TIDMSLI

LKKL14 September 2021

STANDARD LIFE INVESTMENTS PROPERTY INCOME TRUST

LEI: 549300HHFBWZRKC7RW84

RESULTS IN RESPECT OF THE HALF YEARED 30 JUNE 2021

Performance Summary - Financial Review

- NAV total return 10.2 PERCENT

NAV total return of 10.2.% in the six months to 30 June 2021 (H1 2020: -9.0%)

as UK commercial property values began to recover, particularly in sectors

where the Company is strongly positioned. Over the longer term the Company has

continued to outperform its peer group returning 159.2% over ten years compared

to the AIC Property Direct - UK Commercial sector total return of 56.6% and

open ended property funds total return of 38.5%.

- Loan to value 17.6 PERCENT

Loan to value of 17.6% (H1 2020: 26.2%) - Prudent gearing levels with bank

covenants comfortably met.

- Share price total return 20.2 PERCENT

Share price total return of 20.2% (H1 2020: -30.9%) as the share price discount

reduced from 26.8% to 20.6%. Over the longer term the Company has outperformed

its peer group returning 94.4% over ten years compared to the AIC Property

Direct - UK Commercial sector total return of 33.6%.

- Dividends paid 1.9875p per share

(H1 2020: 2.38p per share)

Includes a top-up dividend for 2020 of 0.381p and reflects a 25% increase in

the level of dividends announced since the second half of 2020.

- Available for investment £80m

Significant financial resources at 30 June 2021 of £80 million available for

investment, comprising £55m in the form of the Company's low cost revolving

credit facility ("RCF") and £25m of uncommitted cash balances.

- Share Buybacks £4.5m

Share buybacks totalling £4.5m for the six month period at significant

discounts to NAV which are accretive to both NAV performance and earnings.

Performance Summary - Portfolio Review

- Occupancy rate 87.8 PERCENT

Occupancy rate of 87.8% as at 30 June 2021 (H1 2020: 92.2%) with a fall as a

result of selling let assets and muted office demand.

- Rent collection 93 PERCENT

As at 31 August 2021, rent collection of 94% for quarter 3 and 92% for quarter

2 which averages out to 93% for the first half.

- Operational CO2 saved 221 TONNES

221 tonnes of CO2 emissions saved through the installation of Solar PV schemes

in the portfolio.

- 3 new lettings and 1 lease renewal securing £445,000 per annum in rent.

(H1 2020: 2 new lettings securing £379,000 per annum in rent)

- Acquisition of land as part of carbon strategy

On 10 September 2021, the Company acquired 1,447 hectares of rough upland

grazing and open moorland in the Cairngorm National Park to plant a natural

broadleaf forest and undertake peatland restoration, as well as other bio

diverse habitat creation activities, to undertake a high quality offset

project.

- Restructured 1 lease and 4 rent reviews secured income of £878,000 per annum

of rent.

(H1 2020: Restructured 4 leases and 3 rent reviews to secure longer term income

on £735,000 per annum of rent)

Portfolio total return

- Portfolio total return of 7.9% (H1 2020: -5.6%) compared to MSCI benchmark of

5.7% (H1 2019: -3.8%) for the six month period as capital values rose.

Portfolio biased to outperforming sectors

- Company's Industrial Weighting 50.7%

(H1 2020: 52.7%)(MSCI benchmark: 34.9%)

Industrial weighting of 50.7% with only 11.0% in retail at 30 June 2021 as

portfolio is well aligned to sectors which are forecast to outperform in the

current environment.

- Company's Retail Weighting 11.0%

(H1 2020: 8.2%) (MSCI benchmark: 23.0%)

PERFORMANCE SUMMARY

Earnings & Dividends 30 June 2021 30 June 2020

EPRA earnings per share (p) (excl capital items & swap 1.90 1.96

movements)

Dividends declared per ordinary share (p) 1.99 2.38

Dividend cover (%)* 95.5 83.0

Dividend yield (%)** 4.9 7.9

FTSE All-Share Real Estate Investment Trusts Index Yield 2.7 4.4

(%)

FTSE All-Share Index Yield (%) 2.8 4.7

Capital Values & Gearing 30 June 2021 31 December 2020 Change %

Total assets (£million) 475.5 459.6 3.5

Net asset value per share (p) 88.3 82.0 7.7

Ordinary Share Price (p) 70.0 60.0 16.7

Discount to NAV (%) (20.6) (26.8)

Loan to Value (%)? 17.6 23.0

Total Return 6 months % 1 year % 3 year % 5 year %

return return return return

NAV? 10.2 15.6 13.5 40.0

Share Price? 20.2 22.1 (10.8) 16.7

FTSE All-Share Index 11.1 21.5 6.3 36.9

Property Returns & Statistics (%) 30 June 2021 30 June 2020

Property income return 2.3 2.2

MSCI benchmark income return 2.3 2.3

Property total return 7.9 (5.6)

MSCI benchmark total return 5.7 (3.8)

Void rate 12.2 7.8

* Calculated as revenue earnings per share (excluding capital items) as a

percentage of dividends declared per ordinary share.

** Based on last four quarterly dividends paid to 30 June 2021 of 3.0345p, in

addition to the 5th interim for 2020 of 0.381p, and the share price at 30 June

2021.

? Calculated as bank borrowings less all cash (including cash held at

managing agent) as a percentage of the open market value of the property

portfolio as at 30 June 2021.

? Assumes re-investment of dividends excluding transaction costs.

Sources: Aberdeen Standard Investments, MSCI Investment Property Databank

("IPD").

CHAIRMAN'S STATEMENT

The successful roll-out of the vaccination programme in the UK, and easing of

lockdown measures, has brought welcome signs of recovery to an economy trying

to find its feet having been poleaxed by the COVID-19 pandemic. The economy is

expected to grow around 7% in 2021 which compares to a 10% fall in 2020.

The level of recovery varies widely across all economic sectors as restriction

measures have eased at different rates, with some business owners still facing

uncertainty and worry over how they will return to normal trading, and the rest

of the population still trying to comprehend their 'new normal'. All of this

against the backdrop of concerns over new variants and the Government trying to

work out how best to address the funding deficit created in combatting

COVID-19.

ESG

Environmental, Social and Governance ("ESG") factors have become even more

important over the last 12 months, reversing the trend in previous difficult

economic times of ESG being downplayed. The drive towards Net Zero Carbon has

accelerated and become common language for many people, and wellness is clearly

identified as a key factor in building choice for occupiers. In this

environment your Board has been encouraged by the Investment Manager's

commitment to ESG performance, through asset equipment (energy efficiency) and

amenity (social and wellness).

The Company has acquired 1,447 hectares of rough upland grazing and open

moorland in the Cairngorm National Park for £7.5m to plant a natural broadleaf

forest and undertake peatland restoration as well as other bio diverse habitat

creation activities. The purchase enables the Company to undertake a high

quality offset project at a known cost, securing it from expected future growth

in carbon pricing. The demand for land for planting has grown considerably over

the last 3 years, and we believe the purchase gives the Company an early mover

advantage in this fast developing area.

UK REAL ESTATE MARKET

The UK Commercial real estate market, underpinned as it is by the UK economy,

is starting to show signs of recovery, albeit with polarisation evident across

sectors.

As the UK spent the whole of the first half of the year with some kind of

Covid-19 related restriction and most of the first quarter with severe

restrictions, the MSCI Quarterly Index delivered a striking total return of

5.7% during H1 2021. Once again, however, the return was overwhelmingly driven

by the industrial sector. While offices and retail only achieved six-month

returns of 1.9% and 1.7% respectively, the total return for industrials over

the period was 12.9%. While capital values fell across offices and retail,

industrial values rose by more than 10%. Industrial performance was

broad-based, both in terms of geography and asset type. However, the retail

sector has shown increasing dispersion. While supermarkets and retail

warehouses outperformed the All Property average, achieving 6.6% and 5.4%

respectively, shopping centre returns were -7.7%, despite a sharp slowdown in

value erosion in the second quarter. Standard shop returns were also negative

at -1.2%.

The Covid-19 pandemic has led to an acceleration of change, emphasising trends

that were already evident. Much of this change is likely to be permanent, for

example heightened levels of online shopping (benefitting logistics in

particular), whilst others will change again - for example home working will

form part of a hybrid model, but is unlikely to remain the norm for most

people.

Most of the change driven by Covid-19 has seen a polarisation of returns across

sectors, but there is one significant force that is influencing returns within

sectors, and that is ESG. In previous recessions ESG has declined in

importance, but not so this time. It has become a real driver of behaviours and

therefore of returns, and we expect to see increasing bifurcation of returns

for assets that meet ESG standards and those that do not.

PORTFOLIO AND CORPORATE PERFORMANCE

Your Company produced a portfolio total return of 7.9% in the six month period

with income and capital returns both ahead of their MSCI benchmark (benchmark

total return of 5.7%). The Investment Manager's report provides a full analysis

of the portfolio performance.

This portfolio performance resulted in a NAV total return of 10.2% in the six

month period.

The total return to shareholders in the period was 20.2% as the share price

rose as the economy started to reopen leading to improvement in rent collection

and asset values. These were the main factors behind the discount at which the

Company's shares traded to NAV narrowing from 26.8% at 1 January to 20.6% as at

30 June.

Whilst returns in 2020 were impacted by COVID-19, the Company's portfolio has

consistently outperformed the MSCI index over 1,3, 5, and 10 years establishing

a strong long term track record. An NAV total return of 40.0% over five years

to end of June 2021 compares to the peer group total return of 16.4%. Open

ended property funds returned 9.3% over the same period.

RENT COLLECTION & DIVIDS

Throughout the pandemic, the Board and its Investment Manager have been mindful

of the Company's Environmental, Social and Governance ("ESG") obligations as a

responsible landlord and has reflected this in working considerately with

tenants to collect rents. This has included agreeing repayment plans to suit

the needs of the tenants as well as granting amended lease terms. Write offs

have occurred where appropriate, mainly where the tenant, generally lacking

scale, has no means of paying.

As restrictions are lifted, and the economy starts to show signs of recovery,

rent collection figures are showing improvement and as at 31 August 2021 95% of

all rents due in relation to 2020 are now collected and 94% in relation to the

most recent (third) quarter in 2021. Where the Investment Manager considers the

tenant is capable of settling arrears but does not engage, court action has

been pursued. Further detail on rent collection and interaction with tenants is

included in the Investment Manager's Report.

The Board recognises the importance of dividends to its shareholders and

continued to pay a dividend throughout the pandemic. A fifth interim dividend

in respect of 2020 was announced and paid in early 2021 and, recognising that

the worst of the economic impact of the pandemic seemed to have passed, the

decision was taken for the first quarter to increase quarterly dividend levels

by 25% in 2021. Following this increase, the Board will continue to monitor

closely the impact of the lifting of lockdown restrictions on rent receipts and

recurring earnings in addition to the contribution from new acquisitions, as

the Company deploys its significant capital resources.

FINANCIAL RESOURCES & PORTFOLIO ACTIVITY

Throughout the pandemic, the Company has maintained a strong financial position

and this continues to be the case. On 30 June 2021, the Company had significant

financial resources of £80 million to deploy for further investment,

represented by £25 million of uncommitted cash and all of its £55 million

flexible, low-cost revolving credit facility. Loan to Value ("LTV") remains

prudent at 17.6% and banking covenants are comfortably met with significant

headroom.

This solid grounding allows the Investment Manager the firepower to invest in

strategic, well-positioned acquisitions as well as pursuing initiatives to

reduce the Company's carbon footprint.

MANAGER REBRAND

The Board notes that Standard Life Aberdeen plc has rebranded to abrdn plc. The

Board is working with the Manager on the implications of this and will be

actively considering a change of name for the Company. The Board will engage

with its shareholders on plans for rebranding in due course.

OUTLOOK

After withstanding the unprecedented economic shock created by the Covid-19

pandemic, the economy is now in recovery mode as the vaccination programme has

reached critical mass and restrictions are relaxed, although uncertainties

remain. From a real estate perspective in the UK, structural trends are set to

drive performance over the medium term, leading to polarisation both between,

and within, sectors.

Industrials are forecast to remain the best-performing sector over the next

three years, underpinned by fundamentals supporting further rental growth and

investment demand to push yields lower into the second half of 2021.

By contrast, office fundamentals point to falling rental values and rising

income risk. With little adjustment to values thus far, weak returns are

expected over the medium term along with a widening gap between offices

regarded as best quality space and ageing office space that does not offer

attractive working conditions for staff. Such a split is also expected in the

retail sector, with retail warehouse values now rising rapidly in modern parks,

anchored by strong occupiers in the grocery, discount variety and DIY markets;

meanwhile, fashion-led offerings and high-street or shopping-centre locations

are expected to see ongoing difficulties.

This trend of bifurcation highlights the need to hold the right assets, not

just assets in the right sector.

SLIPIT is well positioned to take advantage of the trends referred to above,

holding over 50% of its portfolio in the industrial sector, well above the

benchmark weighting. Assets held within the retail and office sectors are

substantially well placed to benefit from the intra-sector divide we are

seeing. In addition to this well-structured existing portfolio, the Company

also has a strong balance sheet, with significant financial resources to invest

into the existing portfolio with conviction seeking to boost revenue generation

for the future.

James Clifton-Brown

Chair

13 September 2021

PRINCIPAL RISKS AND UNCERTAINTIES

The Company's assets consist of direct investments in UK commercial property.

Its principal risks are therefore related to the commercial property market in

general, but also the particular circumstances of the properties in which it is

invested, and their tenants. The overarching risk to the Company's portfolio is

COVID-19, which has caused significant loss of life and global economic

disruption. It arguably affects all areas of risk on which the Company reports

and has increased the risk profile of the Company, as set out in the Chair's

Statement and the Investment Manager's Report. The Board and Investment Manager

seek to mitigate risks through a strong initial due diligence process,

continual review of the portfolio and active asset management initiatives. All

of the properties in the portfolio are insured, providing protection against

risks to the properties and also protection in case of injury to third parties

in relation to the properties.

The Board have carried out an assessment of the risk profile of the Company

which concluded that the risks as at 30 June 2021, including the overarching

risk of COVID-19, were not materially different from those detailed in the

statutory accounts for the Company for the year ended 31 December 2020, which

were published in April 2021.

Having reviewed the principal risks, including the impact of COVID-19, the

Directors believe that the Company has adequate resources to continue in

operational existence for the foreseeable future and therefore believes it

appropriate to adopt the going concern basis in preparing the financial

statements.

INVESTMENT MANAGER'S REPORT

MARKET COMMENTARY

In another half-year dominated by the impact of the COVID-19 pandemic, the UK

economy has surprised somewhat on the upside. Economic output contracted by

only 1.5% during the first quarter, despite the majority of it being spent in a

strict lockdown. After a fall in GDP of nearly 10% in 2020, the UK began the

year at a much lower base level of output. However, with remote working well

established, fiscal support firmly in place and the roll-out of vaccines

offering cause for optimism, the economy was able to adapt and function better

than many had anticipated.

Encouragingly, the economy has bounced back strongly during the second quarter

as measures to restrict the spread of the virus were gradually relaxed in line

with a Government roadmap first announced in February. That is despite the

dramatically more transmissible Delta variant of the virus leading to a renewed

surge in cases. Importantly, the successful vaccination programme in the UK

appears to have significantly weakened the link between infections and

hospitalisations.

The re-opening of the economy has seen inflation start to rise. But it is, in

some ways, a recovery period like no other; the pandemic severely affected the

supply side of the economy, which is being rebuilt alongside surging demand.

That has caused bottlenecks in some specific areas of the labour market,

exacerbated by frictions resulting from Brexit and the loss of EU labour

through the pandemic - particularly in London - that has largely not returned

to the UK. In addition, there are significant base effects driving inflation:

fuel prices dropped sharply last spring and are now significantly higher, while

the removal of fiscal packages such as the VAT cut and the "eat out to help

out" scheme will also drive inflation higher this year. Nevertheless, the Bank

of England's monetary policy committee is expected to look through this

inflation, which it argues is transitory, and interest rates are expected to

remain at their record low level for some time to come.

COMMERCIAL PROPERTY

The relaxation of lockdown restrictions during the second quarter has seen a

rebound in retail sales but perhaps not to the extent many had expected.

Footfall, particularly on high streets and in shopping centres, has remained

20-30% below the same period in 2019 but higher conversion rates have pushed

sales above 2019 levels. After an initial surge in sales on the reopening of

non-essential stores in April, sales volumes have plateaued and, indeed, fell

month-on-month in June across non-food stores. Retail parks have outperformed

in footfall and sales terms but, with many big-ticket purchases perhaps brought

forward and re-opened hospitality absorbing more of consumer spending, there

are signs that household goods and DIY sales are now falling back.

There was an extension of the moratorium on tenant evictions to the end of

June, removing the previously planned March cliff-edge that would have occurred

with shops still shuttered. A further extension was always possible, but few

foresaw the nine-month extension to March 2022 that was announced only weeks

before the June quarter day. The length of the extension was based on leaving

sufficient time for landlords and tenants to reach agreements relating to

unpaid rent bilaterally. Alongside the extension, the government announced that

a binding arbitration process would be written into legislation in due course -

likely in the autumn - which will apply if negotiations between landlords and

tenants fail. The legislation will also ring-fence arrears built up by

businesses during periods of enforced closure, implying that landlords will

share the financial impact with their tenants.

There was no material return to office working during the first half of the

year, due to concerns around the safety of office environments and public

transport commuting. Availability rates have risen in all major office markets

but most steeply in London with smaller, more secondary buildings hardest hit.

Vacancy has plateaued during the second quarter but at a high level that is

consistent with falling rents, especially in secondary stock that is out of

favour with tenants. Remote and hybrid working policies will outlive the

pandemic and most occupiers are acting cautiously and consultatively with their

workforces in respect of future requirements. In contrast, take-up remains

exceptionally strong in the industrial sector. In the logistics space, the

first half of 2021 set a new record level of take-up, driven by the fundamental

structural changes to the way and the speed with which goods are distributed to

consumers.

The backdrop of the Covid-19 restrictions in the first half of the year has

meant the MSCI/IPD Quarterly Index total return of 5.7% was quite remarkable.

The return was driven, again by the industrial sector (12.9%) as offices and

retail delivered muted figures (1.9% and 1.7% respectively).

Our house view forecast envisages a modest fall in values over the next year,

primarily driven by our expectation of falling rents in the office sector and a

further adjustment across fashion retail locations as valuations move towards

prevailing levels of pricing.

Strong performance, however, is expected from the industrial sector and from

out-of-town retail, in the form of both supermarkets and retail warehouses.

With the fundamentals supportive of further rental growth, investment demand

for industrials is set to push yields lower in the second half of the year and

the sector is forecast to remain the top performer over the next three years.

We expect bifurcation in the retail sector, with modern retail parks, let at

affordable rents and anchored by grocery, discount variety and DIY occupiers,

likely to deliver strong returns over the next 12 months. Fashion-oriented

parks are more vulnerable to the same occupational challenges facing high

streets and shopping centres, where we expect another year of negative total

returns. Bifurcation is also expected to be a feature of the office market,

with the best quality space favoured by tenants and more resilient for

investors and secondary space increasingly distressed. While our office

forecasts are weak overall, it is secondary space where vacancy is high and

letting appetite is very weak that is most at risk of significant falls in

rents and values.

INVESTMENT OUTLOOK

The UK economy is forecast to continue its recovery this year and achieve

growth of around 7% across 2021 as a whole. However, after a fall of nearly 10%

in 2020, the level of economic activity is expected to remain below pre-Covid

levels until at least next year. That implies an output gap and a rise in

unemployment towards 6% when the Coronavirus Job Retention Scheme ends at the

end of September.

Understandably, there is significant uncertainty around the outlook at present

and there remains a relatively low weighting to the central case as a result.

The global impact of the Delta variant - and the risk of further variants of

concern - is one source of uncertainty, while Brexit and trade remains an

issue. The escalatory situation regarding the Northern Ireland Protocol is but

one example that, far from being "done", Brexit is a process and one that will

be a continued source of friction and uncertainty for many UK businesses.

However, while the economic fundamentals are important, for much of the UK real

estate market it is structural trends that are set to drive performance over

the medium term. It is the continuation of the structural shift to online

shopping, which has been accelerated by the pandemic, that is driving logistics

demand and rental value growth. That same trend is one of the drivers of

discretionary retail's challenges, alongside a host of other headwinds. A

greater sustainability focus among younger shoppers, including rapid growth in

the second-hand market, alongside further digitisation of high street services

are among those additional headwinds.

The Government's failure to reform business rates continues to impair store

viability, while the withdrawal of VAT relief for tourists is a major

additional threat to central London values.

The expected divergence in fortunes across the office sector is expected to be

a key theme going forward, with total demand under downward pressure from

hybrid working and occupiers increasingly discerning about their space. Offices

that are not flexible, do not offer the amenity and connectivity tenants

demand, are not technologically-enabled and, importantly, fall down on

sustainability measures face a hugely challenging future that is not, in our

view, reflected in current values. Assets that are future-fit, however, will

remain attractive and could start to attract a rental premium if supply of the

highest quality buildings is constrained.

PERFORMANCE

The Company considers a range of measures when assessing its performance. The

underlying performance of the real estate assets is the first level of

consideration, and is a direct comparison to the wider market. The NAV total

return, on the other hand, is a better reflection of the return experienced by

the Company as a whole, as it encompasses all aspects of the Company including

debt and expenses. Finally, the share price total return is a useful metric in

so much as it reflects investor experience, but it is the one metric over which

the Investment Manager and the Board have least control.

PORTFOLIO LEVEL PERFORMANCE

The Company's investment portfolio performed well in the first six months of

2021 providing a total return of 7.9%, compared to the MSCI/IPD benchmark of

5.7%. This continues the portfolios out-performance over 1,3,5, and 10 year

periods. The outperformance is driven by a combination of sector allocation

(high exposure to the industrial sector which has performed strongly, and no

exposure to shopping centres that have performed very poorly), and partly due

to stock selection, particularly in retail warehousing where the Company's

exposure is to DIY and budget retail at affordable rents.

NAV PERFORMANCE

The underlying portfolio performance is the main driver of NAV performance,

however the debt used in the fund also has an impact - and with rising values

that impact is positive (the reduced interest rate swap liability over the

first half has also been beneficial). The NAV total return should not be

directly compared to the MSCI/IPD benchmark as the two contain different

factors, so the table below shows the Company's NAV total return over time

compared to the AIC sector of rival companies, and also the Investment

Associations open ended property funds sector.

NAV Total Returns to 30 June 2021 1 year 3 years 5 years (%) 10 years (%)

(%) (%)

Standard Life Investments Property Income Trust 15.6 13.5 40.0 159.2

AIC Property Direct - UK Sector (weighted average) 6.0 7.0 16.4 56.6

Investment Association Open Ended Commercial 1.1 -2.5 9.3 38.5

Property Funds sector

Source: Aberdeen Standard Investments, Association of Investment Companies

("AIC")

SHARE PRICE PERFORMANCE

Shares in the Company were trading at a 26.8% discount at the start of the

reporting period, and that has narrowed over the 6 months to 20.6% following

the increase in dividend and improved sentiment as we progress out of lockdown.

Share Price Total Returns to 30 June 2021 1 year 3 years 5 years (%) 10 years (%)

(%) (%)

Standard Life Investments Property Income Trust 22.1 -10.8 16.7 94.4

FTSE All-Share Index 21.5 6.3 36.9 85.5

AIC Property Direct - UK Sector (weighted average) 34.4 0.5 15.1 33.6

Source: Aberdeen Standard Investments, Association of Investment Companies

("AIC")

DIVID

SLIPIT is focussed on providing shareholders with an attractive level of

dividend. The Company continued to pay a dividend throughout the pandemic, but

the level in 2020 was 80% of that in 2019, 3.808p per share against 4.76p per

share. In the first quarter of 2021 the Company increased the quarterly

dividend by 25% to 0.8925 pence per share (maintained in the second quarter).

The Board believes this level to be sustainable and to have reasonable

prospects for growth as cash is invested and provisions reduce. If required a

5th dividend will again be paid, to ensure at least 90% of net rental income is

distributed, as required by the REIT rules.

The main factor in the Company's ability to pay the dividend is the amount of

rental income it receives. Over the last 9 months the Company has undertaken a

number of sales as it repositions the portfolio for a post Covid world; the net

rent the Company forecast at 30 June 2020 was £26.8m per annum, but by 30 June

2021 that had decreased to £24.5m.

Rental income will grow again as new investments are made and gearing

increased. The other impact on rental income is the collection of rent due.

Prior to Covid the Company regularly recovered 99% - 100% of the rent due,

however, the restrictions on tenants' ability to trade through Covid have

adversely impacted their ability to pay, and for 2020 the collection rate

stands at 95%. For the first half of 2021 it stands at 91%, reflecting the

severe lockdown and its impact on the first quarter, slowly relaxing into the

second. As at 31 August the third quarter figure stands at 94%. It should be

noted that the Company has taken a prudent approach to making provisions for

rent due, at roughly 8% of the rent due in the period.

Rent H1 Collection

collection

Retail 81%

Industrial 99%

Office 89%

Other 73%

Total 91%

PORTFOLIO VALUATION

The investment portfolio is valued on a quarterly basis by Knight Frank LLP. At

30 June the portfolio comprised 46 assets (55 the year before) valued at £

433.8m, with cash of £33.8m (£447.3m and £5.0m prior year). At 30 June there

was no money drawn on the RCF (£14m prior year). The portfolios initial yield

was 5.3% and the equivalent yield was 6.3%.

PORTFOLIO STRATEGY AND ALLOCATION

The Company has a clear investment objective, seeking to offer investors an

attractive level of income together with the prospect of income and capital

growth by investing in a diversified portfolio of commercial property. The

investment manager has focussed on two elements in its strategy recently:

1. ESG: We fundamentally believe that investments with strong ESG

credentials will perform better than similar investments with poor ESG

credentials. In order to achieve a reliable and growing income stream from

property assets, it will be increasingly important to have good quality

properties that meet tenants needs. Wellness is increasingly important to

occupiers, and energy performance (and carbon footprint) to both investors and

occupiers.

2. Change driven by Covid-19 means that an active approach to managing the

portfolio is required. Offices, in particular, are going through rapid change,

much of which is structural, just as retail has over the last 10 years. We have

undertaken a thorough review of the portfolio to ensure that the assets we hold

are "future fit", i.e. they will meet the needs of occupiers and investors in a

post Covid world.

Over the last ten years the Company has benefitted from investing in good

secondary properties at higher than average yields, and then enjoying yield

compression between prime and secondary. We strongly believe that the next 5

years will see a reversal of this theme, and that the spread for secondary

assets will widen, as their ESG credentials will not be good enough, and

investors will shy away. Sustainable and growing income will come from better

quality assets, and yields will remain keen for those. Poorer assets will fail

to attract tenants, and pricing will fall as new investors build in significant

refurbishment costs.

Aberdeen Standard Investments has developed tools to help it address these

changes. To help understand ESG matters at an asset level we have developed the

Impact Dial - a comprehensive measure of where the asset stands today, and what

it is capable of achieving, measureable against a benchmark or fund target. In

the office space we have developed a questionnaire based around key aspects

such as flexibility, amenity, connectivity, technology, and sustainability to

analyse each asset and its potential.

SLIPIT has always taken an active approach to managing its portfolio, and that

has continued into 2021, exiting three office assets that we did not believe

were future fit, and an industrial asset that had poor ESG credentials, that we

thought would impact future performance.

The structure of a portfolio remains an important component to driving returns,

and SLIPIT continues to have a high exposure to industrial (50.7% at 30 June),

a moderate exposure to offices (31.0%), and a low but growing exposure to

retail (11.0%) via retail warehousing. The Company's exposure to "other" is

mainly made up of a Data Centre, and leisure complex in north London with

redevelopment potential. We will increase the industrial and retail exposure

further assuming investments under offer complete.

Stock picking within favoured sectors drives returns as well, and in SLIPIT we

seek to own assets that meet tenants' needs. In the retail space this means

owning assets that are affordable and trade well for the tenant. In offices

that means owning assets with great amenity (eg showers and changing

facilities, coffee lounges etc) that are efficient to occupy (shared meeting

rooms etc). Increasingly, we have seen demand from tenants for fully fitted

office suites and have already provided them in many locations which has led to

enhanced letting terms at several buildings. SLIPIT benefits from a team of

experienced and dedicated asset managers who engage with the company's tenants

to maximise occupancy and income. Over the course of the last 15 months a great

deal of time has been spent liaising with tenants to agree rental payments that

enable their businesses to survive, but also recognising the contractual

arrangements in place.

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE (ESG)

The annual report and accounts provide a lot of information on our approach to

ESG. This report seeks to update on the activities we are undertaking. The

GRESB submission (the most widely used of ESG benchmarking in real estate) was

made in July and we await results, to be shared in the annual report and

accounts.

Our practical approach to ESG takes several forms:

1. All members of the team working on the SLIPIT portfolio have a key goal

"to be able to demonstrate that ESG is considered in every decision they make"

2. A team member given overarching responsibility to drive our PV and EV roll

out

3. New lettings to have enhanced lease provision for collection of utility

consumption data

4. Net zero assessment being made from fund level to asset action plans

5. All assets to be assessed under the ASI Impact Dial proprietary tool

6. All office planned maintenance plans to incorporate additional capex

required to meet future energy standards through to 2030

7. Future carbon offset plan in place to give fixed cost solution.

The PV programme continues to grow, however it is slow progress, as we work on

getting tenant usage data and documentation, securing grid connections and

engineers' reports on loading capacity.

In addition to the 6 operational PV schemes providing 1.2mwp we have a further

13 that are advanced (offering up to 2.8mWp), and another 7 where discussions

on capacity are just starting. To put this into context, the existing PV output

is sufficient to boil a kettle 7,944,006 times a year, or to power 428 electric

cars for a year. It is also equivalent to the yearly electrical use of 239

average UK households.

Even a very efficient property portfolio will have some residual carbon that

will require to be offset. The SLIPIT investment team believes that offsetting

is a last resort after minimising carbon output, and that if it is to be

undertaken then it needs to be done to the highest standard. As a result,

SLIPIT has acquired 1,447 hectares of rough upland grazing and open moorland in

the Cairngorm National Park for reforestation and peatland restoration. 956

acres are for planting, 167 hectares of open ground for diverse natural

habitat, and 324 hectares are of deep peat, of which 115 is suitable for

restoration. This is not an investment into commercial forestry, but is the

purchase of land to plant natural broadleaf trees to generate woodland carbon

credits in the future. The benefit of acquiring a carbon offset by this method

is that the cost is known, and attractive, compared to buying carbon offsets in

the open market. It comes with a significant responsibility. We will be

creating a long term diverse natural habitat, and have to be aware of

sensitivities to local communities and existing land uses. The purchase price

for the land is £7.5m and the Company will be seeking a planting consent for

the land. The cost of fencing and planting is likely to be covered fully by

grants. The Investment Manager and the Board believe that being early entrants

into this market will be of financial benefit to the Company in future years as

more institutions seek net zero pathways.

This is a large project with the planting of approximately 1.5m trees in

addition to the peatland restoration. It is anticipated the site will sequester

approximately 373,000 tonnes of carbon over the life of the project. Other

potential benefits include flood mitigation, bio diverse habitat creation, soil

retention and water purification. The net biodiversity gain is going to become

more important in real estate as changes to planning legislation will require

future net gain to be demonstrated, both on and off site on all new

developments.

ASSET MANAGEMENT

Over the first 6 months, 5 lease restructures / renewals were agreed to extend

the income, securing £877,830pa. Just after the reporting period a further

lease was renewed to secure £255,000pa on a logistics unit (23% above the

previous rent).

In the same period three office lettings and one renewal were completed to

secure £444,575pa. It is hoped that conversion of office interest will increase

as Covid restrictions are eased.

Voids currently stand at 12.2%, an increase caused in part by property

disposals during the period but also from several office lease expiries. Office

demand has been muted as people are required to work from home but we expect to

see an increase in demand through the remainder of the year which will, in

turn, improve our rental income and reduce our cost base.

INVESTMENT SALES

We continued to reposition the portfolio for a post Covid world with the sale

of three office assets for a total of £17.25m that we did not believe were

going to meet future needs, as well as an industrial unit for £6.25m with poor

ESG credentials, and a small retail warehouse unit investment for £2.65m.

After the reporting period we also completed the sale of a small office in

Bishops Stortford for £3.75m.

INVESTMENT PURCHASES

No purchases were completed in the first half of the year although terms have

been agreed to buy a B&Q retail warehouse for £14m at a yield of 6.5%, a

logistics unit in Washington for £7m at a yield of 5.75% recently let on a new

15 year lease, and to fund an industrial development pre let to a Council for

15 years at a total cost of £15m, reflecting a yield of 4.25%.

New purchases will focus on good quality assets that can provide a sustainable

income. ESG will play an important part in the assessment of suitable new

investments in terms of energy efficiency, carbon footprint, tenant use, and

social factors.

DEBT

The Company has two facilities with RBS, both of which expire in April 2023.

The main facility is a fully drawn fixed term loan of £110m, which is subject

to an interest rate swap. The second part of the facility is a Revolving Credit

Facility (RCF) of £55m. At 30 June no sum was drawn from the RCF, as the

proceeds of sales at the end of 2020 and into 2021 were used to repay it. It is

anticipated that the RCF will be utilised again later in 2021 as further

investments are made. The loan to value ratio at 30 June stood at 17.6%, which

is the lowest it has ever been. Given the wider general outlook a range of

20%-30% is seen as more desirable.

CONCLUSION

It is easy to feel quite positive currently, with the economy growing, tenant

activity improving, and the portfolio performing well. The level of change we

are experiencing suits an actively managed fund, and we believe the

repositioning of the portfolio and renewed focus on ESG will drive continued

out-performance. However, caution is required. Autumn and winter are likely to

see a resurgence in Covid, and if that comes in the form of another variant

where vaccines are less effective, then that will have a negative impact. We

are also keeping a close watch on inflationary pressures, especially in

building supplies and labour.

We will continue to manage the portfolio with caution, trying to adapt to

change, and meeting occupier needs so that we can continue to generate a

sustainable rental income to pay an attractive dividend.

Jason Baggaley

Investment Manager

13 September 2021

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors are responsible for preparing the Interim Management Report in

accordance with applicable law and regulations. The Directors confirm that to

the best of their knowledge:

- The condensed Unaudited Consolidated Financial Statements have been prepared

in accordance with IAS 34; and

- The Interim Management Report includes a fair review of the information

required by 4.2.7R and 4.2.8R of the Financial Conduct Authority's Disclosure

Guidance and Transparency Rules; and

- In accordance with 4.2.9R of the Financial Conduct Authority's Disclosure

Guidance and Transparency Rules, it is confirmed that this publication has not

been audited or reviewed by the Company's auditors.

The Interim Report, for the six months ended 30 June 2021, comprises an Interim

Management Report in the form of the Chair's Statement, the Investment

Manager's Report, the Directors' Responsibility Statement and a condensed set

of Unaudited Consolidated Financial Statements. The Directors each confirm to

the best of their knowledge that:

a. the Unaudited Consolidated Financial Statements are prepared in accordance

with IFRSs as adopted by the European Union, give a true and fair view of the

assets, liabilities, financial position and profit or loss of the Group; and

b. the Interim Report includes a fair review of the development and performance

of the business and the position of the Group, together with a description of

the principal risks and uncertainties faced.

For and on behalf of the Directors of Standard Life Investments Property Income

Trust Limited.

Approved by the Board on

13 September 2021

James Clifton-Brown

Chair

FINANCIAL STATEMENTS

Unaudited Consolidated Statement of Comprehensive Income for the period ended

30 June 2021

Notes 1 Jan 2021 to 30 Jun 1 Jan 2020 to 30 Jun 1 Jan 2020 to 31 Dec

2021 £ 2020 £ 2020 £

Rental income 14,236,719 14,475,764 29,439,549

Service charge income 1,919,813 846,574 3,543,976

Surrender premium - - 21,250

Valuation gain/(loss) from investment 3 23,692,631 (38,278,871) (27,640,224)

properties

Loss on disposal of investment properties 3 (1,373,427) (97,867) (4,806,137)

Investment management fees 2 (1,602,289) (1,596,433) (3,198,519)

Valuer's fees (37,078) (45,402) (84,638)

Auditor's fees (74,300) (39,250) (118,400)

Directors' fees and expenses (105,962) (125,882) (236,953)

Service charge expenditure (1,919,813) (846,574) (3,543,976)

Other direct property expenses (2,632,817) (2,540,224) (4,904,968)

Other administration expenses (405,619) (346,263) (512,849)

Operating profit/(loss) 31,697,858 (28,594,428) (12,041,889)

Finance income 526 3,801 3,896

Finance costs (1,746,493) (1,823,245) (3,744,074)

Profit/(loss) for the period before taxation 29,951,891 (30,413,872) (15,782,067)

Taxation

Tax charge - - -

Profit/(loss) for the period, net of tax 29,951,891 (30,413,872) (15,782,067)

Other Comprehensive Income

Valuation gain/(loss) on cash flow hedge 1,289,811 (1,831,613) (1,514,638)

Total other comprehensive gain/(loss) 1,289,811 (1,831,613) (1,514,638)

Total comprehensive gain/(loss) for the period, 31,241,702 (32,245,485) (17,296,705)

net of tax

Earnings per share (p) (p) (p)

Basic and diluted earnings per share 5 7.50 (7.48) (3.88)

Adjusted (EPRA) earnings per share 1.90 1.96 4.10

All items included in the above Unaudited Consolidated Statement of

Comprehensive Income derive from continuing operations.

The notes are an integral part of these Unaudited Consolidated Financial

Statements.

Unaudited Consolidated Balance Sheet as at 30 June 2021

Notes 30 Jun 2021 30 Jun 2020 31 Dec 2020 £

£ £

Non-current assets

Investment properties 3 423,666,556 442,987,223 428,412,375

Lease incentives 3 7,335,331 5,211,158 5,885,270

Rental deposits held on behalf of tenants 833,768 1,393,927 855,866

431,835,655 449,592,308 435,153,511

Current assets

Investment properties held for sale 3, 4 3,700,000 - 4,300,000

Trade and other receivables 6,222,513 9,898,419 10,802,197

Cash and cash equivalents 33,750,589 4,993,983 9,383,371

43,673,102 14,892,402 24,485,568

Total Assets 475,508,757 464,484,710 459,639,079

LIABILITIES

Current liabilities

Trade and other payables 11,414,647 10,894,423 13,096,054

Interest rate swap 8 1,354,600 1,194,281 1,472,387

12,769,247 12,088,704 14,568,441

Non-current liabilities

Bank borrowings 9 109,638,819 123,421,818 109,542,823

Interest rate swap 8 1,090,841 2,857,948 2,262,867

Obligations under finance leases 901,887 903,831 902,645

Rent deposits due to tenants 833,768 1,393,927 855,866

112,465,315 128,577,524 113,564,201

Total liabilities 125,234,562 140,666,228 128,132,642

Net assets 350,274,195 323,818,482 331,506,437

EQUITY

Capital and reserves attributable to Company's equity holders

Share capital 228,383,857 228,383,857 228,383,857

Treasury Share Reserve (5,991,417) - (1,450,787)

Retained earnings 7,038,582 4,447,819 7,339,209

Capital reserves 23,004,801 (6,851,566) (604,214)

Other distributable reserves 97,838,372 97,838,372 97,838,372

Total equity 350,274,195 323,818,482 331,506,437

NAV per share 88.3 79.6 82.0

EPRA NTV 88.9 80.6 82.9

The notes are an integral part of these Unaudited Consolidated Financial

Statements.

Unaudited Consolidated Statement of Changes in Equity for the period ended 30

June 2021

Notes Share Treasury Retained Capital Other Total equity £

Capital £ Shares £ Earnings £ Reserves £ Distributable

Reserves £

Opening balance 1 January 2021 228,383,857 (1,450,787) 7,339,209 (604,214) 97,838,372 331,506,437

Profit for the period - - 29,951,891 - - 29,951,891

Other comprehensive income - - - 1,289,811 - 1,289,811

Total comprehensive income for the - - 29,951,891 1,289,811 - 31,241,702

period

Ordinary shares placed into treasury - (4,540,630) - - - (4,540,630)

net of issue costs

Dividends paid 7 - - (7,933,314) - - (7,933,314)

Valuation gain from investment 3 - - (23,692,631) 23,692,631 - -

properties

Loss on disposal of investment 3 - - 1,373,427 (1,373,427) - -

properties

Balance at 30 June 2021 228,383,857 (5,991,417) 7,038,582 23,004,801 97,838,372 350,274,195

Notes Share Treasury Retained Capital Other Total equity £

Capital £ Shares £ Earnings £ Reserves £ Distributable

Reserves £

Opening balance 1 January 2020 227,431,057 - 6,168,350 33,356,785 97,838,372 364,794,564

Loss for the period - - (30,413,872) - - (30,413,872)

Other comprehensive income - - - (1,831,613) - (1,831,613)

Total comprehensive loss for the - - (30,413,872) (1,831,613) - (32,245,485)

period

Ordinary shares issued net of issue 952,800 - - - - 952,800

costs

Dividends paid 7 - - (9,683,397) - - (9,683,397)

Valuation loss from investment - - 38,278,871 (38,278,871) - -

properties

Loss on disposal of investment 3 - - 97,867 (97,867) - -

properties

Balance at 30 June 2020 228,383,857 - 4,447,819 (6,851,566) 97,838,372 323,818,482

Notes Share Treasury Retained Capital Other Total equity £

Capital £ Shares £ Earnings £ Reserves £ Distributable

Reserves £

Opening balance at 1 January 2020 227,431,057 - 6,168,350 33,356,785 97,838,372 364,794,564

Loss for the year - - (15,782,067) - - (15,782,067)

Other comprehensive income - - - (1,514,638) - (1,514,638)

Total comprehensive loss for the - - (15,782,067) (1,514,638) - (17,296,705)

period

Ordinary shares issued net of issue 952,800 - - - - 952,800

costs

Ordinary shares placed into treasury - (1,450,787) - - - (1,450,787)

net of issue costs

Dividends paid 7 - - (15,493,435) - - (15,493,435)

Valuation loss from investment - - 27,640,224 (27,640,224) - -

properties

Loss on disposal of investment 3 - - 4,806,137 (4,806,137) - -

properties

Balance at 31 December 2020 228,383,857 (1,450,787) 7,339,209 (604,214) 97,838,372 331,506,437

The notes are an integral part of these Unaudited Consolidated Financial

Statements.

Unaudited Consolidated Cash Flow Statement for the period ended 30 June 2021

Cash flows from operating activities Notes 1 Jan 2021 to 1 Jan 2020 to 1 Jan 2020 to

30 Jun 2021 £ 30 Jun 2020 £ 31 Dec 2020 £

Profit/(loss) for the period before taxation 29,951,891 (30,413,872) (15,782,067)

Movement in lease incentives (1,499,070) (659,591) (1,694,642)

Movement in trade and other receivables 4,602,539 (6,080,465) (6,446,180)

Movement in trade and other payables (1,704,263) 1,757,627 3,421,484

Finance costs 1,746,493 1,823,245 3,744,074

Finance income (526) (3,801) (3,896)

Valuation (gain)/loss from investment properties 3 (23,692,631) 38,278,871 27,640,224

Loss on disposal of investment properties 3 1,373,427 97,867 4,806,137

Net cash inflow from operating activities 10,777,860 4,799,881 15,685,134

Cash flows from investing activities

Interest received 526 3,801 3,896

Purchase of investment properties - - (21,297,754)

Capital expenditure on investment properties 3 (388,299) (2,438,541) (4,947,828)

Net proceeds from disposal of investment properties 3 28,101,573 10,602,133 50,973,863

Net cash inflow from investing activities 27,713,800 8,167,393 24,732,177

Cash flows from financing activities

Net proceeds on issue of ordinary shares - 952,800 952,800

Shares bought back during the year (4,540,630) - (1,450,787)

Bank borrowing - 6,000,000 27,000,000

Repayment of RCF - (10,000,000) (45,000,000)

Interest paid on bank borrowing (943,690) (1,545,552) (2,479,388)

Payments on interest rate swap (706,808) (172,761) (1,038,749)

Dividends paid to the Company's shareholders 7 (7,933,314) (9,683,397) (15,493,435)

Net cash outflow from financing activities (14,124,442) (14,448,910) (37,509,559)

Net increase/(decrease) in cash and cash equivalents 24,367,218 (1,481,636) 2,907,752

Cash and cash equivalents at beginning of period 9,383,371 6,475,619 6,475,619

Cash and cash equivalents at end of period 33,750,589 4,993,983 9,383,371

The notes are an integral part of these Unaudited Consolidated Financial

Statements.

Notes to the Unaudited Consolidated Financial Statements for the period ended

30 June 2021

1 ACCOUNTING POLICIES

The Unaudited Consolidated Financial Statements have been prepared in

accordance with International Financial Reporting Standard ("IFRS") IAS 34

'Interim Financial Reporting' and, except as described below, the accounting

policies set out in the statutory accounts of the Group for the year ended 31

December 2020. The condensed Unaudited Consolidated Financial Statements do not

include all of the information required for a complete set of IFRS financial

statements and should be read in conjunction with the Consolidated Financial

Statements of the Group for the year ended 31 December 2020, which were

prepared under full IFRS requirements.

2 RELATED PARTY DISCLOSURES

Parties are considered to be related if one party has the ability to control

the other party or exercise significant influence over the other party in

making financial or operational decisions.

Investment Manager

Aberdeen Standard Fund Managers Limited received fees for their services as

investment managers.

Under the terms of the IMA the Investment Manager is entitled to 0.70% of total

assets up to £500 million; and 0.60% of total assets in excess of £500 million.

The total fees charged for the period ended 30 June 2021 amounted to £1,602,289

(period ended 30 June 2020: £1,596,433). The total amount due and payable at

the period end amounted to £810,544 excluding VAT (period ended 30 June 2020: £

791,146 excluding VAT).

3 INVESTMENT PROPERTIES

Country UK UK UK UK

Class Industrial Office Retail Other Total

30 Jun 2021 30 Jun 2021 30 Jun 2021 30 Jun 30 Jun 2021

2021

Market value as at 1 January 211,200,000 142,695,000 51,150,000 32,650,000 437,695,000

Capital expenditure on investment properties 500 542,165 (161,866) 7,500 388,299

Opening market value of disposed investment properties (9,400,000) (17,425,000) (2,650,000) - (29,475,000)

Valuation gain from investment properties 19,242,790 1,310,424 2,117,985 1,021,432 23,692,631

Movement in lease incentives receivable 806,710 527,411 93,881 71,068 1,499,070

Market value at 30 June 221,850,000 127,650,000 50,550,000 33,750,000 433,800,000

Investment property recognised as held for sale - (3,700,000) - - (3,700,000)

Market value net of held for sale at 30 June 221,850,000 123,950,000 50,550,000 33,750,000 430,100,000

Right of use asset recognised on leasehold properties - 901,887 - - 901,887

Adjustment for lease incentives (3,306,019) (2,737,168) (654,812) (637,332) (7,335,331)

Carrying value at 30 June 218,543,981 122,114,719 49,895,188 33,112,668 423,666,556

The market value provided by Knight Frank LLP at the period ended 30 June 2021

was £433,800,000 (30 June 2020: £447,295,000) however adjustments have been

made for lease incentives of £7,335,331 (30 June 2020: £5,211,158) under IFRS

requirements and leasehold right of use assets of £901,887 (30 June 2020: £

903,381) under IFRS requirements.

Further details regarding the investment property recognised as held for sale

can be found in Note 4.

In the unaudited consolidated cash flow statement, surplus from

disposal of investment properties comprise:

30 Jun 21 30 Jun 20 31 Dec 20

Opening market value of disposed investment properties 29,475,000 10,700,000 55,780,000

Loss on disposal of investment properties (1,373,427) (97,867) (4,806,137)

Net proceeds from disposed investment properties 28,101,573 10,602,133 50,973,863

4 INVESTMENT PROPERTIES HELD FOR SALE

As at 30 June 2021, the Group was actively seeking a buyer for Anglia House,

Bishop's Stortford. The Group both exchanged contracts and completed this sale

on 10 September 2021 for a price of £3,750,000.

5 EARNINGS PER SHARE

The earnings per Ordinary share are based on the net profit for the period of £

29,951,891 (30 June 2020: loss of £30,413,872) and 399,178,920 (30 June 2020:

406,671,111) ordinary shares, being the weighted average number of shares in

issue during the period.

Earnings for the period to 30 June 2021 should not be taken as a guide to the

results for the year to 31 December 2021.

6 INVESTMENT IN SUBSIDIARY UNDERTAKINGS

The Group undertakings consist of the following 100% owned subsidiaries at the

Balance Sheet date:

· Standard Life Investments Property Holdings Limited, a property

investment company with limited liability incorporated in Guernsey, Channel

Islands.

· Standard Life Investments (SLIPIT) Limited Partnership, a property

investment limited partnership established in England.

· Standard Life Investments SLIPIT (General Partner) Limited, a company

with limited liability incorporated in England. This Company is the GP for the

Limited Partnership.

· Standard Life Investments SLIPIT (Nominee) Limited, a company with

limited liability incorporated and domiciled in England.

· Hagley Road Limited, a property investment company with limited

liability incorporated in Jersey, Channel Islands.

7 DIVIDS AND PROPERTY INCOME DISTRIBUTION GROSS OF INCOME TAX

30 Jun 2021 30 Jun 2020 31 Dec 2020

£ £ £

Non property income distributions

0.561p per ordinary share paid in March 2020 relating to the quarter - 2,284,011 2,284,011

ending 31 December 2019

0.238p per ordinary share paid in May 2020 relating to the quarter ending - 968,340 968,340

31 March 2020

Property income distributions

0.629p per ordinary share paid in March 2020 relating to the quarter - 2,557,687 2,557,687

ending 31 December 2019

0.952p per ordinary share paid in May 2020 relating to the quarter ending - 3,873,359 3,873,359

31 March 2020

0.714p per ordinary share paid in August 2020 relating to the quarter - - 2,905,019

ending 30 June 2020

0.714p per ordinary share paid in November 2020 relating to the quarter - - 2,905,019

ending 30 September 2020

0.714 per ordinary share paid in February 2021 relating to the quarter 2,878,508 - -

ending 31 December 2020

0.381p per ordinary share paid in May 2021 relating to the quarter ending 1,512,274 - -

31 December 2020

0.8925p per ordinary share paid in May 2021 relating to the quarter ending 3,542,532 - -

31 March 2021

7,933,314 9,683,397 15,493,435

A property income dividend of 0.8925p per share was declared on 4 August 2021

in respect of the quarter to 30 June 2021 - a total payment of £3,542,532. This

was paid on 27 August 2021.

8 FINANCIAL INSTRUMENTS AND INVESTMENT PROPERTIES

Fair values

The fair value of financial assets and liabilities is not materially different

from the carrying value in the annual financial statements.

Fair value hierarchy

The following table shows an analysis of the fair values of investment

properties recognised in the balance sheet by the level of the fair value

hierarchy:

30 June 2021 Level 1 Level 2 Level 3 Total fair

value

Investment properties - - 434,701,887 434,701,887

The lowest level of input is the underlying yields on each property which is an

input not based on observable market data.

The following table shows an analysis of the fair values of financial

instruments recognised in the balance sheet by the level of the fair value

hierarchy:

30 June 2021 Level 1 Level 2 Level 3 Total fair

value

Loan facilities - 111,538,104 - 111,538,104

The lowest level of input is the interest rate payable on each borrowing which

is a directly observable input.

30 June 2021 Level 1 Level 2 Level 3 Total fair

value

Interest rate swap - 2,445,441 - 2,445,441

Of the figure above, £1,354,600 is included within current liabilities and £

1,090,841 is included within non-current liabilites. The lowest level of input

is the three month LIBOR yield curve which is a directly observable input.

There were no transfers between levels of fair value hierarchy during the six

months ended 30 June 2021.

Explanation of the fair value hierarchy:

Level 1 Quoted (unadjusted) market prices in active markets for identical

assets or liabilities.

Level 2 Valuation techniques for which the lowest level input that is

significant to the fair value measurement is directly or indirectly observable.

Level 3 Valuation techniques for which the lowest level input that is

significant to the fair value measurement is unobservable.

The fair value of investment properties is calculated using unobservable inputs

as described in the annual report and accounts for the year ended 31 December

2020.

Sensitivity of measurement to variance of significant unobservable inputs:

· A decrease in the estimated annual rent will decrease the fair value.

· An increase in the discount rates and the capitalisation rates will

decrease the fair value.

· There are interrelationships between these rates as they are partially

determined by the market rate conditions.

· The fair value of the derivative interest rate swap contract is

estimated by discounting expected future cash flows using current market

interest rates and yield curves over the remaining term of the instrument.

The fair value of the loan facilities are estimated by discounting expected

future cash flows using the current interest rates applicable to each loan.

9 BANK BORROWINGS

On 28 April 2016 the Company entered into an agreement to extend £145 million

of its existing £155 million debt facility with RBS. The debt facility

consisted of a £110 million seven year term loan facility and a £35 million

five year RCF which was extended by two years in May 2018 with the margin on

the RCF now at LIBOR plus 1.45%. Interest is payable on the Term Loan at 3

month LIBOR plus 1.375% which equates to a fixed rate of 2.725% on the Term

Loan.

In June 2019, the Company also entered into a new arrangement with the Royal

Bank of Scotland International Limited (RBSI) to extend its Revolving Credit

Facility (RCF) by £20 million. This facility has a margin of 1.60% above LIBOR.

As at 30 June 2021 none of the RCF was drawn (30 June 2020: £14 million).

Under the terms of the loan facility there are certain events which would

entitle RBS to terminate the loan facility and demand repayment of all sums

due. Included in these events of default is the financial undertaking relating

to the LTV percentage. The loan agreement notes that the LTV percentage is

calculated as the loan amount less the amount of any sterling cash deposited

within the security of RBS divided by the gross secured property value, and

that this percentage should not exceed 60% for the period to and including 27

April 2021 and should not exceed 55% after 27 April 2021 to maturity.

10 EVENTS AFTER THE BALANCE SHEET DATE

On 10 September 2021, the Company completed the acquisition of rough upland

grazing and open moorland in Cairngorm National Park for £7.5m, further details

of which are in the Chair's Statement.

Also on 10 September 2021, the Company completed the sale of Anglia House,

Bishop's Stortford for £3.75m.

All enquiries to:

The Company Secretary

Northern Trust International Fund Administration Services (Guernsey) Limited

Trafalgar Court

Les Banques

St Peter Port

Guernsey

GY1 3QL

Tel: 01481 745001

Fax: 01481 745051

Jason Baggaley

Aberdeen Standard Investments

Tel: 0131 245 2833

Gregg Carswell

Aberdeen Standard Investments

Tel: 0131 222 8278

END

END

(END) Dow Jones Newswires

September 14, 2021 02:00 ET (06:00 GMT)

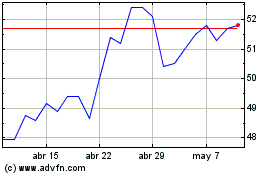

Abrdn Property Income (LSE:API)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Abrdn Property Income (LSE:API)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024