GE Hit by Steep Decline in Jet Engine Business -- Update 1

29 Abril 2020 - 8:09AM

Noticias Dow Jones

By Thomas Gryta

General Electric Co. said it was cutting $2 billion in costs to

offset falling sales and profits, as the company's aviation

business was hit hard by the virtual halt to air travel because of

the coronavirus pandemic.

The conglomerate's first-quarter revenue fell 8% and it posted

operating losses in several of its business units, but the unit

that manufactures and maintains jet engines was hardest hit.

Profits fell 40% in the aviation unit in the first quarter and

the company expects a difficult second quarter. GE said commercial

repair visits were down 60% so far in April and new engine

installations were down 45%.

"This is an unprecedented decline in the aviation market and is

likely to be challenging for a while," CEO Larry Culp said in an

interview Wednesday. "We are well aware that it may take a while"

for air travel to recover.

The conglomerate has been revamping itself under Mr. Culp with a

focus on cutting debt and generating more cash but cut its

first-quarter projections earlier this month along with pulling its

full-year financial outlook.

GE on Wednesday reported first-quarter adjusted negative cash

flow from industrial operations of $2.2 billion; it had projected

negative cash flow of about $2 billion. The company said the

pandemic reduced cash flow by about $1 billion and warned that

second-quarter results will decline sequentially.

GE shares slipped 3% in premarket trading to $6.50 and are

trading near multi-year lows. The stock tumbled in 2017 and 2018

after GE disclosed deep problems in its power unit and capital arm

that forced it to slash its dividend and sell off business. GE

hired Mr. Culp as CEO in October 2018 and he had made progress in

streamlining operations before the pandemic hit.

In the interview, Mr. Culp said GE could use the crisis to speed

up its own restructuring efforts. "In the process of reacting to

what has hit us here, if we play our cards right we will accelerate

the operational and cultural transformation of GE," he said.

"I think on the margin everyone understands, be it unions or be

it governments, that companies are going to be reacting to this

environment, " he said. "Does it help? It is too early to

tell."

GE's aviation business was GE's biggest and most profitable in

recent years as it benefited from a booming aerospace market and

investments, including the launch of GE's most advanced engine to

power Boeing Co.'s MAX jet.

On Wednesday, Boeing said it would further reduce its aircraft

production and cut 10% of its workforce. Rival Airbus SE is cutting

output by a third. Travel bans and restrictions are expected to

halve global air travel in 2020 and left airlines unwilling or

unable to take new planes.

The company is also one of the world's biggest airplane leasing

companies through its GE Capital unit. GE said Wednesday that most

of its airline customers are seeking short-term deferrals, but it

expects many airlines to receive government support. GE said it is

preparing to repossess some jets, as well as restructure existing

deals. It took a $45 million impairment in the first quarter on its

nearly 1,000 jet fleet.

GE, which started the year with about 205,000 workers, has

already announced some job cuts and furloughs in the aviation unit,

which had 52,000 employees. The company said Wednesday it was

accelerating job cuts and restructuring in its power and renewable

energy units, citing a reduced outlook for projects and investments

in those sectors.

The company cut 10% of its U.S. aviation workers and furloughed

thousands more. It laid off 700 workers in the power unit and about

1,200 contractors, according to a securities filing.

The power unit, which makes turbines for power plants, swung to

a quarterly loss of $129 million while the renewable energy unit,

which mostly makes wind turbines, lost $302 million. The health

care unit, which makes hospital equipment including ventilators,

posted higher sales and a 15% jump in profits.

Overall, GE reported net income attributable to common

shareholders of $6.2 billion. The results were boosted by the sale

of the part of its health-care business and gains on GE's stake in

Baker Hughes Co.

Excluding those gains, GE said its adjusted earnings were 5

cents a share, compared with a Wall Street estimate of 8 cents a

share. Revenue fell to $20.5 billion, just below analyst

expectations of $20.83 billion, according to FactSet Research.

GE said it ended March with $48 billion in cash and equivalents,

boosted by the sale of its biopharma division to Danaher Corp. for

proceeds of more than $20 billion. The company also issued $6

billion in debt in April and used it to eliminate near-term

maturities. The company said it is committed to paying down its

long term debts, but it now expects to take longer to reach its

goals.

Write to Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

April 29, 2020 08:54 ET (12:54 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

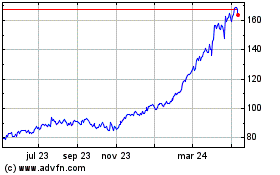

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

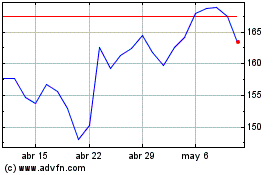

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De May 2023 a May 2024