Abracadabra Protocol To Counter CRV Risk With 200% Interest Rate Hike

02 Agosto 2023 - 1:00PM

NEWSBTC

DeFi lending protocol, Abracadabra Money, is currently debating a

proposal to boost the interest rate in its CRV lending markets as

it looks to mitigate its exposure to the DeFi token. In the

last few days, CRV has seen its value decline significantly

due to the recent Curve Finance exploit on Sunday, which resulted

in a total loss of over $60 million. According to data from

CoinMarketCap, CRV is currently trading at $0.56, with an 8.28%

loss in the last 24 hours. Abracadabra Exposed To Significant CRV

Risk Levels In a governance proposal submitted on Aug 1, DAO

contributor and community manager Romy highlighted that Abracadabra

was currently exposed to a substantial level of CRV risk. To

address this situation, the proposal contains a strategy that

introduces collateral-based interest to both CRV cauldrons –

lending markets – on Abracadabra. Related Reading: Ethereum DeFi

Coins Plunge As Curve Concerns Threaten Major Market Crash Romy

stated that Curve Finance, the underlying platform of CRV, has seen

its TVL negatively affected over the last month by several events,

including the Conic Finance Hack, the JPEG’d exploit, and the

attack on Curve itself. In particular, Romy noted that the

theft of $25 million from Curve’s CRV/ETH pool had impacted the

on-chain liquidity for CRV, altering the conditions that led to the

adoption of the token as a collateral asset on Abracadabra.

In addition, the proposal also noted that Abracadabra had recorded

CRV outflows toward markets with lower Loan-to-Value (LTV) ratios

and higher interest rates. Together, all these factors have

affected CRV’s price and liquidity, prompting the need for

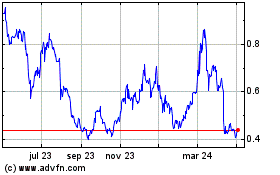

Abracadabra to reduce its exposure to the token. CRV trading

at $0.558 on the daily chart: Source: CRVUSD chart on

Tradingview.com Abracadabra’s Proposed Strategy To Introduce 200%

Interest Hike As earlier stated, Romy’s governance proposal aims to

cover Abracadabra CRV’s risk by applying collateral-based interest

to the two CRV lending markets on the platform. It was stated that

this strategy had been previously implemented with the WBTC and

WETH cauldrons. This introduction of collateral-based

interests would allow Abracadabra to levy interest directly on each

CRV cauldron’s collateral which is directly transferred to the

protocol’s treasury and converted to Abracardra’s native stablecoin

MIM, either via on-chain or off-chain transactions. Related

Reading: Is It A Good Idea To Buy Curve Now? Here’s What This

Founder Thinks Based on projections, Romy stated that this strategy

would allow Abracadabra to boost its treasury reserve and cut

potential losses due to CRV exposure to about $5M borrowed

MIM. Under the new proposed interest structure, the interest

rates will be determined based on two factors: the combined

outstanding principal of the CRV cauldrons and the collateral ratio

of each cauldron. The base interest rate will vary depending

on the total borrowed amount, classified into three ranges:

$0M-$5M, $5M-$10M, and $10M-$18M. For instance, as the current

outstanding principal stands at $18M, the base interest rate would

be set at 200%. Using this rate, it is estimated that the

loan would be completely covered in six months’ time. Furthermore,

the collateral ratio would influence the interest multiplier, with

ratios ranging from <= 40% to <= 70% correlating to

multipliers of 1x, 5x, 10x, and 25x, respectively.

According to the proposal, this interest rate structure ensures the

maximum chances of “full principal recovery” for Abracadabra. The

voting session for this proposal commenced on Aug. 1. and will run

for only 46 hours due to the supposed urgency of the matter. As of

the time of writing, 51 members of the Abracadabra DAO have placed

their votes, with 99.74% supporting the proposal. Source:

Snapshot Featured image from Ceqoa, chart from Tradingview

Curve DAO Token (COIN:CRVUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Curve DAO Token (COIN:CRVUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024