TIDMKGF

RNS Number : 2467R

Kingfisher PLC

26 June 2020

26 June 2020

KINGFISHER PLC

(the "Company")

Annual Report and Accounts 2019/20 and Notice of 2020 Annual

General Meeting

The Company's Annual Report and Accounts for the year ended 31

January 2020 (the 'Annual Report') and Notice of Annual General

Meeting to be held on 24 July 2020 have been published on the

Company's website www.kingfisher.com (together 'the Documents').

The Documents have also been posted or otherwise made available to

shareholders, depending on their elected method of

communication.

In accordance with Listing Rule 9.6.1 a copy of the Documents,

together with the Form of Proxy have also been submitted to the

National Storage Mechanism and will shortly be available for

inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

The final results for the year ended 31 January 2020, released

by the Company on 17 June 2020, include the information required

pursuant to Rules 4.1 and 6.3.5R of the UK Disclosure Guidance and

Transparency Rules, excepting publication of the responsibility

statement of the Directors in respect of the 2020 Annual Report, a

description of the principal risks and uncertainties facing the

Company, and the related party transactions carried out by the

Company and its subsidiaries during the year, which are detailed

below:

1. Principal risks

The principal risks and uncertainties facing the Company are set

out below.

1. LEVEL AND IMPACT OF CHANGE

As we continue to evolve our business, there are significant

programmes of work underway targeting improvements in our offer,

market positions and cost base. These programmes may not achieve

their objectives and have the potential to disrupt our business

if we fail to properly prioritise activity and manage change

effectively. Failure to realise programme targets and/or business

disruption could result in weaker than anticipated sales growth

and a failure to maintain operating margins or generate sufficient

cash to meet our objectives.

Link to strategic priorities

* 'Focus and fix' in 2020

* Move to a balanced, simpler local-group operating

model with an agile culture

* Grow e-commerce sales

* Build a mobile-first, service orientated customer

experience

* Differentiate and grow through own exclusive brands

(OEB)

* Test new store concepts and adapt our store footprint

* Source and buy better, reduce our costs and our

inventory

How our risks have changed

No change. Change has been a constant feature of our business

for some time and we have established processes in place to

manage, monitor and report the delivery of strategic activities

arising from these programmes.

How we manage and monitor the risk

* Central Transformation & Results Delivery Office

established with Group Executive-level leadership.

* Clearly prioritised strategic change taskforces

established with Group Executive ownership and

measurable outcomes.

* Monthly tracking against key milestones and reporting

to the Group Executive and the Board.

* Regular strategic updates to the Board.

* Retail banner Transformation Directors in place to

design and deliver change into the business.

* Periodic reviews of governance and enabling

activities undertaken by Internal Audit.

2. CONTAGIOUS DISEASES

A prolonged global health threat could adversely affect our

business by disrupting our and our partners operations, causing

a significant reduction in footfall and consumer spending and

by negatively impacting our ability to receive products from

affected countries. Also, high levels of absence in our workforce

could impact our ability to operate stores or provide appropriate

functional support to our business.

Such restrictions and/or reductions in demand could adversely

affect our financial condition and results of operations.

Link to strategic priorities

* 'Focus and fix' in 2020

* Responsible business

How our risks have changed

New risk.

How we manage and monitor the risk

We monitor the development of such events closely, convening

a Group-led Crisis Committee to bring together functional leaders

to determine the additional actions necessary to manage the

consequences of a situation and its impact on our people and

operations.

We started to convene the Group Crisis Committee in late January

to consider the impact of the Covid-19 outbreak. Since then,

the Committee has met frequently to monitor events and response

strategies closely. The Board provides regular oversight to

evaluate the impact of Covid-19 on Kingfisher, including impact

on long term viability and going concern.

The health and safety of our colleagues and customers has remained

our top priority, alongside supporting governments to limit

the spread of the virus. We have mobilised business continuity

and crisis teams in each of our markets with response measures

including:

* Implementing changes to our stores (the majority

initially closed for browsing, with a move to

contactless click and collect or home delivery models

and a limit on ranges to essential items. Almost all

of our stores are now open with strict hygiene and

social distancing measures enforced).

* Redeploying or furloughing selected Group colleagues.

* Moving office-based staff to a work from home basis.

* Significantly reducing discretionary spend, including

freezing of pay reviews and recruitment.

* Stopping all non-committed capital expenditure.

* Taking advantage of other working capital

optimisation measures, e.g. delays or holidays for

rates and taxes.

* Reprioritisation of sourcing requirements and

adjusting purchasing plans.

We will continue to adjust our response activities as publicly

available information evolves.

3. BUSINESS RESILIENCE

Technology is key to our business and the achievement of our

strategic objectives. We are increasingly reliant on resilient

and secure systems and networks to maintain our operations.

Similarly, we are dependent on complex supply chains and delivery

solutions to deliver our products to our customers. A significant

failure of our IT infrastructure or key systems could result

in the loss of data or an inability to operate efficiently,

with an adverse financial, regulatory or reputational impact.

A disruption to our supply chain could have a similar impact.

Link to strategic priorities

* Grow e-commerce sales

* Build a mobile-first, service orientated customer

experience

* Source and buy better, reduce our costs and our

inventory

How our risks have changed

No change. We recognise that complexity in our business and

supply chain inevitably results in a high level of risk. We

maintain a programme of continuous improvement to understand

and manage the evolving risk landscape.

How we manage and monitor the risk

IT infrastructure:

* A common IT infrastructure is in place across our

markets. We work closely with our suppliers to

maintain the stability of our environment.

* We operate from highly resilient data centres that

are tested regularly.

* We have tested and proven everything that is

essential/common to the 'infrastructure stack'. We

continue to learn and enhance both our solution and

our understanding.

* We have been operating core solutions with

volume/stress for some time and we continue to assess

the efficiency and capability of the

solution/infrastructure. Where appropriate we have

taken action to ensure we have an environment that is

fit for purpose.

* We deploy a robust suite of tools to identify and

manage internal and external threats to our

infrastructure, systems and platforms.

* Service continuity is embedded with our IT culture.

Supply chain:

* A new three-year Supply and Logistics roadmap will be

developed in 2020/21 which will consider our future

logistics capacity needs based upon the various

sourcing, inventory and sales generative strategies

identified in the Group's strategic planning

activities.

* A full review of our business continuity plans is

underway looking at our internal points of failure

and key partner disaster-recovery plans to ensure

that a response to supplier and logistics failures is

also built into the actions. Plans are being tested

live as part of our Covid-19 response activities.

* The Group Supply Chain function has established a

programme management office that governs all major

supply chain change programmes. This links into the

overall Group strategic governance framework.

* We identify key suppliers by category to establish

capacity and volumes and assess the impact of an

interruption in supply.

* See Principal Risk 7 for more detail about Brexit

planning.

4. COMPETITION

Intensifying competition, including online, may put downward

pressure on sales and margins and could have an adverse effect

on our revenues and profitability. We compete with many companies

in each of our markets. Targeted actions by competitors could

negatively impact our market share, the value of our assets

and our financial results.

Link to strategic priorities

* Build a mobile-first, service orientated customer

experience

* Differentiate and grow through own exclusive brands

(OEB)

* Source and buy better, reduce our costs and our

inventory

How our risks have changed

New risk.

How we manage and monitor the risk

We monitor our performance to react quickly to targeted actions

by competitors via:

* Enhanced rapid-insight key performance metrics.

* Reinforced performance reviews tracked by the Offer

and Sourcing board to respond to risks.

We are building a differentiated offer through:

* Customer trend monitoring in all our markets to

anticipate and develop an appropriate offer.

* A clearly defined set of range principles and

customer projects to create a compelling offer and to

reinforce differentiation of our offer to build sales

growth and margin improvement.

* Periodic review of the offer strategy and range

review roadmap to prioritise key programmes.

* Building strong programmes, deployed across the Group,

to benefit from volume and lower purchase price to be

able to compete on prices.

We are focusing on a strong customer journey, including:

* End-to-end project planning activities to ensure 'in

full, in time' delivery.

* Supplier management processes in place covering

selection, risk assessment, monitoring of supplier

responses and communication.

* Clear minimum standards for suppliers covering credit,

sustainability, quality and technical.

* Dual sourcing where needed to avoid disruption in the

event of supplier failure.

5. CHANGING CUSTOMER PREFERENCES

As customer preferences change, we must ensure we have innovative

digital channels supported by a strong and agile infrastructure,

including supply chain and logistics capability and an optimised

property portfolio, to make our product sufficiently compelling

to customers and available when and where they want it. Failure

to optimise our channels could affect our ability to stimulate

spend and deliver the desired sales growth. It could also adversely

impact the value of our assets and our financial results.

Link to strategic priorities

* Focus and fix' in 2020

* Grow e-commerce sales

* Build a mobile-first, service orientated customer

experience

* Test new store concepts and adapt our store footprint

How our risks have changed

Increasing. Failure to keep pace with changing customer preferences

is a key risk for us and an area we recognise is evolving rapidly.

We continue to enhance our priorities and processes to manage

and monitor the risk.

How we manage and monitor the risk

* During the year, we made eight new appointments to

the Group Executive, two of which were the roles of

Chief Customer and Digital Officer and Chief Supply

Chain Officer. We have also brought together the

Digital and IT teams to better align their

activities.

* A Group digital strategy has been developed, with

various digital priority programmes underway.

* We have an established regular Digital Governance

Forum to monitor financial and project portfolio

performance and to prioritise upcoming digital

initiatives.

* We have launched a number of strategic programmes

which include store concepts and service platforms,

offer and range, and our digital journey.

6. POLITICAL AND MARKET VOLATILITY

Geopolitical uncertainty and local volatility, including strikes

and work stoppages, exist across all the markets in which we

operate, exposing us to potential risks which may impact consumer

confidence, availability of our workforce or negatively impacting

our ability to receive products from affected countries potentially

disrupting the day-to-day operations of our business.

Link to strategic priorities

* Move to a balanced, simpler local-group operating

model with an agile culture

How our risks have changed

Increasing. We have seen an increased level of uncertainty

relating to the economy across our key markets, heightened

geopolitical tensions, disruption in some of our markets and

continued currency volatility.

How we manage and monitor the risk

Treasury mitigations

* The provision of supply chain finance programmes to

support suppliers. Additional information on these

arrangements can be found in note 21 of the

consolidated financial statements.

* Portfolio of international banking partners that

provide flexibility and reliable local retail cash

and card payment processing services.

* Access to funding, both debt funding, including an

up-to-date Debt Capital Markets programme, and

significant committed liquidity facilities.

* Diversification of cash holdings across a number of

financial institutions with the strongest short-term

credit rating.

* An appropriate and prudent mix of hedging policies,

cash deposits and debt financing to minimise the

impact of foreign exchange currency volatility on the

company.

* Offer and pricing strategies designed to address

consumer confidence.

Monitoring and engagement activities

* The Corporate Affairs team actively monitors the

political and economic situations in the countries in

which we operate or which may impact our operations.

* Strategies in place to identify, monitor and aim to

influence changes to legislation which may impact the

business.

* The Corporate Affairs team oversees direct policy and

political engagement with dedicated resource in the

UK, France, Belgium, Poland and Romania. This is

supported by local representatives in our retail

banners and our membership of key business trade

associations in every market.

* Crisis management processes and teams in place to

monitor and manage situations as they arise.

* Group Offer and Sourcing teams manage supplier

relationships with the aim of managing cost and

quality and maintaining appropriate levels of product

availability through periods of disruption.

7. BREXIT

Following completion of the UK exit agreement, significant

risks remain from the ongoing negotiation of the future trade

agreement with the European Union and possible divergence of

the UK regulatory framework. Failure to reach an adequate agreement

within the currently agreed transition period may impact our

purchase costs, the continuity of our supply chain and our

ability to operate our European businesses as we do today.

These conditions also present economic uncertainty impacting

UK consumer confidence.

Link to strategic priorities

* Move to a balanced, simpler local-group operating

model with an agile culture

How our risks have changed

No change. This risk has reduced since the conclusion of the

UK exit agreement at the end of January 2020 and avoidance

of the previous no-deal Brexit scenario. However, the risks

surrounding the ongoing trade negotiations remain significant.

How we manage and monitor the risk

* A multi-functional Kingfisher Brexit Steering Group

has been in place since the 2016 referendum. This

group is responsible for monitoring the Brexit

process and agreeing actions.

* We continue to engage directly with Government and

alongside key trade bodies.

* We continue to consider different Brexit scenarios,

preparing mitigation plans across key operational

areas, including:

* Import duties and related import costs and

mitigations through alternative sourcing

arrangements.

* Improvements to importation and customs clearance

processes to avoid delays at borders.

* Supply chain disruption risks and use of alternative

ports and distribution arrangements.

* Working closely with our suppliers to ensure they

have similarly made adequate preparation.

* Updating our product standards and documentation to

ensure products remain compliant for sale in both EU

and UK markets.

* Monitoring and updating our regulatory procedures

generally.

8. ATTRACTING, RETAINING AND INVESTING IN OUR PEOPLE CAPABILITY

Our colleagues are critical to the successful delivery of our

strategy and business. Failure to achieve an effective organisational

design, appropriate ways of working and the right balance of

skills, capability and capacity as well as adequate succession

plans, could impact our ability to meet our business objectives.

Link to strategic priorities

* 'Focus and fix' in 2020

* Move to a balanced, simpler local-group operating

model with an agile culture

* Lead the industry in Responsible Business practices

How our risks have changed

No change. We continue to monitor and manage this risk closely.

While the risk exposure is significant we have a clear understanding

of the scale of the change and have plans in place to manage

these.

How we manage and monitor the risk

* We have announced the appointment of a new Chief

People Officer to the Group Executive.

* Work has continued through the year to ensure our HR

processes, policies and guidelines are fit for

purpose and in line with our ambition with a focus on

recruitment, reward, talent and engagement.

* The Nomination Committee oversees the Board

composition and succession planning, and the

Remuneration Committee oversees the reward policy.

* We have ensured time allocated at Group Executive and

Board meetings to work on succession planning,

holding leaders accountable for developing their own

successors.

* We have continued to invest in leadership and talent

programmes to strengthen succession pipelines and

drive change. These include development activities

for our store-based colleagues and how we support and

recognise the role of our customer advisors across

the organisation.

* Delivery of Home Improvement and Range Academies to

build capability and inform colleagues of new ways of

working and product ranges.

* Engagement processes are in place to enable us to

check across all our colleagues our ability to drive

the changes we need whilst being able to respond to

insights which may impact on our duty of care as an

employer.

9. LEGAL AND REGULATORY

The Group's operations are subject to an increasing range of

regulatory requirements in the markets in which it operates.

A major corporate issue or crisis, a significant fraud or material

non-compliance with legislative or regulatory requirements

would impact our brand and reputation, could expose us to significant

fines or penalties and would require significant management

attention.

Link to strategic priorities

* Source and buy better, reduce our costs and our

inventory

* Lead the industry in Responsible Business practices

How our risks have changed

Increasing. Regulatory requirements are increasing in many

areas and therefore we see this as an area of increasing risk.

How we manage and monitor the risk

* Employees and suppliers working for or with

Kingfisher must conduct themselves according to our

minimum standards of ethics and behaviours as defined

by our Code of Conduct.

* Group-wide mandatory training on Code of Conduct

(which includes a module on anti-bribery and

corruption) was rolled out in 2019 and will be

continued in 2020.

* Responsibility for compliance with our Code of

Conduct rests with each retail banner Chief Executive

Officer.

* Appropriate resources are available to our retail

banners to ensure that both colleagues and suppliers

are aware of, and comply with, the Code of Conduct.

* Legal teams at Group-level and in each of our retail

banners work and communicate together to form a legal

and compliance network.

* Communications teams at Kingfisher and each of our

retail banners work together to form a communications

network.

* A Crisis Communications team is in place to manage

major incidents.

* Policies and procedures are in place to support the

health and safety, environmental, ethical, fraud,

data protection, crisis management, legislative and

regulatory areas. Health & safety data is reported

quarterly to the Board.

* Modern Slavery Steering and Working Groups oversee an

action plan to address risks of modern slavery and

our annual transparency statement, which is published

in line with legal requirements.

* Data Protection training is in place for all

colleagues and a Fair Competition training module is

available to key individuals in high--risk areas.

* Anti-bribery training is in place and all key

individuals must complete this training.

* A whistleblowing hotline, facilitated by an

independent third party, is in place throughout the

Group. All calls are followed up and investigated

where necessary. Statistics and trends are monitored

at the local Audit Committee level and reported

regularly to the Board.

* A risk-based third-party due diligence process is in

place to assess and mitigate risks such as bribery

and corruption, personal data processing and modern

slavery.

* A Group policy and training is in place for

appropriate colleagues to make them aware of their

obligations under the Market Abuse Regulation.

10. CYBER AND DATA SECURITY

The risk of a sustained cyber-attack has increased in the retail

sector. Failure to meet our legal and regulatory obligations

in respect of data privacy and security could result in financial

penalties and adverse reputational damage, as well as impacting

our ability to maintain efficient operations.

Link to strategic priorities

* Grow e-commerce sales

* Build a mobile-first, service orientated customer

experience

* Lead the industry in Responsible Business practices

How our risks have changed

Increasing. In line with other organisations we continue to

see an increase in the frequency and sophistication of cyber-attacks

and security incidents which require us to remain vigilant

in this area. The risk is extending beyond traditional IT environments

into business processing and supply chain increasing the risk

landscape.

How we manage and monitor the risk

Cyber security

* Cyber security continues to receive Group

Executive-level sponsorship and Board focus.

* Dedicated IT Governance boards are established to

monitor this evolving risk and the associated

mitigating controls.

* As part of our IT planning processes, we have

established a roadmap which covers security,

governance and identity initiatives to continue to

mature the tools and capabilities we have available

to us.

* Independent reviews are performed of our cyber

security processes and initiatives on an annual

basis.

* We regularly review the cyber threats facing

Kingfisher and have been working with partners and

security specialists to implement tools and processes

to better identify and remediate vulnerabilities.

Data protection

* A data protection organisational structure has been

deployed within the Group.

* We have data protection and management policies in

place.

* Data protection has been enhanced in light of GDPR

including:

* Data privacy impact assessments.

* Assessments for new and existing suppliers.

* Annual e-learning awareness training for all

colleagues.

* Checkpoints within IT developments to ensure

compliant design and delivery.

11. REPUTATION AND TRUST

Our customers, colleagues, suppliers and the communities in

which we operate expect us to conduct our business in a way

that is responsible. Our Code of Conduct establishes the behaviours

we expect of ourselves and others and we have publicly communicated

ambitious Responsible Business targets. Failure to deliver

on our obligations and commitments could undermine trust in

Kingfisher, damage our reputation and impact our ability to

meet our strategic objectives.

Link to strategic priorities

* 'Focus and fix' in 2020

* Lead the industry in Responsible Business practices

How our risks have changed

New risk.

How we manage and monitor the risk

Governance

* Our Code of Conduct establishes the core behaviours

we expect of ourselves and others and we have

publicly communicated ambitious Responsible Business

principles and measures. See principal risk 9 for

more detail.

* A new Responsible Business Committee of the Board has

been established (see the Responsible Business

section on pages 22 to 25).

* Our annual reward measures help to ensure that

Environment, Social and Governance (ESG) issues and

stakeholder concerns are further prioritised.

* Issues Tracking and Stakeholder Dialogue

* Monitoring of external stakeholders' views of our

company through traditional and digital media for all

our companies.

* Regular stakeholder engagement and employee

engagement means that listening and responding to

stakeholder concerns is fully entrenched within the

corporate strategy.

* For colleagues, this ranges from established Employee

Forums and Works' Councils in all of our businesses

including a collective forum that meets with the CEO

and members of the Board, including the Chairman.

* Externally we have regular engagement with NGO

partners in our key markets, including Shelter, Forum

for the Future, Green Alliance, and the Centre for

European Reform, which helps to ensure that the

company remains close to social and environmental

concerns. (Read more about company stakeholder

engagement on pages 18 to 19 and Board stakeholder

engagement on pages 56 to 57).

Due Diligence and External Assurance

* Our Annual Report covers how we manage our business

in the interests of all stakeholders in line with

section 172 of the Companies Act while our annual

Responsible Business report covers our approach and

performance on ESG issues in greater depth.

* Our due diligence of suppliers covers a range of ESG

issues, from environment to modern slavery; and

includes our policy framework and supplier standards

which we expect suppliers to adhere to; supplier

training and capacity building; and auditing of

high-risk suppliers.

* Our due diligence extends to the data we disclose.

Selected ESG data in the annual Responsible Business

report and Modern Slavery Statement is independently

audited by DNV GL.

* Independent ratings agencies also monitor and rate

our ESG performance throughout the year - including

MSCI, CDP, Sustainalytics and ISS ESG.

* Communications and Issues Management

* Kingfisher and its companies have a network of

communications teams, who undertake comprehensive

communications planning for key developments and

issues. We work with a network of external reputation

advisers in all our key markets.

* Kingfisher plc maintains a Crisis Management

Framework and Business Continuity Plans for all the

Group. This includes a Crisis Communications Plan and

core central team made up of the Internal Audit and

Risk Director; Director of Enterprise Risk; Corporate

Affairs Director; and Head of Media Relations.

12. ACQUISITIONS AND DISPOALS

As part of the optimisation of our business activities we may

from time to time divest activities or acquire new businesses.

Divestments or acquisitions are based on detailed plans that

assess the value creation opportunity for the company. These

plans are inherently uncertain and provide execution and market

risks which might have been overlooked or incorrectly forecasted.

If an existing, or future, divestment or acquisition effort

is delayed or is not successful, we may incur additional costs

and the value of our asset may decrease significantly and have

an adverse effect on our revenues and profitability.

Link to strategic priorities

* Focus and fix' in 2020

* Move to a balanced, simpler local-group operating

model with an agile culture

How our risks have changed

New risk.

How we manage and monitor the risk

* We have created a Group Investment Committee (GIC)

and strengthened review and approval activities of

potential acquisition and disposal activity through

the Finance Committee.

* The Group delegation of authority requires Kingfisher

plc Board scrutiny and approval of all mergers and

acquisitions (M&A) activity exceeding GBP10 million

in value and CEO approval for all activity below

GBP10 million.

* Our long-term business plan process regularly

assesses the business strategy and performance of

each entity within the portfolio against strategic

KPIs.

* The Group Executive conducts periodic deep dives on

portfolio performance.

* The Audit Committee receives a rolling review of

business unit risks and operations throughout the

year.

* We have a dedicated M&A function with appropriately

skilled experts and use of approved external

advisors. Clear accountability for M&A process rests

with the Chief Transformation and Development

Officer.

* We have a structured M&A project management approach

including a transaction playbook and project

governance that ensures all relevant functional

experts are consulted in the M&A process.

2. Details of related party transactions

During the year, the Company and its subsidiaries carried out a

number of transactions with related parties in the normal course of

business and on an arm's length basis. The names of the related

parties, the nature of these transactions and their total value are

shown below:

2019/20 2018/19

GBPmillions Income Receivable Income Receivable

------- ----------- ------- -----------

Transactions with Koçtas

Yapi Marketleri Ticaret

A.S. in which the Group

holds a 50% interest

Commission and other income 0.3 - 0.4 -

------- ----------- ------- -----------

Transactions with Crealfi

S.A. in which the Group

holds a 49% interest

Provision of employee services

Commission and other income 0.1 - 0.6 -

4.9 0.2 5.7 0.3

------- ----------- ------- -----------

Transactions with Kingfisher

Pension Scheme

Provision of administrative

services 1.0 0.2 1.5 -

------- ----------- ------- -----------

Services are usually negotiated with related parties on a

cost-plus basis. Goods are sold or bought on the basis of the price

lists in force with non-related parties.

The remuneration of key management personnel is given in note

8.

Other transactions with the Kingfisher Pension Scheme are

detailed in note 27.

3. Directors' Statement of Responsibility

The Directors confirm that to the best of their knowledge:

-- the financial statements, prepared in accordance with the

relevant financial reporting framework, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the parent company and the undertakings included in the

consolidation taken as a whole;

-- the Strategic report includes a fair review of the

development and performance of the business and the position of the

company and the undertakings included in the consolidation taken as

a whole, together with a description of the principal risks and

uncertainties they face; and

-- the Annual Report and financial statements, taken as a whole,

are fair, balanced and understandable and provide the information

necessary for shareholders to assess the company's position and

performance, business model and strategy.

Paul Moore, Group Company Secretary

Tel: +44 (0)207 644 1041

Kingfisher plc

3 Sheldon Square, London W2 6PX

- Ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACSSEMFSMESSEDM

(END) Dow Jones Newswires

June 26, 2020 06:40 ET (10:40 GMT)

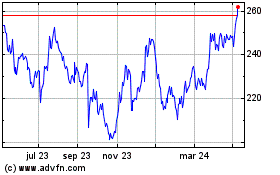

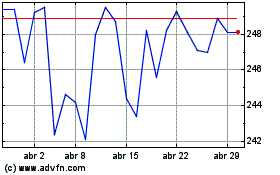

Kingfisher (LSE:KGF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Kingfisher (LSE:KGF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024