ApeCoin (APE) Sees Higher Prices Even In Bearish Market Conditions

20 Septiembre 2022 - 6:49PM

NEWSBTC

After the emergence of Decentralized Finance, Non-fungible tokens

erupted in the crypto space. The novel sector carried its frenzy

wave for a long time before normalizing and continuing a gradual

expansion. One of the notable coins from the NFT sector is

ApeCoin. ApeCoin is built on Ethereum and connected to the

Bored Ape Yacht Club NFT launched in 2021. At launch, only one

billion ApeCoin tokens were created and fixed without plans of

releasing more. Related Reading: Cosmos Struggles With $17 As Price

Heads Into Distribution Phase During the launch, the team sold some

tokens and reserved some for later dispersal. The Reason Behind

Higher Gains Of APE Coin Earlier this year, analysts predicted that

ApeCoin APE could reach $5 by November 2022. But the coin has

surpassed the predictions and is currently trading at $5.65 on

September 20. Though the ApeCoin APE, at the time of writing, has

lost over 7% in the last 24 hours, it added over 10% in the last

week. The achievements place it above many coins presently trading

in the red. Many investors now wonder what the force behind

ApeCoin’s growth could be. A little research showed that the recent

event on its network could have helped to boost the price

gain. On September 17, ApeCoin treasury gifted 25 million APE

tokens to launch contributors. These tokens were part of the ones

reserved after launch. The event news pushed APE up almost

immediately before it settled down again. Fast-forward to September

20, the market sentiment for APE is still positive, gradually

moving its price above others in the same league. Why Is The Crypto

Market Bearish? The early hours of September 19 saw the whole

crypto market in the red. Many coins lost their previous price

gains and crashed. This trend started on September 15, immediately

after the Ethereum Merge. The event expected to reverse the

market to a bullish trend now caused the opposite. Bitcoin

historical data shows that it lost $1000 immediately after the

merge. On the other, Ethereum lost its grip on $1600+, plunging to

$1,471.69 the same merge day. Three days later, Ether’s price

fell to $1,335.33, causing many to say that the upgrade was

overhyped. As Bitcoin and Ethereum lost price gains, other

cryptocurrencies followed suit, leaving the market in red on

September 19. But what could be the reason for the price

loss? This week opened with a lot of dread as the market awaited

the new interest rate hike. Recall that the inflation data released

for August was higher than expected. As a result, the Federal

Reserve is to release a new interest rate, a third-straight

75-basis-point. Will The Interest Rate Hike Plunge The

Market? The meeting for the rate decision kicked off on

September 20 and will end on September 21 with the announcement.

Currently, the whole financial market awaits the information in

fear. Some even hinted that the Feds might target a

100-point, a level not reached in the last 40 years. Analysts on

Wall Street and JPMorgan Chase keep debating whether the 100-point

basis would be the next level. Related Reading: ETH

Backpedals After Hitting $1,800 Ahead Of Merge Last Week But on the

side of investors, a 75-basis point will be suitable for them

instead of the feared level. As the meeting is moving towards the

end, asset prices have become highly volatile, showing the

uncertainty gripping investors. By tomorrow, September 21,

the Fed’s decision will determine the trend erupting in the crypto

market. Featured image from Pixabay and chart from

TradingView.com

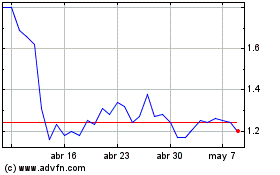

ApeCoin (COIN:APEUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

ApeCoin (COIN:APEUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024