TIDMCOBR

RNS Number : 1390P

Cobra Resources PLC

05 June 2020

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN OR INTO THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION.

For immediate release

05 June 2020

Cobra Resources plc

("Cobra" or the "Company")

Final Results for the Year Ended 31 December 2019

Cobra, an exploration and mining company announces its results

for the year ended 31 December 2019.

Key Highlights

2019 was a significant year for the Company, achieving its

primary strategic objective of transforming from a cash shell to an

operating business by identifying a precious or base metals project

in either Australia or Africa. This included:

1. Completing the Lady Alice Mines acquisition.

2. Establishing an enviable portfolio with two quality assets,

including an option over a 211,000 oz gold resource, in a secure

and low sovereign risk jurisdiction.

3. Recruiting a management team and Board with deep resource

industry experience to lead the Company's exploration efforts.

4. Articulating a clear exploration plan that aims to maximise

value and de-risk future exploration drilling.

Post-Period End Highlights

-- Successful completion of the Stage 1 soil sampling programme

over Barns, Baggy Green and White Tank prospects, which established

key pathfinder elements to mineralisation.

-- Successful Completion of the Stage 2 soil sampling programme

which identified the presence of pathfinder elements in the

extension to Baggy Green, as well as a strong correlation with

regional structures, and generating 2 new target areas.

-- Application made for ADI funding for 4 new IOCG-style targets

-- Actively planning the Stage 3 soils analysis, in order to

finalise priority targets, in preparation for a drilling programme

during the second half of 2020.

Craig Moulton, Managing Director of Cobra commented:

"Notwithstanding a difficult capital market during 2019 Cobra

managed to attract sufficient funds to commence the staged

exploration programme in South Australia. It is satisfying to see

that this programme is now yielding the results we expected. I am

very excited to see what the planned drilling programme will

deliver for shareholders later this year."

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this news release contain forward-looking

information. These statements address future events and conditions

and, as such, involve known and unknown risks, uncertainties and

other factors which may cause the actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the statements.

Such factors include without limitation the completion of planned

expenditures, the ability to complete exploration programs on

schedule and the success of exploration programs. Readers are

cautioned not to place undue reliance on the forward-looking

information, which speak only as of the date of this news

release.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

End

Enquiries:

Craig Moulton +61 (0) 40 6932187

Cobra Resources plc Daniel Maling (UK) +44 (0) 758 003 2520

SI Capital Limited Nick Emerson

(Joint Broker) Sam Lomanto +44 (0) 14 8341 3500

-------------------- ------------------------

Peterhouse Capital Limited Duncan Vasey

(Joint Broker) Lucy Williams +44 (0) 20 7469 0932

-------------------- ------------------------

Chairman's Statement

INTRODUCTION

As its first full year as a publicly listed company, 2019

represents an important milestone for Cobra Resources. It was a

foundation year where the Board worked to build the business in

preparation for its transition to a fully-fledged operating

company, which occurred on the 16 January 2020 when the enlarged

group including the Wudinna Gold project was admitted to a Standard

Listing and to trading on the Main Market of the London Stock

Exchange. Getting the right assets was a significant achievement

and from which we will continue to build a strong and sustainable

business in the years ahead. It has been satisfying to see the

Parent Company acquire rights over a such high quality and advanced

asset such as the Wudinna Gold project; build a strong management

team and establish itself as an operating Group on the Main Market

of the London Stock Exchange.

BACKGROUND

Cobra Resources began life as publicly listed company in July

2018 with the aim of finding suitable precious, base or energy

metals exploration or mining projects in either Australia or

Africa. During 2019 the Board identified several potentially

suitable projects, which were reviewed in detail to evaluate their

strengths, growth potential and likely longer-term value to

shareholders.

Following an extensive due diligence process the Wudinna Gold

project was identified as the most compelling opportunity primarily

due to its technical and commercial merits. This included having an

existing gold resource of over 200,000 ounces with significant

upside potential, being located in a jurisdiction that was stable,

with low sovereign risk, and having the infrastructure and skilled

resources to efficiently explore and grow the project. As a bonus,

the project vendors were not only well renowned explorers but were

committed to the long-term future of the Company, demonstrating

this by their participation in the following fund raise.

We were also fortunate to recruit a new Managing Director during

the year, Craig Moulton. Craig has joined the board, currently as

the sole executive director and has a deep commercial and technical

background in the exploration and mining industry, having worked

for many years in prestigious mining houses including CRA

Exploration, Rio Tinto and Cliffs Natural Resources, as well as

resources commodity market specialists Wood Mackenzie. I am

confident that Craig has the skills and leadership necessary to

drive the Company to success through disciplined technical

exploration and prudent fiscal management.

OPERATIONAL REVIEW

The Company commenced marketing the Lady Alice Mines acquisition

in March 2019, however, volatile equity markets caused at least in

part by the UK BREXIT negotiations, provided significant headwinds

to fund raising activities for junior resource companies generally

at that time. A combination of a change in prospectus format

requirements by the FCA and the summer holidays then further

delayed progress. With sentiment turning significantly more

positive for junior gold explorers towards the latter half of 2019,

the Company was able to complete a fund raise sufficient to

commence initial exploration activities on 16 January 2020.

While the completion of fundraising activities took longer than

anticipated, this time was put to good use, enabling the team to

complete a detailed review of the technical data acquired from

Andromeda Metals, the Joint Venture partner at the Wudinna Gold

project. This included a detailed analysis of the key controls on

mineralisation from existing core, as well as a review of the

geophysical data and some important foundational work on the

geochemistry, all of which has provided an excellent platform for

the exploration work to leverage during 2020.

As a result of the above analysis the Company articulated a

three-stage geochemical sampling programme to be executed in the

first half of 2020. The first stage aimed to calibrate soil

geochemical sampling with known mineralisation, with the aim of

establishing key pathfinder elements that can significantly reduce

exploration risk during the drilling phase. The second and third

phases would then look take these new pathfinders and apply it to

brownfield and greenfield exploration targets respectively, with

the aim of refining priority drilling targets.

With increased confidence in the planned drilling targets, the

Company then planned to raise sufficient funds to progress the

drilling during the second half of 2020.

It is satisfying to be able to report that the Company has

achieved the first two milestones and is on track to complete the

third, honouring its commitments to its investors and the

market.

POST PERIOD EVENTS

On 16 January 2020 the Company announced that its entire issued

share capital of 153,747,138 ordinary shares had been readmitted to

the standard segment of the Official List of the Financial Conduct

Authority and to trading on the main market for listed securities

of the London Stock Exchange plc under the TIDM "COBR".

The Company also announced the appointment of Peterhouse Capital

Limited as joint broker to the Company.

On admission to trading on the main market of the London Stock

Exchange, the Company raised gross cash proceeds of GBP613,330, and

settled GBP90,587 of immediate cash liabilities in shares, by

issuing 61,330,000 Placing Shares; 10,058,224 Initial Consideration

Shares; 6,066,632 First Reimbursement Shares; 5,818,750 Fee Shares

(issued to directors in lieu of fees); and 3,240,000 Ordinary

shares issued to consultants in lieu of cash payments at the

Placing Price of 1p per share.

On 5 March 2020 the Company announced the issue of 1,745,007

ordinary shares. 757,073 shares were issued to the previous

directors of Lady Alice Mines Pty Ltd, pursuant to the acquisition

agreement, 654,600 shares were issued to a former directors of the

Company pursuant to a settlement agreement and 333,334 shares were

issued pursuant to the exercise of 333,334 share warrants at a

price of 2p per share. The shares were admitted to trading on 12

March 2020.

On 29 April 2020 the Company announced the resignation of Rolf

Gerritsen and appointment of Daniel Maling and David Clarke as

non-executive directors.

On 7 May 2020 the Company announced the issue of 30,095,354

ordinary shares pursuant to the completion of a private placement

conducted at 2.25p per share raising gross proceeds of

approximately GBP677,000. The shares were admitted to trading on 15

May 2020.

On 14 May 2020 the Company announced the completion of the Stage

2 soil sampling programme with 654 samples being sent to ALS

laboratories in Adelaide. The programme saw the collection of 104

new samples at the Barns prospect - Southern Extension; Baggy Green

- South; Baggy Green South East; and the Clarke prospect, as well

as 550 re-assays of previous samples. The work programme also

included a regional scale interpretation of the Newcrest

Aeromagnetic data and a mineral component analysis of all Stage 2

soil samples. From these analyses the following results are

evident:

-- A significant number of results with elevated or anomalous

pathfinder elements (Te, W, Bi, Mo) were returned at Baggy Green

North and Grace prospects;

-- The Baggy Green North results provide significantly increased

confidence that the existing resource may extend between 800m to

1.2km to the north, potentially tripling the existing strike

length;

-- The Clarke and Barns projects show highly anomalous gold

values, but less pathfinders due to deeper sand cover or more

extensive calcrete;

-- A regional scale interpretation of aeromagnetic data has

demonstrated a significant relationship between regional scale

structures, pathfinder elements and gold mineralisation, confirming

that gold mineralisation is structurally controlled;

-- Gold mineralisation in structurally hosted orogenic gold

deposits, such as Wudinna, is typically hosted in adjacent

secondary structures or bends, disruptions, or jogs in the major

structure;

-- The structural interpretation has also identified two new

high priority targets where major structures, already associated

with mineralisation, intersect;

-- The Grace prospect has demonstrated highly anomalous level of

Molybdenum, which requires further investigation, but this is a

known association of IOCG (Olympic Dam-style) mineralisation;

and

-- Re-assaying historic RAB drilling will provide a means of

identifying further pathfinder anomalies at Barns - Southern Zone,

Clarke and at Benaud where deeper sand cover (3m+) has prevented

effective sampling.

On 15 May 2020 the Company announced the issue of 1,250,000

ordinary shares pursuant to the exercise of 1,250,000 warrants at

2p per share. The shares were admitted to trading on 21 May

2020.

COVID-19

On 11 March 2020, the World Health Organisation declared the

Coronavirus outbreak to be a pandemic in recognition of its rapid

spread across the globe, with over 200 countries now affected. Many

governments are taking increasingly stringent steps to help contain

or delay the spread of the virus and as a result there is a

significant increase in economic uncertainty.

For the Group's 31 December 2019 financial statements, the

Coronavirus outbreak and the related impacts are considered

non-adjusting events. Consequently, there is no impact on the

recognition and measurement of assets and liabilities. Due to the

uncertainty of the outcome of current events, the Group cannot

reasonably estimate the impact these events will have on the

Group's financial position, results of operations or cash flows in

the future.

CONCLUSION

With the successful completion of our Stage 2 sampling programme

we are expecting a busy period of exploration activity with the

completion of the Stage 3 analysis, finalising priority targets and

then formalisation of our drilling programme during the second half

of 2020.

Finally, on behalf of the board, I would like to thank

shareholders for their continued support and look forward to

creating more value together as we unlock the potential in our

prized Wudinna Gold Project.

Greg Hancock

Chairman

3 June 2020

Consolidated Income Statement

Notes 31 December 31 December

2019 2018

GBP GBP

Revenue - -

Administrative expenses (544,500) (376,860)

IPO expenses (124,400) (196,472)

Operating loss 2 (668,900) (573,332)

Finance income and costs - -

Loss before tax (668,900) (573,332)

Taxation 5 - -

Loss for the year attributable to equity

holders (668,900) (573,332)

=========== ===========

Earnings per ordinary share

Basic and diluted loss per share attributable (GBP0.0099) (GBP0.0195)

to owners of the Parent Company 6

=========== ===========

Consolidated Statement of Comprehensive Income

31 December 31 December

2019 2018

GBP GBP

Loss for the year (668,900) (573,332)

Other Comprehensive income

Items that may subsequently be reclassified

to profit or loss:

* Exchange differences on translation of foreign

operations (1,461) -

Total comprehensive loss attributable

to equity holders of the Parent Company (670,361) (573,332)

=========== ===========

The accompanying notes are an integral

part of these financial statements.

Consolidated Statement of Financial Position

Notes

2019 2018

GBP GBP

Non-current assets

Intangible assets 8 612,242 -

Property, plant and equipment 9 3,428 -

Total non-current assets 615,670 -

----------- ---------

Current assets

Trade and other receivables 10 37,433 28,147

Cash and cash equivalents 11 7,675 328,135

----------- ---------

Total current assets 45,108 356,282

----------- ---------

Non-current liabilities

Deferred consideration 13 (350,066) -

----------- ---------

Current liabilities

Trade and other payables 12 (436,553) (27,248)

Deferred consideration 13 (215,486) -

Total current liabilities (652,039) (27,248)

----------- ---------

Net (liabilities)/assets (341,327) 329,034

=========== =========

Capital and reserves

Share capital 14 672,335 672,335

Share premium account 160,992 160,992

Share based payment reserve 69,038 69,038

Retained losses (1,242,231) (573,332)

Foreign currency reserve (1,461) -

----------- ---------

Total equity (341,327) 329,034

=========== =========

Company Statement of Financial Position

Notes

2019 2018

GBP GBP

Non-current assets

Investment in subsidiary 7 432,260 -

Property, plant and equipment 9 3,428 -

Total non-current assets 435,688 -

----------- ---------

Current assets

Trade and other receivables 10 241,518 28,147

Cash and cash equivalents 11 1,749 328,135

----------- ---------

Total current assets 243,267 356,282

----------- ---------

Non-current liabilities

Deferred consideration 13 (350,066) -

----------- ---------

Current liabilities

Trade and other payables 12 (422,560) (27,248)

Deferred consideration 13 (215,486) -

Total current liabilities (638,046) (27,248)

----------- ---------

Net (liabilities)/assets (309,157) 329,034

=========== =========

Capital and reserves

Share capital 14 672,335 672,335

Share premium account 160,992 160,992

Share based payment reserve 69,038 69,038

Retained losses (1,211,522) (573,332)

Equity shareholders' funds (309,157) 329,034

=========== =========

Consolidated Statement of Changes in Equity

Share Share Share based Retained Foreign Total

capital premium payment losses currency

reserve reserve

GBP GBP GBP GBP GBP GBP

------- -------- ----------- ----------- -------- ---------

Loss for the year - - - (573,332) - (573,332)

Translation differences - - - - - -

------- -------- ----------- ----------- -------- ---------

Comprehensive loss for the period - - - (573,332) - (573,332)

------- -------- ----------- ----------- -------- ---------

Shares issued at incorporation 1 - - - - 1

Shares and warrants issued 672,334 211,167 - - - 883,501

Cost of share issue - (50,175) - - - (50,175)

Share warrant charge - - 69,038 - - 69,038

------- -------- ----------- ----------- -------- ---------

At 31 December 2018 672,335 160,992 69,038 (573,332) - 329,034

------- -------- ----------- ----------- -------- ---------

Loss for the year - - - (668,900) - (668,900)

Translation differences - - - - (1,461) (1,461)

------- -------- ----------- ----------- -------- ---------

Comprehensive loss for the period - - - (668,900) (1,461) (670,361)

------- -------- ----------- ----------- -------- ---------

At 31 December 2019 672,335 160,992 69,038 (1,242,232) (1,461) (341,327)

------- -------- ----------- ----------- -------- ---------

Company Statement of Changes in Equity

Share Share Share based Retained Total

capital premium payment losses

reserve

GBP GBP GBP GBP GBP

Loss for the year - - - (573,332) (573,332)

Translation differences - - - - -

------- -------- ----------- ----------- ---------

Comprehensive loss for the period - - - (573,332) (573,332)

------- -------- ----------- ----------- ---------

Shares issued at incorporation 1 - - - 1

Shares and warrants issued 672,334 211,167 - - 883,501

Cost of share issue - (50,175) - - (50,175)

Share warrant charge - - 69,038 - 69,038

At 31 December 2018 672,335 160,992 69,038 (573,332) 329,034

------- -------- ----------- ----------- ---------

Loss for the year - - - (638,190) (638,190)

Translation differences - - - - -

------- -------- ----------- ----------- ---------

Comprehensive loss for the period - - - (638,190) (638,190)

------- -------- ----------- ----------- ---------

At 31 December 2019 672,335 160,992 69,038 (1,211,522) (309,157)

------- -------- ----------- ----------- ---------

Consolidated Cash Flow Statement

Notes 31 December 31 December

2019 2018

GBP GBP

Cash flows from operating activities

Operating loss (668,900) (573,332)

Shares issued in lieu of fees - 110,002

Depreciation 9 979 -

Foreign exchange 5,950 -

Increase in trade and other receivables 10 (9,286) (28,147)

Increase in trade and other payables 12 313,519 27,248

Share warrant charge - 69,038

Net cash used in operating activities (357,738) (395,191)

----------- -----------

Cash flows from investing activities

Payments for exploration and evaluation activities 8 (5,660) -

Payment for acquisition of subsidiary, net of cash acquired 17 11,645 -

Payments for tangible fixed assets 9 (4,407) -

Net cash used in investing activities 1,578 -

----------- -----------

Cash flows from financing activities

Proceeds from the issue of shares 35,700 773,501

Cost of shares issued - (50,175)

Net cash generated from financing activities 35,700 723,326

----------- -----------

Net (decrease)/increase in cash and cash equivalents (320,460) 328,135

Cash and cash equivalents at beginning of year 328,135 -

Cash and cash equivalents at end of year 11 7,675 328,135

=========== ===========

Company Cash Flow Statement

Notes 31 December 31 December

2019 2018

GBP GBP

Cash flows from operating activities

Operating loss (638,190) (573,332)

Shares issued in lieu of fees - 110,002

Depreciation 9 979 -

Increase in trade and other receivables 10 (4,958) (28,147)

Increase in trade and other payables 12 359,611 27,248

Share warrant charge - 69,038

Net cash used in operating activities (282,558) (395,191)

----------- -----------

Cash flows from investing activities

Payments for tangible fixed assets 9 (4,407) -

Investment in subsidiary 7 (535) -

Net cash used in investing activities (4,942) -

----------- -----------

Cash flows from financing activities

Proceeds from the issue of shares 35,700 773,501

Cost of shares issued - (50,175)

Loan to subsidiary company 10 (74,586)

Net cash (used in)/generated from financing activities (38,886) 723,326

----------- -----------

Net (decrease)/increase in cash and cash equivalents (326,386) 328,135

Cash and cash equivalents at beginning of year 328,135 -

Cash and cash equivalents at end of year 11 1,749 328,135

=========== ===========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR UVVRRRKUNRAR

(END) Dow Jones Newswires

June 05, 2020 07:05 ET (11:05 GMT)

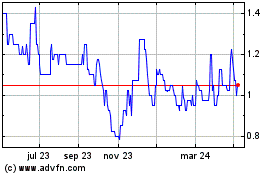

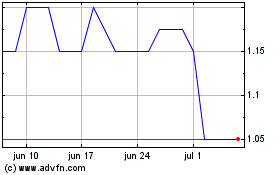

Cobra Resources (LSE:COBR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cobra Resources (LSE:COBR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024