Hedera Falls To Critical Support Level: Can HBAR Rebound This September?

01 Septiembre 2023 - 5:00AM

NEWSBTC

Hedera (HBAR) recently encountered a significant hurdle as it faced

price rejection at a crucial weekly bearish order block. Currently

hovering at the $0.0500 level, this juncture has emerged as a

formidable obstacle for sellers looking to capitalize on the

prevailing bearish sentiment. In a price report, it was revealed

that HBAR’s funding rates have consistently remained in negative

territory for the past few days. This bearish skew in the futures

market further underscores the challenges HBAR faces in its price

recovery. The current HBAR price, as reported by CoinGecko,

stands at $0.050716, with a 5.0% decline over the last 24 hours and

nearly 13% drop over the past seven days. Related Reading: The

ApeCoin Quandary: Why Additional Losses Could Persist Declining

Open Interest Reflects Reduced Hedera Demand Adding to the bearish

narrative, open interest rates for HBAR have plummeted from $27

million to $21 million within the last five days (from August 24th

to August 31st). This substantial drop indicates a waning demand

for HBAR within the futures market, potentially emboldening sellers

to seek further gains. The fate of HBAR remains closely intertwined

with Bitcoin’s performance. As Bitcoin drops below the key $26,000

level, it has retraced a significant portion of its loss courtesy

of a favorable US court ruling in Grayscale Investments’ Bitcoin

ETF case against the Securities and Exchange Commission. HBAR

market cap currently at $1.6 billion. Chart: TradingView.com SEC’s

ETF Delay Casts a Shadow on the Crypto Market Bitcoin’s value,

along with that of other cryptocurrencies, took a hit following the

SEC’s announcement of a delay in reviewing seven spot Bitcoin

exchange-traded fund (ETF) applications until October. This delay

has cast a shadow of uncertainty over the cryptocurrency market,

impacting investor sentiment. CoinShares, in its latest Digital

Asset Fund Flows Weekly Report, revealed that digital assets

collectively experienced outflows of $168 million over the past

week, marking a two-week streak of declining investments. This

negative sentiment can be attributed to the growing belief that the

approval of a spot Bitcoin ETF will take longer than initially

anticipated. HBAR seven-day price movement. Source: Coingecko.

Related Reading: Can Shiba Inu Climb Before September Starts?

Evaluating The $0.00001 Projection However, amidst this turbulent

market atmosphere, there is a glimmer of hope, especially after

Grayscale’s win in its lawsuit against the SEC. The court

acknowledged the SEC’s error in rejecting Grayscale’s bitcoin ETF

application. This legal triumph could potentially inject some

optimism back into the crypto market in the coming days. The fate

of HBAR remains closely linked to Bitcoin’s performance, and

uncertainties stemming from the SEC’s ETF delay continue to weigh

on the broader cryptocurrency market. Grayscale’s legal victory,

however, offers a ray of hope amidst the prevailing bearish

sentiment. Meanwhile, traders and investors are advised to tread

cautiously and monitor market developments closely. (This site’s

content should not be construed as investment advice. Investing

involves risk. When you invest, your capital is subject to risk).

Featured image from IntelligentHQ

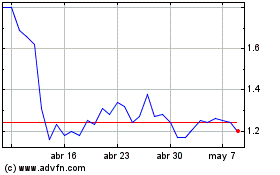

ApeCoin (COIN:APEUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

ApeCoin (COIN:APEUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024