UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER

PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month of

September, 2020

Commission File

Number 001-15106

PETRÓLEO

BRASILEIRO S.A. - PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation - PETROBRAS

(Translation of Registrant's

name into English)

Avenida República

do Chile, 65

20031-912 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

PETROBRAS ANNOUNCES EXPIRATION AND

EXPIRATION

DATE RESULTS OF ITS CASH TENDER OFFERS

RIO DE JANEIRO, BRAZIL – September 16, 2020 –

Petróleo Brasileiro S.A. – Petrobras (“Petrobras”) (NYSE: PBR) today announced the expiration

and expiration date results of the previously announced offers to purchase for cash by its wholly-owned subsidiary Petrobras Global

Finance B.V. (“PGF”) of any and all of its outstanding notes of the series set forth in the table below (the

“Notes” and such offers, the “Offers”).

The Offers were made pursuant to the terms and conditions

set forth in the offer to purchase dated September 10, 2020 (the “Offer to Purchase” and, together with the

accompanying notice of guaranteed delivery, the “Offer Documents”).

The Offers expired at 5:00 p.m., New York City time, on September

16, 2020 (the “Expiration Date”). The settlement date with respect to the Offers will occur on September 21,

2020 (the “Settlement Date”).

The table below sets forth the aggregate principal amount

of Notes validly tendered in the Offers and not validly withdrawn, and the aggregate principal amount of Notes reflected in notices

of guaranteed delivery delivered, at or prior to the Expiration Date, the consideration payable for Notes accepted for purchase

in the Offers and the acceptance priority level (the “Acceptance Priority Level”) in connection with the Maximum

Consideration Condition described in the Offer to Purchase:

|

Title

of Security

|

CUSIP/ISIN

|

Acceptance

Priority Level

|

Principal

Amount Outstanding(1)

|

Consideration(2)

|

Principal

Amount Tendered by the Expiration Date

|

Principal

Amount Reflected in Notices of Guaranteed Delivery

|

Principal

Amount Expected to be Accepted

|

6.125% Global Notes

Due January 2022

|

71647N AR0 /

US71647NAR08

|

1

|

US$618,790,000

|

US$1,071.50

|

US$396,183,000

|

US$26,000

|

US$396,209,000

|

5.875% Global Notes

Due March 2022

|

– / XS0716979595

|

2

|

€348,642,000

|

€1,090.00

|

€194,470,000

|

-

|

€194,470,000

|

4.375% Global Notes

Due May 2023

|

71647N AF6 /

US71647NAF69

|

3

|

US$1,405,620,000

|

US$1,068.50

|

US$316,212,000

|

US$2,191,000

|

US$318,403,000

|

4.250% Global Notes

Due October 2023

|

– / XS0835890350

|

4

|

€371,256,000

|

€1,094.00

|

€37,673,000

|

-

|

€37,673,000

|

6.250% Global Notes

Due March 2024

|

71647NAM1 /

US71647NAM11

|

5

|

US$1,585,773,000

|

US$1,133.50

|

US$615,053,000

|

US$199,000

|

US$615,252,000

|

4.750% Global Notes

Due January 2025

|

– / XS0982711714

|

6

|

€639,649,000

|

€1,126.25

|

€98,678,000

|

-

|

€98,678,000

|

5.299% Global Notes

Due January 2025

|

71647N AT6, 71647N AV1,

N6945A AJ6 / US71647NAT63,

US71647NAV10, USN6945AAJ62

|

7

|

US$2,117,334,000

|

US$1,115.00

|

US$888,775,000

|

US$912,000

|

US$889,687,000

|

8.750% Global Notes

Due May 2026

|

71647N AQ2 /

US71647NAQ25

|

8

|

US$2,042,471,000

|

US$1,290.50

|

US$522,871,000

|

US$1,460,000

|

US$524,331,000

|

6.250% Global Notes

Due December 2026

|

– / XS0718502007

|

9

|

£615,182,000

|

£1,125.50

|

£32,643,000

|

-

|

£32,643,000

|

7.375% Global Notes

Due January 2027

|

71647N AS8 /

US71647NAS80

|

10

|

US$2,267,504,000

|

US$1,216.00

|

US$373,156,000

|

US$7,484,000

|

-

|

5.999% Global Notes

Due January 2028

|

71647NAW9, N6945AAK3,

71647NAY5 / US71647NAW92,

USN6945AAK36, US71647NAY58

|

11

|

US$2,767,898,000

|

US$1,140.00

|

US$416,635,000

|

US$1,766,000

|

-

|

5.750% Global Notes

Due February 2029

|

71647N AZ2 /

US71647NAZ24

|

12

|

US$1,588,527,000

|

US$1,137.50

|

US$259,065,000

|

-

|

US$259,065,000

|

5.375% Global Notes

Due October 2029

|

– / XS0835891838

|

13

|

£390,878,000

|

£1,073.00

|

£34,280,000

|

-

|

£34,280,000

|

6.625% Global Notes

Due January 2034

|

– / XS0982711474

|

14

|

£460,316,000

|

£1,105.00

|

£18,570,000

|

-

|

£18,570,000

|

6.875% Global Notes

Due January 2040

|

71645WAQ4 /

US71645WAQ42

|

15

|

US$1,093,129,000

|

US$1,156.25

|

US$91,795,000

|

US$9,000

|

-

|

6.750% Global Notes

Due January 2041

|

71645W AS0 /

US71645WAS08

|

16

|

US$1,058,788,000

|

US$1,145.00

|

US$149,982,000

|

US$8,000

|

-

|

5.625% Global Notes

Due May 2043

|

71647N AA7 /

US71647NAA72

|

17

|

US$618,064,000

|

US$1,062.50

|

US$74,229,000

|

US$15,000

|

-

|

7.250% Global Notes

Due March 2044

|

71647N AK5 /

US71647NAK54

|

18

|

US$1,647,605,000

|

US$1,201.75

|

US$50,268,000

|

US$2,329,000

|

-

|

6.900% Global Notes

Due March 2049

|

71647N BD0 /

US71647NBD03

|

19

|

US$2,250,000,000

|

US$1,167.00

|

US$159,347,000

|

US$13,614,000

|

-

|

|

|

__________________________________________

|

|

|

|

(1)

|

Including Notes held by Petrobras or its affiliates.

|

|

|

(2)

|

Per US$1,000, €1,000 or £1,000, as applicable, principal amount of Notes. Holders whose

Notes are accepted for purchase will be paid accrued and unpaid interest on such Notes from, and including, the last interest payment

date for the Notes to, but not including, the Settlement Date.

|

In order to be eligible to participate in the Offers, holders

of Notes reflected in notices of guaranteed delivery received by PGF prior to the Expiration Date must deliver such Notes to PGF

by 5:00 p.m., New York City time, on September 18, 2020 (the “Guaranteed Delivery Date”).

On the terms and subject to the conditions set forth in the

Offer to Purchase, because the purchase of all Notes validly tendered in the Offers would cause PGF to purchase an aggregate principal

amount of Notes that would result in an aggregate amount to be paid by PGF in excess of the Maximum Consideration described in

the Offer to Purchase, PGF expects that it will accept for purchase all of the Notes validly tendered, including Notes for which

PGF received notices of guaranteed delivery and that are delivered on or prior to the Guaranteed Delivery Date, in Acceptance Priority

Levels 1 through 9, 12, 13 and 14 (the “Covered Notes”). PGF expects to reject tenders of Notes, including Notes

for which PGF received notices of guaranteed delivery, in Acceptance Priority Levels 10, 11 and 15 through 19 (the “Non-Covered

Notes”). Non-Covered Notes will be returned or credited without expense to the holders’ accounts promptly after

the Expiration Date. The principal amount of Covered Notes that will be purchased by PGF on the Settlement Date is subject to change

based on deliveries of Covered Notes pursuant to the guaranteed delivery procedures described in the Offer to Purchase. A press

release announcing the final results of the Offers is expected to be issued on or promptly after the Settlement Date.

The total cash payment to purchase on the Settlement Date the

Covered Notes, excluding accrued and unpaid interest, will be approximately US$3,978 million based on the Pounds Sterling to U.S.

dollar exchange rate of US$1.2975 per Pound Sterling, and the Euro to U.S. dollar exchange rate of US$1.1828 per Euro, in each

case calculated as of 2:00 p.m., New York City time on the Expiration Date, as reported on Bloomberg screen page “FXIP”

under the heading “FX Rate vs. USD.”

# # #

PGF engaged BB Securities Limited, Citigroup Global Markets

Inc., Credit Suisse Securities (USA) LLC, Goldman Sachs & Co. LLC, Mizuho Securities USA LLC and MUFG Securities Americas Inc.

to act as dealer managers with respect to the Offers (the “Dealer Managers”). Global Bondholder Services Corporation

acted as the depositary and information agent (the “Depositary”) for the Offers.

Any questions or requests for assistance regarding the Offers

may be directed to BB Securities Limited at +44 (207) 367-5800, Citigroup Global Markets Inc. at +1 (212) 723-6106, Credit Suisse

Securities (USA) LLC at +1 (800) 820-1653, Goldman Sachs & Co. LLC at +1 (212) 902-6351 or +1 (800) 828-3182 (toll-free),

Mizuho Securities USA LLC at +1 (212) 205-7736 or +1 (866) 271-7403 (toll free) and MUFG Securities Americas Inc.at +1 (212) 405-7481

or +1 (877) 744-4532 (toll free). Requests for additional copies of the Offer Documents may be directed to Global Bondholder Services

Corporation at +1 (866) 470-3800 (toll-free) or +1 (212) 430-3774. The Offer Documents can be accessed at the following link:

http://www.gbsc-usa.com/Petrobras/.

This announcement is for informational purposes only. This

announcement is not an offer to purchase or a solicitation of an offer to sell any securities. The Offers were made solely pursuant

to the Offer Documents.

Documents related to the Offers have not been filed with,

and have not been approved or reviewed by any federal or state securities commission or regulatory authority of any country. No

authority has passed upon the accuracy or adequacy of the Offer Documents or any other documents related to the Offers, and it

is unlawful and may be a criminal offense to make any representation to the contrary.

The communication of this press release and any other

documents or materials relating to the Offers is not being made and such documents and/or materials have not been approved by an

authorized person for the purposes of Section 21 of the Financial Services and Markets Act 2000. This press release and any other

documents related to the Offers are for distribution only to persons who (i) have professional experience in matters relating to

investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”),

(ii) are persons falling within Article 49(2)(a) to (d) (“high net worth companies, unincorporated associations, etc.”)

of the Order, (iii) are outside the United Kingdom, (iv) are members or creditors of certain bodies corporate as defined by or

within Article 43(2) of the Order, or (v) are persons to whom an invitation or inducement to engage in investment activity (within

the meaning of section 21 of the Financial Services and Markets Act 2000) in connection with the issue or sale of any securities

may otherwise lawfully be communicated or caused to be communicated (all such persons together being referred to as “relevant

persons”). This press release and any other documents related to the Offers are directed only at relevant persons and must

not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this process

release and any other documents related to the Offer are available only to relevant persons and will be engaged in only with relevant

persons.

Forward-Looking Statements

This press release contains forward-looking statements. Forward-looking

statements are information of a non-historical nature or which relate to future events and are subject to risks and uncertainties.

No assurance can be given that the transactions described herein will be consummated or as to the ultimate terms of any such transactions.

Petrobras undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information

or future events or for any other reason.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

PETRÓLEO BRASILEIRO S.A--PETROBRAS

|

|

|

|

|

|

|

By:

|

/s/ Guilherme Rajime Takahashi Saraiva

|

|

|

|

Name: Guilherme Rajime Takahashi Saraiva

|

|

|

|

Title: Attorney in Fact

|

|

|

By:

|

/s/ Lucas Tavares de Mello

|

|

|

|

Name: Lucas Tavares de Mello

|

|

|

|

|

Title: Attorney in Fact

|

Date: September 17, 2020

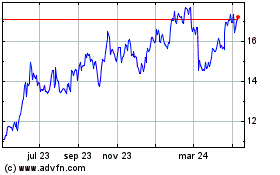

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

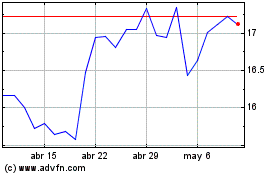

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024