Core power unit posts another weak quarter, but stock rises at

lack of negative surprises

By Thomas Gryta

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 1, 2019).

General Electric Co. executives said they were making progress

in turning around the troubled conglomerate, after the company

reported another quarter of weak profits in its core power business

and legacy problems in its GE Capital unit.

Larry Culp, who took over as chief executive in October, warned

that fixing the power unit would take time and he declined to

provide detailed financial targets for the new year.

"2019 still very much work in progress but the company is

becoming stronger," Mr. Culp said in a conference call Thursday. He

said he expected the company's industrial revenues to rise this

year, with gains in most units and declines in power.

Mr. Culp cautioned the company's cash flow in 2019 would be

impacted by restructuring, charges related to its power business,

investments in its health-care spinoff and other one-time items. He

said he expected cash flow to grow substantially in 2020 and

2021.

While GE's quarterly results were weak compared with peers and

executives avoided committing to specific targets for the year

ahead, the lack of setbacks was positive.

"I think for a number of investors, the absence of yet another

negative surprise is perhaps very much a part of the story," Mr.

Culp said in an interview Thursday.

Shares of GE closed 11.65% higher at $10.16, marking the stock's

biggest single-day percentage gain in a decade. The shares have

rallied more than 50% from their low in December but are still

trading below where they were when Mr. Culp took over and 35% below

where they stood a year ago.

GE plans to provide financial projections at some point when it

has enough confidence in its operations.

"I'm not going to put the company's reputation at further risk

by satisfying an artificial calendar in that regard," Mr. Culp

said. "We are going to come out with guidance when we can walk

people through it, where the math adds up, and we can be very clear

on how we are going to go about delivering on those numbers."

Mr. Culp said the company aims to reduce its leverage by $50

billion from selling off its transportation division, selling down

its stake in oil-services firm Baker Hughes and the initial public

offering of the health-care business. He said GE doesn't plan to

sell its Gecas plane-leasing business, which several private-equity

firms have expressed interest in buying.

GE expects to contribute $4 billion to GE Capital this year. It

also agreed to pay $1.5 billion to settle a long-running

investigation by the Justice Department into a defunct

subprime-mortgage business called WMC.

The government was investigating whether the business violated

federal lending laws as part of a larger probe into the subprime

mortgage crisis. The charge was in line with the amount GE had

previously set aside for a potential settlement.

The fourth-quarter profit attributable to GE was $761 million,

compared with a loss of $10.82 billion a year earlier, when it

booked a large charge for a shortfall in reserves at a defunct GE

Capital insurance business.

GE finance chief Jamie Miller said GE still expects to pay $2

billion into reserves this year. An annual review should be

finished in mid- to late February, she said, but no changes are

expected.

Last year, GE surprised investors when it revealed it was still

on the hook for the policies, which provide coverage for nursing

home stays and other care, and it would need to bolster reserves by

$15 billion over seven years.

Revenue rose 5% to $33.28 billion, including a 25% decline in

power business, which makes turbines for power plants, and a 21%

jump in its aviation business, which manufactures jet engines.

Those are the two biggest units that will be the core of the

company after it moves ahead with plans to break itself apart

following a difficult two years.

Cash flow from operations was $6.4 billion for the quarter, down

9% from last year. The fourth quarter is typically the strongest

for GE. Full-year cash flow from operations dropped 80% to $2.3

billion from $11 billion in 2017.

On the conference call, GE said its goals were to attain a A

credit rating and return to a dividend payment "in line with peers

over time." Investors have been nervous about GE's credit rating,

which was downgraded two notches last year to BBB by the major

credit-rating firms. The company has twice in the past 18 months

cut its once generous dividend.

The power division, which had been GE's biggest in terms of

revenue, has been at the center of GE's financial and operational

woes. The pain continued in the fourth quarter with a segment loss

of $872 million, which GE said came from "continued execution and

operational issues." The company is reviewing every power project

and contract, but said the work will take time.

The company's aviation business continued to outshine the other

operations -- segment profit was higher than all others combined --

as demand for its jet engines remained strong from plane makers

Boeing Co. and Airbus SE. Profit rose 24% to $1.7 billion in the

quarter on revenue of $8.5 billion.

The other major GE business, health care, showed little growth

as profit rose 2% to $1.18 billion and revenue grew 2% to $5.4

billion in the quarter.

The company did provide some directional projections for 2019,

expecting industrial revenue to rise in the low to mid-single

digits. The Power division will have another down year as the

overall market remains slow.

In aviation, 75% to 80% of commercial engine sales are locked in

through existing orders along with services revenue of $15 billion.

Overall, the division expects high-single-digit revenue growth and

low single-digit profit growth.

Despite settling the mortgage-related investigation, Mr. Culp

still must contend with continuing government probes into GE's

accounting. Both the Justice Department and the Securities and

Exchange Commission are investigating GE's revenue recognition of

service contracts in its power business, a $22 billion charge

booked in the third quarter and the process that uncovered the

insurance shortfall.

"It is very hard to predict how long some of these other

investigations are likely to take," Mr. Culp said. GE has

previously denied wrongdoing, and Mr. Culp said it is cooperating

with the investigations.

"We would certainly like to wrap up anything of that nature

sooner rather than later," he said. "But those investigations tend

to go on for extended periods of time. We've been through them

before."

Write to Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

February 01, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

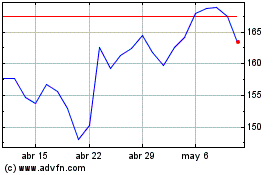

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

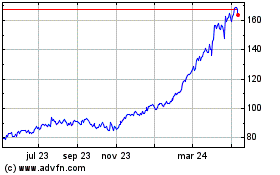

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024