Arbitrum Launches Fraud Proofs In Testnet: Why Is ARB Down?

17 Abril 2024 - 8:00PM

NEWSBTC

Arbitrum, the largest Ethereum layer-2 scaling solution by total

value locked (TVL), is taking steps towards decentralization. In an

update on April 16, Offchain Labs–Arbitrum developers–said they

have deployed the permissionless version of their fraud proofs,

dubbed Bounded Liquidity Delay (BOLD), to testnet. Ethereum

Layer-2s Are Popular, But There Is A Big Problem Ethereum layer-2

solutions have been gaining prominence over the years. According to

L2Beat data on April 17, these platforms control over $37 billion

of assets. Protocol developers and users can send transactions

cheaply through Arbitrum, Optimism, Base, and other

alternatives. However, while they are popular and command

billions in TVL, most of these platforms’ fraud proofs are being

developed. Typically, when users transact all chains, all

transactions must be confirmed by a web of miners or validators,

depending on the consensus mechanism. Related Reading: Whale

Alert: MATIC Poised For Epic Surge – Time To Dive In? This differs

in layer-2 options, which must reroute transactions and process

them off-chain. There is no way of proving whether queued

transactions are valid before being batched and confirmed on-chain.

The fraud proofs, such as those presented by Arbitrum and other

optimistic rollup solutions, are designed to address a critical

issue in layer-2 solutions. Specifically, once live and integrated

into Arbitrum, BOLD will serve as a safety net, ensuring the

validity of transactions processed off-chain. This mechanism is

crucial in maintaining the integrity of transactions while enabling

efficient off-chain processing. In compliance with blockchain

principles, BOLD will be decentralized. As such, the community will

run nodes, which differs from the current setup. As it is,

transaction validation in Arbitrum is centralized, and only a few

validators are tasked with this. Arbitrum Deploys BOLD In Testnet,

ARB Prices Falling With BOLD in the testnet, Arbitrum is opening up

its rails so that anyone can participate in network security and

validate withdrawals back to Ethereum. This move will be critical

in building a more decentralized ecosystem and making the platform

more robust. Arbitrum becomes the first Ethereum layer-2 to launch

its fraud proofs in testnet. In a post on X, Ryan Watts of Optimism

also notified the community that plans are underway to

create a decentralized fraud-proof system for the second-most

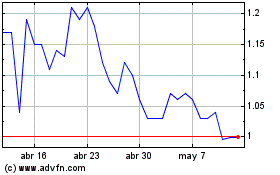

largest layer-2 by TVL. Even with this major milestone, ARB prices

are stable and under pressure. Related Reading: Crypto Analyst Says

Don’t Buy Altcoins Just Yet – Here’s Why The token is down 50% from

March 2024 highs at spot rates and remains under immense selling

pressure. If buyers reverse the April 12 and 13 sell-off, the token

might recover strongly, racing towards $1.5. Feature image from

Canva, chart from TradingView

Arbitrum (COIN:ARBUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Arbitrum (COIN:ARBUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024