DYDX Is Up By 11% In A Week, But Investors Must Watch Out For This Event

29 Agosto 2023 - 8:00AM

NEWSBTC

DYDX, the native token of a decentralized exchange (DEX) with the

same name, has been on a good run in the past few days. According

to CoinGecko data, the cryptocurrency’s price jumped by 10.7% in

the past week, reflecting a positive performance after an

unfavorable start to August. However, there has been rising concern

that this spurt of bullish momentum may be short-lived. And the

upcoming token unlock event is the primary source of this

skepticism. dYdX To Unlock $13.8 Million Worth Of Token In Single

Event Token unlock events are not a strange phenomenon in the

cryptocurrency space, as many blockchain networks and decentralized

finance (DeFi) protocols have a portion of their token supply

locked – to be released periodically. DYDX is one of those tokens

with a locked supply and its next token unlock event is happening

on Tuesday, August 29. In the latest iteration, the decentralized

exchange will unlock $13.82 million worth of its native token to be

distributed to its community treasury and rewards for liquidity

providers and traders, according to data from Token Unlocks.

Related Reading: Ethereum Bulls Put Up A Fight, But Can They Clear

This Major Hurdle? The token tracking dashboard shows that the DEX

will release 6.52 million DYDX tokens, which accounts for 3.76% of

the token’s current circulating supply. Breaking this figure

down, 2.49 million tokens – equivalent to $5.279 million at the

current market price – will be allocated to the community

treasury, which funds contributor grants, community initiatives,

liquidity mining, and so on. Meanwhile, the remaining 4.03 DYDX

tokens will be distributed between trading rewards (2.88 million

tokens worth roughly $6.11 million) and liquidity provider rewards

(1.15 million tokens worth an estimated $2.44 million). This is the

second time the DEX will be carrying out an unlock event in August

2023. On August 1, 2023, dYdX executed an identical unlock event,

distributing the same amount of tokens to the community treasury,

liquidity providers, and traders. Upon completion of this

forthcoming event, over 25% of the total token supply will be

unlocked, while less than 75% of the supply will still be locked.

Could This Event Hamper DYDX’s Rise? Given that a considerable

chunk of the 6.52 million DYDX tokens will be going to liquidity

providers and traders, the chances are that a substantial portion

of the tokens will be offloaded in the open market. As such, the

DYDX price could suffer due to increased selling pressure. The

signs are not particularly positive from a historical perspective,

either. Price action data reveals that the price of DYDX struggled

after the identical unlock event on August 1. Related Reading:

MATIC Social Sentiment Slides To Negative Territory – What’s The

Impact On Price? The token lost nearly 10% of its value in a few

days, reaching $1.91 by August 4. Although the token has witnessed

an impressive turnaround, investors could see DYDX fall below the

$2 level again if history were to repeat itself. As of this

writing, the DYDX token changes hands for $2.12, reflecting a 1.7%

price dip in the last 24 hours. CoinGecko data shows that there has

been a 36.2% decline in the token’s daily trading volume, signaling

a recent fall in market activity. DYDXUSDT trading at $2.135 |

Source: daily DYDXUSDT chart on TradingView Featured image from

Getty Images, chart from TradingView

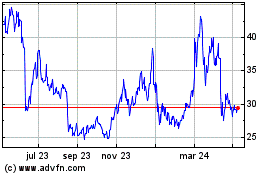

Dash (COIN:DASHUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Dash (COIN:DASHUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024