GE to Scale Back Boston HQ, Return $87 Million of Incentives -- Update

14 Febrero 2019 - 5:57PM

Noticias Dow Jones

By Thomas Gryta and Jon Kamp

BOSTON -- General Electric Co. is scaling back its planned

Boston headquarters, including selling the property and dropping

plans to add hundreds of jobs, because the shrinking conglomerate

no longer needs the facilities.

The company reached an agreement with Massachusetts to return

$87 million of incentives and jointly sell the waterfront site. GE

plans to lease back some of the buildings to house its senior

executives and about 250 employees, down from initial plans to add

about 800 staff.

GE moved to Boston from Fairfield, Conn., in 2016 after

considering 40 other locations in a high-profile decision. The $200

million project included renovating two existing brick buildings

and constructing a new glass office tower. In 2017, the company put

on hold plans for the office tower as its financial condition

deteriorated.

"While changes in the company's portfolio and operating model

will lead to a smaller corporate headquarters, we are fully

committed to Boston," said Ann Klee, vice president of Boston

development and operations at the company. The Boston Globe earlier

reported on the news.

In the last 18 months, GE has cut its dividend to a penny a

quarter and sold businesses to raise cash to help reduce its more

than $100 million in debt. New Chief Executive Larry Culp aims to

shrink GE's headquarters operations and push those costs and

responsibilities down to the individual business units. The

strategy is to give unit leaders more accountability for spending

and profits, while reducing the number of employees in overhead

functions.

Massachusetts owns the brick buildings, which were once the home

of candy maker Necco and under renovation, and GE owns the property

where the new tower was planned. The plans and permits for the new

building will be transferred with a sale, the company said. GE and

the government will split any proceeds from the sale that exceed

the amount spent by the parties on the project.

GE is also walking away from a property-tax incentive package

from the city of Boston valued at as much as $25 million, said John

Barros, Boston's economic-development chief. That money, which was

based on the company hitting employment and site-development

benchmarks, hasn't been paid out.

The industrial conglomerate's Boston home sits across a channel

from the downtown financial district and on the edge of the trendy

Seaport neighborhood, where development has been booming for years.

The GE site was long derelict while a prior owner sat on the

property, but Mr. Barros believes it is prime real estate in a

congested city undergoing a sustained development boom.

"Given Boston's real estate market, it will get developed," he

said. "I really feel like GE moving to Boston opened up a key part

of our city for development. We will get jobs on that site."

GE broke ground on the building site in 2017 with much fanfare

in a ceremony that included former CEO Jeff Immelt, Gov. Charlie

Baker and Mayor Marty Walsh. The plan was to house 800 employees,

including 600 "digital industrial product managers, designers and

developers," the company said in its announcement.

When Mr. Immelt retired in 2017, GE delayed the construction of

the glass tower as the company started to restructure its business

and scale back its digital operations.

The conglomerate moved its headquarters to Boston three years

ago, uprooting itself from more than 40 years in the woods of

Connecticut, in order to be in a more urban setting where it could

recruit the workers needed to develop its technology

operations.

At the time, the company said the move would have no material

financial impact because of the package of incentives and the sale

of its Connecticut site along with 30 Rockefeller Plaza in New

York. The 126-year-old company has previously been based in upstate

New York, as well as Midtown Manhattan. It moved to Connecticut in

1974.

Write to Thomas Gryta at thomas.gryta@wsj.com and Jon Kamp at

jon.kamp@wsj.com

(END) Dow Jones Newswires

February 14, 2019 18:42 ET (23:42 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

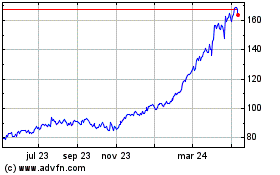

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

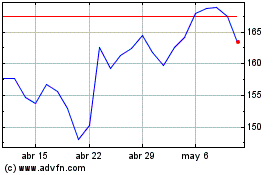

De Mar 2024 a Abr 2024

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024