TIDMNAR

RNS Number : 3401T

Northamber PLC

14 November 2019

14 November 2019

Northamber PLC

("Northamber" or the "Company")

Preliminary Results for the year ended 30 June 2019

Chairman's Statement

I am writing in my capacity as Acting Chairman, a role I have

assumed as David Phillips is currently suffering from ill health

and it may be some time before he is fully recovered and able to

resume his role as Chairman. We have an experienced board and

strong management team upon which to rely until such time as David

returns.

This year has been dominated by the sale of the Company's

freehold warehouse facility in Weybridge, albeit that it took place

shortly after the year end and the impact is not therefore

reflected in these accounts. I will cover this in more detail later

in this statement, but I shall now turn to the year under

review.

Trading

At first glance, the headline results for the year appear

disappointing with turnover of GBP50.3 million against GBP58.1

million for the previous year, but further analysis provides an

insight into the underlying trends in the business. It is also

important to recall that we took a deliberate decision to exit

lower margin, commoditised product groups, which saw a material

reduction in turnover between the first and second half of the year

ended 30 June 2018. So, there is a steadier picture when comparing

the revenues for the second half of FY2018, with the two halves of

FY2019.

The first half of FY2019 was impacted by the previously reported

supplier contract breach. The legal case we brought against the

supplier continues, and we are still incurring legal costs.

Turnover in H2 at GBP26.1 million was GBP1.8 million higher than

for H1 and Gross Profit increased by GBP0.26 million to GBP2.3m,

with the gross margin increased from 8.4% to 8.8%.The year on year

improvement in gross margin was more pronounced, rising from 7.82%

to 8.6%.The process of expansion of the more rewarding strategic

Audio Visual & Solutions products continues and is reflected in

these figures, along with the reduction in the proportion of lower

margin products.

I believe that these figures show the strengthening trading

business we are building, with a considerable improvement and

confirms our policy of expanding profitable product ranges.

Financial Position

The sale of the Weybridge warehouse property after the period

end will of course have a very significant impact on the shape of

the balance sheet but we closed the financial year in a strong

position.

Based on the position at 30 June 2019, which excludes the

GBP16.4 million cash proceeds from the property sale, the Company

had a very strong balance sheet with a net current assets ratio of

2.2 compared with 2.4 in the previous year and cash on hand of

GBP3.4 million compared with GBP5.1 million in the previous

year.

The working capital ratios all increased this year which were

the result mainly of changes in the structure of the product range

and in the supplier/customer profiles.

At 30 June 2019 the Net Assets per share were 60.8p (2018:

62.2p), based on the Balance Sheet values including our two

unencumbered freehold properties (but before the sale of the

Weybridge property).

Sale of the Property

It is too early to report on how best to apply the proceeds of

the sale of the warehouse property; there are a number of options

open to the board on how best to utilise these funds for the

benefit of the company and the shareholders. We also need to decide

on an appropriate course of action in relation to our overall

property requirements. We shall of course be reporting the outcome

of any decision made in due course.

Dividend

Having regard to the strength of the Group's debt free tangible

asset base, the Board is proposing to pay an increased final

dividend of 0.3p per share, at a total cost of GBP82,498 which will

be paid on 17 January 2020 to shareholders on the register on 13

December 2019.

Staff

As in previous years the Board would like to express their great

appreciation for the dedication and effort produced by the staff

during the year as we continue to drive changes in strategy.

Outlook

It is our intention to continue to implement the strategy of

product and margin improvements which is showing positive results.

It remains, however, beyond our ability to control or remove those

restraints and constraints which have applied for the last few

years. These have not abated and are even more applicable in the

current climate of uncertainty.

As mentioned above, the Board will be deliberating the most

appropriate strategy to grow the business and maximise shareholder

value, whilst also balancing the longer-term requirements for

appropriate property facilities.

The future of the Company, with the resources available to it,

looks more promising despite the wider economic and political

backdrop, and I look forward to updating you on progress in due

course.

G.P. Walters

Acting Chairman

For more information please contact:

Northamber plc 020 8296 7000

Geoff Walters

Cantor Fitzgerald Europe

(Nominated Adviser & Broker) 020 7894 7000

Phil Davies / Michael Boot

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 30 June 2019

2019 2018

Total Total

GBP'000 GBP'000

Revenue 50,329 58,136

Cost of sales (45,998) (53,589)

Gross Profit 4,331 4,547

Distribution costs (2,849) (2,850)

Administrative costs (2,352) (2,276)

Loss from operations (870) (579)

Investment revenue 272 90

Loss before tax (598) (489)

Tax (charge) - -

Loss for the year and total comprehensive

loss (598) (489)

============ =========

Basic and diluted loss per ordinary

share (2.17)p (1.74)p

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 30 June 2019

2019 2018

GBP'000 GBP'000

Non current assets

Property, plant and equipment 1,792 7,894

Current assets

Inventories 3,320 3,378

Trade and other receivables 9,492 8,145

Cash and cash equivalents 3,446 5,067

Assets classified as held for 6,019 -

sale

----------- ---------

22,277 16,590

----------- ---------

Total assets 24,069 24,484

=========== =========

Current liabilities

Trade and other payables (7,434) (6,964)

Total liabilities (7,434) (6,964)

----------- ---------

Net assets 16,635 17,520

=========== =========

Equity

Share capital 273 281

Share premium account 5,734 5,734

Capital redemption reserve 1,513 1,505

Treasury Shares (7) -

Retained earnings 9,122 10,000

----------- ---------

Equity shareholders' funds attributable

to the owners of the parent 16,635 17,520

=========== =========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 30 June

2019

Share Share Capital Treasury shares Retained Total Equity

Capital Premium Redemption Earnings

Account Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

July 2018 281 5,734 1,505 - 10,545 18,065

Dividends - - - - (56) (56)

Transactions

with owners - - - (56) (56)

Loss and total

comprehensive

loss for the

year - - - - (489) (489)

Balance at 30

June 2018 281 5,734 1,505 10,000 17,520

Dividends - - - - (55) (55)

Purchase and

cancellation

of shares (8) 8 - (225) (225)

Purchase of

treasury

shares - - - (7) - (7)

Transactions

with owners (8) - 8 (7) (280) (287)

Loss and total

comprehensive

loss for the

year - - - - (598) (598)

Balance at 30

June 2019 273 5,734 1,513 (7) 9,122 16,635

============ ============ ============ ---------------- ============ ================

CONSOLIDATED STATEMENT OF CASH FLOWS

For the year ended 30 June 2019

2019 2018

GBP'000 GBP'000

Cash flows from operating activities

Operating (loss) from continuing operations (870) (579)

Depreciation of property, plant and equipment 153 188

(Profit) on disposal of property, plant - -

and equipment

------------- ---------------

Operating (loss) before changes in working

capital (717) (391)

Decrease)/(increase) in inventories 58 798

Increase/(decrease) in trade

and other receivables (1,346) 907

Increase/(decrease) in trade

and other payables 470 (1,196)

Cash (used in)/generated from

operations (1,535) 118

Income taxes paid - -

Net cash (used in)/generated

from operating activities (1,535) 118

------------- ---------------

Cash flows from investing activities

Interest received 272 90

Purchase of property, plant and

equipment (71) (57)

Proceeds from disposal of property, - -

plant and equipment

Net cash from investing activities 201 33

Cash flows from financing activities

Dividends paid to equity shareholders (55) (56)

Purchase of cancellation of shares (225) -

Purchase of treasury shares (7) -

Net cash used in financing activities (287) (56)

------------- ---------------

Net increase in cash and cash

equivalents (1,621) 95

Cash and cash equivalents at

beginning of year 5,067 4,972

Cash and cash equivalents at

end of year 3,446 5,067

------------- ---------------

Notes

1. Financial information

The results of the year ended 30 June 2019 have been prepared

using the accounting policies and methods of computation consistent

with those used in the Group's annual report for the year ended 30

June 2019. The results have also been presented and prepared in a

form consistent with that which will be adopted in the Group's

annual report for the year ended 30 June 2019 and in accordance

with the recognition and measurement requirements of the

International Reporting Standards as adopted by the European

Union.

The financial information set out above does not constitute the

group's statutory accounts for the years ended 30 June 2018 or 30

June 2019, but is derived from those accounts. The statutory

accounts for the year ended 30 June 2018 have been delivered to the

Registrar of Companies and those for 2019 will be delivered

following the group's annual general meeting. The auditors have

reported on these accounts, their reports were unqualified and did

not contain statements under s.498(2) or (3) of the Companies Act

2006. The information contained in this statement does not

constitute statutory accounts within the meaning of section 434 of

the Companies Act 2006.

2. Revenue

Although the sales of the group are predominantly to the UK

there are sales to other countries and the following table sets out

the split of the sales for the year. Revenue is attributable to

individual countries based on the location of the customer.

Revenues comprise: 2019 2018

GBP'000 GBP'000

Revenue from contracts

with

customers - UK 49,655 57,661

-other 674 475

--------- ----------

50,329 58,136

Investment revenue 272 90

--------- ----------

50,601 58,226

--------- ----------

One customer accounted for more than 10% of the group's revenue

for the year, being GBP6.4m (2018: GBP7.6m).

3. Loss per ordinary share

The calculation of the basic and diluted earnings per share is

based on the following data:

2019 2018

GBP'000 GBP'000

(Loss) for the year attributable

to equity holders of the parent company (598) (489)

=========== ===========

2019 2018

Number of shares Number Number

Weighted average number of ordinary

shares for the purpose of basic and

diluted earnings per share 27,499,434 28,158,735

=========== ===========

4. Dividends

A final dividend of 0.3p per share will be paid on 17 January

2020 to those members on the register at close of business on 13

December 2019.

5. Notice of meeting

The annual report accounts for the year ended 30 June 2019 will

be posted to shareholders in due course and the Annual General

Meeting will be held on 18 December 2019.

The Company's registered office is Namber House, 23 Davis Road,

Chessington, Surrey, KT9 1HS.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR FMMMMNFKGLZM

(END) Dow Jones Newswires

November 14, 2019 02:00 ET (07:00 GMT)

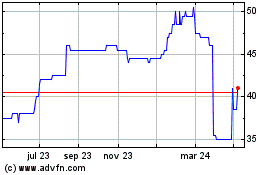

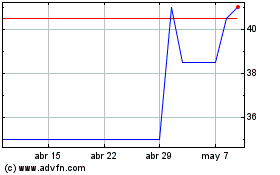

Northamber (LSE:NAR)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Northamber (LSE:NAR)

Gráfica de Acción Histórica

De May 2023 a May 2024