Next PLC Trading Statement (2774H)

31 Julio 2019 - 1:01AM

UK Regulatory

TIDMNXT

RNS Number : 2774H

Next PLC

31 July 2019

Date: Embargoed until 07.00hrs, Wednesday 31 July 2019

Contacts: Amanda James, Group Finance Director (analyst calls)

NEXT PLC Tel: 0333 777 8888

Alistair Mackinnon-Musson Email: next@rowbellpr.com

Rowbell PR Tel: 020 7717 5239

Photographs: http://www.nextplc.co.uk/media/image-gallery/campaign-images

Next plc

Trading Statement - 31 July 2019

SUMMARY

-- Q2 full price sales up +4.0% on last year

-- Full year full price sales guidance increased from +1.7% to +3.6%

-- Full year profit guidance increased by GBP10m to GBP725m (+0.3% on last year)

-- Earnings Per Share guidance increased from +3.4% to +5.2% on last year

SALES FOR THE 26 WEEKS TO 27 JULY 2019

Full price sales in the first half were up +4.3% on last year.

Total sales, including markdown sales, were up +3.8%. The table

below sets out the full price sales growth by business divisions:

Retail stores, Online and Finance interest income, by quarter and

for the first half.

First Quarter Second Quarter First Half

Full price sales (VAT exclusive) to 27 April to 27 July to 27 July

================================================== ============== =============== ============

Retail - 3.6% - 4.2% - 3.9%

Online +11.8% +12.0% +11.9%

Product full price sales +4.0% +3.7% +3.8%

============== =============== ============

Finance interest income +11.4% +8.3% +9.9%

Total full price sales including interest income +4.5% +4.0% +4.3%

============== =============== ============

Second Quarter Analysis - 13 weeks to 27 July

Full price sales in the second quarter have been better than we

anticipated and were up +4.0% on last year. This was 4.5% better

than the guidance of -0.5% given in our May Trading Statement. A

closer examination of the quarter's performance by month (set out

in the chart below) shows that full price sales during May and June

combined were up +3.0%; July was particularly strong and up +6.8%

on last year. However, some of July's over-performance in full

price sales came as a result of lower markdown sales in our

end-of-season Sale. We believe that the sales performance in

May/June is a better guide to underlying growth and we have used

this number as the basis for our second half guidance (see

below).

Click or paste the following link into your web browser to view

the graph titled '2019 Full Price Sales Variance by Month vs 2018

(GBPm and %)'. Refer to page 2 for this graph

http://www.rns-pdf.londonstockexchange.com/rns/2774H_1-2019-7-30.pdf

End-of-Season Sale

We went into the end-of-season Sale on 6 July, with surplus

stock down -1% on last year. Clearance rates to date (the

percentage of Sale items that have been sold) are -2% lower than

expected. As a result, we have adjusted our guidance to assume a

similar reduction in Sale clearance rates in the second half.

SALES, PROFIT AND EPS GUIDANCE FOR THE FULL YEAR

Following the better than anticipated sales performance in the

second quarter, we are increasing our full price sales guidance for

the second half from +1.7% to +3.0%, in line with our full price

sales growth in May and June.

The table below sets out our revised central guidance for full

price sales, Group profit and Earnings Per Share growth for the

year to January 2020. For completeness, our previous guidance is

also shown.

The increase in our full price sales guidance is GBP70m and,

after accounting for associated costs, is expected to add GBP20m to

profit. Lower clearance rates to date, along with anticipated lower

clearance rates in the second half, are forecast to cost an

additional GBP10m. As a result, we are increasing our guidance for

full year Group profit by GBP10m to GBP725m, marginally up on last

year. We now expect Earnings Per Share to grow by +5.2%.

Previous

Full Year Full Year

Full year estimate to January 2020 Central Guidance Central Guidance

======================================== ================== ==================

Retail sales vs. 2018/19 - 5.1% - 8.5%

Online sales vs. 2018/19 +11.8% +11.0%

Finance interest income vs. 2018/19 +8.1% +9.9%

Total full price sales versus 2018/19 +3.6% +1.7%

Group profit before tax(1) GBP725m GBP715m

Group profit before tax vs. 2018/19 +0.3% - 1.1%

Earnings Per Share growth vs. 2018/192 +5.2% +3.4%

================== ==================

(1) This profit estimate excludes the impact of the transition

to IFRS 16 'Leases'.

(2) GBP280m of shares were purchased in the first half of the

year and we are assuming that a further GBP20m are purchased in the

second half of the year, with a future share purchase price of

GBP56.16.

SHARE BUYBACKS

We maintain our guidance to return GBP300m of surplus cash3 to

shareholders, by way of share buybacks. To date we have purchased

GBP280m.

(3) Surplus cash is cash flow after capital expenditure,

interest, tax and ordinary dividends but before financing any

increase in Online debtors.

INTERIM RESULTS

We are scheduled to announce our results for the first half of

the year on Thursday 19 September 2019.

Forward Looking Statements

Certain statements in this Trading Update are forward looking

statements. These statements may contain the words "anticipate",

"believe", "intend", "aim", "expects", "will", or words of similar

meaning. By their nature, forward looking statements involve risks,

uncertainties or assumptions that could cause actual results or

events to differ materially from those expressed or implied by

those statements. As such, undue reliance should not be placed on

forward looking statements. Except as required by applicable law or

regulation, NEXT plc disclaims any obligation or undertaking to

update these statements to reflect events occurring after the date

these statements were published.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTVBLFXKDFZBBV

(END) Dow Jones Newswires

July 31, 2019 02:01 ET (06:01 GMT)

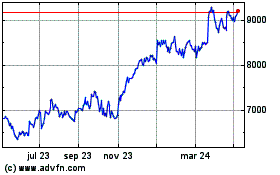

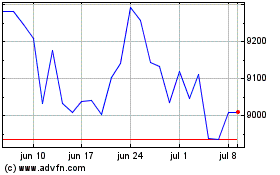

Next (LSE:NXT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Next (LSE:NXT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024