TIDMTHAL

RNS Number : 7166B

Thalassa Holdings Limited

14 June 2021

Thalassa Holdings Limited

14 June 2021

This announcement contains inside information as defined in

Article 7 of the Market Abuse Regulation 596/2014 and is disclosed

in accordance with the Company's obligations under Article 17 of

those Regulations.

Thalassa Holdings Ltd

(Reuters: THAL.L, Bloomberg: THAL:LN)

("Thalassa", "THAL" or the "Company")

Preliminary Results for the year ended 31 December 2020

2020 HIGHLIGHTS

Group Results 2020 versus 2019 US$

-- Group Profit /(loss) after tax for the year $0.9m vs.

$(3.0)m

Continuing Operations

-- Operating Loss before exceptional costs & depreciation $(3.1)m vs. $(3.4)m

-- Operating Loss before depreciation (EBITDA) $(3.2)m vs.

$(4.3)m

-- Group Profit/(Loss) from continuing operations $1.7m vs.

$(3.5)m

Discontinued Operations

-- Group Profit/(Loss) from discontinued operations $(0.87)m vs. $0.5m

-- Group Earnings Per Share (basic and diluted)*(1)

$0.06/GBP0.05 vs. $(0.18)/GBP(0.14)

-- Book value per share*(2) $1.97/GBP1.51 vs. $1.69/GBP1.28

-- Investment Holdings $7.6m vs. $1.7m

-- Net Cash $5.0m vs. $18.2m*(3)

-- Shares repurchased (Number & Value) 3.6m ($2.1m) vs. 1.6m

($1.1m)

*(1) based on weighted average number of shares in issue of

14,139,629 (2019: 17,143,300) and GBP1 = $1.29 (2019: GBP1 =

$1.28)

*(2) based on actual number of shares in issue as at 31 December

2020 of 7,945,838 (2019: 16,242,283)

and GBP1 = $1.36 (2019: GBP1 = $1.32)

* 3 Cash reduced as a result of Capital Distribution

2020 HIGHLIGHTS

-- LSR

Capital distribution to THAL shareholders of the Company's

position in Alina Holdings PLC (formerly The Local Shopping REIT

Plc ("LSR"))

-- Autonomous Robotics Limited

Won a grant funded award from the Oil & Gas Technology

Centre ("OGTC") to progress the development of the Company's Flying

Node. The project is sponsored by two global energy companies from

France and Norway.

Recruited three robotics software engineers to accelerate the

development of the node software

Member of a consortium which was accepted onto a new MOD multi

supplier framework agreement. Partners are two multi-billion-dollar

defence contractors, one US, the other Israeli.

-- id4 AG

id4 awarded Winner of Best Compliance Solution Award at the

prestigious "WealthBriefing Swiss Awards 2020". Commercial software

solution now being rolled out with successful contract

announcements

-- Tappit Technologies (UK) Limited

A GBP3m investment completed in Tappit Technologies (UK) Ltd, an

events-based cashless payment system.

Investor Enquiries:

Thalassa Holdings Ltd

Duncan Soukup, Chairman +33 (0)6 78 63 26 89

WH Ireland Limited (Financial Adviser)

Chris Fielding, Managing Director, Corporate Finance +44 (0)207 220 1650

www.thalassaholdingsltd.com

Note to Editors:

Thalassa Holdings Ltd, incorporated and registered in the BVI,

is a holding company with various interests across a number of

industries.

CHAIRMAN'S STATEMENT

2020 an Annus Horribilis.

2020 was a serious reminder, especially for any advocates of big

Government, why less is more. From China through India to Europe

and the USA the recurring stories of failed Politically-led medical

response to the COVID-19 virus and the resultant spend "whatever it

takes" monetary policy response is a glaringly stark reminder why

the World is better off with less not more Government

intervention.

To make matters worse, if that was possible, 2020 also reminded

us why Political leaders shouldn't actually be running soup

kitchens. How arrogant does someone have to be to convince

themselves, with disastrous consequences, that they knew more about

medicine than the medical practitioners advising them. Global

lockdowns and re-openings followed by further lockdowns brought

travel chaos; mass business failures were only avoided due to

Central Bank intervention as Interest rates were driven down to 0%

and, in some cases, into negative territory, whilst money printing

became the preferred drug of every Central Banker. And now, a year

later Europe is only slowly progressing towards mass vaccination

and economic recovery.

The consequences of unprecedented monetary intervention are

still unknown, but as is already becoming clear from indicated

changes to US and UK Fiscal policies, taxes will have to increase

to pay the Piper. Whilst the USA appears to be 'normalising',

Europe is still struggling to formulate either a unified medical or

economic response to the COVID Pandemic.

Notwithstanding the above, somewhat critical assessment of the

World's response to the COVID Pandemic, Stock markets are at or

around all-time highs, driven by a limited number of "story

stocks", long on rhetoric but short or devoid of earnings!

And to cap it all, market commentary would have us believe that

it really is different this time and that infinite multiples, on

stocks with minimal-, or in some cases, no earnings, are justified

when interest rates are at or around 0%. I fear that US tech

investors in the "it's different this time" camp will soon be

subjected to a very rude lesson and reminder that what Mr Market

giveth, he can also take away, in the blink of an eye, as interest

rates rise in response to increasing inflation.

Operational update

Whilst 2019, was, from Thalassa's point of view, a period of

immense hard work with very little reportable news. 2020 was not

only busy but constructive in that we were able to capitalise on

the collapse in stock prices between January and April 2020 which

resulted in booking substantial gains on our hedge positions for

the year. Whilst we were actively hedging, to protect the Company

from the fallout from COVID-19, we were busy managing our current

holdings and investing in a number of new situations:

Autonomous Robotics Ltd Proof of Concept completed. Discussions

with potential commercial development partners at advanced stage

but with no guaranty of successful completion. Focus on

commercialisation of Node system and fundraising for production of

shallow water system.

Apeiron Holdings AG The Company's subsidiary id4, a Swiss

RegTech Software developer has now completed Phase 2 development of

its SAAS software and has begun securing initial contracts whilst

simultaneously expanding current relationships with initial

clients.

Anemoi International Ltd London listing (on the Standard List)

completed and now actively looking for an RTO target.

WGP The Company stands to earn a further $4 million if a second

specific contract is awarded before 1 January 2023. Unfortunately,

the project has been delayed due to welding failures during

construction of the client's new Floating Production Storage and

Offloading vessel ("FPSO") currently being built in Singapore. The

new oil field should have commenced production in 2022; this has

now been pushed out to 2023. Our contract expires in January 2023.

It is still likely that seismic work will commence before

production is due to commence in Q3 2023, however it is too early

to get a feel for the revised timetable.

Alina Holdings Plc (formerly The Local Shopping REIT Plc.) In

November 2020 Alina successfully relisted on the London Stock

Exchange as an operating company in the Leisure sector. Management

are reviewing a number of opportunities in the European market,

however, given the resurgence in COVID-19 related cases and renewed

lockdowns in France and Germany may well have a significant

negative impact on summer tourism this year, it is unlikely that

Management of Alina will be in a big hurry to complete an early

transaction given the overhang of opportunities currently available

in the market.

Miscellaneous Holdings As previously reported, Thalassa went

into the January/March 2020 market collapse well positioned and

benefited substantially from the 30% fall in Global stock prices

and were able to extend those gains through the second half of the

year.

2021 Outlook Continued Central Bank intervention, coupled with

President Biden's recently announced $2.25 Trillion infrastructure

spending plan have substantially changed our view on Stock Market

Risk, particularly in the USA. If, and in our view, it is a big if,

the infrastructure spending plan is approved by both Congress and

the Senate, it is likely to only do so after significant horse

trading and compromise. In our opinion, the euphoric response to

the President's spending plan leaves little or no room for

disappointment and leaves the US (Tech) Market wide open to

disappointment.

Share buy-back . As previously announced, the Company's share

buy-back programme has been suspended in order to conserve

cash.

I would like to thank the Company's staff who continue to work

tirelessly in these difficult times.

Duncan Soukup

Chairman

8 June 2021

CONSOLIDATED STATEMENT OF INCOME

for the year ended 31 December 2020

2020 2019

Note $ $

Continuing Operations

Revenue 3 55,855 170,357

Cost of sales 900 (276,001)

Gross profit / (loss) 56,755 (105,644)

----------------------------------------------- ----- ------------ ------------

Administrative expenses excluding exceptional

costs (3,131,073) (3,332,632)

Exceptional administration costs 5 (77,603) (898,878)

----------------------------------------------- ----- ------------ ------------

Total administrative expenses (3,208,676) (4,231,510)

----------------------------------------------- ----- ------------ ------------

Operating loss before depreciation (3,151,921) (4,337,154)

----------------------------------------------- ----- ------------ ------------

Depreciation 14 (47,771) (26,308)

----------------------------------------------- ----- ------------ ------------

Impairment - (157,185)

----------------------------------------------- ----- ------------ ------------

Operating loss 4 (3,199,692) (4,520,647)

----------------------------------------------- ----- ------------ ------------

Net financial income/(expense) 7 3,591,382 (640,117)

----------------------------------------------- ----- ------------ ------------

Other gains 1,160,300 -

----------------------------------------------- ----- ------------ ------------

Share of profits less (losses) of associated

entities 24 - (629,523)

----------------------------------------------- ----- ------------ ------------

Profits on disposal of associated entities - 2,000,978

----------------------------------------------- ----- ------------ ------------

Profit/(loss) before taxation 1,551,990 (3,789,309)

----------------------------------------------- ----- ------------ ------------

Taxation 8 109,303 253,065

----------------------------------------------- ----- ------------ ------------

Profit/(loss) for the year from continuing

operations 1,661,293 (3,536,244)

----------------------------------------------- ----- ------------ ------------

Discontinued Operations

Profit/(loss) for the year from discontinued

operations 25 (868,303) 478,046

----------------------------------------------- ----- ------------ ------------

Gain on disposal of subsidiary 25 121,891 -

----------------------------------------------- ----- ------------ ------------

Profit/(loss) for the year 914,881 (3,058,198)

----------------------------------------------- ----- ------------ ------------

Attributable to:

Equity shareholders of the parent 765,725 (3,028,479)

Non-controlling interest 149,156 (29,719)

914,881 (3,058,198)

----------------------------------------------- ----- ------------ ------------

Earnings per share - US$ (using weighted

average number of shares)

Basic and Diluted - Continuing Operations 0.13 (0.20)

Basic and Diluted - Discontinued Operations (0.06) 0.03

Basic and Diluted 9 0.06 (0.18)

----------------------------------------------- ----- ------------ ------------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the year ended 31 December 2020

2020 2019

$ $

Profit for the financial year 914,881 (3,058,198)

Other comprehensive income:

Exchange differences on re-translating

foreign operations (332,954) 578,281

Total comprehensive income 581,927 (2,479,917)

---------------------------------------- ---------- ------------

Attributable to:

Equity shareholders of the parent 432,771 (2,450,198)

Non-Controlling interest 149,156 (29,719)

Total Comprehensive income 581,927 (2,479,917)

---------------------------------------- ---------- ------------

CONSOLIDATED STATEMENT OF

FINANCIAL POSITION

as at 31 December 2020

2020 2019

Note $ $

Assets

Non-current assets

Goodwill 11 204,724 204,724

Intangible assets 11 948,739 173,466

Investment properties 13 - 4,138,318

Property, plant and equipment 12 418,656 75,455

Available for sale financial assets 14 1,934,068 4,801,450

Loans 15 7,606,077 1,695,302

Total non-current assets 11,112,264 11,088,715

------------------------------------- ----- ------------- -------------

Assets Held for Sale - 435,383

Current assets

Trade and other receivables 16 680,443 1,432,031

Cash and cash equivalents 9,712,779 24,198,744

Total current assets 10,393,222 25,630,775

------------------------------------- ----- ------------- -------------

Liabilities

Current liabilities

Trade and other payables 17 1,044,721 1,685,491

Borrowings 18 4,706,981 7,557,243

Total current liabilities 5,751,702 9,242,734

------------------------------------- ----- ------------- -------------

Net current assets 4,641,520 16,388,041

------------------------------------- ----- ------------- -------------

Non-current liabilities

Long term debt 18 39,331 510,965

Total non-current liabilities 39,331 510,965

------------------------------------- ----- ------------- -------------

Net assets 15,714,453 27,401,174

------------------------------------- ----- ------------- -------------

Shareholders' Equity

Share capital 21 208,522 255,675

Share premium 36,714,225 45,416,298

Treasury shares 21 (11,414,289) (8,690,465)

Other reserves 106,245 439,199

Non-Controlling Interest (166,925) 628,673

Retained earnings (9,733,325) (10,648,206)

Total shareholders' equity 15,714,453 27,401,174

Total equity 15,714,453 27,401,174

------------------------------------- ----- ------------- -------------

CONSOLIDATED STATEMENT OF CASH FLOWS

for the year ended 31 December 2020

Notes 2020 2019

$ $

Cash flows from operating activities

Profit/(Loss) for the year before taxation (3,199,699) (3,789,309)

Impairment losses on goodwill - 157,185

(Increase)/decrease in trade and other receivables 123,388 5,956,290

(Decrease)/increase in trade and other payables 78,171 (896,649)

Loss/(gain) on disposal of PPE - 2,686

Gain/(loss) on disposal of AFS investments 1,907,391 (23,484)

Net exchange differences 1,379,321 (287,533)

Accrued interest income - (50,042)

Depreciation 12 47,771 26,308

Share of losses of associate/gain on disposal (701,165) (1,371,455)

Fair value movement on AFS financial assets 1,290,219 224,307

Cash generated by operations 925,397 (51,696)

Taxation 109,303 132,663

Net cash flow from operating activities 1,034,700 80,967

---------------------------------------------------- ------ -------------

Net cash flow from discontinued operations (563,302) -

---------------------------------------------------- ------ ------------- -------------

Sale/(purchase) of property, plant and equipment (390,971) (15,181)

Sale/(purchase) of intangible assets (775,273) (173,466)

Sale/(purchase) of investment property 3,725,261 293,521

Net (purchase)/sale of AFS financial assets (2,608,009) (4,214,755)

Investments in subsidiaries (8,150,392) 4,450,049

Net cash flow in investing activities - continuing

operations (8,199,384) 340,168

---------------------------------------------------- ------ ------------- -------------

Payment/proceeds from the Norwegian tax settlement

of WGP group - (346,296)

Proceeds from disposal of Alina Holdings

PLC 121,891

Net cash flow from / (used) in investing

activities - discontinued operations 121,891 (346,296)

---------------------------------------------------- ------ ------------- -------------

Cash flows from financing activities

Purchase of treasury shares (2,723,824) (1,352,506)

Leasing Liabilities 39,331 -

Proceeds from borrowings 212,344 23,649,036

Repayment of borrowings (3,007,076) (16,128,792)

Net cash flow from financing activities -

continuing operations (5,479,225) 6,167,738

---------------------------------------------------- ------ ------------- -------------

Net cash flow from financing activities - (468,856) -

discontinued operations

---------------------------------------------------- ------ ------------- -------------

Net increase in cash and cash equivalents (13,554,176) 6,242,577

Cash and cash equivalents at the start of

the year 24,198,744 17,370,372

Effects of exchange rate changes on cash

and cash equivalents (931,790) 585,795

Cash and cash equivalents at the end of the

year 9,712,778 24,198,744

---------------------------------------------------- ------ ------------- -------------

CONSOLIDATED STATEMENT OF CHANGES

IN EQUITY

for the year ended 31 December 2020

Attributable to of the Company

owners

------------- ------------ ------------------------- ------------- ------------

Non- Total

Share Share Treasury Other Retained controlling Shareholders

Capital Premium Shares Reserves Earnings Total Interest Equity

$ $ $ $ $ $ $ $

Balance as at

31 December

2018 255,675 45,416,298 (7,337,959) (139,082) (7,708,799) 30,486,133 - 30,486,133

Purchase of

treasury

shares - - (1,352,506) - - (1,352,506) - (1,352,506)

Acquisition of

subsidiary

with

NCI - 89,072 89,072 658,392 747,464

Total

comprehensive

income for

the

period - - - 578,281 (3,028,479) (2,450,198) (29,719) (2,479,917)

Balance as at

31 December

2019 255,675 45,416,298 (8,690,465) 439,199 (10,648,206) 26,772,501 628,673 27,401,174

Redemption of

Capital (47,153) (8,702,073) - - - (8,749,226) - (8,749,226)

Purchase of

treasury

shares - - (2,723,824) - - (2,723,824) - (2,723,824)

Disposal of

subsidiary

with NCI 149,156 149,156 (944,754) (795,598)

Total

comprehensive

income for

the

period - - - (332,954) 765,725 432,771 149,156 581,927

Balance as at

31 December

2020 208,522 36,714,225 (11,414,289) 106,245 (9,733,325) 15,881,378 (166,925) 15,714,453

--------------- ------------- ------------ ------------- ---------- ------------- ------------ ------------ -------------

ACCOUNTING POLICIES

The Group prepares its accounts in accordance with applicable

International Financial Reporting Standards ("IFRS") as adopted by

the European Union.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR KXLFFFQLZBBE

(END) Dow Jones Newswires

June 14, 2021 02:00 ET (06:00 GMT)

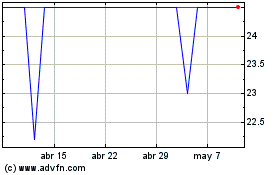

Thalassa (LSE:THAL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Thalassa (LSE:THAL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024