Franklin Limited Duration Income Trust (“FTF” or the “Fund”) Notification of Sources of Distributions

27 Mayo 2022 - 12:19PM

Business Wire

Franklin Limited Duration Income Trust [NYSE American: FTF]:

Notification of Sources of

Distributions

Pursuant to Section 19(a) of the

Investment Company Act of 1940

The Fund’s estimated sources of the distribution to be paid on

May 31, 2022 and for the fiscal year 2022 year-to-date are as

follows:

Estimated Allocations for May Monthly Distribution as of April

30, 2022:

Distribution Per Share

Net Investment Income

Net Realized Short-Term Capital Gains

Net Realized Long-Term Capital Gains

Return of Capital

$0.0669

$0.0542 (81%)

$0.0000 (0%)

$0.0000 (0%)

$0.0127 (19%)

Cumulative Estimated Allocations fiscal year-to-date as of April

30, 2022, for the fiscal year ending December 31, 2022:

Distribution Per Share

Net Investment Income

Net Realized Short-Term Capital Gains

Net Realized Long-Term Capital Gains

Return of Capital

$0.2868

$0.1212 (42%)

$0.0000 (0%)

$0.0000 (0%)

$0.1656 (58%)

Shareholders should not draw any conclusions about the Fund’s

investment performance from the amount of the current distribution

or from the terms of the Fund’s Plan. FTF estimates that it has

distributed more than its income and net realized capital gains;

therefore, a portion of the FTF distribution to shareholders may be

a return of capital. A return of capital may occur, for example,

when some or all of the money that a shareholder invested in a Fund

is paid back to them. A return of capital distribution does not

necessarily reflect FTF’s investment performance and should not be

confused with ‘yield’ or ‘income’. The amounts and sources of

distributions reported herein are only estimates and are not being

provided for tax reporting purposes. The actual amounts and sources

of the amounts for tax reporting purposes will depend upon the

Fund’s investment experience during the remainder of its fiscal

year and may be subject to changes based on tax regulations. The

Fund will send a Form 1099-DIV to shareholders for the calendar

year that will describe how to report the Fund’s distributions for

federal income tax purposes.

Average Annual Total Return (in relation

to the change in net asset value (NAV) for the 5-year period ended

on 04/30/2022)1

Annualized Distribution Rate (as a

percentage of NAV for the current fiscal period through

04/30/2022)2

Cumulative Total Return (in relation to

the change in NAV for the fiscal period through 04/30/2022)3

Cumulative Fiscal Year-To-Date

Distribution Rate (as a percentage of NAV as of 04/30/2022)4

0.32%

10.15%

-8.67%

3.63%

Fund Performance and Distribution Rate Information:

1

Average Annual Total Return in relation

to NAV represents the compound average of the Annual NAV Total

Returns of the Fund for the five-year period ended through April

30, 2022. Annual NAV Total Return is the percentage change in the

Fund’s NAV over a year, assuming reinvestment of distributions

paid.

2

The Annualized Distribution Rate is the

current fiscal period’s distribution rate annualized as a

percentage of the Fund’s NAV through April 30, 2022.

3

Cumulative Total Return is the

percentage change in the Fund’s NAV from December 31, 2021 through

April 30, 2022, assuming reinvestment of distributions

paid.

4

The Cumulative Fiscal Year-To-Date

Distribution Rate is the dollar value of distributions for the

fiscal period (December 31, 2021 through April 30, 2022), as a

percentage of the Fund’s NAV as of April 30, 2022.

The Fund’s Board of Trustees (the “Board”) has authorized a

managed distribution plan pursuant to which the Fund makes monthly

distributions to shareholders at an annual minimum fixed rate of

10%, based on the average monthly NAV of the Fund’s common shares

(the “Plan”). The Fund calculates the average NAV from the previous

month based on the number of business days in the month on which

the NAV is calculated. The Plan is intended to provide shareholders

with a constant, but not guaranteed, fixed minimum rate of

distribution each month and is intended to narrow the discount

between the market price and the NAV of the Fund’s common shares,

but there can be no assurance that the Plan will be successful in

doing so. The Fund is managed with a goal of generating as much of

the distribution as possible from net ordinary income and

short-term capital gains, that is consistent with the Fund’s

investment strategy and risk profile. To the extent that sufficient

distributable income is not available on a monthly basis, the Fund

will distribute long-term capital gains and/or return of capital in

order to maintain its managed distribution rate. A return of

capital may occur, for example, when some or all of the money that

was invested in the Fund is paid back to shareholders. A return of

capital distribution does not necessarily reflect the Fund’s

investment performance and should not be confused with “yield” or

“income”. Even though the Fund may realize current year capital

gains, such gains may be offset, in whole or in part, by the Fund’s

capital loss carryovers from prior years.

The Board may amend the terms of the Plan or terminate the Plan

at any time without prior notice to the Fund’s shareholders. The

amendment or termination of the Plan could have an adverse effect

on the market price of the Fund’s common shares. The Plan will be

subject to the periodic review by the Board, including a yearly

review of the annual minimum fixed rate to determine if an

adjustment should be made.

For further information on Franklin Limited

Duration Income Trust, please visit our web site at:

www.franklintempleton.com

Franklin Resources, Inc. [NYSE:BEN] is a global investment

management organization with subsidiaries operating as Franklin

Templeton and serving clients in over 155 countries. Franklin

Templeton’s mission is to help clients achieve better outcomes

through investment management expertise, wealth management and

technology solutions. Through its specialist investment managers,

the company offers boutique specialization on a global scale,

bringing extensive capabilities in equity, fixed income,

multi-asset solutions and alternatives. With offices in more than

30 countries and approximately 1,300 investment professionals, the

California-based company has 75 years of investment experience and

approximately $1.5 trillion in assets under management as of April

30, 2022. For more information, please visit

franklintempleton.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220527005366/en/

Franklin Templeton at 1-800-342-5236

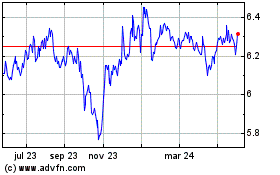

Franklin Limited Duratio... (AMEX:FTF)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

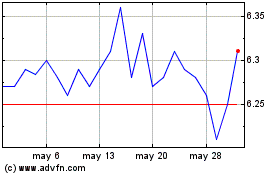

Franklin Limited Duratio... (AMEX:FTF)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025