Statement of Changes in Beneficial Ownership (4)

09 Diciembre 2019 - 4:26PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

MAY ALAN RICHARD |

2. Issuer Name and Ticker or Trading Symbol

Hewlett Packard Enterprise Co

[

HPE

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

EVP, Chief People Officer |

|

(Last)

(First)

(Middle)

C/O HEWLETT PACKARD ENTERPRISE COMPANY, 6280 AMERICA CENTER |

3. Date of Earliest Transaction

(MM/DD/YYYY)

12/5/2019 |

|

(Street)

SAN JOSE, CA 95002

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 12/5/2019 | | A | | 85698 (3) | A | $15.83 | 128622 (1) | D |

|

| Common Stock | 12/5/2019 | | F | | 33216 | D | $15.83 | 95406 | D |

|

| Common Stock | | | | | | | | 100827 (2) | I | By Joint Trust |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Restricted Stock Units | (4) | 1/2/2019 | | A | | 869.5351 (5) | | (5) | (5) | Common Stock | 869.5351 | (5) | 30372.5351 | D |

|

| Restricted Stock Units | (4) | 1/2/2019 | | A | | 2152.2307 (6) | | (6) | (6) | Common Stock | 2152.2307 | (6) | 74148.2307 | D |

|

| Restricted Stock Units | (4) | 1/2/2019 | | A | | 2625.6518 (7) | | (7) | (7) | Common Stock | 2625.6518 | (7) | 88418.6518 | D |

|

| Explanation of Responses: |

| (1) | The total direct beneficial ownership reflects an increase of 9,900 shares due to the transfer of 9,900 shares previously reported as being held indirectly by the reporting person in a Joint Trust with the reporting person's spouse on 10/09/19. |

| (2) | The total indirect beneficial ownership reflects a decrease of 9,900 shares due to the transfer of 9,900 shares from the Joint Trust with the reporting person's spouse on 10/09/19 to his direct holdings. |

| (3) | On 12/07/17 the reporting person was granted performance adjusted restricted stock units ("PARSUs") subject to Non-GAAP Net Income and relative total stockholder return conditions being met at the time of vesting. These PARSUs vest 50% after 2 and 3 years subjects to performance, and are issued in Issuer's common stock. |

| (4) | Each restricted stock unit represents a contingent right to receive one share of Issuer's common stock. |

| (5) | As previously reported, on 12/07/16, the reporting person was granted 50,648 Restricted Stock Units "RSUs"), 28,410 of which vested on 12/07/17, 28,411 of which vested on 12/07/18, and 28,412 of which will vest on 12/07/19. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. Also included are 869.5351 dividend equivalent rights that reflect 237.4703 dividend equivalent rights at $13.46 per RSU credited to the reporting person's account on 01/02/19, 201.6625 dividend equivalent rights at $15.85 per RSU credited to the reporting person's account on 04/03/19, 209.0484 dividend equivalent rights at $15.29 per RSU credited to the reporting person's account on 07/03/19, and 221.3539 dividend equivalent rights at $14.44 per RSU credited to the reporting person's account on 10/02/19. Unvested RSUs in this footnote reflect post spin-off conversion adjustments previously reported. |

| (6) | As previously reported, on 12/07/17, the reporting person was granted 105,485 RSUs, 35,161 of which vested on 12/07/18, and 35,162 of which will vest on each of 12/07/19 and 12/07/20. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. Also included are 2,152.2307 dividend equivalent rights that reflect 587.7749 dividend equivalent rights at $13.46 per RSU credited to the reporting person's account on 01/02/19, 499.1451 dividend equivalent rights at $15.85 per RSU credited to the reporting person's account on 04/03/19, 517.4264 dividend equivalent rights at $15.29 per RSU credited to the reporting person's account on 07/03/19, and 547.8843 dividend equivalent rights at $14.44 per RSU credited to the reporting person's account on 10/02/19. |

| (7) | As previously reported, on 12/10/18 the reporting person was granted 85,793 RSUs, 28,597 of which will vest on 12/10/19, and 28,598 of which will vest on each of 12/10/20 and 12/10/21. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. Also included are 2,625.6518 dividend equivalent rights that reflect 717.0663 dividend equivalent rights at $13.46 per RSU credited to the reporting person's account on 01/02/19, 608.9409 dividend equivalent rights at $15.85 per RSU credited to the reporting person's account on 04/03/19, 631.2435 dividend equivalent rights at $15.29 per RSU credited to the reporting person's account on 07/03/19, and 668.4011 dividend equivalent rights at $14.44 per RSU credited to the reporting person's account on 10/02/19. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

MAY ALAN RICHARD

C/O HEWLETT PACKARD ENTERPRISE COMPANY

6280 AMERICA CENTER

SAN JOSE, CA 95002 |

|

| EVP, Chief People Officer |

|

Signatures

|

| Derek Windham as Attorney-in-Fact for Alan R. May | | 12/9/2019 |

| **Signature of Reporting Person | Date |

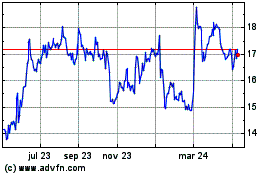

Hewlett Packard Enterprise (NYSE:HPE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

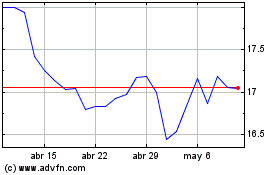

Hewlett Packard Enterprise (NYSE:HPE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024