TIDMZAM

RNS Number : 6562B

Zambeef Products PLC

11 June 2021

Zambeef Products plc

("Zambeef" or the "Group")

Interim results for the Half Year Ended 31 March 2021

Zambeef (AIM: ZAM), the fully integrated cold chain foods and

retail business with operations in Zambia, Nigeria and Ghana, today

announces its results for the half-year ended 31 March 2021.

Financial Highlights

Figures in 000's 2021 2020 % 2021 2020 %

ZMW ZMW USD USD

------------ ------------ --------- ---------

Revenue 2,150,473 1,797,633 20% 102,501 129,233 -21%

Cost of sales (1,411,049) (1,171,504) 20% (67,257) (84,220) -20%

Gross profit 739,424 626,129 18% 35,244 45,013 -22%

Administrative expenses (584,654) (500,630) 17% (27,867) (35,991) -23%

Operating profit 154,770 125,499 23% 7,377 9,022 -18%

Share of loss equity

accounted investment (915) (1,898) -52% (44) (136) -68%

Exchange losses (42,558) (62,870) -32% (2,029) (4,520) -55%

Finance costs (56,360) (48,241) 17% (2,686) (3,468) -23%

Profit before taxation 54,937 12,490 340% 2,618 898 192%

Taxation charge (21,846) (927) 2257% (1,041) (67) 1454%

Group (loss)/profit

for the period from

continued operations 33,091 11,563 186% 1,577 831 90%

Profit/(Loss) from discontinued

operations 20,843 (9,423) -321% 993 (677) -247%

Total Profit for the

period 53,934 2,140 2420% 2,570 154 1569%

EBITDA 259,888 182,665 42% 12,387 13,141 -6%

---------------------------------- --------- --------- ------

Gross Profit Margin 34.38% 34.83% 34.38% 34.83%

EBITDA Margin 12.09% 10.16% 12.09% 10.16%

Debt/Equity (Gearing) 27.6% 28.9% 27.57% 28.93%

Debt-To-EBITDA 3.88 5.48 3.88 5.48

------------ ------------ ------ --------- --------- ------

PERFORMANCE OVERVIEW

The Group had a strong start to the financial year, delivering

results ahead of pre-pandemic levels. Demand for products,

particularly poultry products, remained strong allowing the Group

to remain in line with revenue expectations. The cost containment

embarked on by management also continued to yield significant

savings and contributed positively to the results. Improvements in

the load shedding situation, following the good regional rains,

resulted in reduced generator fuel costs and improved production

efficiencies.

Notwithstanding, the half year period continued to present

challenges in the operating environment, resulting from the

Covid-19 pandemic and the previous 2020 economic uncertainties,

despite greater stability compared to the second half of the 2020

financial year. The rising inflation put pressure on consumer

disposable income and reduced the share of wallet going towards

food spend. Supply constraints on some of Zambeef's product lines

further put pressure on cost of inputs.

KEY FINANCIAL HIGHLIGHTS

Revenue was ZMW2.2 billion (USD103 million) and we achieved a

gross profit of ZMW739.4 million (USD35.2 million), measuring 20%

and 18% above the prior year in kwacha terms, but both down by 21%

and 22% in USD terms, respectively. The performance in USD was

adversely impacted by the steady depreciation of the local

currency.

The Group's strong performance was driven by growth in the

poultry, retail and cropping divisions. Management continued

optimising top line growth through revenue management while the

continued cost control measures helped deliver strong Earnings

Before Interest Taxes, Depreciation and Amortisation (EBITDA).

The profitability was mainly driven by cropping, increased

volumes and margins in the stock feed division and Retail and Cold

Chain Food Products which is in line with our strategic imperative

of consistent revenue growth through expansion of our retail

network.

Despite being slightly lower than the prior year (measured in

USD), exchange losses and financing costs remained high in kwacha

terms, eroding bottom-line performance. The depreciation of the

kwacha led to increased financing costs and exchange losses on our

dollar denominated debt, notwithstanding continued principal

repayments during the period.

Zambeef's Total Profit for the period increased from ZMW2.1m to

ZMW53.9m (USD0.154m to USD2.57m).

Commenting on these results, the Chairman, Mr Michael Mundashi

said:

"Despite the macroeconomic headwinds and Covid-19 related

uncertainties continuing into the current year, we saw a relatively

more stable environment during the period under review in terms of

the rate of depreciation of the kwacha. Despite these challenges,

the Group generated an operating profit, including discontinued

operations, of ZMW175.6 million (USD8.4 million) compared to ZMW116

million (USD8.3 million) achieved in first half of the previous

financial year. This achievement, in the face of such economic and

market difficulties, illustrates the Group's fundamental strengths

as a diversified and resilient business.

"The Board remains committed to achieving the Group's strategic

priorities while navigating the seasonal market and economic

challenges. The focus will be on optimising the assets of core

businesses to pay down debt and to invest for the future.

"The macro-economic climate is expected to remain challenging

for Zambia in 2021, characterised by high national debt levels and

continued foreign currency supply constraints which could

negatively affect business activity across the economy.

"The Group remains committed to delivering value to shareholders

and is positioned to navigate the turmoil while capitalising on

opportunities."

For further information, please visit www.zambeefplc.com or

contact:

Zambeef Products plc Tel: +260 (0) 211 369003

Walter Roodt

Faith Mukutu

finnCap (Nominated Adviser and Broker) Tel: +44 (0) 20 7220

0500

Ed Frisby/Kate Bannatyne/Tim Harper (Corporate Finance)

Tim Redfern/Barney Hayward (ECM)

Autus Securities Limited Tel: +260 (0) 761 002 002

Mataka Nkhoma

About Zambeef Products plc

Zambeef Products plc is the largest integrated cold chain food

products and agribusiness company in Zambia and one of the largest

in the region, involved in the primary production, processing,

distribution and retailing of beef, chicken, pork, milk, eggs,

dairy products, fish, flour and stockfeed, throughout Zambia and

the surrounding region, as well as Nigeria and Ghana it has 236

retail outlets throughout Zambia and West Africa.

The Company is one of the largest suppliers of beef in Zambia.

Five beef abattoirs and three feedlots are located throughout

Zambia, with a capacity to slaughter 230,000 cattle a year. It is

also one of the largest chicken and egg producers in Zambia, with a

capacity of 8.8m broilers and 22.4 million day-old chicks a year.

It is one of the largest piggeries, pig abattoirs and pork

processing plants in Zambia, with a capacity to slaughter 75,000

pigs a year, while its dairy has a capacity of 120,000 litres per

day.

The Group is also one of the largest cereal row cropping

operations in Zambia, with approximately 7,787 hectares of row

crops under irrigation, which are planted twice a year, and a

further 8,694 hectares of rainfed/dry-land crops available for

planting each year.

CHAIRMAN'S REPORT

Dear Shareholder,

It is my great pleasure to present to you the Chairman's Report

with respect to the financial half year period ended March 31,

2021.

Despite the 2020 macroeconomic headwinds and Covid-19 related

uncertainties continuing into the current year, we saw a relatively

more stable environment during the period under review in terms of

the rate of depreciation of the kwacha and the easing of monetary

policy. However, the period saw adverse market conditions in

respect of securing supply, which saw a sharp rise in food

inflation.

The Group generated an operating profit, including discontinued

operations, of ZMW175.6 million (USD8.4 million) compared to ZMW116

million (USD8.3 million) achieved in the previous half-year period.

The operating profit excluding discontinued operations was ZMW154.8

million (USD7.4 million) compared to ZMW125.5 million (USD9.0

million) achieved in the previous half-year period . The Group's

performance had shown resilience in the face of market

difficulties, illustrating the strengths of the vertically

integrated business model which is key to creating long-term

shareholder value.

The Board remains committed to achieving the Group's strategic

priorities while navigating the seasonal market and economic

challenges. The focus will be on optimising the assets of core

businesses, to pay down debt and to invest for the future.

The Economic Environment

The Zambian economy has been under significant pressure stemming

from the national debt burden, which was exacerbated by the impact

of the coronavirus pandemic. Despite indications of recovery in the

global economy from the effects of the coronavirus pandemic, the

Zambian economic recovery remains gradual in the face of a high

debt burden, high inflation and a volatile currency.

The Zambian kwacha has depreciated by 10% since the end of the

2020 full financial year period. The pace of depreciation of the

local currency has slowed down owing to monetary policy

interventions and the prospective benefits of a higher copper price

on the international exchange markets.

Inflationary pressures, particularly food inflation, have

resulted in a significant drop in our customers' disposable income

and has continued to put pressure on the share of wallet going

towards food spend. Inflation for the half-year period under review

closed at 22.8% compared to 14% for the previous corresponding

period. The resultant bumper harvest from the good summer rainfall

season is expected to drive down food inflation in the second half

of the financial year.

Divisional Performance review

Retail and Cold Chain Food Products

The Group continues to prioritise revenue optimisation, asset

utilisation and cost control as pillars to drive profitability in

the combined retail and cold chain food products divisions. Revenue

grew by 29% and operating profit growth of 61% in kwacha terms was

achieved.

The division experienced supply challenges during the period

which resulted in inputs price increases. As a result, volumes

declined across product categories. However, demand for our

products was high as we remained competitively priced.

Management positioned the Poultry division as a focus point for

growth this year and continues to implement measures to improve

production efficiencies and therefore profitability. Increased

demand for broilers and eggs allowed for revenue improvement in the

Poultry division despite a volume decline.

Stockfeed

Volumes were flat compared to prior year during the period owing

to slow growth and some declines on major product lines. The

shortage of day-old chicks on the market limited customers buying

of broiler feed while an export ban reduced export sales and the

ability to earn foreign currency. The high cost of imported

materials negatively impacted costs of sales.

Cropping

Zambia had a good summer rainfall season during the half year

period, and as a result, yields for the summer crop are expected to

be in line with expectations. The country is expected to deliver a

bumper harvest which will result in lower maize prices which will

help stabilise food inflation.

Strategy review

The board undertook a review of the medium to long-term strategy

to position the business to respond to the challenges and

opportunities for the future. I am happy to update shareholders

that the process is proceeding according to plan. Part of the

strategy review process included a review of our operational

business units and also governance structures. The board review

which I announced at the annual general meeting included a review

of the composition of the board in terms of both compliment and

size and I am pleased to announce that this process has since been

concluded.

Outlook

Although we expect some level of stability, the macro-economic

climate is expected to remain challenging during the second half

period. The kwacha is expected to continue depreciating at a steady

rate with expected improvements towards the end of the calendar

year. The copper price, which is a major foreign exchange earner

for the country, is expected to continue holding as production

increases. Monetary policy easing is expected to continue and

inflation is expected to stabilise following the summer crop bumper

harvest. The Covid-19 pandemic and how it will evolve has further

potential to impact our operations. There are fears of a potential

third wave as the country navigates through the winter season that

occurs during the following reporting period.

The group remains committed to delivering value to shareholders

and is positioned to navigate the turmoil while capitalising on

opportunities.

Acknowledgement

On behalf of the Company and the Board of Directors, I would

like to express my sincere gratitude to Margaret Mudenda, John

Rabb, David Osborne and Professor Enala Mwase who resigned from the

board in February and March 2021. Their dedication and

contributions to the success of the business over the years will be

greatly missed.

Since my last Report, we welcomed Monica Musonda, Pearson Gowero

and Roman Frenkel to our Board of Directors. Their industry

experience and backgrounds will be key in driving the business into

the next phase of the Groups evolution as a regional food

provider.

I would also want to thank my fellow board members for steering

the Group through this challenging period. To our management and

staff, I express my gratitude to them for another solid

performance, dedicated efforts and resilience in the face of

challenges. I am proud of our achievements to date, and I am

excited by the potential

opportunities upon which we will build on our progress.

Michael Mundashi

Chairman

11 June 2021

CHIEF EXECUTIVE OFFICER'S REVIEW

Overview

The half year period continued to present challenges in the

operating environment, resulting from the Covid-19 pandemic and

2020 economic uncertainties, despite greater stability compared to

the second half of the 2020 financial year. Inflation continued to

rise, although the exchange rate depreciated at a much slower rate.

Money supply continued to improve in the economy. High inflation

put pressure on disposable incomes as prices of goods and services

increased resulting in depressed consumer spending. Due to the low

supply of livestock from producers, after the devastating effects

on their profitability by the previous drought and depreciation of

the currency, the retail and cold chain food products supply was

negatively affected. The resultant surge in food product prices to

our customers forced them towards more affordable offerings of our

products.

The load shedding situation improved towards the end of the

calendar year 2020 following good regional rains as a result of the

La Nina weather pattern, resulting in reduced generator fuel

expenditure and improved production efficiencies.

Despite the challenges noted above, Zambeef has had a strong

start to the financial year, delivering results ahead of

pre-pandemic levels as revenue increased and costs were

contained.

The Group delivered operating profit, including discontinued

operations, of ZMW175.6 million (USD8.37 million), equating to a

growth of 51.3% in kwacha terms and a flat performance of 0.3%

growth in US dollar terms, compared with ZMW116.1 million

(USD8.35million) in HY2020. The operating profit excluding

discontinued operations was ZMW154.8 million (USD7.4 million)

compared to ZMW125.5 million (USD9.0 million) achieved in the

previous half-year period.

Our revenue, including discontinued operations, was ZMW2.2

billion (USD106.9 million) and we achieved a gross profit of

ZMW782.1 million (USD37.2 million), respectively 23.7% and 24.3%

above the prior year in kwacha terms, but both down by 18% and

17.6% in US dollar terms, respectively.

The Group's strong performance was driven by growth in the

Poultry, Retail and Cropping divisions. Management continued

optimising top line growth through revenue management while the

continued cost control measures helped deliver strong Earnings

Before Interest Taxes, Depreciation and Amortisation (EBITDA), and

ensured resultant operating leverage.

Exchange losses and financing costs remained high in kwacha

terms, eroding bottom-line performance. The depreciation of the

kwacha led to increased financing costs and exchange losses on our

dollar denominated debt, notwithstanding continued principal

repayments during the period.

Our diversified and vertically integrated business with strong

brands, supportive partners and an experienced management team

helped deliver the encouraging results.

Strategic focus

Our strategic focus is to optimise our asset utilisation and

maximise returns. We remain committed to our strategy of focussing

on our core businesses, in which we strive to be the best in class.

The continued deleveraging and divestiture of non-core assets will

enable us to free up cash to invest into our core businesses and

therefore deliver shareholder value.

Retail and Cold Chain Food Products (CCFP)

The period saw traditionally high volume sales lines come under

pressure amidst a high inflationary environment and reduced

customer spending. Despite high demand in our key product lines,

supply constraints negatively impacted volume growth. Revenue

growth was mainly driven by pricing increases on traditional

product categories and aided by sales volume growth of traded goods

and affordable categories. Shoprite in-store butcheries were a

source of revenue growth as they proved relatively more resilient

to inflationary pressures.

Sales volumes came under pressure on the back of supply

constraints due to constrained livestock producer profitability

levels. Significant producer price increases were necessary under

the review period to livestock producers to increase output. The

large price increases that were necessary to stimulate supply

resulted in customers moving towards more affordable protein

offerings. The Poultry division was a major contributor of revenue

growth due to high demand for it as a relatively affordable protein

source, in the form of chicken and eggs.

Despite the challenges, the Retail and CCFP business registered

a healthy revenue growth of 29% above HY2020. Management employed a

revenue optimisation strategy, responding quickly to the evolving

volatile operating environment.

Retail and CCFP delivered an operating profit growth of 61% in

kwacha terms. Operational efficiency improvements and overhead

spend discipline ensured translation of the top line growth to the

bottom-line. Reduced load shedding helped reduce generator set fuel

costs, which further contributed to the increased profitability,

particularly in the second quarter.

Stockfeed (Novatek)

Revenue for the division was 17% above prior year mainly due to

price, as volumes remained flat on prior year. The demand for

poultry feed reduced following a day-old chick supply shortage

across the market. An export ban on animal feed from Zambia

resulted in a further slowdown of production volumes. However, fish

feed continues to register exponential growth following the sector

specific lifting of the export ban and government's efforts to make

Zambia a regional player in the aquaculture sector. The

depreciation of the kwacha to the USD and ZAR negatively impacted

foreign currency denominated costs.

Cropping

The revenue decline registered in the Cropping business is due

to the timing of wheat sales and the impact of the sale of

Sinazongwe farm. However, operating profit increased in kwacha

terms despite the decline in dollar terms. Zambia experienced a

good rainfall season and the yield on the summer crop is expected

to be in line with expectations.

Outlook

Although we expect the macroeconomic situation to remain

volatile, we expect more stability in the medium term than we

experienced in the second half of 2020. Copper prices have rallied

following the global recovery from the economic downturn caused by

the coronavirus pandemic.

The Covid-19 pandemic and how it evolves will continue to be an

important factor in how we perform for the remainder of the year.

We believe that a healthy, sustainable and profitable growth trend

can only be achieved when we work together with our partners,

communities and customers. We remain committed to implementing and

enforcing Covid-19 protocols in our outlets.

Despite the macro-economic headwinds and uncertainty caused by

the Covid-19 pandemic, Zambeef's underlying performance is expected

to remain resilient.

Rehabilitating our balance sheet remains a priority. We have

focused on deleveraging and thereby demonstrating to our

shareholders that we have a clear path to take care of pending debt

maturities. Our current strategy will help relieve exchange losses

and financing cost pressures to the bottom line, which will

increase free cash flow to enable us to invest for the future.

DIVISIONAL PERFORMANCE

Table 1 (ZMW) and Table 2 (USD) below provide a summary of the

consolidated performance of the key business divisions reported at

an operating profit level.

Table 1: Divisional financial summary in ZMW'000

ZMW Revenue Gross Profit Overheads Operating Profit

2021 2020 2021 2020 2021 2020 2021 2020

Division ZMW'000 ZMW'000 ZMW'000 ZMW'000 ZMW'000 ZMW'000 ZMW'000 ZMW'000

----------- ---------- ---------- --------- --------- ---------- ---------- --------- ---------

Total

Retailing 1,392,447 1,138,678 138,614 120,170 (166,941) (166,107) (28,327) (45,937)

----------- ---------- ---------- --------- --------- ---------- ---------- --------- ---------

CCFP 950,587 745,736 235,600 196,628 (133,156) (104,790) 102,444 91,837

----------- ---------- ---------- --------- --------- ---------- ---------- --------- ---------

Less

Interco (841,687) (721,059)

----------- ---------- ---------- --------- --------- ---------- ---------- --------- ---------

Combined

Retail

& 1,501,347 1,163,355 374,214 316,798 (300,097) (270,897) 74,117 45,900

CCFP

----------- ---------- ---------- --------- --------- ---------- ---------- --------- ---------

Stock

Feed 748,062 641,656 144,290 122,378 (76,981) (60,753) 67,309 61,625

----------- ---------- ---------- --------- --------- ---------- ---------- --------- ---------

Cropping 163,313 256,990 191,473 161,886 (102,673) (85,151) 88,800 76,735

----------- ---------- ---------- --------- --------- ---------- ---------- --------- ---------

Others 145,964 109,476 29,447 25,067 (14,174) (11,634) 15,273 13,434

----------- ---------- ---------- --------- --------- ---------- ---------- --------- ---------

Total 2,558,686 2,171,477 739,424 626,129 (493,925) (428,435) 245,499 197,694

=========== ========== ========== ========= ========= ========== ========== ========= =========

Less:

Intra/

--------- --------- ---------- ---------- --------- ---------

Inter

Group (408,213) (373,844)

--------- --------- ---------- ---------- --------- ---------

Sales

----------- ---------- ---------- --------- --------- ---------- ---------- --------- ---------

Central

---------- ---------- --------- ---------

Overhead (90,729) (72,195) (90,729) (72,195)

----------- ---------- ---------- --------- --------- ---------- ---------- --------- ---------

Group

Total 2,150,473 1,797,633 739,424 626,129 (584,654) (500,630) 154,770 125,499

----------- ---------- ---------- --------- --------- ---------- ---------- --------- ---------

Table 2: Divisional financial summary in USD'000

USD Revenue Gross Profit Overheads Operating Profit

2021 2020 2021 2020 2021 2020 2021 2020

Division USD'000 USD'000 USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

-------------- --------- --------- --------- --------- --------- --------- --------- ---------

Total

Retailing 66,370 81,861 6,608 8,640 (7,957) (11,942) (1,350) (3,302)

-------------- --------- --------- --------- --------- --------- --------- --------- ---------

CCFP 45,309 53,612 11,228 14,135 (6,347) (7,533) 4,883 6,602

-------------- --------- --------- --------- --------- --------- --------- --------- ---------

Less Interco (40,119) (51,838)

-------------- --------- --------- --------- --------- --------- --------- --------- ---------

Combined

Retail

& 71,560 83,635 17,836 22,775 (14,304) (19,475) 3,533 3,300

CCFP

-------------- --------- --------- --------- --------- --------- --------- --------- ---------

Stock Feed 35,656 46,129 6,877 8,798 (3,669) (4,368) 3,208 4,430

-------------- --------- --------- --------- --------- --------- --------- --------- ---------

Cropping 7,784 18,475 9,127 11,638 (4,894) (6,122) 4,233 5,516

-------------- --------- --------- --------- --------- --------- --------- --------- ---------

Others 6,957 7,870 1,404 1,802 (675) (836) 728 966

-------------- --------- --------- --------- --------- --------- --------- --------- ---------

Total 121,957 156,109 35,244 45,013 (23,542) (30,801) 11,702 14,212

============== ========= ========= ========= ========= ========= ========= ========= =========

Less: Intra/

--------- --------- --------- --------- --------- ---------

Inter Group (19,456) (26,876)

--------- --------- --------- --------- --------- ---------

Sales

-------------- --------- --------- --------- --------- --------- --------- --------- ---------

Central

--------- --------- --------- ---------

Overhead (4,325) (5,190) (4,325) (5,190)

-------------- --------- --------- --------- --------- --------- --------- --------- ---------

Group Total 102,501 129,233 35,244 45,013 (27,867) (35,991) 7,377 9,022

-------------- --------- --------- --------- --------- --------- --------- --------- ---------

Taking the performance of each of our key business areas in

turn:

Retail and CCFP

The combined Retail and CCFP divisions generated an EBIT margin

of 5% which increased by 99 basis points from the previous

financial year generating an absolute value increase of 61% to ZMW

74.1 million (HY2020: ZMW 45.9 million) in kwacha terms and 7.1%

increase to USD 3.5 million (HY2020: USD 3.3 million) in dollar

terms.

The strong performance was underpinned by revenue optimisation

in Poultry products mainly due to favourable price and high demand

given the relative affordability of Chicken and Egg as a source of

protein. Cost pressure arising from supply constraints negatively

impacted on the profitability in Pork, Beef and Milk.

West Africa Retail

Our Nigerian business was impacted by the sporadic protests

related to the Shoprite announcement of the intention to pull out

of the Nigeria market and the EndSARS protests. In addition, the

business experienced supply challenges across its major product

lines. Despite all these challenges, revenue increased by 43% to

ZMW 155.7 million (HY2020: ZMW 109 million) mainly due to pricing

and exchange translational effects with dollar revenue declining by

5%. However, operating profit declined by 89% in dollar terms due

to rising costs.

Stockfeed (Novatek)

Sales volumes were flat on prior year mainly due to declines on

key volume categories. Shortage of day-old chicks slowed the growth

of broiler feed while an export ban impacted export sales.

Revenue grew by 17% in kwacha terms (23% decline in USD terms),

while the operating profit only grew by 9.2% to ZMW 67 million

(HY2020: ZMW 62 million) or declined by 28% to USD 3.2 million

(HY2020: USD 4.4 million) in dollar terms. The gross margin

increased to 19.3% from 19.1% in the prior year owing to favourable

pricing despite rising costs of inputs.

Overheads increased by 27% to ZMW 77 million (HY2020: ZMW 61

million) owing to high repairs and maintenance costs and labour

costs.

Cropping

The Cropping business is key to Zambeef, providing raw material

inputs for value added processing within the Group and serving as a

currency hedge by being able to generate USD cash flow.

Revenue decreased 37% to ZMW 163 million (HY2020: ZMW 257

million) or 58% to USD 7.8 million (HY2020: USD 18.5 million) in

dollar terms, mainly due to timing of wheat sales during this

year's cycle and the impact of the previous years sale of

Sinazongwe farm and currently the assets held for sale at Chiawa

farm. Gross profit increased 18% compared to the prior half-year,

with only a 21% increase in the overheads even in the context of

the depreciation of the kwacha.

Zambia experienced a good rainfall season and the summer harvest

is expected to be in line with expectations. However, the price of

maize is expected to be lower than the prior year following the

expected bumper harvest predicted for Zambia.

Other businesses

Total revenue from the Group's other business units increased by

33% to ZMW 146 million (HY2020: ZMW 109 million) mainly due to

growth in both the milling and leather to shoe businesses. This

translated to gross profit growth of 17% in kwacha terms due to

cost pressures in Milling arising from the increase in price of

wheat in kwacha terms following the depreciation of the

currency.

The leather to shoe business turnaround strategy is beginning to

pay off as the division saw an increase in demand for its products,

particularly school shoes, following the opening of schools after

Covid-19 related closures. Management focus has been to optimise

production efficiencies, control overhead costs, innovation and

look for new market opportunities for its products.

Walter Roodt

Chief Executive Officer

11 June 2021

ZAMBEEF PRODUCTS PLC AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTH PERIODED 31 MARCH 2021

Unaudited Audited

31 Mar 2021 31 Mar 2020 30 Sept 2020

----- ------------ ------------ --------------------------

Group Note ZMW'000s ZMW'000s ZMW'000s

----- ------------ ------------ --------------------------

Revenue 5(i) 2,150,473 1,797,633 3,875,104

----- ------------ ------------ --------------------------

Net profit/(loss) arising

from price changes in

fair value of biological

assets 9 17,242 10,408 (14,381)

----- ------------ ------------ --------------------------

Cost of sales (1,428,291) (1,181,912) (2,645,101)

----- ------------ ------------ --------------------------

Gross profit 5(i) 739,424 626,129 1,215,622

----- ------------ ------------ --------------------------

Administrative expenses (587,575) (501,168) (1,011,968)

----- ------------ ------------ --------------------------

Other income 2,921 538 6,877

----- ------------ ------------ --------------------------

Operating profit 154,770 125,499 210,531

----- ------------ ------------ --------------------------

Share of loss equity accounted

investment (915) (1,898) (3,177)

----- ------------ ------------ --------------------------

Exchange losses on translating

foreign currency transactions

and balances (42,558) (62,870) (137,705)

----- ------------ ------------ --------------------------

Finance costs (56,360) (48,241) (92,322)

----- ------------ ------------ --------------------------

Profit/(loss) before taxation 5(i) 54,937 12,490 (22,673)

----- ------------ ------------ --------------------------

Taxation charge 6(a) (21,846) (927) (112,957)

----- ------------ ------------ --------------------------

Group profit/(loss) for

the period from continued

operations 33,091 11,563 (135,630)

----- ------------ ------------ --------------------------

(Loss)/profit from discontinued

operations 15 20,843 (9,423) 33,435

----- ------------ ------------ --------------------------

Total (loss)/profit for

the period 53,934 2,140 (102,195)

----- ------------ ------------ --------------------------

Group profit/(loss) attributable

to:

----- ------------ ------------ --------------------------

Equity holders of the

parent 54,056 1,650 (103,419)

----- ------------ ------------ --------------------------

Non-controlling interest (122) 490 1,224

----- ------------ ------------ --------------------------

53,934 2,140 (102,195)

----- ------------ ------------ --------------------------

Other comprehensive income

----- ------------ ------------ --------------------------

Exchange gains on translating

presentational currency 117,226 434,406 625,042

----- ------------ ------------ --------------------------

Remeasurement of net defined

benefit liability - - 6,229

----- ------------ ------------ --------------------------

Remeasurement of leases - (12) 315

----- ------------ ------------ --------------------------

Total comprehensive income

for the period 171,160 436,534 529,391

----- ------------ ------------ --------------------------

Total comprehensive income/(loss)

for the period attributable

to:

----- ------------ ------------ --------------------------

Equity holders of the

parent 173,523 433,889 525,030

----- ------------ ------------ --------------------------

Non-controlling interest (2,363) 2,645 4,361

----- ------------ ------------ --------------------------

171,160 436,534 529,391

----- ------------ ------------ --------------------------

Earnings per share Ngwee Ngwee Ngwee

----- ------------ ------------ --------------------------

Basic and diluted earnings

per share from continued

operations 7 8.29 2.76 (45.53)

----- ------------ ------------ --------------------------

Basic and diluted earnings

per share from discontinued

operations 7 5.20 (2.35) 11.12

----- ------------ ------------ --------------------------

Total 7 13.49 0.41 (34.41)

----- ------------ ------------ --------------------------

The accompanying notes form part of the financial

statements.

ZAMBEEF PRODUCTS PLC AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTH PERIODED 31 MARCH 2021

Unaudited Audited

31 Mar 31 Mar

2021 2020 30 Sept 2020

------ --------- --------- -------------

Group Note USD'000s USD'000s USD'000s

------ --------- --------- -------------

Revenue 5(ii) 102,501 129,233 239,648

------ --------- --------- -------------

Net proft/(loss) arising

from price changes in fair

value of biological assets 9 822 748 (889)

------ --------- --------- -------------

Cost of sales (68,079) (84,968) (163,581)

------ --------- --------- -------------

Gross profit 5(ii) 35,244 45,013 75,178

------ --------- --------- -------------

Administrative expenses (28,006) (36,029) (62,583)

------ --------- --------- -------------

Other income 139 38 425

------ --------- --------- -------------

Operating profit 7,377 9,022 13,020

------ --------- --------- -------------

Share of loss equity accounted

investment (44) (136) (197)

------ --------- --------- -------------

Exchange losses on translating

foreign currency transactions

and balances (2,029) (4,520) (8,516)

------ --------- --------- -------------

Finance costs (2,686) (3,468) (5,709)

------ --------- --------- -------------

Profit/(loss) before taxation 5(ii) 2,618 898 (1,402)

------ --------- --------- -------------

Taxation charge 6(f) (1,041) (67) (6,986)

------ --------- --------- -------------

Group profit/(loss) for

the period from continued

operations 1,577 831 (8,388)

------ --------- --------- -------------

Profit/(loss) from discontinued

operations 15 993 (677) 2,068

------ --------- --------- -------------

Total profit/(loss) for

the period 2,570 154 (6,320)

------ --------- --------- -------------

Group profit/(loss) attributable

to:

------ --------- --------- -------------

Equity holders of the parent 2,577 119 (6,396)

------ --------- --------- -------------

Non-controlling interest (7) 35 76

------ --------- --------- -------------

2,570 154 (6,320)

------ --------- --------- -------------

Other comprehensive income

------ --------- --------- -------------

Exchange (losses)/gains

on translating presentational

currency (11,265) (42,051) (52,402)

------ --------- --------- -------------

Remeasurement of net defined

benefit liability - - 385

------ --------- --------- -------------

Remeasurement of leases - (1) 20

------ --------- --------- -------------

Total comprehensive loss

for the period (8,695) (41,898) (58,317)

------ --------- --------- -------------

Total comprehensive income/(loss)

for the period attributable

to:

------ --------- --------- -------------

Equity holders of the parent (8,581) (42,144) (58,661)

------ --------- --------- -------------

Non-controlling interest (114) 246 344

------ --------- --------- -------------

(8,695) (41,898) (58,317)

------ --------- --------- -------------

Earnings per share Cents Cents Cents

------ --------- --------- -------------

Basic and diluted earnings

per share from continued

operations 7 0.40 0.20 (2.82)

------ --------- --------- -------------

Basic and diluted earnings

per share from discontinued

operations 7 0.25 (0.17) 0.69

------ --------- --------- -------------

Total 7 0.65 0.03 (2.13)

------ --------- --------- -------------

The accompanying notes form part of the financial

statements.

ZAMBEEF PRODUCTS PLC AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENT OF MOVEMENTS IN EQUITY

FOR THE SIX MONTH PERIODED 31 MARCH 2021

Total

Foreign attributable

Preference exchange to owners

Share Share share Revaluation translation Retained of the Non-controlling Total

capital premium capital reserve reserve earnings parent interest equity

ZMW'000s ZMW'000s ZMW'000s ZMW'000s ZMW'000s ZMW'000s ZMW'000s ZMW'000s ZMW'000s

At 1 October

2019 3,006 1,125,012 1,000 1,199,058 381,929 535,704 3,245,709 (4,881) 3,240,828

Loss for the

period - - - - - 1,650 1,650 490 2,140

Transfer of

surplus

depreciation - - - (14,833) - 14,833 - - -

Other

comprehensive

income:

Remeasurement

of Leases - - - - - (12) (12) - (12)

Exchange gains

on translating

presentational

currency - - - - 432,251 - 432,251 2,155 434,406

Total

comprehensive

income

for the period - - - (14,833) 432,251 16,471 433,889 2,645 436,534

At 31 March

2020 3,006 1,125,012 1,000 1,184,225 814,180 552,175 3,679,598 (2,236) 3,677,362

Profit for the

period - - - - - (105,069) (105,069) 734 (104,335)

Transfer of

surplus

depreciation - - - (16,512) - 16,512 - - -

Other

comprehensive

income

Remeasurement

of net defined

benefit

liability - - - - - 6,229 6,229 - 6,229

Adjustment on

transition

to IFRS16 - - - - - 327 327 - 327

Exchange gains

on translating

presentational

currency - - - - 189,654 - 189,654 982 190,636

Total

comprehensive

income

for the period - - - (16,512) 189,654 (82,001 91,141 1,716 92,857

At 30 September

2020 3,006 1,125,012 1,000 1,167,713 1,003,834 470,174 3,770,739 (520) 3,770,219

Profit for the

period - - - - - 54,056 54,056 (122) 53,934

Transfer of

surplus

depreciation - - - (23,141) - 23,141 - - -

Other

comprehensive

income

Remeasurement

of leases - - - - - - - - -

Exchange gains

on translating

presentational

currency - - - - 119,467 - 119,467 (2,241) 117,226

Total

comprehensive

income

for the period - - - (23,141) 119,467 77,197 173,523 (2,363) 171,160

At 31 March

2021 3,006 1,125,012 1,000 1,144,572 1,123,301 547,371 3,944,262 (2,883) 3,941,379

ZAMBEEF PRODUCTS PLC AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENT OF MOVEMENTS IN EQUITY

FOR THE SIX MONTH PERIODED 31 MARCH 2021

Foreign Total

Preference exchange attributable

Share Share share Revaluation translation Retained to owners Non-controlling Total

capital premium capital reserve reserve earnings of the parent Interest equity

USD'000s USD'000s USD'000s USD'000s USD'000s USD'000s USD'000s USD'000s USD'000s

At 1 October

2019 449 185,095 100 173,209 (197,748) 84,782 245,887 (370) 245,517

Transactions

with owners

Profit for the

period - - - - - 119 119 35 154

Transfer of

surplus

depreciation - - - (1,066) - 1,066 - - -

Other

comprehensive

income:

Exchange losses

on translating

presentational

currency - - - - (42,262) - (42,262) 211 (42,051)

Remeasurement

of leases - - - - - (1) (1) - (1)

Total

comprehensive

income

for the period - - - (1,066) (42,262) 1,184 (42,144) 246 (41,898)

At 31 March

2020 449 185,095 100 172,143 (240,010) 85,966 203,743 (124) 203,619

Loss for the

period - - - - - (6,515) (6,515) 41 (6,474)

Transfer of

surplus

depreciation - - - (872) - 872 - - -

Other

comprehensive

income

Remeasurement

of leases - - - - - 21 21 - 21

Remeasurement

of defined

benefit

liability - - - - - 385 385 385

Exchange gains

on translating

presentational

currency - - - - (10,408) - (10,408) 57 (10,351)

Total

comprehensive

income - - - (872) (10,408) (5,237) (16,517) 98 (16,419)

At 3o September

2020 449 185,095 100 171,271 (250,418) 80,729 187,226 (26) 187,200

Profit for the

period - - - - - 2,577 2,577 (7) 2,570

Transfer of

surplus

depreciation - - - (1,103) - 1,103 - - -

Other

comprehensive

income

Remeasurement

of leases - - - - - - - - -

Exchange gains

on translating

presentational

currency - - - - (11,158) - (11,158) (107) (11,265)

Total

comprehensive

income - - - (1,103) (11,158) 3,680 (8,581) (114) (8,695)

At 31 March

2021 449 185,095 100 170,168 (261,576) 84,409 178,645 (140) 178,505

ZAMBEEF PRODUCTS PLC AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENT OF FINANCIAL POSITION -- 31 MARCH

2021

Unaudited Audited

Note 31 Mar 2021 31 Mar 2020 30 Sept 2020

ZMW'000s ZMW'000s ZMW'000s

ASSETS

Non - current assets

Goodwill 166,801 166,801 166,801

Property, plant and equipment 8 3,419,935 3,292,653 3,264,505

Investment in associate 42,911 10,478 43,826

Deferred tax assets 6(e) 8,680 80,073 9,552

3,638,327 3,550,005 3,484,684

Current assets

Biological assets 9 689,646 520,437 176,305

Inventories 906,914 682,619 1,103,640

Trade and other receivables 149,606 87,924 132,668

Assets held for disposal 15 175,654 131,857 175,654

Amounts due from related

companies 4,949 38,281 9,337

Income tax recoverable 6(c) 19,800 18,329 1,784

Cash and cash equivalents 10 83,678 62,113 111,136

2,030,247 1,541,560 1,710,524

Total assets 5,668,574 5,091,565 5,195,208

EQUITY AND LIABILITIES

Capital and reserves

Share capital 3,006 3,006 3,006

Preference share capital 1,000 1,000 1,000

Share premium 1,125,012 1,125,012 1,125,012

Reserves 2,815,244 2,550,580 2,641,721

3,944,262 3,679,598 3,770,739

Non-controlling interest (2,883) (2,236) (520)

3,941,379 3,677,362 3,770,219

Non - current liabilities

Interest bearing liabilities 11 124,233 234,846 190,218

Leases 12 10,242 19,741 19,750

Deferred liability 10,578 15,737 11,389

Deferred taxation 6(e) 85,041 32,154 69,950

230,094 302,478 291,307

Current liabilities

Interest bearing liabilities 11 359,159 391,108 326,899

Leases 12 16,446 24,701 23,259

Trade and other payables 400,006 231,592 321,648

Provisions 120,857 54,310 113,347

Amounts due to related

companies - 1,265 443

Taxation payable 6(c) 23,940 15,253 41

Bank overdrafts 10 576,693 393,496 348,045

1,497,101 1,111,725 1,133,682

Total equity and liabilities 5,668,574 5,091,565 5,195,208

ZAMBEEF PRODUCTS PLC AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENT OF FINANCIAL POSITION -- 31 MARCH

2021

Unaudited Audited

30 Sept

31 Mar 2021 31 Mar 2020 2020

Note USD '000s USD '000s USD '000s

ASSETS

Non - current assets

Goodwill 7,554 9,236 8,282

Property, plant and equipment 8 154,888 182,317 162,091

Investment in associate 1,943 580 2,176

Deferred tax asset 6(j) 394 4,434 474

164,779 196,567 173,023

Current assets

Biological assets 9 31,234 28,817 8,754

Inventories 41,074 37,797 54,798

Trade and other receivables 6,776 4,868 6,587

Assets held for disposal 15 7,955 7,301 8,722

Amounts due from related

companies 224 2,120 464

Income tax recoverable 6(h) 897 1,015 89

Cash and cash equivalents 10 3,790 3,439 5,518

91,950 85,357 84,932

Total assets 256,729 281,924 257,955

EQUITY AND LIABILITIES

Capital and reserves

Share capital 449 449 449

Preference share capital 100 100 100

Share premium 185,095 185,095 185,095

Reserves (6,999) 18,099 1,582

178,645 203,743 187,226

Non-controlling interest (140) (124) (26)

178,505 203,619 187,200

Non - current liabilities

Interest bearing liabilities 11 5,626 13,004 9,445

Leases 12 464 1,093 981

Deferred liability 479 872 565

Deferred tax liability 6(j) 3,852 1,780 3,473

10,421 16,749 14,464

Current liabilities

Interest bearing liabilities 11 16,266 21,656 16,231

Leases 12 745 1,368 1,155

Trade and other payables 18,116 12,823 15,971

Provisions 5,474 3,007 5,629

Amounts due to related companies - 69 22

Taxation payable 6(h) 1,084 845 2

Bank overdrafts 10 26,118 21,788 17,281

67,803 61,556 56,291

Total equity and liabilities 256,729 281,924 257,955

ZAMBEEF PRODUCTS PLC AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTH PERIODED 31 MARCH 2021

Unaudited Audited

6 months 6 months

to to Year to

31 Mar 2021 31 Mar 2020 30 Sept 2020

ZMW'000s ZMW'000s ZMW'000s

Cash inflow/(outflow)

from/(on)

operating activities

Profit/(loss) before

taxation 54,937 12,490 (22,673)

Finance costs 56,360 48,241 92,322

(Profit)/loss on

disposal of

property,

plant and equipment (1,345) - 4,796

Adjustment on

transition to IFRS

16 - (1,187) -

Depreciation on

right-of-use assets - 304 8,362

Depreciation 84,275 66,285 141,408

Share of loss of

equity accounted

investment 915 1,898 3,177

Profit/(loss) on

discontinued

operations 20,843 (9,423) 1,529

Fair value price

adjustment (17,242) (10,408) 14,381

Net unrealised

foreign exchange

(gains)/losses (5,345) 31,935 186,272

Earnings before

interest, tax,

depreciation

and amortisation,

fair value

adjustments

and net unrealised

foreign exchange

losses 193,398 140,135 429,574

(Increase)/decrease

in biological

assets (496,099) (339,612) (20,269)

Decrease in inventory 196,726 258,540 (162,481)

Decrease in trade and

other receivables (16,938) 10,101 (34,643)

Decrease in amounts

due from related

companies 4,388 3,273 (2,410)

Decrease in trade and

other payables

and provisions 85,868 (26,597) 122,496

Increase in amount

due to related

companies (443) 1,014 192

(Decrease)/increase

in deferred

liability (811) (625) 1,256

Income tax paid - (3,145) (5,525)

Net cash

inflow/(outflow

from/(on)

operating activities (33,911) 43,084 328,190

Investing activities

Purchase of property,

plant and

equipment (59,829) (57,952) (92,664)

Proceeds from sale of

assets 2,247 342 6,452

Right of use assets - - (15,425)

Proceeds from sale of

assets/investments - - 167,264

Net cash (outflow)/

inflow (on)/

from investing

activities (57,582) (57,610) 65,627

Net cash

(outflow)/inflow

before

financing (91,493) (14,526) 393,817

Financing

Long term loans

repaid (81,925) (56,612) (162,217)

Repayment of short

term funding (228,246) - (623,231)

Receipt of short term

funding 232,646 15,602 487,320

Leases obtained - 3,658 14,329

Leases repaid (16,321) - (35,478)

Finance costs

including

discontinued

operations (56,360) (48,241) (92,322)

Net cash outflow from

financing (150,206) (85,593) (411,599)

Decrease in cash and

cash equivalents (241,699) (100,119) (17,782)

Cash and cash

equivalents at

beginning

of period (236,909) (274,425) (274,425)

Effects of exchange

rate changes

on the balance of

cash held in foreign

currencies (14,407) 43,161 55,298

Cash and cash

equivalents at end

of period (493,015) (331,383) (236,909)

Represented by:

Cash in hand and at

bank 83,678 62,113 111,136

Bank overdrafts (576,693) (393,496) (348,045)

(493,015) (331,383) (236,909)

ZAMBEEF PRODUCTS PLC AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTH PERIODED 31 MARCH 2021

Unaudited Audited

6 months 6 months

to to Year to

31 Mar 31 Mar 30 Sept

2021 2020 2020

USD'000s USD'000s USD'000s

Cash inflow/(outflow) from/(on) operating

activities

Profit/(loss) before taxation 2,618 898 (1,402)

Finance costs 2,686 3,468 5,709

Profit/(loss) on disposal of property,

plant and equipment (64) - 297

Adjustment on transition to IFRS 16 - (90) -

Depreciation charge on right-of-use

assets - 22 517

Depreciation 4,017 4,765 8,745

Share of loss of equity accounted

investment 44 136 196

Profit/(loss) on discontinued operations 993 (677) 95

Fair value price adjustment (822) (748) 889

Net unrealised foreign exchange losses/(gains) (255) 2,296 11,495

Earnings before interest, tax, depreciation

and amortisation, fair value adjustments

and net unrealised foreign exchange

losses 9,217 10,070 26,541

Increase/(decrease) in biological

assets (23,646) (24,415) (1,253)

Decrease in inventory 9,377 18,587 (10,048)

Decrease in trade and other receivables (807) 726 (2,142)

Decrease in amounts due from related

companies 209 235 (149)

Increase/(decrease) in trade and other

payables 4,093 (1,912) 7,575

(Decrease)/increase in amount due

to related companies (21) 73 12

(Decrease) in deferred liability (39) (45) 102

Income tax paid - (226) (342)

Net cash inflow/(outflow) from/(on)

operating activities (1,617) 3,093 20,296

Investing activities

Purchase of property, plant and equipment (2,852) (4,166) (5,731)

Proceeds from sale of assets 107 25 399

Right of use asset - - (954)

Proceeds from sale of assets/investments - - 10,344

Net cash outflow on investing activities (2,745) (4,141) 4,058

Net cash outflow before financing (4,362) (1,048) 24,354

Financing

Long term loans repaid (3,820) (4,070) (10,032)

Repayment of short term funding (10,773) - (38,542)

Receipt of short term funding 10,952 1,123 30,137

Leases obtained - 263 886

Leas repaid (778) - (2,194)

Finance costs including discontinued

operations (2,686) (3,468) (5,709)

Net cash outflow from financing (7,105) (6,152) (25,454)

Decrease in cash and cash equivalents (11,467) (7,200) (1,100)

Cash and cash equivalents at beginning

of period (11,763) (20,790) (20,790)

Effects of exchange rate changes on

the balance of

cash held in foreign currencies 902 9,641 10,127

Cash and cash equivalents at end

of period (22,328) (18,349) 11,763

Represented by:

Cash in hand and at bank 3,790 3,439 5,518

Bank overdrafts (26,118) (21,788) (17,281)

(22,328) (18,349) (11,763)

A copy of the Interim Report will shortly be available to view

on the Company's website at www.zambeefplc.com/aim-rule-26/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BGGDLBDBDGBB

(END) Dow Jones Newswires

June 11, 2021 06:30 ET (10:30 GMT)

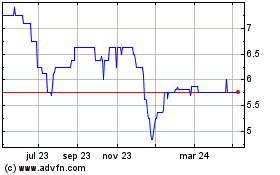

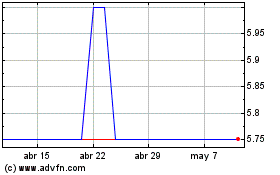

Zambeef Products (LSE:ZAM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Zambeef Products (LSE:ZAM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024