TIDMTRT

RNS Number : 5447C

Transense Technologies PLC

20 October 2020

20 October 2020

Transense Technologies plc

("Transense", or "the Company")

Final results for the year ended 30 June 2020

Transense Technologies plc (AIM: TRT), the provider of

specialist sensor systems, reports final results for the year ended

30 June 2020 and sets out strategic plans for future growth:

Commercial Highlights

-- Transense complete licence agreement with Bridgestone Corporation for iTrack IP

-- iTrack operating business transferred to Bridgestone and

royalty income to commence in July 2020

-- Breakthrough deal - reduces risk profile by moving Transense

towards financial self-sufficiency

-- US Army & GE Aviation Improved Turbine Engine Program

("ITEP"); three critical design reviews completed on schedule, with

first engine to test due in third quarter 2021

-- New TLGX Series of tyre inspection tools launched

-- New leadership and management focus in both SAW and Translogik

Financial Highlights

-- Transfer of iTrack operating business and assets to

Bridgestone realises net cash of GBP1.04m (after repayment of

loans, but before costs). Transaction eliminates future net trading

losses on discontinued activities, which amounted to GBP1.45m in

year ended 30 June 2020

-- Revenues from continuing operations in line with prior year at GBP0.60m (2019: GBP0.60m)

-- EBITDA loss from continuing operations reduced to GBP0.68m (2019: GBP0.70m)

-- Net loss after taxation from continuing operations of GBP1.09m (2019: GBP0.84m)

-- Net loss after taxation for the year of GBP2.54m (2019: GBP1.47m)

-- Cash and cash equivalents at year end of GBP1.19m (2019: GBP2.65m)

Post period end highlights

-- iTrack royalty, SAW and Translogik probe all showing signs of growth

-- Breakeven in unaudited Q1 FY21 profit before tax v GBP0.60m

loss in Q1 FY20, future profitability now visible

-- Formed Commercial Advisory Panel for SAW to provide sector insights

-- P roposals to change capital structure at AGM to facilitate future distributions

Executive Chairman of Transense, Nigel Rogers, said:

"It has been an exciting year for Transense. The licensing of

existing and future iTrack technology to ATMS Technology Limited, a

subsidiary of Bridgestone Corporation Japan, was completed towards

the end of the year and will achieve a transformation of the

Company's future prospects. This transaction should put Transense

in the unprecedented position of being financially self-sufficient

and in turn enable management to increase their focus on the

commercialisation of our Surface Acoustic Wave technology, and

development of our tyre probe business, Translogik.

We believe that our technical leadership offers an exceptional

approach to problem solving for customers seeking improved

performance, efficiency and safety. Our challenge now is to

generate additional enquiries in order to derive the full benefit

of these core strengths.

Trading in the first quarter of the current financial year was

in line with expectations and reflects the substantial reduction in

overheads. The unaudited pre-tax result in Q1 FY 21 shows the

business trading around break-even level compared to a loss of

GBP0.6m incurred in Q1 FY 20.

Early indications are that royalty income on iTrack deployment

during the current financial year has significant growth potential,

although caution is clearly applicable in view of the global risks

associated with the broader economic and practical effects of the

Covid-19 pandemic.

Meanwhile, with a fresh management grip on the commercial

development of SAW, and a range of new products for Translogik we

look forward with enhanced confidence."

For further information please visit www.transense.com or

contact:

Transense Technologies plc Tel: +44 (0) 1869 238380

Nigel Rogers (Executive Chairman)

Melvyn Segal (CFO)

Allenby Capital (Nomad and Broker) Tel: +44 (0)20 3328

Jeremy Porter/James Reeve (Corporate Finance) 5656

Tony Quirke (Equity Sales)

About Transense

Based in Oxfordshire, UK, Transense has developed

patent-protected sensor systems and supporting technology for use

in a variety of diverse high growth markets. The directors believe

that Transense's Surface Acoustic Wave (SAW), wireless,

battery-less, sensor systems offer significant advantages over

legacy wireless sensor systems. Transense is targeting the torque,

temperature and pressure sensing markets with its SAW technology.

Translogik offers a range of tyre testing equipment aimed at fleet

managers and tyre service providers.

Transense's shares are admitted to trading on AIM, a market

operated by the London Stock Exchange (AIM: "TRT").

www.transense.com

The information communicated in this announcement is inside

information for the purposes of Article 7 of Regulation

596/2014.

Chairman's statement

I am very pleased to report the final results of the Company for

the year ended 30 June 2020, following my appointment as Chairman

in February 2020, and subsequently as Executive Chairman in June

2020.

It has been an exciting year for Transense. The completion of

the licensing of existing and future iTrack technology to ATMS

Technology Limited ("ATMS"), a subsidiary of Bridgestone

Corporation, Japan ("Bridgestone") towards the end of the year

marked the delivery of a transformation in the Company's prospects.

This will put Transense in the unprecedented position of being

financially self-sufficient and will in turn facilitate increased

management focus on the commercialisation of our Surface Acoustic

Wave ("SAW") technology, and development of our tyre probe

business, Translogik.

We are determined to take this opportunity to deliver further

commercial success with SAW. We fully recognise the trend towards

more highly automated machinery and robotics and the continuous

need to improve the efficiency, diagnostics and control of

equipment and vehicles and by doing so achieving global targets for

emissions reduction.

We believe that our patented SAW sensor technology can help our

customers to achieve these goals, through the accurate non-contact

measurement of torque and other key parameters in their products

and systems that has been rigorously tested in the most demanding

of environments and applications.

Strategy

The business strategy of the Group continues to be the

development of innovative sensing solutions across a range of

applications, which are commercialised either through the launch of

products and services to customers or by forming strategic

alliances with partner organisations. Value is realised through a

combination of commercial income, royalties, licensing income and

capital gains on disposals .

In recent years, the Company has devoted significant time and

financial resources into the development of the iTrack system, a

comprehensive tyre monitoring system used by mine operators to help

optimise operations for increased productivity and profitability.

In August 2019, the Company entered into a Joint Collaboration

Agreement with Bridgestone, to offer the iTrack system exclusively

to its global customer base.

The success of this arrangement led in June 2020 to Transense

granting a ten year worldwide exclusive licence over current and

future iTrack technology to ATMS, a subsidiary of Bridgestone, in

exchange for a royalty payment based on the number and

classification of vehicles with iTrack fitted. At the end of the

ten year period, ATMS will have an option to purchase the iTrack

technology for a nominal sum. The operating business and net

trading assets relating to iTrack were also transferred to ATMS for

a gross consideration of US$3.26m facilitating the repayment of all

Bridgestone's loans of $1.95m. At the year end outstanding

consideration of $1.62m was due and loans of $1.2m were still

outstanding. Both of these were settled in full by the end of

September. The initial royalty receivable from ATMS in respect of

vehicles using the iTrack system at completion was at a run rate of

approximately GBP0.60m per annum.

Under these arrangements, the Company will continue to derive a

significant and growing royalty income stream from the vastly

enhanced commercial opportunities and resources contributed by

Bridgestone/ATMS. Furthermore, our partnership eliminates the

investment risk that would have been associated with continuing to

build the sales & marketing, customer service and product

development infrastructure that would have been required as an

independent participant in a large and geographically diverse

global market.

Consequently, we go forward with a significantly lower strategic

risk profile from which to explore opportunities for our continuing

technology interests, both in SAW and in Translogik tyre monitoring

equipment.

SAW technology

Revenues from SAW technology (including grant income) were

steady at GBP0.21m (2019: GBP0.21m), and this segment generated a

trading loss of GBP0.58m (2019: GBP0.28m), which included increased

amortisation and one-off impairment charges relating to intangible

patent assets.

T ransense aims to be the world's first choice provider of SAW

sensor solutions. We will achieve this by continuing to identify

innovative methods to apply our patented technology, and by the

subsequent transfer of know-how to major corporate partners in

carefully selected target industry sectors. We seek to strengthen

the presence of our technology in a broader range of applications

by actively marketing the provision of technical, engineering

consultancy and proto-typing services. Our goal is to commercialise

at scale by establishing licensees, joint ventures or other

strategic alliances with the support of a secure supply chain.

The credentials of our SAW technology have been validated by its

selection after rigorous testing by GE Aviation for use in the GE

T901 Improved Turbine Engine Program ("ITEP"), under which the US

Army will re-engine its Boeing AH-64 Apaches and Sikorsky UH-60

Black Hawk helicopters. Over a period of years, the US Army intends

to replace more than 6,000 engines installed in their current fleet

of these two aircraft. The wider market for the T901 engine

includes replacement engines for these aircraft in military forces

outside of the US, as well as other military and commercial medium

sized vertical take-off aircraft globally. During 2020, the ITEP

successfully completed each of three Critical Design Review events

and is on schedule to execute the First Engine To Test assembly of

all subcomponents in the second half of calendar year 2021. We have

continued to work in close co-operation with GE's specified first

tier system supply partners to support these activities.

Our sensors are also installed on drive input shafts supplied to

the NTT IndyCar series by McLaren, to provide encrypted torque data

used to regulate the power rating permitted to individual race

teams. There are further opportunities to expand the use of this

technique into alternative race formats.

There is now a clear focus on the need to expand the commercial

reach of this technology. Towards the end of the financial year

Nick Hopkins was appointed to lead our SAW team as Managing

Director, reporting to the Board. Nick has previously worked with

Anthony and Bryan Lonsdale who were instrumental in developing the

SAW applications used by Transense and will be supported by Chief

Technology Officer, Victor Kalinin. Since his appointment, the

Board has approved plans to further develop the business. Our short

term aim is to generate additional commercial and grant support

income to ensure that SAW makes a positive contribution to the

Company's financial results.

Beyond this relatively modest ambition, we have formulated plans

to develop our network in carefully selected market sectors in

which we anticipate growth opportunities, including all forms of

transport, both on- and off-road, to include the leisure,

commercial and domestic markets, avionics, industrial turbines and

green energy. We have made significant progress in forming a

Commercial Advisory Panel (CAP); a group of senior industrialists

with knowledge, experience and insight into these key sectors. It

is now our intention to implement plans to increase our market

engagement, including direct referrals, as well as enhanced

website(s), social media presence and participation in technical

webinars and symposiums.

We believe that our technical leadership offers an exceptional

approach to problem solving for customers seeking improved

performance, efficiency and safety. Our challenge now is to

generate additional commercial opportunities in order to derive the

full benefit of these core strengths.

Translogik tyre inspection probes

Revenues from Translogik probes increased by 7% to GBP0.51m

(2019: GBP0.48m), and this segment generated a trading profit of

GBP0.12m (2019: GBP0.19m), primarily as a consequence of increased

marketing and product development expenditure.

Our product range comprises accurate and reliable inspection

gauges for car and commercial truck and bus tyres, allowing

effortless and rapid reading of tread depth, tyre pressure, radio

frequency identification ("RFID") and tyre pressure monitoring

system ("TPMS") data. This data can be transferred via Bluetooth to

a smart device and stored and displayed on the customers' tyre

management software system. Translogik probes are specified for use

in the Goodyear Tire Optix system, the Bridgestone 'Toolbox' and

'Total Tyre Care' systems, and the Continental 'Fleetfox' system,

underpinning our belief that they represent an industry

standard.

During the year, product development was underway to support the

recent market launch of the new TLGX Series, a modular range of

four new gauges offering a broad variety of features at competitive

prices. These have been developed primarily for system integrators

and fleet management software providers, and early indications of

interest are encouraging.

Capital Structure

The Board considers it important that the Company has the

flexibility to pay dividends and make other returns of capital to

shareholders when appropriate and desirable to do so. This will,

however, require certain actions relating to the current capital

structure of the Company. Accordingly, the Board will bring forward

proposals at the forthcoming Annual General Meeting to cancel all

outstanding deferred shares, and the amount standing to the credit

of the share premium account.

Financial results and condition

Revenues for the year from continuing operations were steady at

GBP0.60m (2019: GBP0.60m). Subscription revenues generated from

users of the iTrack system were accounted for as part of

discontinued activities and increased by 50% to GBP1.47m (2019:

GBP0.98m). In the current and subsequent financial years, royalty

income from iTrack will be accounted for as part of continuing

operations and will commence at the rate of GBP0.60m per annum,

increasing in line with the growth in the installed base.

Gross margin was 55.1% of revenues from continuing operations

(2019: 63.1%).

Administrative expenses were slightly increased at GBP1.70m

(2019: GBP1.58m), mainly as a result of increased amortisation and

one-off impairment charges relating to intangible SAW patent

assets. The net loss before taxation from continuing operations was

GBP1.27m (2019: GBP1.12m).

The total comprehensive loss for the year was GBP2.54m (2019:

GBP1.47m), reflecting the loss on discontinued activities of

GBP1.45m (2019: GBP0.62m) and an R&D tax credit of GBP0.18m

(2019: GBP0.28m).

Net cash used in operations increased to GBP1.86m (2019:

GBP0.43m), which includes the cash resources absorbed by iTrack

operating activities during the year of GBP1.33m up to the date of

the transfer of the business to ATMS on 24 June 2020 (2019:

GBP0.33m). The Company closed the year with net cash and cash

equivalents of GBP1.19m (2019: GBP2.65m). The completion balance

sheet relating to the iTrack business was agreed between the

Company and ATMS after the end of the financial year on 10

September 2020, at which time the balance of the consideration

monies was settled. Including the Bridgestone loan repayment and

payment of related fees, there was no significant net effect on

post year end cash.

Board and advisor changes

It is clear that the business has changed over the course of the

year under review, and particularly as a consequence of the

transactions with ATMS/Bridgestone. As a key part of these

arrangements, David Ford and Graham Storey-Macintosh (formerly

Chairman and Chief Executive respectively) left the Transense board

and transferred to lead ATMS as Chief Executive and Director of

Global Sales respectively. On behalf of the board and shareholders,

I would like to take this opportunity to express our gratitude for

their major contribution to the development of the Group's

businesses over several years. I also wish them a bright future,

not least because of our continuing financial interest in the

success of their new venture.

It has been a very enjoyable challenge to Chair the Board since

February and lead the negotiations with Bridgestone. On completion,

I was also happy to commit additional time capacity to the Company

by accepting the role as Executive Chairman. I have been very ably

supported throughout by Melvyn Segal as Chief Financial Officer and

Rodney Westhead, our Senior Independent Non-Executive Director. We

are mindful that it may be beneficial to add to the board in due

course, however we are currently satisfied that we have the

requisite knowledge and experience to fully discharge the

responsibilities of the Board.

We have also taken the opportunity afforded by this major change

in the structure of the Company's business to review our advisory

and compliance support arrangements. Accordingly, we have appointed

Cooper Parry as Auditors, and Allenby Capital as Nominated Advisor

and Broker. We consider that these new arrangements provide the

correct blend of scale and skills to meet the needs of the Company

and its shareholders at the current time, and for the foreseeable

future.

Current trading and prospects

Trading in the first quarter of the current financial year is in

line with expectations and reflects the substantial reduction in

overhead. Revenues from SAW and Probes have increased compared to

the same period last year and early indications are that royalty

income on iTrack deployment during the year has significant growth

potential, although caution is clearly applicable in view of the

global risks associated with the broader economic and practical

effects of the Covid-19 pandemic. The unaudited pre-tax result in

Q1 FY 21 shows the business trading around break-even level

compared to the loss of GBP0.6m incurred in Q1 FY 20.

The iTrack licence deal has both simplified and de-risked the

business going forward, and moves Transense closer to the original

model of developing and licensing technology. We now have a

reasonable expectation that the Company will be financially

self-sufficient for the foreseeable future.

Meanwhile, we have a fresh management grip on the commercial

development of SAW, and a range of new products for Translogik.

Accordingly, we look forward with renewed confidence.

Nigel Rogers

Executive Chairman

20 October 2020

Strategic Report

Financial Review

Results for the year

Revenues for the year from continuing operations were steady at

GBP0.60m (2019: GBP0.60m).Subscription revenues generated from

users of the iTracksystem were accounted for as part of

discontinued activities and increased by 50% to GBP1.47m (2019:

GBP0.98m). In the current and subsequent financial years, royalty

income from iTrack will be accounted for as part of continuing

operations and will commence at the rate of GBP0.60m per annum,

increasing in line with the growth in the installed base.

Gross margin was 55.1% of revenues from continuing operations

(2019: 63.1%).

Administrative expenses were slightly increased at GBP1.70m

(2019: GBP1.58m), mainly as a result of increased amortisation and

one-off impairment charges relating to intangible SAW patent

assets. The net loss before taxation from continuing operations was

GBP1.27m (2019: GBP1.12m).

The total comprehensive loss for the year was GBP2.54m (2019:

GBP1.47m), reflecting the loss on discontinued activities of

GBP1.45m (2019: GBP0.62m) and an R&D tax credit of GBP0.18m

(2019: GBP0.28m).

The Earnings per share (EPS) are set out below (in Pence):

2020 2019

EPS (loss from continuing operations) (6.7) (6.4)

EPS (total loss) (15.6) (11.1)

Taxation

The Company has UK tax losses available to carry forward at 30

June 2020 of approximately GBP23m, subject to HMRC agreement.

Certain elements of development expenditure undertaken by the

Company are eligible for enhanced research and development tax

relief which generally relates to salary costs of technical staff.

The accounting treatment adopted is to recognise the R&D tax

credits on a cash basis due to the uncertain nature of the claim.

Following the year end, the Company received R&D tax credits

amounting to GBP0.18m in respect of the year ended 30 June

2019.

Cash flow and financial position

Net cash used in operations increased to GBP1.86m (2019:

GBP0.43m), which includes the cash resources absorbed by iTrack

operating activities during the year of GBP1.33m up to the date of

the transfer of the business to ATMS on 24 June 2020 (2019:

GBP0.33m). During the year, the Company received the benefit of

interest-free working capital loans from Bridgestone of GBP1.59m,

GBP0.61m of which was repaid in June on completion of the transfer,

and the remaining balance was settled after the year end out of the

consideration monies.

The Company closed the year with net cash and cash equivalents

of GBP1.19m (2019: GBP2.65m). The completion balance sheet relating

to the iTrack business was agreed between the Company and ATMS

after the end of the financial year on 10 September 2020, at which

time the balance of the consideration monies was settled. Including

the Bridgestone loan repayment and payment of related fees, there

was no significant net effect on post year end cash.

The forward looking cash flow forecasts based on the anticipated

level of activity indicates that the Group should have sufficient

funds available for the foreseeable future.

Going Concern

The financial statements have been prepared on the going concern

basis.

The Group meets its day to day working capital requirements

through existing cash reserves and does not currently have an

overdraft facility. The Directors have prepared cash flow forecasts

for the period to 30 June 2023. These forecasts indicate that the

Group should continue to be able to operate within its current cash

resources for this period.

Melvyn Segal

Finance Director

20 October 2020

Consolidated Statement of Comprehensive Income

For the year ended 30 June 2020

Year ended Year ended

30 June 30 June

2020 2019

restated

GBP'000 GBP'000

Continuing

operations

Revenue 603 596

Cost of sales (271) (220)

---------------------------------------------- ----------------------------------------------

Gross profit 332 376

Administrative

expenses (1,703) (1,581)

---------------------------------------------- ----------------------------------------------

Operating loss (1,371) (1,205)

Financial income 5 2

Financial expense (17) -

Other income 118 79

---------------------------------------------- ----------------------------------------------

Loss before

taxation (1,265) (1,124)

Taxation 175 283

---------------------------------------------- ----------------------------------------------

Loss for the year

from continuing

operations (1,090) (841)

---------------------------------------------- ----------------------------------------------

Discontinued

operations

Loss for the year

from

discontinued

operations (1,452) (624)

---------------------------------------------- ----------------------------------------------

Loss for the year (2,542) (1,465)

============================================== ==============================================

Basic and fully

diluted loss

per share

(pence)

From continuing

operations (6.68) (6.38)

============================================== ==============================================

From total loss

for the year (15.59) (11.11)

============================================== ==============================================

Loss for the year (2,542) (1,465)

---------------------------------------------- ----------------------------------------------

Other

comprehensive

income:

Exchange

difference on

translating

foreign

operations - 2

---------------------------------------------- ----------------------------------------------

Other

comprehensive

income for the

year - 2

---------------------------------------------- ----------------------------------------------

Total

comprehensive

expense for the

year

attributable to

the equity

holders of the

parent (2,542) (1,463)

============================================== ==============================================

The comparative Statement of Comprehensive Income has been

restated in order to present the results of continuing operations

and discontinued operations separately with no change in the

overall loss for the year.

Consolidated Balance Sheet

at 30 June 2020

30 June 30 June

2020 2020 2019 2019

GBP'000 GBP'000 GBP'000 GBP'000

Non current

assets

Property,

plant and

equipment 290 529

Intangible

assets 844 946

---------------------------------------------- ----------------------------------------------

1,134 1,475

Current

assets

Inventories 63 566

Corporation

tax 175 -

Trade and

other

receivables 1,677 789

Cash and cash

equivalents 1,193 2,647

---------------------------------------------- ----------------------------------------------

3,108 4,002

---------------------------------------------- ----------------------------------------------

Total assets 4,242 5,477

Current

liabilities

Trade and

other

payables (854) (604)

Borrowings (976) -

Lease

liabilities (61) -

Current tax

liabilities - (55)

Provisions - (70)

---------------------------------------------- ----------------------------------------------

(1,891) (729)

Non current

liabilities

Lease

liabilities (168) -

---------------------------------------------- ----------------------------------------------

Total

liabilities (2,059) (729)

---------------------------------------------- ----------------------------------------------

Net assets 2,183 4,748

============================================== ==============================================

Equity

Issued share

capital 5,451 5,451

Share premium 2,591 2,591

Translation

reserve - 23

Share based

payments 41 41

Accumulated

loss (5,900) (3,358)

---------------------------------------------- ----------------------------------------------

Total equity 2,183 4,748

============================================== ==============================================

Consolidated Statement of Changes in Equity

Share Share Translation reserve Share based payments Cumulative Total

capital premium losses equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

July 2018 5,025 682 21 41 (1,893) 3,876

Comprehensive

income for the

year:

Loss for the

year - - - - (1,465) (1,465)

Other

comprehensive

income for the

year:

Currency

movement on

subsidiary

reserves - - 2 - - 2

Total

comprehensive

income for the

year - - 2 - (1,465) (1,463)

Shares issued

and share

premium 426 1,909 - - - 2,335

------------------------------------------ ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ----------------------------------------------

Balance at 30

June 2019 5,451 2,591 23 41 (3,358) 4,748

------------------------------------------ ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ----------------------------------------------

Comprehensive

income for the

year:

Loss for the

year - - - - (2,542) (2,542)

Other

comprehensive

income for the

year:

Currency - - - - - -

movement on

subsidiary

reserves

Total

comprehensive

income for the

year - - - - (2,542) (2,542)

Translation

reserve

recycled on

disposal - - (23) - - (23)

------------------------------------------ ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ----------------------------------------------

Balance at 30

June 2020 5,451 2,591 - 41 (5,900) 2,183

========================================= ============================================== ============================================== ============================================== ============================================== ==============================================

Consolidated Cash Flow Statement

For the year ended 30 June 2020

Year ended Year ended

30 June 30 June

2020 2019

GBP'000 GBP'000

Loss from operations (2,542) (1,465)

Adjustments for:

Taxation (171) (266)

Loss on disposal of

trade and assets 72 -

Net financial

expense/(income) 9 (2)

Depreciation 538 369

Loss on disposal of

fixed assets 18 -

Impairment of - -

investments

Amortisation and

impairment of

intangible

assets 504 396

---------------------------------------------- ----------------------------------------------

Operating cash flows

before movements

in working capital (1,572) (968)

(Increase)/decrease in

receivables (177) (91)

Increase in payables 477 247

(Increase)/decrease in

inventories (582) 119

---------------------------------------------- ----------------------------------------------

Cash used in operations (1,854) (693)

Taxation

(paid)/received (4) 266

---------------------------------------------- ----------------------------------------------

Net cash (used

in)/generated from

operations (1,858) (427)

---------------------------------------------- ----------------------------------------------

Investing activities

Interest received 8 2

Acquisitions of

property, plant and

equipment (764) (424)

Acquisitions of

intangible assets (513) (433)

Investment in - -

subsidiary

Proceeds from disposal

of trade and

assets (net of cash

disposed of) 772 -

---------------------------------------------- ----------------------------------------------

Net cash used in

investing activities (497) (855)

---------------------------------------------- ----------------------------------------------

Financing activities

Proceeds from issue of

equity share

capital - 2,335

Loans advanced 1,585 -

Loans repaid (609) -

Interest paid (17) -

Payment of lease

liabilities (58) -

---------------------------------------------- ----------------------------------------------

Net cash from financing

activities 901 2,335

---------------------------------------------- ----------------------------------------------

Net (decrease) /

increase in cash and

cash equivalents (1,454) 1,053

Unrealised currency

translation gain - 2

Cash and equivalents at

the beginning

of year 2,647 1,592

---------------------------------------------- ----------------------------------------------

Cash and equivalents at

the end of year 1,193 2,647

============================================== ==============================================

NOTES RELATING TO THE GROUP FINANCIAL STATEMENTS

BASIS OF PREPARATION

The group financial statements have been prepared and approved

by the Directors in accordance with the International Financial

Reporting Standards (IFRS) as adopted by the EU and with those

parts of the Companies Act 2006 applicable to companies reporting

under adopted IFRS.

IFRS and IFRIC are issued by the International Accounting

Standards Board (the IASB) and must be adopted into European Union

law, referred to as endorsement, before they become mandatory under

the IAS Regulation.

1 SEGMENT INFORMATION

The Group had two reportable segments being the unique trading

divisions, SAWSense and Translogik, which make use of technology

developed by the Group to measure and record temperature, pressure

and torque. In prior year financial statement disclosures, the

Translogik segment included the material iTrack results. A decision

was made to sell the iTrack trade to Bridgestone and enter into a

licence agreement to receive future royalties. As a consequence of

the focus on the impact of this, Translogik now includes only

continuing activity and the discontinued iTrack activity has been

shown as a separate segment.

The revenues include royalties, engineering support and sale of

product in relation to this technology.

Information regarding the Group's segments is included in the

notes to the financial statements. Revenue and EBITDA are the

Group's key focus and in turn is the main performance measure

adopted by management.

The tables below set out the Group's revenue split and operating

segments. These disclose information for continuing operations and

in view of their relative size, information for discontinued

operations. The disposal of iTrack operations will result in future

royalty income replacing direct sales income and costs.

Revenue

Year ended Year ended Year ended Year ended

30 June 2020 30 June 2020 30 June 2019 30 June 2019

Continuing Discontinued Continuing Discontinued

GBP'000 GBP'000 GBP'000 GBP'000

North

America 282 235 274 469

South

America 83 793 54 616

Australia 5 479 1 397

UK and

Europe 148 - 192 -

Rest of

the World 85 201 75 148

---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ----------------------------------------------

603 1,708 596 1,630

============================================= ============================================= ============================================= =============================================

Segments

Translogik SAWSense Discontinued Unallocated Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Year ended 30

June 2020

Sales 510 93 1,708 - 2,311

===================== ===================== ===================== ===================== ====================

Gross profit 249 83 1,380 - 1,712

Other income - 118 - - 118

Overheads (121) (783) (2,759) (799) (4,462)

----------------------------- ------------------------------ ------------------------------ ------------------------------ -----------------------------

Operating

profit/(loss) 128 (582) (1,379) (799) (2,632)

Net financial

expense - - 3 (12) (9)

Loss on

disposal - - (72) - (72)

Taxation - - (4) 175 171

------------------------------- ------------------------------- ------------------------------- ------------------------------- -------------------------------

Profit/(loss)

for the year 128 (582) (1,452) (636) (2,542)

====================== ====================== ====================== ====================== ======================

EBITDA Discontinued Continuing Total

reconciliation GBP'000 GBP'000 GBP'000

Operating loss (1,379) (1,253) (2,632)

Depreciation,

amortisation

and impairment 470 572 1,042

------------------------------- ------------------------------- -------------------------------

EBITDA (909) (681) (1,590)

====================== ====================== ======================

Translogik SAWSense Discontinued Unallocated Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Year ended 30

June 2019

Sales 476 120 1,630 - 2,226

===================== ===================== ===================== ===================== ====================

Gross profit 263 113 1,415 - 1,791

Other income - 79 - 79

Overheads (72) (472) (2,022) (1,037) (3,603)

----------------------------- ------------------------------ ------------------------------ ------------------------------ -----------------------------

Operating

profit/(loss) 191 (280) (607) (1,037) (1,733)

Net financial

income - - - 2 2

Taxation - - (17) 283 266

------------------------------- ------------------------------- ------------------------------- ------------------------------- -------------------------------

Profit/(loss)

for the year 191 (280) (624) (752) (1,465)

====================== ====================== ====================== ====================== ======================

EBITDA Discontinued Continuing Total

reconciliation GBP'000 GBP'000 GBP'000

Operating loss (607) (1,126) (1,733)

Depreciation,

amortisation

and impairment 339 426 765

------------------------------- ------------------------------- -------------------------------

EBITDA (268) (700) (968)

====================== ====================== ======================

During the year ended 30 June 2020 there were 2 ( 2019 : 1)

customers whose turnover accounted for more than 10% of the Group's

total continuing revenue as follows:

Year ended 30 June 2020 Revenue Percentage

GBP'000 of total

Customer A 93 15%

Customer B 66 11%

Year ended 30 June 2019 Revenue Percentage

GBP000 of total

Customer A 169 28%

Customer B 35 6%

Discontinued revenue includes Bridgestone as a customer, who

have now acquired the iTrack business and which is expected through

royalties to contribute in excess of 10% of future revenues.

2 FINANCIAL INCOME AND EXPENSE

Recognised in the statement of comprehensive income

Year ended Year ended

30 June 30 June

2020 2019

GBP'000 GBP'000

Financial income 5 2

============================================= =============================================

Financial expense (17) -

============================================= =============================================

3 TAXATION

Recognised in the statement of comprehensive income in respect

of continuing operations

Year ended Year ended

30 June 30 June 2019

2020

restated

GBP'000 GBP'000

Current tax expense

Current year - -

Adjustment for

previous year (175) (283)

---------------------------------------------- ----------------------------------------------

Tax credit in

statement of

comprehensive income (175) (283)

============================================= =============================================

Reconciliation of effective tax rate

Year ended Year ended

30 June 30 June

2020 2019

restated

GBP'000 GBP'000

Loss before tax

from continuing

operations (1,265) (1,124)

============================================= =============================================

Tax calculated at

the average

standard UK

corporation tax

rate of 19.00%

(2019: 19:00%) (240) (214)

Expenses not

deductible for tax

purposes 2 12

Additional

deduction for R&D

expenditure (145) (120)

Current year losses

for which no

deferred

tax asset was

recognised 383 288

Adjustment to

deferred tax

average rate of

19% - 34

Prior year

adjustment (175) (283)

---------------------------------------------- ----------------------------------------------

Total tax credit (175) (283)

============================================= =============================================

A deferred tax

asset has not been

recognised

in respect of the

following item:

Tax losses and

other timing

differences 4,416 3,760

============================================= =============================================

The applicable UK corporation tax rate is 19% throughout the

reporting period.

The Group has tax losses, subject to agreement by HM Revenue and

Customs, in the sum of GBP23.2m (2019: GBP20.7m), which are

available for offset against future profits of the same trade.

There is no expiry date for tax losses. An appropriate asset will

be recognised when the Group can demonstrate a reasonable

expectation of sufficient taxable profits to utilise the temporary

differences.

The Finance Act 2020 maintained the rate of UK Corporation Tax

at 19%.

The effective tax rate used to calculate the current tax for the

year ended 30 June 2020 was 19.00% (2019: 19.00%). Unrecognised

deferred tax balances at 30 June 2020 have been calculated using a

rate of 19% (2019: 17%) as this is now the enacted rate for future

periods.

4 EARNINGS PER SHARE

Basic loss per share is calculated by dividing the loss by the

weighted average number of ordinary shares in issue during the year

of 16,307,282 ( 2019 : 13,184,581). Unexercised options over the

ordinary shares are not included in the calculation of diluted loss

per share as they are anti-dilutive.

Year ended Year ended

30 June 30 June

2020 2019

Number Number

Weighted average number of shares - basic 16,307,282 13,184,581

Share option adjustment - -

------------------------------ ------------------------------

Weighted average number of shares - diluted 16,307,282 13,184,581

====================== ======================

Year ended Year ended

30 June 30 June

2020 2019

GBP'000 GBP'000

Loss from continuing operations (1,090) (841)

Loss from discontinued operations (1,452) (624)

------------------------------ ------------------------------

(2,542) (1,465)

------------------------------ ------------------------------

Basic loss per share from continuing operations (6.68) (6.38)

Basic loss per share from discontinued operations (8.91) (4.73)

------------------------------ ------------------------------

Basic loss per share (15.59) (11.11)

====================== ======================

There are 1,544,085 share options and 226,850 warrants in place

at 30 June 2020 (2019: 804,085) that are not included within

diluted earnings per share because they are anti-dilutive.

5 CASH AND CASH EQUIVALENTS

30 June 2020 30 June 2019

GBP000 GBP000

Cash and cash equivalents per balance

sheet 1,193 2,647

Cash and cash equivalents per cash

flow

statements 1,193 2,647

------------ ------------

6 DISPOSAL OF SUBSIDIARIES, TRADE AND ASSETS OF ITRACK BUSINESS

On 24 June 2020, the Company granted an exclusive worldwide

licence (the "Licence") to ATMS Technology Limited ("ATMS"), a

newly-formed wholly owned subsidiary of Bridgestone, covering all

current and future iTrack technology for a period of ten years. In

order to capitalise fully on the market potential of the use of the

technology, the operational business and trading assetsrelating to

the iTrack system, including the shareholdings in the Company's

subsidiaries in Chile and South Africa, have been transferred to

ATMS at a fair value which largely equated to the net asset value.

Approximately 50 % of the consideration was received at completion

by the Company with the remaining GBP1.24m included in other

receivables and all received in August and September 2020. The

Company also repaid $0.75m of the loan previously advanced by

Bridgestone in June 2020 with the remaining $1.2m repaid post year

end in August 2020.

The assets and liabilities disposed of were as follows:

GBP'000

Property plant and equipment 720

Intangible assets 111

Inventories 1,085

Trade and other receivables 508

Cash (held by subsidiaries) 361

Trade and other payables (320)

----------------------------------------------

Net assets 2,465

=============================================

Consideration in cash at completion 1,313

Consideration on agreement of completion accounts 1,237

Foreign exchange reserve recycled through Statement

of Comprehensive Income 23

----------------------------------------------

2,573

Net assets disposed of (2,465)

Legal and professional fees in respect of the

sale (180)

----------------------------------------------

Loss on disposal of trade and assets (72)

=============================================

The cash flows from the discontinued operations were:

Year ended Year ended

30 June 30 June

2020 2019

GBP'000 GBP'000

Operating cash flows (1,333) (332)

Investing cash flows (560) (401)

Financing cash flows 976 -

------------- ------------

Total net cash outflows (917) (733)

======= =======

7 OPERATING LEASES AND TRANSITION TO IFRS 16

The operating lease relates to the lease of premises which is

used by the Group and Company. Following the adoption of IFRS16

these commitments are now included in lease liabilities at 30 June

2020.

On transition to IFRS 16 at 1 July 2019, the Group has adopted

the modified approach whereby the net present value of the

remaining property lease payments at this date of GBP287,000 are

recognised as the opening liability with an equal

right-of-use-asset of GBP272,000 as adjusted for prepaid rent and

unamortised lease incentives depreciated over the remaining lease

period. This represents the remaining 54 months of the lease

amounting to GBP329,000 discounted by GBP42,000 at the assessed

incremental borrowing rate of 6% (compared to the minimum

contractual commitment at 30 June 2019 of GBP73,000 with the

benefit of a potential break option which was not exercised).

Depreciation of GBP57,000 has been charged in respect of the asset

for the year and finance charges of GBP16,000 compared with

GBP67,000 of rent that would have been charged under the previous

basis, an increase of GBP6,000 in the total charges included in the

Statement of Comprehensive Income. The comparatives for the year

ended 30 June 2019 have not been adjusted and are prepared in

accordance with IAS17.

8 STATUTORY ACCOUNTS

The Financial information set out in this preliminary

announcement does not constitute the Company's Consolidated

Financial Statements for the financial years ended 30 June 2020 or

30 June 2019 but are derived from those Financial Statements.

Statutory Financial Statements for 2019 have been delivered to the

Registrar of Companies and those for 2020 will be delivered

following the Company's AGM. The auditors Cooper Parry Group

Limited have reported on the 2020 financial statements and Grant

Thornton LLP on the 2019 financial statements. Their reports were

unqualified, did not draw attention to any matters by way of

emphasis without qualifying their report and did not contain

statements under Section 498(2) or (3) of the Companies Act 2006 in

respect of the Financial Statements for 2020 or 2019.

The Statutory accounts are available on the Company's website

and will be posted to shareholders who have requested a copy and

thereafter by request to the Company's registered office.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FFSEFUESSELS

(END) Dow Jones Newswires

October 20, 2020 02:00 ET (06:00 GMT)

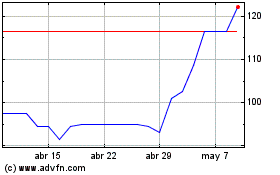

Transense Technologies (LSE:TRT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Transense Technologies (LSE:TRT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024