TIDMBSE

AIM and Media Release

16 April 2020

BASE RESOURCES LIMITED

Quarterly Activities Report - March 2020

Key Points

* Kwale Operations continue uninterrupted with health and safety procedures

implemented to minimise the risk of COVID-19 to personnel and surrounding

communities.

* Production increases from prior quarter across all products.

* Ongoing sound demand from customers, with ilmenite and rutile prices

continuing to strengthen in the quarter while zircon prices reduced

slightly.

* On the basis of continued operations, FY2020 production guidance is

maintained.

* Kwale North Dune pre-feasibility study commenced.

* Positive progress with the Government of Madagascar on the Toliara Project

fiscal terms and lifting of the suspension of on-ground activities was

halted as ministries were suspended to manage the COVID-19 pandemic.

* Toliara Project FID delayed due to COVID-19 impacts and uncertainty.

* Full US$75m revolving credit facility drawn down to enhance liquidity and

provide flexibility during the COVID-19 pandemic.

African mineral sands producer, Base Resources Limited (ASX & AIM: BSE) (Base

Resources or the Company) is pleased to provide a quarterly operational,

development and corporate update.

Supported by sound customer demand, production at the Company's Kwale Mineral

Sands Operations (Kwale Operations) in Kenya has continued uninterrupted with

broad health and safety procedures implemented to minimise the risk of COVID-19

to our personnel and surrounding communities.

Discussions with the Government of Madagascar on fiscal terms, and the lifting

of the suspension of on-the-ground activities, for the Toliara Project

progressed positively over the quarter but have been temporarily halted with

the Government focusing on combating the COVID-19 pandemic. Other activities

to progress the project, such as front-end engineering design, continued in the

quarter.

COVID-19 IMPACTS

COVID-19 and its impacts on the Company's business, people and stakeholders is

the subject of ongoing close monitoring and response development.

Kwale Operations continue to be maintained, balancing the considerations of

employee and community health, operational safety, community benefits,

government policy and regulation, customer demand and financial prudence.

Consequently, a halt to, or curtailment of, operations at some point in the

future is possible if circumstances change.

Base Resources has made a number of changes to workplaces as outlined below.

Kwale Operations

The Company has implemented a suite of mitigations aimed at protecting the

health and safety of our employees and neighbouring communities while

operations continue. Taking note of Government of Kenya requirements, Base

Resources has:

* Substantially modified workplace practices, focusing on hygiene and social

distancing measures to minimise the risk of COVID?19 transmission

including:

+ Reducing the number of personnel at the mine site by around 40% by

introducing a "stay at home" and "work from home" policy for

non-operational employees.

+ Increasing the number of buses transporting employees to and from the

mine site to allow for appropriate physical distancing.

+ The introduction of health screening and associated protocols for all

personnel prior to travelling to or entering site.

+ Regular fumigation of common work areas including ablutions, crib

rooms, buses and heavy mobile equipment.

+ Increasing the scope of personal protective equipment required for

those working in close proximity to each other.

* Worked with local authorities to ensure compliance with Government COVID-19

reduction measures while maintaining operational continuity.These include

altering rosters to fit within the nation-wide curfew and securing

exemptions for relevant support activities as well as modifying

arrangements to comply with the Kwale and Mombasa county border travel

restrictions.

* Provided the option for fly-in-fly-out (FIFO) employees to return to their

home country, as the practicalities of serving isolation or quarantine

restrictions in both Kenya and their home country have rendered roster

travel impractical.

* Assisted with a number of community initiatives, including:

+ Working with the Kwale County government to distribute personal

protective equipment to health workers and community-based handwashing

equipment to help improve sanitation.

+ Food support programs, implemented in conjunction with local and

national authorities, and local support groups, to help with the

economic impact on tourism and unemployment in the Kwale region.

The Company is actively assessing further opportunities to support local

communities, and Kenya more broadly.

Madagascar and Perth Offices

In alignment with government measures, Base Resources offices in Madagascar

have been closed and employees are, subject to the requirements of their role,

either working from home or staying at home. All FIFO employees have returned

to their home countries.

Perth based employees are working from home.

KWALE OPERATIONS

Production & Sales Mar 2019 June 2019 Sept 2019 Dec 2019 Mar 2020

Quarter Quarter Quarter Quarter Quarter

Production (tonnes)

Ilmenite 87,179 88,789 73,808 91,406 105,035

Rutile 20,171 22,588 16,390 19,812 23,683

Zircon 6,943 7,063 6,980 7,923 9,163

Zircon low 172 347 466 546 780

grade

Sales (tonnes)

Ilmenite 81,339 99,620 60,109 106,544 87,819

Rutile 14,593 31,889 14,018 13,078 25,280

Zircon 7,260 7,968 6,713 7,090 7,377

Zircon low 115 219 839 616 -

grade1

[Note (1): Reported as tonnes of zircon contained in concentrate, it realises

90% to 100% of the value of the equivalent volume of standard grade zircon, due

to rutile credits.]

Mining operations continued steadily on the South Dune orebody with mined

tonnage of 4.3Mt, lower than the last quarter's 4.6Mt. Productivity was

impacted by lower face heights and reduced water pressures as some hydro mining

guns approached the end of the current mining blocks and the distance from the

pumping stations increased. As hydraulic mining units are re-located to new

mining blocks during the coming quarter, productivity is expected to improve.

Mined grade moderated during the quarter from 4.2% to 3.9% heavy mineral (HM)

as expected.

Mining & WCP Mar 2019 June 2019 Sept 2019 Dec 2019 Mar 2020

Performance Quarter Quarter Quarter Quarter Quarter

Ore mined (tonnes) 4,349,984 3,644,160 4,909,999 4,579,386 4,295,645

HM % 3.59 3.52 2.66 4.22 3.86

HMC produced 154,001 131,475 114,149 189,952 153,754

(tonnes)

Wet concentrator plant (WCP) production of heavy mineral concentrate (HMC)

declined to 154kt (last quarter: 190kt) due to lower mined tonnage and ore

grades. Stocks of HMC built up last quarter were utilised to maintain a 90tph

mineral separation plant (MSP) feed rate, reducing closing stocks of HMC to

13kt (last quarter: 46kt). Sand tails continued to be deposited into the

mined-out Central Dune area. Rehabilitation works on the Central Dune and the

mined-out areas of the South Dune continued.

MSP Performance Mar 2019 June 2019 Sept 2019 Dec 2019 Mar 2020

Quarter Quarter Quarter Quarter Quarter

MSP Feed (tonnes of 155,373 160,766 121,600 155,217 186,197

HMC)

MSP feed rate (tph) 78 76 67 86 90

MSP recovery %

Ilmenite 104 100 103 100 99

Rutile 102 104 103 102 99

Zircon 78 76 86 88 87

Total MSP feed tonnage was higher than the prior quarter reflecting use of

available HMC stocks and resulting in increased production of all products.

Recoveries were slightly lower than prior quarters due to varying MSP feed

conditions associated with managing low HMC stocks.

Bulk loading operations at the Company's Likoni Port facility continued to run

smoothly, dispatching more than 110kt of bulk ilmenite and rutile and low-grade

zircon during the quarter (last quarter: 116kt). Containerised shipments of

rutile and zircon through the Mombasa Port largely proceeded according to plan.

Summary of unit costs Mar 2019 June 2019 Sept 2019 Dec 2019 Mar 2020

& Revenue per tonne (US$) Quarter Quarter Quarter Quarter Quarter

Unit operating costs per $138 $127 $173 $140 $128

tonne produced

Unit cost of goods sold per $151 $180 $213 $141 $175

tonne sold

Unit revenue per tonne of $368 $482 $469 $355 $476

product sold

Revenue: Cost of goods sold 2.4 2.7 2.2 2.5 2.7

ratio

Despite higher total operating costs than the previous quarter, caused by

non-cash changes to the rehabilitation and mine closure provision, the

significantly increased production volume resulted in a lower unit operating

cost of US$128 per tonne produced (rutile, ilmenite, zircon and low-grade

zircon) (last quarter: US$140 per tonne).

Unit cost of goods sold is influenced by both the underlying operating costs

and product sales mix. Operating costs are allocated to each product based on

revenue contribution, which sees the higher value rutile and zircon products

attracting a higher cost per tonne than the lower value ilmenite. Therefore,

the greater the sales volume of rutile and zircon relative to ilmenite in a

quarter, the higher both unit revenue per tonne and unit cost of goods sold

will be.

Ilmenite, and the majority of rutile, is sold in bulk, with typical shipment

sizes of 50-54kt for ilmenite and 10-12kt for rutile, which means any given

quarter will usually contain either one or two bulk rutile and ilmenite sales.

Zircon is sold in smaller parcels and sales generally align with production

volume. Product sales mix will therefore vary depending on the number of bulk

shipments of ilmenite and rutile in each quarter.

Cost of goods sold of US$175 per tonne sold (operating costs, adjusted for

stockpile movements, and royalties) was higher due to the increased proportion

of rutile in the sales mix (last quarter: US$141 per tonne). The higher

proportion of rutile sold in the quarter contributed to an increase in both the

cost of goods sold and average revenue per tonne to US$476 per tonne (last

quarter: US$355 per tonne). From the combination of these factors, the revenue

to cost of goods sold ratio for the quarter increased to 2.7 (last quarter:

2.5).

FY20 PRODUCTION GUIDANCE

Base Resources' prevailing production guidance for the 2020 financial year (

FY20) remains unchanged. However, due to the inherent uncertainties associated

with the COVID-19 pandemic, a halt to, or curtailment of, operations at some

point in the future is possible. In such an event, the Company may update or

withdraw its FY20 production guidance, as appropriate in the circumstances.

Kwale Operations FY20 production guidance remains at:

* Rutile - 75,000 to 81,000 tonnes.

* Ilmenite - 335,000 to 355,000 tonnes.

* Zircon - 29,000 to 32,000 tonnes.

The above FY20 production guidance is based on the following assumptions:

* Mining of 18.7Mtat an average HM grade of 3.58%, with the remainder of the

FY20 volume coming entirely from Ore Reserves2.

* Average MSP feed rate of 79tph.

* Average MSP product recoveries of 102% for rutile, 101% for ilmenite and

85% for zircon.

[Note (2): The Ore Reserves estimate underpinning the above production guidance

was prepared by Competent Persons in accordance with the JORC Code (2012

edition). For further information regarding the Ore Reserves estimate refer to

Base Resources' announcement on 9 October 2017 "2017 Kwale Mineral Resources

and Ore Reserves Statement" available at https://baseresources.com.au/investors

/announcements/. The above production guidance is the result of detailed

studies based on the actual performance of the Kwale mine and processing

plant. These studies include the assessment of mining, metallurgical, ore

processing, environmental and economic factors.]

MARKETING

Despite the COVID-19 pandemic, and seasonal factors, demand during the quarter

for all products was firm and most customers, across the various products,

market segments and regions, have advised that their facilities operated at

normal levels with regular orders received from their customers.

Global pigment producers have generally indicated that demand for pigment was

strong through the quarter and tight market conditions continued to prevail for

sulphate ilmenite and high-grade chloride feedstocks (including rutile)

resulting in further price improvement for both ilmenite and rutile.

Subsequent to quarter end, some Chinese customers have advised that there is a

weakening outlook for pigment exports.

Rutile demand remains strong and ongoing restricted supply is currently

maintaining a tight market. The recent government-imposed interruptions to the

operation of major chloride slag facilities in South Africa is expected to

further restrict the supply of high-grade feedstock in 2020. The Company has

firm sales contracts in place for almost all of its forecast rutile production

for the remainder of calendar year 2020.

Despite COVID-19 related uncertainty over the outlook for pigment exports,

Chinese pigment producers (the Company's main ilmenite customers) have

re-confirmed their demand for ilmenite and their intention to proceed with

planned shipments over the coming months. Tight restrictions on ilmenite

supply have continued into 2020 and some customers continue to seek significant

additional ilmenite volumes and earlier shipments, having expressed concern

over the security of feedstock supply. A prolonged interruption to Chinese

domestic ilmenite production through February 2020, due to COVID-19 shutdowns,

compounded the general global shortage of available ilmenite through the

quarter, which has continued into the June quarter. It is understood that

ilmenite supply in India has been further impacted as a result of COVID-19

related suspensions on activity throughout the country. This will further

exacerbate the global ilmenite shortage.

Subdued conditions in the zircon market continued through the seasonally weak

March quarter resulting in some marginal price erosion. The COVID-19 related

shutdown of some operations in China during February 2020 resulted in the

deferral of some shipments but concerns over security of zircon supply boosted

demand towards the end of the quarter. The Company's small backlog of zircon

sales, caused by these deferrals, was cleared by mid-April.

Zircon sales for the June quarter are mostly proceeding as planned at prices

reasonably consistent with March quarter contracts, with firm demand from

Chinese customers in particular. Demand for zircon end products is uncertain

over the coming months but it is expected that any drop in demand will be

offset to some extent by the restrictions on zircon supply coming from major

producers in South Africa and other locations.

SAFETY

With no lost time or medical treatment injuries occurring during the quarter,

or in the past year, Kwale Operations' lost time injury frequency rate (LTIFR)

and total recordable injury frequency rate (TRIFR) are both zero. No injuries

were recorded in the quarter for the Toliara Project and the total number of

injuries of any type since project commencement remains at zero. Compared to

the Western Australian All Mines 2017/2018 LTIFR of 2.0, this is an exceptional

performance reflective of the ongoing focus and importance placed on safety by

management. Base Resources' employees and contractors have now worked 19.9

million man-hours lost time injury (LTI) free, with the last LTI recorded in

early 2014. Further, 10.5 million hours have been worked without a medical

treatment injury.

COMMUNITY AND ENVIRONMENT

Kwale Operations

Base Resources has implemented a number of actions to assist the Kwale

community manage the COVID-19 pandemic, including the distribution of personal

protective equipment to county health workers and establishment of

community-based handwashing equipment to help improve sanitation. Food support

programs have also been put in place in conjunction with local and national

authorities, and local support groups, to cater for the economic impact on

tourism and unemployment.

Agricultural livelihood programs at Kwale made considerable progress during the

quarter working with partners Business for Development, the PAVI farmers'

cooperative, and the Cooperative Bank of Kenya. PAVI, through a joint

initiative with Base Resources, secured additional funding through a Government

of Kenya agribusiness support project to further build capacity and develop the

cooperative.

Preparations are now underway to plant maize, sorghum, cotton, green grams,

various spices and sunflower during this year's upcoming planting season.

Measures have been put in place to continue to progress these activities in

compliance with government restrictions implemented as a result of the COVID-19

pandemic.

With land rehabilitation activities increasing on site, community groups have

continued to supply special grasses for the program and grass seed. Irrigation

has also been installed to assist with germination prior to the upcoming rains

which will help with erosion controls.

Toliara Project

Community training programs and social infrastructure construction work remain

on hold following the government-required suspension of on-the-ground

activities on the Toliara Project. The 24 apprentices training in Kenya at the

Kwale Operation have remained on site and are subject to restricted movements

consistent with government requirements and company protocols in dealing with

COVID-19. Base Resources continues to work with local authorities to assist in

the response to public health challenges in the Toliara region.

BUSINESS DEVELOPMENT

Toliara Project Development - Madagascar

In November 2019, the Government of Madagascar required the Company to

temporarily suspend on-the-ground activity on the Toliara Project while

discussions on fiscal terms applying to the project were progressed3. Activity

remains suspended as Base Resources engages with the Government in relation to

the fiscal terms applicable to the mining sector in Madagascar, including the

Toliara Project. Discussions progressed positively over the quarter but have

been temporarily halted due to the Government focus on and implementation of

COVID-19 measures, including closing all ministries and public departments

except for justice, security and health.

[Note (3): Refer to Base Resources' market announcement "Toliara Project -

Government of Madagascar statement" released on 7 November 2019, which is

available at https://baseresources.com.au/investors/announcements/ .]

With the effective shutdown of Government, international travel restrictions

and broader COVID-19 measures and impacts both in Madagascar and globally, it

is considered clear that FID will be delayed beyond 30 September 2020, as had

been contemplated in the Toliara Project definitive feasibility study (DFS)

released last quarter. Given current uncertainties, it is not considered

appropriate to provide formal guidance on a revised FID date until such time as

there is greater clarity on the trajectory of resumption of global economic

activity.

Key activities during the quarter included:

* Completion of the French translation of the DFS, required to support the

Company's Large Mining Investment Law (LGIM) application.

* Commencement of front-end engineering design (FEED) activities including:

+ Processing plant engineering, mechanical and electrical equipment and

preferred vendor selection.

+ Continuation of tender evaluation and preferred contractor selection

for key packages including marine EPC, piling at the export facility,

bridge, power and fuel supply.

+ Commencement of project control systems development.

* Commencement of lenders' due diligence with the independent technical

experts (SRK and Arcadis).

* Optimisation of accommodation camp numbers, building type and layout.

Key activities planned for the coming quarter include:

* Resource planning, schedule and budget reviews in relation to the delays

caused by the COVID-19 pandemic.

* Continuation of FEED activities including:

+ Completion of work on tails pumping and metallurgical changes.

+ Completion of design criteria documents, basis of design, equipment

lists and specifications.

* Continued development of the Toliara Project's Environmental and Social

Management System (ESMS).

* Subject to the lifting of the Government suspension and COVID-19 travel

bans, re-establishing on-site activities, including:

+ Environmental baseline studies and monitoring programs.

+ Land acquisition and resettlement programs.

+ Training programs for local people ahead of planned construction.

+ Borehole drilling and additional geotechnical investigations (on and

offshore) at the export facility, bridge and road to optimise designs.

+ Quarry material investigations.

+ Submission of outstanding drill samples for assay.

+ Community programs including relocation of tombs, resuming construction

of schools and medical facilities, installation of solar pumping

equipment into community boreholes, social economic baseline studies,

human rights and health impact assessments.

Total expenditure on the Toliara Project for the quarter was US$3.3 million

(last quarter: US$6.8 million).

Extensional Exploration - Kenya

Mining tenure arrangements continued to progress with the Kenyan Ministry of

Petroleum and Mining as a precursor to an anticipated updated Ore Reserves

estimate based on the expanded 2017 Kwale South Dune Mineral Resource announced

on 4th October 20174. However, progress has slowed as the government focuses

on combating the COVID-19 pandemic.

A concept study for mining the 171Mt North Dune Mineral Resources estimate

(136Mt Indicated and 34Mt Inferred)5 was completed in early January 2020, with

a pre-feasibility study commencing in the quarter.

Completion of the remaining drilling program (4,200 metres) in the North-East

Sector (Kwale East) of PL 2018/0119 remains on hold pending community access

being secured.

Further drilling of the northern sections of the Vanga Prospecting License (PL/

2015/0042) remained on hold pending resolution of community access issues. A

north eastern extension of the Vanga Prospecting Licence is under application

(App No/1753) to cover further prospective ground which has since become

available.

The additional prospecting licence applications lodged for an area south of

Lamu (Apps No/2136, 2146 and 2153) together with an area in the Kuranze region

of Kwale county about 70 km west of the Kwale Operation (App No/2123) remain in

progress through the granting process.

Expenditure on exploration activities in Kenya during the quarter was US$0.1

million (last quarter: US$0.1 million).

[Note (4): Refer to Base Resources' market announcement "Mineral Resource

Increase for Kwale South Dune" released on 4 October 2017, which is available

at https://baseresources.com.au/investors/announcements/. Note (5): For

further information on the Kwale North Dune Mineral Resources estimate, refer

to Base Resources' market announcement "Mineral Resource for Kwale North Dune

deposit" released on 1 May 2019, which is available at https://

baseresources.com.au/investors/announcements/. Base Resources confirms that it

is not aware of any new information or data that materially affects the

information included in the 1 May 2019 announcement and all material

assumptions and technical parameters underpinning the estimates in the 1 May

2019 announcement continue to apply and have not materially changed.]

CORPORATE

Kenyan VAT receivable

As previously announced, Base Resources has refund claims for VAT paid in

Kenya, relating to both construction of the Kwale Project and the period since

operations commenced, which totalled approximately US$19.5 million at 31 March

2020. These claims are proceeding through the Kenya Revenue Authority process

with refunds totalling US$3.1 million received during the quarter (last

quarter: US$3.1 million). Base Resources is continuing to engage with the

Kenyan Treasury and the Kenya Revenue Authority, seeking to expedite the refund

claims.

Revolving Credit Facility

In January 2020, Base Resources repaid the outstanding US$15.0 million balance

of its Revolving Credit Facility (RCF).

In late March, the Company drew down the full US$75.0 million available under

the RCF to secure enhanced liquidity and provide flexibility as part of a

prudent management strategy in navigating the evolving uncertainty associated

with the COVID-19 pandemic.

In summary, at 31 March 2020:

* Net cash of US$44.4 million, consisting of:

+ Cash and cash equivalents of US$119.4 million.

+ Revolving Credit Facility debt of US$75.0 million.

* 1,171,609,774 fully paid ordinary shares on issue.

* 69,167,541 performance rights issued pursuant to the terms of the Base

Resources Long Term Incentive Plan, comprising:

+ 6,527,607 vested performance rights, which remain subject to exercise6.

+ 62,639,934 unvested performance rights, which are subject to

performance testing in accordance with their terms of issue.

[Note (6): Vested performance rights have a nil cash exercise price and,

unless exercised beforehand, these rights expire on 30 September 2024.]

Forward looking statements

Certain statements in or in connection with this announcement contain or

comprise forward looking statements. Such statements may include, but are not

limited to, statements with regard to capital cost, capacity, future production

and grades, sales projections and financial performance and may be (but are not

necessarily) identified by the use of phrases such as "will", "expect",

"anticipate", "believe" and "envisage". By their nature, forward looking

statements involve risk and uncertainty because they relate to events and

depend on circumstances that will occur in the future and may be outside Base

Resources' control. Accordingly, results could differ materially from those

set out in the forward-looking statements as a result of, among other factors,

changes in economic and market conditions, success of business and operating

initiatives, changes in the regulatory environment and other government

actions, fluctuations in product prices and exchange rates and business and

operational risk management. Subject to any continuing obligations under

applicable law or relevant stock exchange listing rules, Base Resources

undertakes no obligation to update publicly or release any revisions to these

forward-looking statements to reflect events or circumstances after today's

date or to reflect the occurrence of unanticipated events.

ENDS.

For further information contact:

James Fuller, Manager Communications and Investor UK Media Relations

Relations

Base Resources Tavistock Communications

Tel: +61 (8) 9413 7426 Jos Simson and Barnaby Hayward

Mobile: +61 (0) 488 093 763 Tel: +44 (0) 207 920 3150

Email: jfuller@baseresources.com.au

This release has been authorised by the Board of Base Resources.

About Base Resources

Base Resources is an Australian based, African focused, mineral sands producer

and developer with a track record of project delivery and operational

performance. The Company operates the established Kwale Operations in Kenya

and is developing the Toliara Project in Madagascar. Base Resources is an ASX

and AIM listed company. Further details about Base Resources are available at

www.baseresources.com.au

PRINCIPAL & REGISTERED OFFICE

Level 1, 50 Kings Park Road

West Perth, Western Australia, 6005

Email: info@baseresources.com.au

Phone: +61 (0)8 9413 7400

Fax: +61 (0)8 9322 8912

NOMINATED ADVISOR

RFC Ambrian Limited

Stephen Allen

Phone: +61 (0)8 9480 2500

JOINT BROKER

Berenberg

Matthew Armitt / Detlir Elezi

Phone: +44 20 3207 7800

JOINT BROKER

Numis Securities Limited

John Prior / James Black / Paul Gillam

Phone: +44 20 7260 1000

END

(END) Dow Jones Newswires

April 16, 2020 02:00 ET (06:00 GMT)

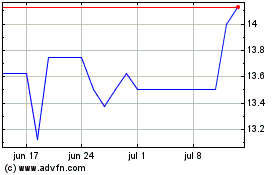

Base Resources (LSE:BSE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Base Resources (LSE:BSE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024