation

issued by the UK Government may mean that shareholders will not be

able to attend the meeting. It is recommended that our shareholders

continue to monitor the Company's website as well as the Company's

stock exchange announcements for any updates to the

arrangements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UWABRAKUBUAR

(END) Dow Jones Newswires

July 29, 2021 02:00 ET (06:00 GMT)

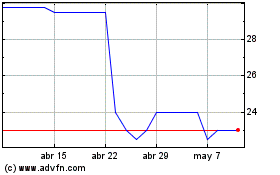

Srt Marine Systems (LSE:SRT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Srt Marine Systems (LSE:SRT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024