TIDMPPC

RNS Number : 6858Q

President Energy PLC

22 June 2020

22 June 2020

PRESIDENT ENERGY PLC

("President" or the "Company")

Result of General Meeting

President Energy (AIM: PPC), the upstream oil and gas company

with a diverse portfolio of production and exploration assets

focused primarily South America, announces that the resolutions

proposed at its General Meeting held earlier today, and as set out

in the Circular sent to shareholders on 4 June 2020 ("the

Circular"), were all duly passed. Accordingly, the Subscription,

the Loan Conversion, the Placing and the Retail Offer will all

become unconditional on 23 June 2020 at the time that the

Subscription Shares, the Conversion Shares, the Placing Shares and

the Retail Offer Shares are admitted to trading on AIM.

The Company has also today announced its annual results for the

year ended 31 December 2019.

Accordingly, and further to the announcement made on 3 June 2020

and following the announcement of the Company's annual results, IYA

Global Limited ("IYA"), a company beneficially owned by Peter

Levine, has entered into an agreement to amend the existing

unsecured loan facility between IYA Global Limited and President

("IYA Loan Facility"). The agreement to amend the IYA Loan Facility

provides for a reduction in the conversion price (in respect of the

convertible part of the IYA Loan facility) from 4.65 pence per

share to 1.85 pence per share and provides for an increase in the

amount to be converted up to US$5,263,850.59. In addition, the

maturity date of the IYA Loan Facility has been extended until 31

December 2024 with the option on the part of the Company to repay

the facility in part or whole without penalty at any time prior to

that date. As part of the amendment agreement, IYA has agreed to

convert the full amount of the convertible part of the IYA Loan

Facility into 227,000,000 new Ordinary Shares ("Conversion Shares")

at 1.85 pence per share. It is intended that the Conversion Shares

will be issued to PLLG Investments Limited ("PLLG").

Following the conversion referred to above Peter Levine (through

his investment vehicle PLLG) will hold 601,453,462 Ordinary Shares

of the Company representing 29.95 per cent of the Company's

enlarged share capital.

In addition, as set out in the Circular, certain Directors and

other employees of the Company who intended to subscribe directly

with the Company for Placing Shares in the Placing at the Placing

Price have entered into subscription agreements in relation to a

total of 15,136,619 Placing Shares. (the "Directors' Subscription")

The participation of the relevant Directors is set out in the table

below:

Director Number of Placing Resultant shareholding % of Enlarged

Shares acquired post Placing Issued Share

Capital

Rob Shepherd 8,108,108 9,170,502 0.5

------------------ ----------------------- --------------

Jorge Dario Bongiovanni 3,547,296 3,704,475 0.2

------------------ ----------------------- --------------

The entry into the IYA Loan Facility, the issuance of the

Conversion Shares and the Directors' Subscriptions are related

party transactions for the purposes of Rule 13 of the AIM Rules for

Companies. Alexander Moody-Stuart, an independent director for

these purposes, confirms, having consulted with the Company's

Nominated Adviser, that the terms of the IYA Loan Facility, the

issuance of the Conversion Shares and the Directors' Subscriptions

are fair and reasonable insofar as the Company's shareholders are

concerned.

Application has been made for the Subscription Shares, the

Conversion Shares, the Placing Shares and the Retail Offer Shares

being a total of 741,642,271 new Ordinary Shares (together "the New

Shares") to be admitted to trading on AIM and dealings are expected

to commence on 23 June 2020 ("Admission").

The Subscription Shares and the Loan Conversion Shares (as

defined in the Circular) will be issued respectively to Trafigura

and to PLLG Investments Limited ("PLLG"). Following admission of

the Subscription Shares and the Loan Conversion Shares becoming

effective in accordance with Rule 6 of the AIM Rules, Trafigura and

PLLG will own respectively 334,743,721 and 601,453,462 ordinary

shares in the Company, representing 16.7% and 29.95 % of the

Company's enlarged issued share capital.

The New Shares will rank pari passu with the existing shares of

the Company. Following Admission, the Company's issued share

capital will consist of 2,007,914,603 Ordinary Shares. Accordingly,

the figure of 2,007,914,603 may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in the Company under the FCA's Disclosure Guidance and

Transparency Rules.

Unless the context requires otherwise, capitalised terms used in

this Announcement have the meaning set out in the announcement of

the Company of 3 June 2020.

S

President Energy PLC

Peter Levine, Chairman

Rob Shepherd, Group FD +44 (0) 207 016 7950

finnCap (Nominated Advisor)

Christopher Raggett, Charlie Beeson +44 (0) 207 220 0500

Shore Capital (Broker)

Jerry Keen, Antonio Bossi + 44 (0) 207 408 4090

Tavistock (Financial PR)

Nick Elwes, Simon Hudson +44 (0) 207 920 3150

Notes to Editors

President Energy is an oil and gas company listed on the AIM

market of the London Stock Exchange (PPC.L) primarily focused in

Argentina, with a diverse portfolio of operated onshore producing

and exploration assets.

The Company has operated interests in Puesto Flores, Estancia

Vieja, Puesto Prado, Angostura and Las Bases, Rio Negro Province

and in the Puesto Guardian Concession, in the Noroeste Basin in NW

Argentina. Alongside this, President Energy has cash generative

production assets in Louisiana, USA and further significant

exploration and development opportunities through its acreage in

Paraguay and Argentina.

The Group is also actively pursuing value accretive acquisitions

of high-quality production and development assets in Argentina

capable of delivering positive cash flows and shareholder returns.

With a strong institutional base of support, including the IFC,

part of the World Bank Group, an in-country management team as well

as a Board whose interests are aligned to those of its

shareholders, President Energy gives UK investors rare access to

the Argentinian growth story combined with world class standards of

corporate governance, environmental and social responsibility.

This announcement contains inside information for the purposes

of article 7 of Regulation 596/2014

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

1. Details of the person discharging managerial responsibilities/person

closely associated

a) Name: 1. Peter Levine

2. Rob Shepherd

3. Jorge Bongiovanni

4. Dr. Martin Gee

5. Scott Daspit

6. Jordan Coleman

-------------------------------- ------------------------------------------

2. Reason for the notification

----------------------------------------------------------------------------

a) Position/status: 1. PDMR - Chairman & Chief Executive

2. PDMR - Group Finance Director

3. PDMR - Non-Executive Director

4. PDMR - Head of Sub-Surface

5. PDMR - VP Operations USA

6. PDMR - Operations Manager

-------------------------------- ------------------------------------------

b) Initial notification/Amendment: Initial notification

-------------------------------- ------------------------------------------

3. Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor

----------------------------------------------------------------------------

a) Name: President Energy Plc

-------------------------------- ------------------------------------------

b) LEI: 213800MA2ZN22I4ITA79

-------------------------------- ------------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type

of transaction; (iii) each date; and (iv) each

place where transactions have been conducted

----------------------------------------------------------------------------

a) Description of the Ordinary shares of 1 penny per

financial instrument, share

type of instrument:

ISIN: GB00B3DDP128

Identification code:

-------------------------------- ------------------------------------------

b) Nature of the transaction: P urchase of Ordinary Shares

-------------------------------- ------------------------------------------

c) Price(s) and volume(s): Price(s) Volume(s)

1. Peter Levine 227,000,000

------------

2. Rob Shepherd 8,108,108

------------

3. Jorge Bongiovanni 3,547,296

------------

4. Dr. Martin

Gee 2,149,338

------------

5. Scott Daspit 646,865

------------

6. Jordan Coleman 323,432

------------

All at 1.85 pence per share

-------------------------------- ------------------------------------------

d) Aggregated information: as in 4 c) above

Aggregated volume:

Price:

-------------------------------- ------------------------------------------

e) Date of the transaction: 23 June 2020

-------------------------------- ------------------------------------------

f) Place of the transaction: AIM, London Stock Exchange (XLON)

-------------------------------- ------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ROMXLLFLBQLBBBE

(END) Dow Jones Newswires

June 22, 2020 09:07 ET (13:07 GMT)

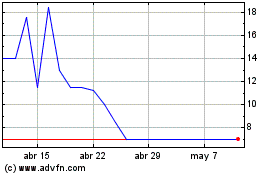

Molecular Energies (LSE:MEN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Molecular Energies (LSE:MEN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024